Global business aviation traffic has lost over 86,000 sectors so far in July compared to the same period July 2019, which equates to 20% decline

Global business aviation traffic has lost over 86,000 sectors so far in July compared to the same period July 2019, which equates to 20% decline, an improvement on the 30% deficit in June YOY, but a step backwards from mid-July when activity was approaching 85% of last year´s volumes.

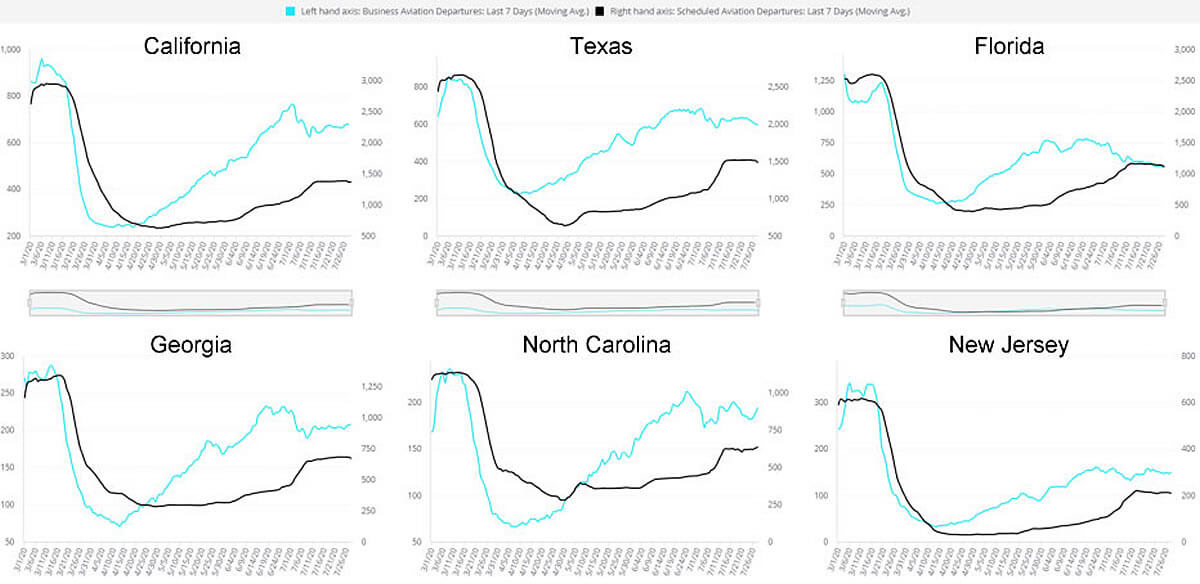

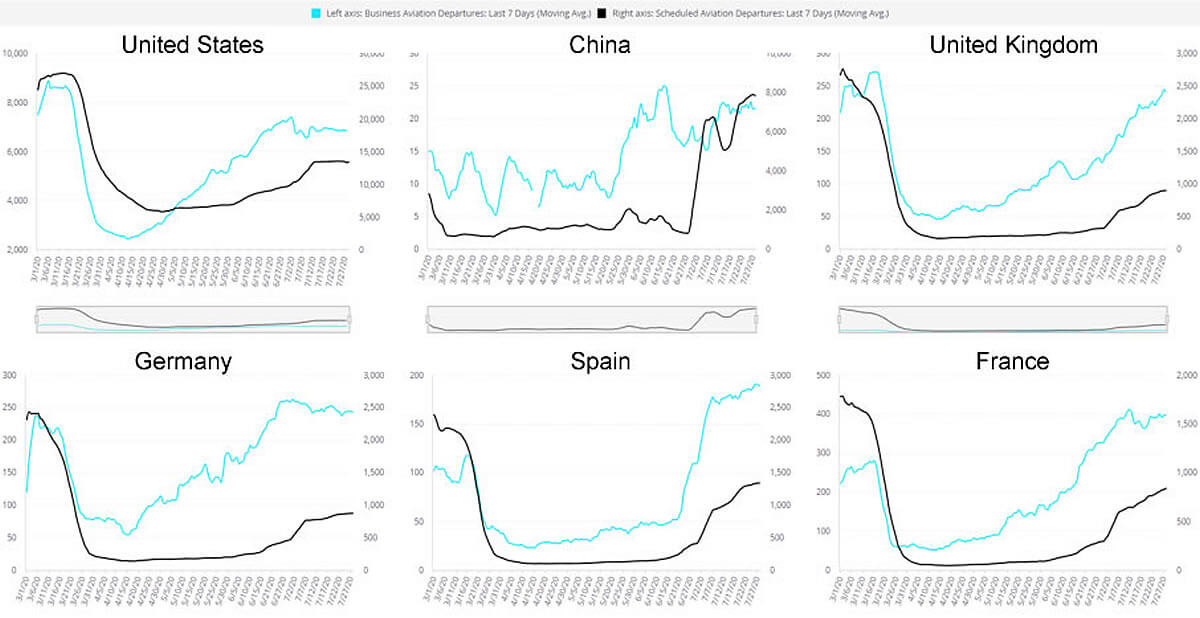

According to WINGX`s weekly Global Market Tracker, published today, the reversal is clearest in the US, where 7-day average daily activity has slipped from 7,300 sectors at the start of the month to around 6,800 in recent days. The declines are weighted towards weekdays, down by at least a quarter, compared to weekends, where sectors are more robust. For North America as a whole, the July activity trend is -23% month-to-date, which reflects softening activity in Canada and Mexico.

Several US States have reversed course on reopening the economy in July as virus infections have surged. This is the main break on recovery in flight activity, with business aviation flights in California, Texas, Michigan, North Carolina stalled at 20% below, and New York activity still stubbornly down by a third YOY. The East Coast hubs are really struggling, with White Plains almost 40% down for the month, Teterboro still 60% shy of normal July activity. Gains in YOY activity out of Florida and Arizona persevere, but they´re barely 1% up YOY. Palm Beach is an outlier, with activity gains of 20%. There are some other exceptions, with flights out of Aspen up by 18% this month, Denver only 2% down, Salt Lake City 2% up, and Van Nuys airport seeing resilient activity, flights trailing by 6% so far in July.

Europe

The European market continues to see stronger recovery in July, with regional activity now only 14% down, and just 6% down in the last 7 days. France has registered over 10K flights in the month, 12.5% under par, and Germany is just 2.5% below normal for July. Switzerland has a similarly flat trend, and several countries – Austria, Belgium, Croatia – are seeing more flights this month than in July 2019. Spain has shown the strongest recovery this month, with the domestic market, 40% of its traffic, seeing more than 10% growth. Mallorca´s flights are up 22% and Ibiza is only 8% under par this month. UK visits to Spain are up 12%, arrivals from Switzerland up 29%, from Germany, 40% growth. This picture may change in the next week, following the re-imposition of UK quarantine on travellers to Spain.

Airports

Elsewhere in Europe, Nice is back in action, flights recovered to 83% of normal. Le Bourget is still trailing but now only 31% behind. Swiss airports are seeing much improved activity, with Geneva flat YOY and Zurich just 1.5% adrift. The Russian market has been fairly robust, 8% below normal, and Vnukovo is recovering, flights down by 12%. UK, Italy and Greece are the wayward countries. Even leisure hubs like Olbia are down by a quarter for bizav arrivals. The UK´s top airport, Farnborough is still in the dumps, flights down 40%. Biggin Hill has taken second spot from Luton, flights up at 94% of normal. Arrivals into Greece are 35% adrift, with top tourist spots like Mykonos seeing 50% fewer bizav visits.

Rest of the world

Outside Europe and the US, business aviation flight activity is lagging in Africa and Middle East, a third behind usual activity, with recovery stalling at 85% of normal in Asia, 95% in Oceania. In those regions, China´s activity has oscillated around 10% below par, and the Australian market is just a couple of points off usual levels. Elsewhere, recorded bizav activity in Brazil and Columbia is up YOY. India is only a little adrift, the UAE has seen a 17% increase in flight activity this month, but Saudi Arabia continues to slump, 40% below levels last July.

Aircraft

The global footprint by aircraft type continues to emphasise the resilience of lighter aircraft, with Very Light Jets flying 93% of normal, Light Jets down by only 12.5%. Super Light sectors off by 18%. The decline steepens to 20% in the midsize segments, and Heavy Jet operations trail by over 30%, with Ultra-Long Range jets flying 35% less so far in July. The redoubtable PC12 continues to fly most missions, with Citation Excel/XLS the busiest jet, sectors down by 20%. The most resilient business jet types are Challenger 300/350 and Phenom 300, flying 15% fewer sectors this July.

Managing Director Richard Koe comments: “The recovery in business aviation activity has taken a knock as travel restrictions persist, but the sector is still showing much more resilience than the scheduled sector; bizav trends are heading towards a 20% decline for the US in July, in stark contrast to 50% deficit in airline connections.

“The recovery in Europe has released pent-up demand slightly later, just in time for peak summer season. Unfortunately, unpredictable quarantine interventions have probably already introduced sufficient uncertainty to limit the extent of that recovery in the second half of the summer.”