The resumption of the Grand Prix circuit in Austria on 5th and 12th July provided a window on the recovery in business aviation in Europe

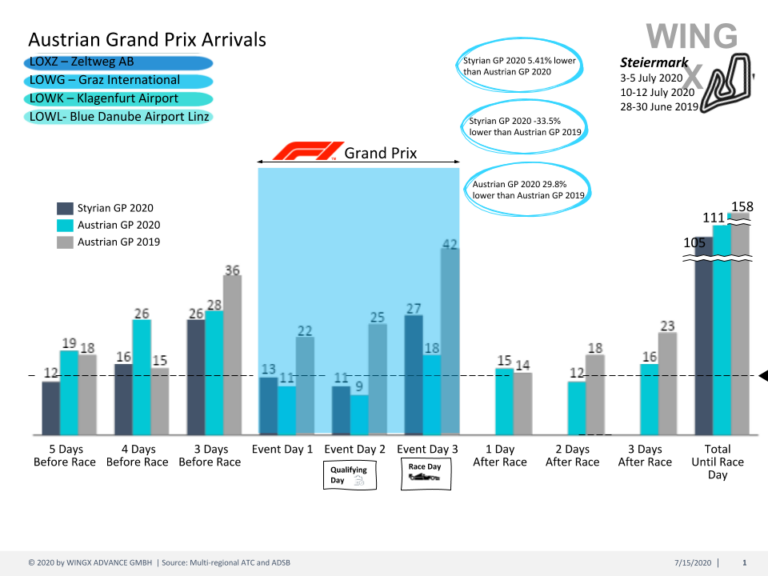

The resumption of the Grand Prix circuit in Austria on 5th and 12th July provided a window on the recovery in business aviation in Europe. Business aviation activity in and out of the four closest airports to the Red Bull Ring came to 76 flights during the race days, compared to 178 last year, a 58% YOY decline. However, the 12th July event, the Styrian GP, attracted a further 84 movements, so the two events combined were only 15% down on the main event last year. There were many fewer flights to the event this year from within Austria, especially Vienna, also less interest from the UK, but about the same number from France, and slightly more visitors from Germany. Overall, business aviation flights in all of Austria were up 6% YOY in the first fortnight of July.

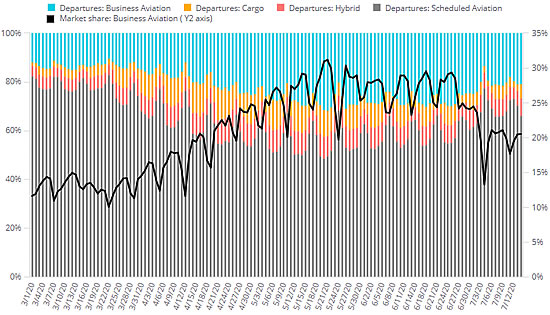

Stepping back, the recovery in global business aviation continues, albeit bumpily. The trend through the first two weeks of July shows 19% decline compared to first fortnight July 2019. Rolling 7-Day average daily activity has peaked at just under 16,000 flights this month, compared to the low-point of under 4,000 in April 2020. North America has somewhat stabilised at 20% below par in July, and Europe is now clearly driving the recovery, with flights at 82% of usual July activity. Oceania seems to have normalised at 10% below, and activity out of Asia is treading water 23% below. Since the start of the year, global bizav activity is down by 31%, and since mid-March, activity has dropped 47%. Comparably, worldwide scheduled airline sectors are down 75% since mid-March.

The US was the key recovery market in May and June, and that showed up around Independence Day celebrations during which comparable day analysis showed growth in YOY business jet departures. The recent surge in virus infections particularly in the South and West of the country is somewhat blunting the ongoing recovery, but even so, through the first 2 weeks of this month, the overall deficit is only 17% YOY. Florida is still up, this month versus July 2019, Arkansas flat again, Utah also has some growth. New York is down 26%, New Jersey 46% below, and although California is the busiest State so far this month, activity at 85% of usual, we can expect a sharp decline as lockdown policies get re-imposed.

In Europe pent-up demand has been released since the opening of Schengen borders in mid-June and the ending of most country quarantines at the start of July. Besides Austria, other resilient markets include Croatia, which also has 5% growth year on year, Spain, just 1% off July 2019 activity, Switzerland and Turkey within 5% of normal, Germany 8% below par. International borders have clearly opened up, with a small increase in flights between France and Switzerland. Scandinavian markets have stood still in the last month, flights still trailing by over 20%, and the UK and Greece remain the laggards, activity 40% down for July. The UK relaxed quarantine from 10th July, and although flights are down 41% vs July 2019, 7-Day activity has lifted 38% since the 1st of the month.

Globally, the bizav recovery continues to be characterised by demand for smaller aircraft; sectors flown in first 2 weeks of July on light jets are only 8% down year on year, and in the US, these and Very Light Jet flights are busier in 2020 than in 2019. Medium business jet activity is improving, with the SMJ segment within 85% of normal activity this month. Heavy Jet flights are down by 30% and Ultra Long Range Jet sectors lagging at 36% below par. The PC-12 remains the busiest aircraft type, 87% of normal activity, with Nantucket and Denver the busiest PC-12 airports this month. Amongst the business jets, the Phenom 300 and Challenger 300 are busiest, globally within 10% of par, just 5% off in the US.

Managing Director Richard Koe comments: “So far this summer, the overall recovery in global business aviation activity is persisting despite the rise in global infections and the bumpiness in lockdown policies. The European summer season is the big driver, now that most regional quarantines are lifted, with promising trends in Central Europe. We expect that to follow around the Med in the next few weeks. The bigger question mark is around the US recovery, where renewed restrictions and their economic repercussions could slow or reverse the flight activity recently regained.”