Almost 50,000 fewer business aviation sectors have been operated in September 2020 compared to September 2019

Almost 50,000 fewer business aviation sectors have been operated in September 2020 compared to September 2019, according to WINGX`s weekly Global Market Tracker published today - a YOY deficit of 16.5%.

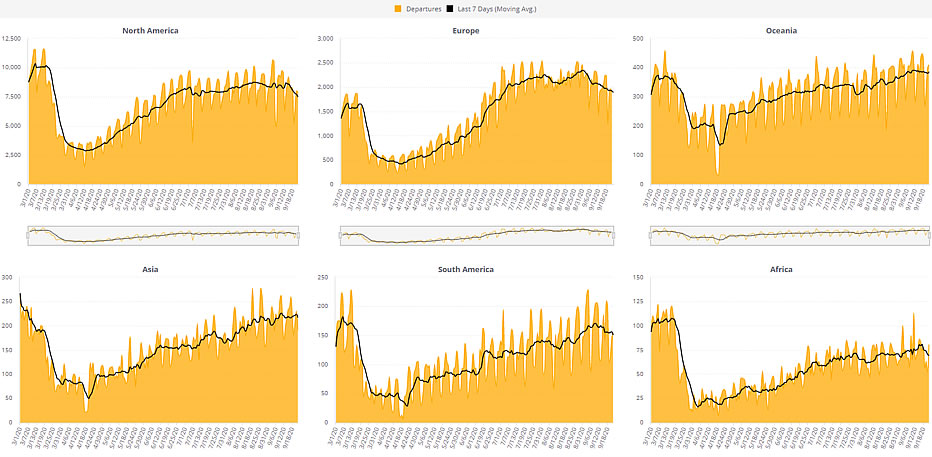

This gap is widening since August, as the summer holiday demand dries up, particularly in Europe. The decline in flights mirrors the relapse in scheduled airline activity this month. Across both market sectors, travel demand has clearly softened in the leisure sector and failed to pick up in corporate travel. For the business aviation market, North America has seen the biggest recovery stall, flights trending down by 20% YOY. In Europe, business jet and prop flights are now trailing September 2019 by 8%. Both regions are seeing YOY declines of around 50% in airline traffic.

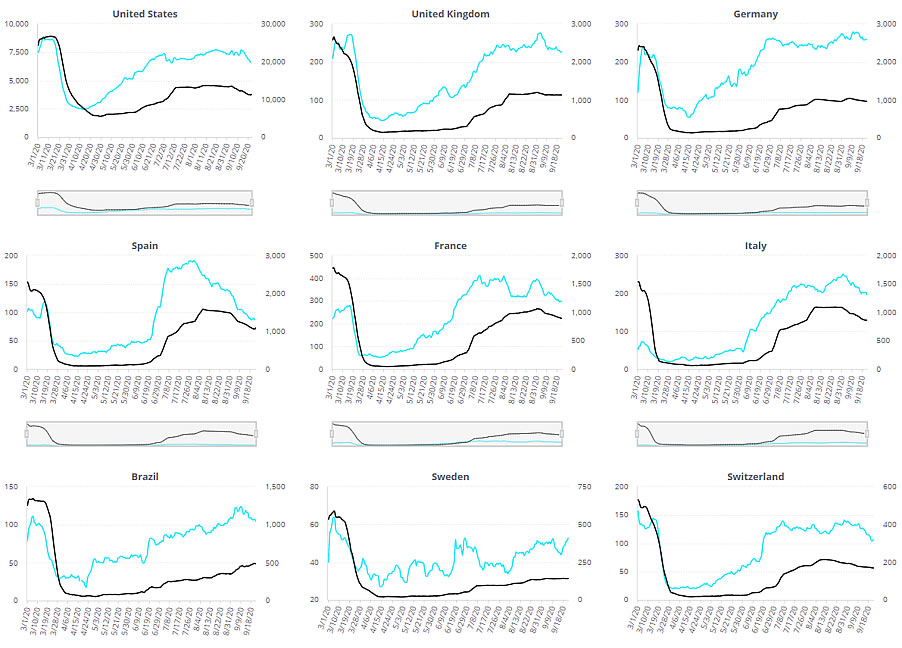

The US market has seen an 18% decline in business jet and prop sectors this month, through 22nd September. Activity has declined 13% over the last 7 days, with trends now back where they were in August. Flight activity in Florida is ahead of September 2019, although that trend is fading from the Labor Day surge at the start of the month. Colorado is slightly up compared to same period last year, with the summer-long growth in activity now dissipating. Arizona is flat and Michigan is close to normal for September. The core business jet States are still floundering in terms of YOY activity, with flights out of Texas 20% under par, and California activity 15% behind. Activity out of New York is trailing by 18% although that represents a big improvement to deeper stagnation throughout the summer.

United States

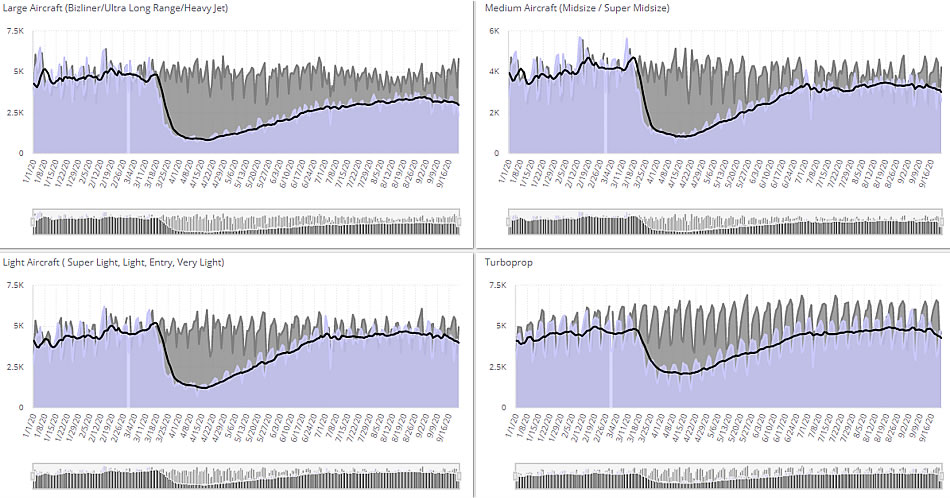

Charter demand continues to offer some buoyancy in the US. Branded charter operators are flying 12% fewer sectors in September, YOY, and just 6% deficit in hours. By comparison, aircraft management companies are flying 17% less, fractional operations down by 15%, private flight departments posting 25% fewer sectors. In the charter market, the Citation Excel/XLS is the busiest jet, but Lear 60 and Hawker Nextant have strong YOY growth. Heavier jets are struggling to find demand, the Challenger 600 flying 25% less YOY. The prop charter market is resilient, with the PC-12 sustaining up 5% YOY. Part 135 hours are up for branded charter operators like Jet Edge, XO Jet and Clay Lacy. The busiest airports September so far are Teterboro and Van Nuys, charters respectively down by 44% and up by 7%.

Europe

In Europe, flight activity is clearly ebbing in September, with leading market France showing 15% decline in business jet and prop flights month-to-date. Flight activity in Germany is down by 8% YOY, down 13% in terms of flight hours. The UK and Spain are worst affected so far this month, both countries seeing more than 20% declines in flight activity compared to the same September period last years. Russia, Turkey, Austria and Sweden have sustained YOY growth in flights this month. Business jet flights out of Croatia are 7% higher this month than in September 2019, and from Portugal, up 3%. Business jet charter demand is relatively resilient, this activity down 5% YOY across Europe, and still higher in Germany and Switzerland than for the same period in September last year.

Across European airports, business jet and prop activity is trailing by most at the key hubs such as Le Bourget, Luton, Nice and Farnborough, all seeing at least 25% YOY deficits. Biggin Hill and Zurich are flat YOY. Vienna is seeing some YOY growth, and there is a month-long surge in activity out of Vnukovo, Olbia, Munich, Ataturk and Athens, all well above 2019 levels of business aviation this month. Connections with conspicuous growth this month include Vnukovo-Riga-Pulkovo, Bodrum-Ataturk-Dalaman, Vnukovo-Nice, and Cannes-Le Bourget. The biggest declines are on the perennially busy connections between Geneva, Le Bourget, Nice and Farnborough. Ninety seven percent of all business aviation flights from Europe stayed in Europe, with interregional connections seeing steep declines: transatlantic flights from Europe to North America are trending down by over 60% in September.

Rest of the world

Outside Europe and the US, the trend in business aviation activity in September is down by 18%, 24% behind in terms of flight hours operated. Significant declines in Canada, Mexico and New Zealand are offsetting a recovery in flight activity in Australia and growth in flights out of Brazil and China. UAE, Israel and Malaysia are all seeing more flights in September this year than last year, although flight hours are down. Saudi Arabia has seen a 26% decline in flights this month, 50% fall in flight hours. Business jet flights between Riyadh and Jeddah are down by 36% this month. The busiest business jet outside the US and European regions is the Challenger 600, sectors down by 23%. Global 6000/6500 activity is trending down 42%; but CJ2 flights are up 15% this month.

Managing Director Richard Koe comments: “The unwinding of the late summer recovery is underway, with the absence of the business traveller unsurprising given that governments and corporations are requesting employees to work from home. Wherever the virus second wave concerns are strongest, all travel demand including business aviation is weakest, the UK and Spain most notable examples this month. The bright spot for the business aviation sector is that charter demand is relatively resilient and is clearly representing a larger share of activity than before the pandemic.”