With business travel largely on hold, the leisure demand is showing up in terms of robust charter demand, leisure destination and smaller aircraft

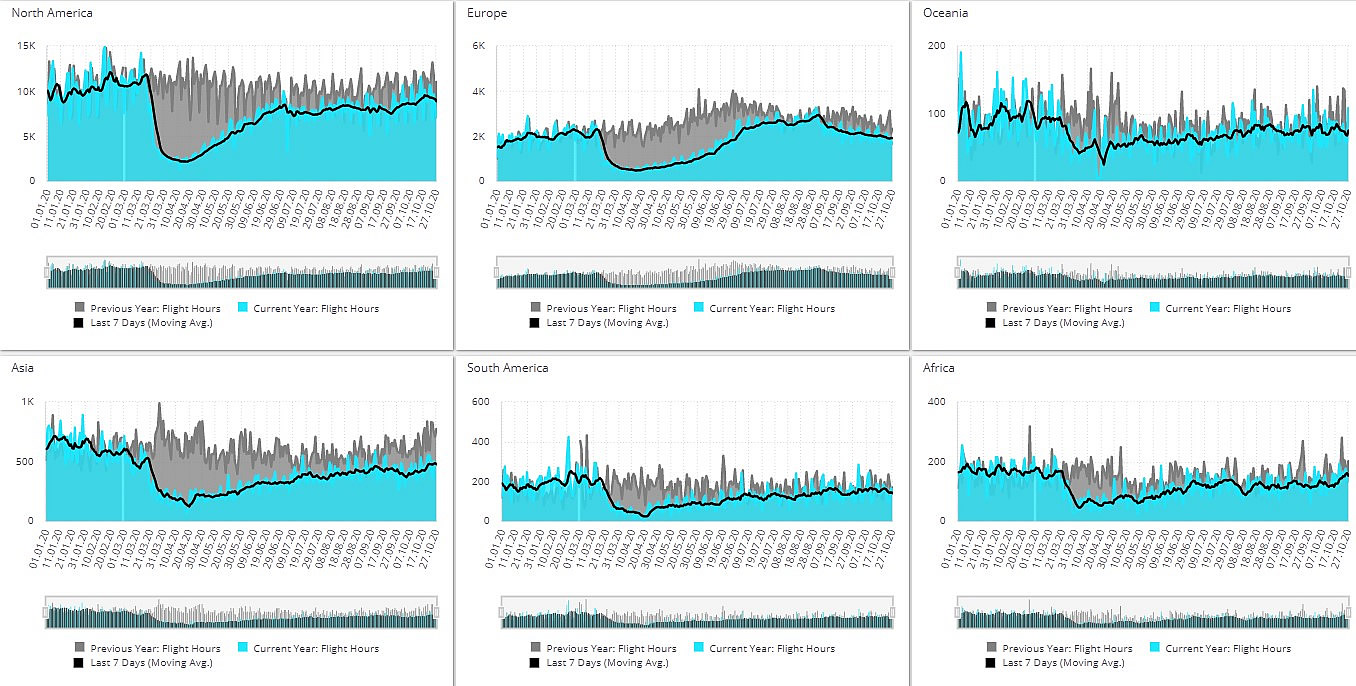

Global business aviation activity is down by 15% through most of October 2020 compared to the same period in 2019, according to WINGX`s weekly Global Market Tracker, published today.

This is a resilient trend considering the resurgence of virus concerns in key European and US markets, and the associated travel restrictions, which have been reflected in more than 50% drops in scheduled airline operations.

Rolling 7-day average bizav activity hit a post-March high of just over 12,000 daily sectors on 19th October, compared to a low point of just 4,000 in the Spring, and a high point of 11,000 this summer. With business travel largely on hold, the leisure demand is showing up in terms of robust charter demand, leisure destination and smaller aircraft.

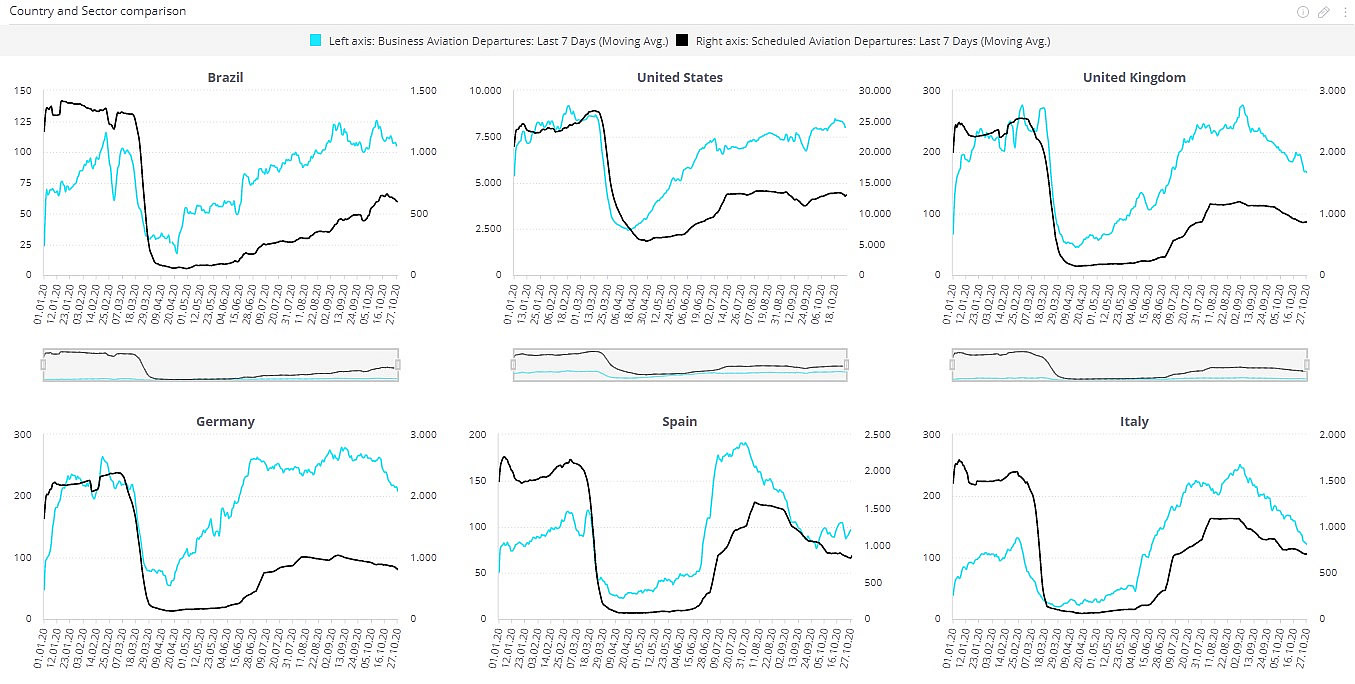

Three quarters of global business aviation activity this month is in the North American region, with the United States seeing the lion’s share, trending 14% below normal, then Canada, Mexico and Bahamas next busiest, all with more severe declines. The US market is slightly improving at the aggregate level in the last 2 months, and at 86% of October 2019 volume, the trend is fairly encouraging given this month is typically driven by calendar events which are all cancelled this year. The Charter market is buoyant, with branded charter operations only 7% below normal. Fractional operations are now also seeing a stronger recovery, trending likewise at 93% of normal. Private operations, including corporate flight departments, continue to fly much less, sectors 23% below vs same period last year.

United States

Two of the busiest four US States have seen growth in business aviation activity this month, with both Florida and Colorado seeing double-digit growth YOY. Texas is the busiest State, jet and prop activity trailing 14% YOY. Flight activity out of California, still mainly in lockdown, is down only 11%. The East Coast is where we see the biggest dent in normal operations, flights out of New York, down 14%, Pennsylvania -21% and New Jersey still at the back, flights down 46% YOY. South Carolina is another outlier, flights up 2%, and there is sustained growth to getaway destinations - Utah, Montana, and Idaho. Across the US, the busiest aircraft segments are Light and Very Light Jets. Charter activity is trending up on several aircraft platforms including Citation X, Lear 60, Nextant and Challenger 300/350.

Europe

US trends are converging with Europe; as the former improves, the latter is deteriorating, reflecting the spike in virus infections this month. October trends show a decline of 13% in overall regional sectors flown, 18% drop in terms of flight hours, emphasizing the shift towards smaller aircraft flying shorter sectors. Four of the biggest six markets are now seeing fast-deteriorating declines: Switzerland, France, Spain, and particularly the UK, flights down by a third vs October 2019. Germany and Italy are so far less affected, above 90% of normal, and domestic flights in Germany, Italy, also Sweden are up in October. Flight activity in Turkey and Russia is well up, also mostly domestic.

The charter market is also more buoyant in Europe, with 8% declining trends so far in October. Branded charter operations are substantially up in Greece, Cyprus, Ukraine, Poland also Russia and Turkey. The busiest charter flows are domestic: UK, France, Spain, all well behind, and Germany, only 5% below normal. The busiest international charter connection in Europe is UK to France, flights down by 35%. Next is UK to Germany, charters up almost 10% this month. Other country flows point to half-term holiday demand: charters are well up between Germany, Italy, UK, Turkey and Greece. Charter pairs from Vnukovo are well up – with Riga, Bodrum, Nice, Larnaca.

Rest of the world

Outside Europe and North America, the narrative is little changed, with flights overall declining 18% YOY, flight hours suffering more, falling 26% on the fall-off in demand for inter-continental sectors. Declines continue to be significant in Canada, Mexico, Saudi Arabia, India, whereas business jet activity is much more robust in Brazil, Israel, Colombia, China, and UAE. The busiest airports in these regions are in Mexico, Brazil, Australia, such as Del Norte and Toluca, flights well down, although Los Cabos is up, so too are Corgonhas, São Paulo, and Adelaide and Townsville in Australia. Top Asia-Pac airports include Beijing, Seletar and Hong Kong, flight activity still well down at all three locations. Guangzhou has the biggest growth in business aviation activity this month in Asia.

Managing Director WINGX Richard Koe comments “Business aviation demand is holding up globally, encouraging to see a post-March high in daily operations. Charter and Fractional operations are fairly robust, and as we know that business travel is greatly subdued, this suggests there is a strong underlying demand for safe and convenient leisure and lifestyle travel.”