The bizav activity footprint is clearly leisure-driven, with peaks in connections to and from holiday resorts on the Med

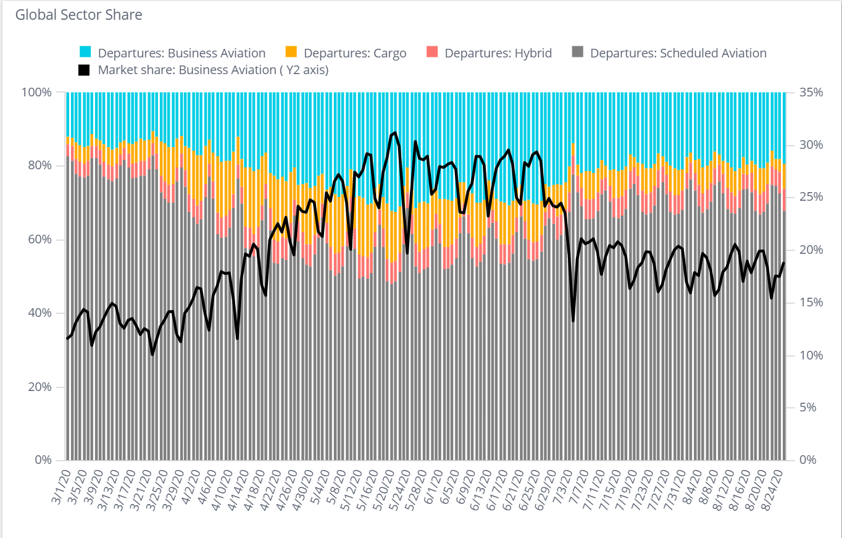

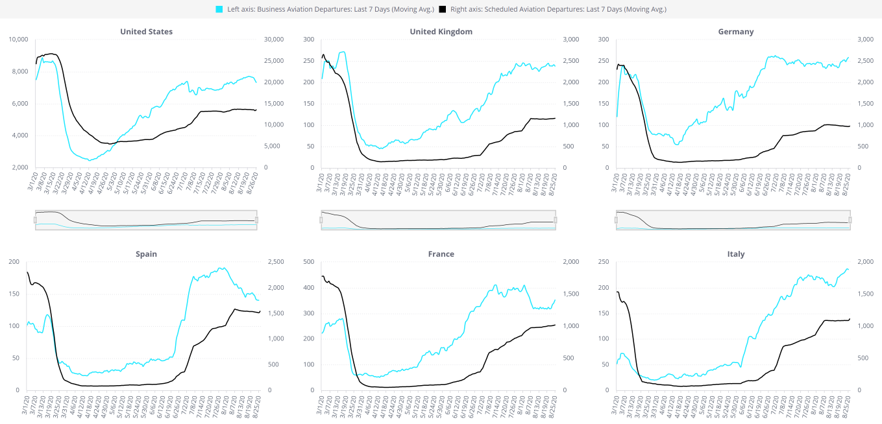

In the last 7 days, global business aviation sectors were at 86% of the comparable period last August, in contrast to the commercial airlines, with scheduled sectors stuttering at around half normal. The European area is sustaining the momentum in business aviation, with August so far logging 3% more sectors on business jets and turboprops than in August last year.

The bizav activity footprint is clearly leisure-driven, with peaks in connections to and from holiday resorts on the Med, fed largely by customers from Continental Europe - Germany, France, Switzerland - as well as Turkey and Russia.

According to WINGX`s weekly Global Market Tracker published today, the recovery in European bizjet flying is mixed regionally, correlating to the trajectory of the pandemic, with renewed virus contagion in Spain slamming the break on the Iberian tourist season, whilst Germany´s relatively low contagion levels have been mirrored in much higher levels of mobility, business aviation included. Croatia appears to be the European holiday hot spot this summer, with business aviation arrivals up almost 50% this month. Flights into Cannes are up almost 20% YOY, and arrivals into Bodrum have climbed 35% higher than in August last year. The departure points with strongest growth include Zurich, Vnukovo, Munich and Ataturk airports.

The charter market has seen a strong recovery in Europe, with growth slanted towards lighter aircraft, all segments from Super Light to Very Light seeing more activity YOY. The VLJ market, up almost 20% in terms of hours flown, is strongest in France, Italy, Switzerland, and Germany. VLJ departures from Le Bourget, Olbia and Nice are up 20%; from Biggin Hill, Majorca, Figari and Zurich, activity is up by over 40%. Nice-Olbia is the busiest VLJ pair so far this month, although that connection is down 40% YOY. In the larger business jet segments, the market is still well behind, with Heavy Jet and Ultra Long-Range operations down 20%, although there are operators like Air Hamburg which have sustained high utilisation across a large cabin fleet.

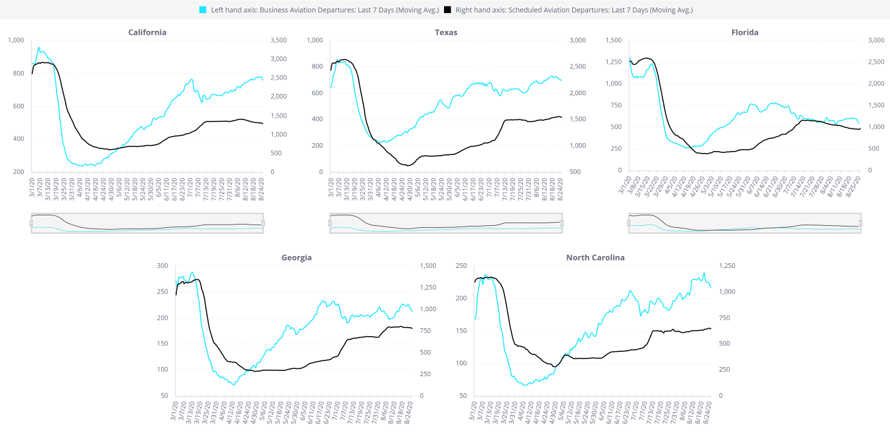

The United States is still by far the largest market for business aviation activity, almost 70% of all flights so far in August. Hence the slowdown in US flight recovery, dating since the pandemic took off in early July, has more than offset the activity gains in Europe. August activity in the US is now trailing YOY volumes by almost 40k sectors, an 18% decline, very similar to where we were in July, although there has been a 5% improvement in the 7-day average daily activity since the start of the month. The roll back in travel restrictions in California and Texas has stalled flight volumes at about 85% of normal, whilst activity in and from Florida continues to retreat from earlier summer growth. The East Coast States are seeing very slow recovery even though the regional pandemic has diminished since June.

The bright sparks in the North American region continue to be geographically located around getaway destinations, in Colorado, Montana, Wyoming, Idaho, and in flights to US Virgin Islands, Puerto Rico and Jamaica. Branded charter operators like Jet Linx, Mountain Aviation, and XO Jet are maintaining high levels of utilisation, and Flexjet is the stand-out fractional operator. The busiest business jet this month is the Challenger 300, operating just under 10K sectors, in line with the market´s 18% YOY decline. Jets with relatively stronger trends include the Phenom 300, Cessna Encore, CJ3 and Hawker Nextant. The larger cabin jets are flying much less, but the Gulfstream G300/400/450 platform is an exception, with North American departures down only 9% this month.

Outside Europe and the US, the picture continues to be mixed, with Oceania and Asia relatively stable, Latin America and Africa flight activity well below normal. In Latin America, steep declines in operations in Mexico contrast with fairly buoyant activity in Brazil. In Africa, much less activity in Morocco contrasts with business aviation aircraft flying more sectors YOY within Nigeria. Business jet activity in China is back up, and there has been growth in Malaysia, contrast declines in Singapore and Hong Kong. In the Middle East, business jet flight activity in Saudi Arabia is still severely muted, which is not the case for Qatar. Severe lockdown renewals in Australia and New Zealand have seen flight activity fall away quickly this month.

Managing Director Richard Koe comments:“The bounce-back in business aviation activity in Europe has been encouraging, even though it´s clearly a temporary boost coming from last-minute leisure demand as quarantines lift and switch, and the summer season winds up. The US recovery has been stunted, and the return of the business executive in the Fall is questionable with many corporations not requiring employees back at the office before mid-2021. That said, commercial airline capacity shows little sign of rebooting, and we still expect at least some shift from scheduled to on-demand services as the business traveller starts to need to fly again.”