According to WINGX`s weekly Global Market Tracker, 147,353 business aviation flights have been operated globally in the first half of December, the trend dropping to 20% below the same period last year

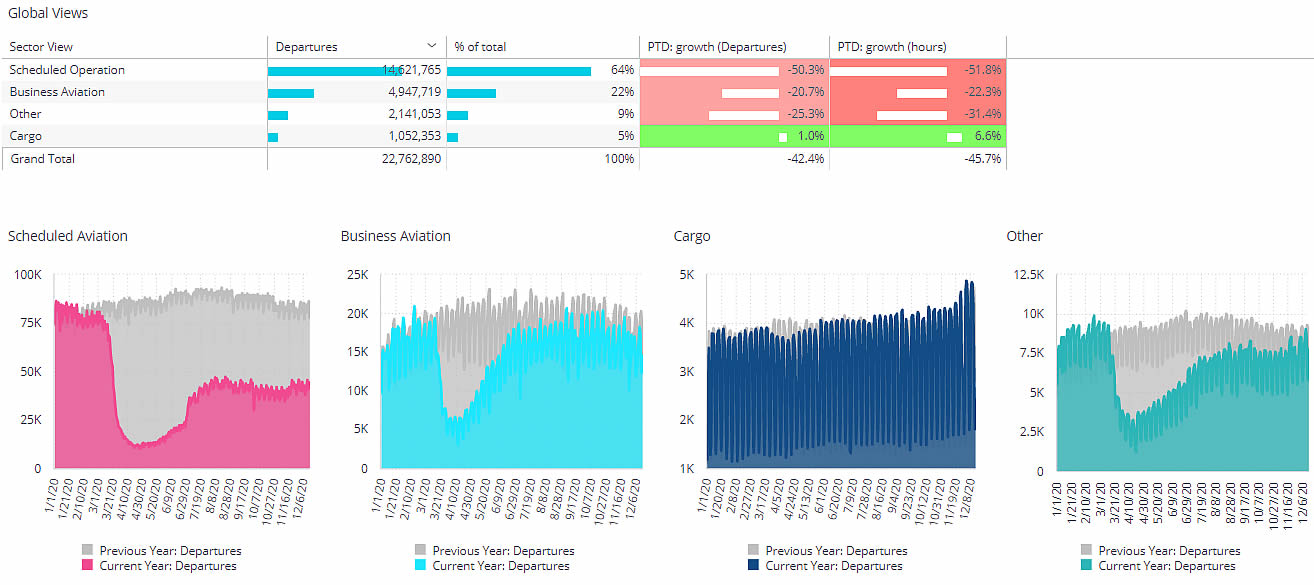

According to WINGX`s weekly Global Market Tracker, 147,353 business aviation flights have been operated globally in the first half of December, the trend dropping to 20% below the same period last year as demand stutters in the face of renewed lockdowns in North America and Europe. There are some resilient spots, evident in high-end leisure destinations, particularly warm-weather resorts in the Caribbean. Globally, the last quarter´s recovery trend is coming in at just under 20% below normal, with the full year decline heading for around a quarter below 2019. By comparison, scheduled airline activity is likely to see well under half the sectors in 2020 compared to 2019. Scheduled cargo operations have bucked the trend, gaining almost 10% in activity this year compared to last.

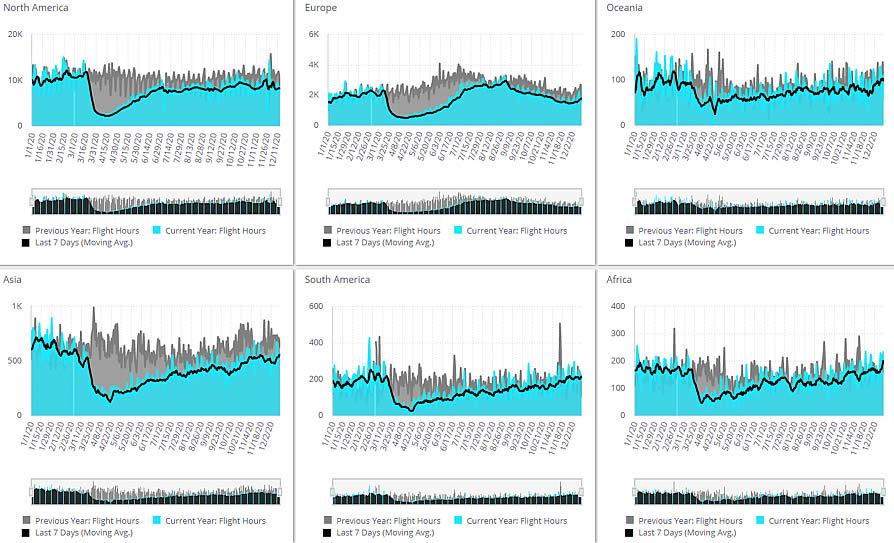

Back to business aviation, where business jet and prop movements are seeing a continued deterioration through the winter so far, but no dramatic decline. The decline in flight demand in the North American market is weighing down the overall market, with the key US region seeing 24% fewer flights so far this month. The impact was heaviest at the start of the month, following the Thanksgiving holidays and the presidential elections; since then activity has mildly picked up. International flights make up only a small part of the volume but several connections are showing growth compared to December 2019: departures from the US to Mexico are up by 4%, to Bermuda, by 7%, to Turks and Caicos, flights up 24%, and from the US to the Dominican Republic, business jet flights are up by more than 50% compared to same period last year.

Focusing on the Caribbean, business jet and prop flights are down by 14% in December YOY, significantly stronger trends than the broader market. Of just over 3,000 business aviation arrivals in the Caribbean this month, over half are jet operations. A quarter of the arrivals have been operated by Aircraft Management companies, their activity close to normal for this time of year. Most of the connections are from the US, but notably connections with Europe have more than doubled on last year. Ultra-Long Range jets have recorded a YOY growth in flights to the Caribbean this month. The busiest sectors are local, the King Air 200 much busier than usual on connections between Jamaica, Cuba, Aruba and mainland US, mostly Florida. The Caribbean is not the only location to see a pick-up in leisure travellers; business jet travel into Aspen is up by more than 50% this month versus 2019.

Europe has a more resilient trend than the US in December, with flights trending down by 19% for the first half of December. The UK is pulling the market down, with flights falling at least a third from normal. Austria is also severely affected by the renewed lockdown, clearly losing its usual winter tourists for this time of year. France and Switzerland are relatively less affected, just over 15% deficits. Russia´s growth in flight activity in the last 2 months has slowed, but still holding up to YOY levels. Turkey continues to be Europe´s outlier, posting gains of 18% this month, mainly in business jet traffic. For Europe as a whole, the charter market continues to be relatively resilient, flights down by 15% but demand still quite robust for lighter jets such as the Citation Mustang and Phenom 300.

At the airport level, Vnukovo and Ataturk are the leading lights in Europe, seeing more activity than in 2019 over most of the last two months. In the US, Scottsdale and West Palm Beach have seen the strongest trends, clearly growing market share of business aviation flights since the pandemic. Outside Europe and North America, the Middle East is seeing a stronger recovery, with Dubai airports seeing more traffic, though Saudi Arabia has not picked up yet. In Asia, business aviation hubs such as Hong Kong and Seletar have not yet seen a strong recovery, but general aviation flying has picked up strongly in Australia, notable at airports in Perth and Darwin. Whilst prop aircraft are dong most of the work in Australasia, the heavy jet segment is getting more usage across Asia, with light jets most resilient in the European region, and midsize jets still seeing relatively robust demand in the US.

Managing Director WINGX Richard Koe comments “Business aviation is navigating turbulent waters with the renewed lockdowns, and in what is already a fallow period of the year for leisure travel, the hollowed out corporate travel market is offering little support. That said, trending activity hasn´t drastically dropped from the post-Spring highs in October, and the leisure market, especially to getaway sun and ski destinations, may be picking up as we approach Christmas.”