WINGX: Since the start of this month, most travel restrictions for flights between countries in Europe have been lifted, and the result has been a much stronger recovery in all aviation activity

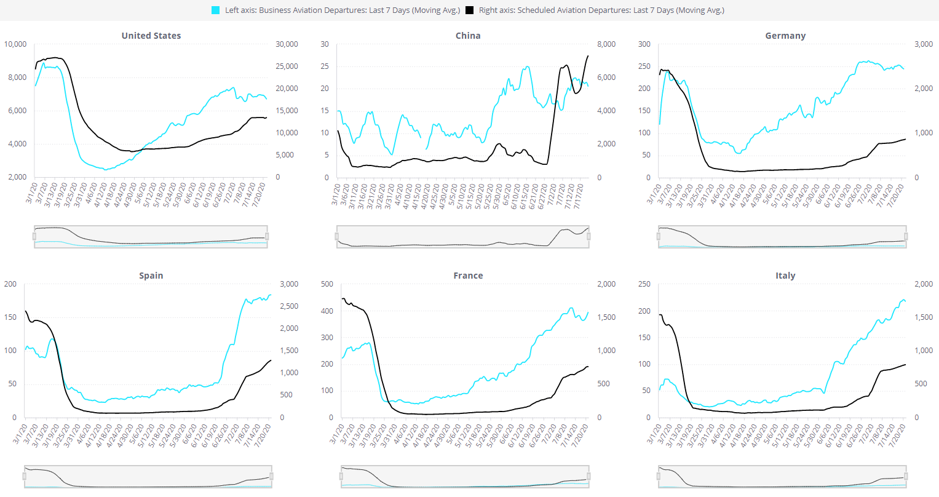

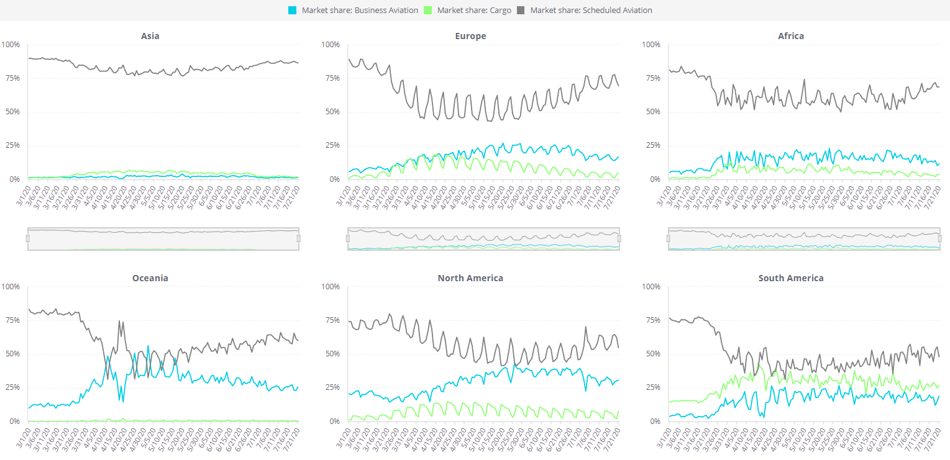

According to WINGX weekly Global Market Tracker, since the start of this month, most travel restrictions for flights between countries in Europe have been lifted, and the result has been a much stronger recovery in all aviation activity. Business aviation is still far out-pacing commercial airlines, with bizav sectors coming within 15% of normal through the first 3 weeks of July, contrast the airlines, lagging July 2019 activity by more than 60%. Central Europe is seeing the strongest regional recovery, with bizav activity in Germany, Switzerland within 5% of normal, and flights from Austria up by 9% compared to July last year, reflecting the relaunch of the Grand Prix season with two consecutive events at the Red Bull ring.

July is Europe´s key month for business aviation activity, and typically has 15% share of full year traffic, much higher for the main summer resorts in the Med area. This year the summer season is truncated but the reopened borders have released pent-up demand, with business aviation flights to and from Spain down only 2% so far this month. Ibiza is still suffering, flights down by 10%, unsurprising given the restrictions on its signature party scene. But Malaga´s bizav activity is up by 8%, and bizav arrivals into Majorca are actually up 20%, representing an additional 6 flights a day compared to July 2019. Seville, Alicante and Jerez are also all growing. Spain´s recovery is still mainly in domestic traffic, but German, Swiss and Dutch tourists are now leading the return in international visitors.

A mixed recovery elsewhere in Europe: bizav flights into Belgium this month are up 13% YOY, boosted by the just-completed European summit; the UK is doing better since the quarantine lifted on 10th July but still lags the rest of Europe, flights trailing 37% YOY; Italy is similarly trailing, for example Olbia arrivals are down 32% YOY, and the vast majority of its traffic still domestic; France has regained top country spot, activity down just 14%, but notably flight hours are down 23%. Excluding turboprops, bizjet traffic is up for flights within Turkey, Russia and Germany, and notably, up YOY for flights from UK to Spain. Nice is Europe´s business jet hotspot, as usual, flights recovering to 81% of normal, but Le Bourget´s activity is still 40% under par. Cannes is a bright spot, biza traffic up 5% in July.

Across the pond, the US market, which had been powering the recovery in global business aviation in May and June, is treading water so far in July. In fact the rolling 7-day average daily activity has fallen from 7,300 flights at the start of the month to 6,800 at the latest date. Partly this reflects the reset since Independence Day, this year at the weekend, last year a weekday. Two of the busiest US States, California and Texas, are close to the national trend at 20% below normal. There´s still some momentum in Florida, flights up 5% YOY. Arizona is staying ahead, 1% more flights this July than last, and Colorado just 1% down. But New York still trails 32%, and business aviation activity out of New Jersey is barely back to 50% of normal levels.

Year on year growth in July activity in the US is centred around a few key resorts and their closest metro access: Aspen, Jackson Hole, Eagle and Salt Lake City, West Palm Beach, Fort Lauderdale, Scottsdale, Phoenix. Major metro hubs like Chicago, Las Vegas, Washington are seeing 30% less traffic across their airports this month. The East Coast did get some uplift from Independence Day traffic between White Plains, Nantucket and Martha´s Vineyard. Recovery in business jet activity on the West Coast has been curbed with the renewed lockdown since 14th July, with Burbank, Oakland, Los Angeles some 30% down in July. Notably, Van Nuys activity is only 7% down, and Carlsbad activity is up so far this month. Busiest business jet in California this month is the Challenger 300/350, activity up 1% YOY.

Outside the US and Europe, the busiest business aviation markets are Brazil, Australia, China, India and UAE. Although these markets represent only a fraction of global activity, YOY trends are back to normal for Australia and India, and up in Brazil and UAE. Also Nigeria has some growth in business jet activity in July, with Malaysia and South Africa two other countries to have regained ground this month. Business aviation flight activity in China is trailing by 16%, Japan down by 28%, and Saudi Arabia is amongst the worst-affected countries, flights down by 45%. Australasia is the most ´normalised´ region, with some Australian airports seeing strong growth this month, notably Perth and Melbourne. New Zealand has successfully contained the virus but bizav flights are still down by 7% YOY.

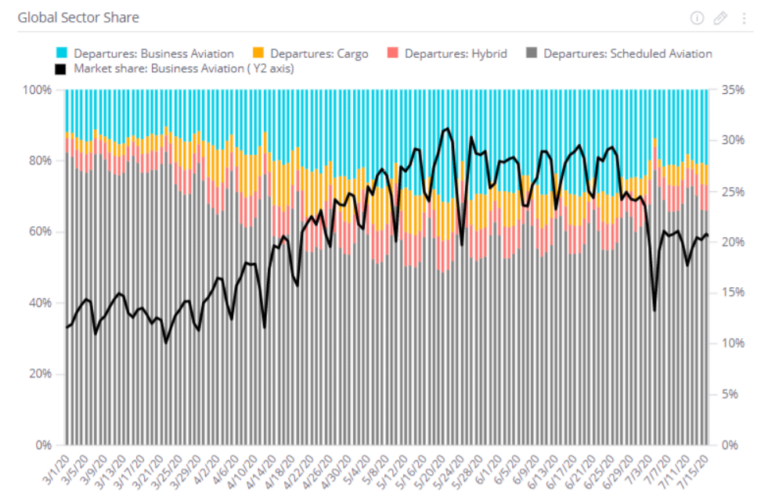

Managing Director WINGX Richard Koe comments: “The European region is ahead of the US on the pandemic curve and has regained the initiative in terms of recovery in business aviation, although not in scheduled airline activity. Both regions have seen leisure market rebounds in bizav, the US bounce-back now stalled by secondary lockdown in California, the European region released as quarantines lift. Bizav is also offering more attractive connectivity, with flights to Majorca a representative example: business aviation arrivals are up 20% in July, no doubt partly owing to the 64% drop in airline connections to the same location.”