As expected, in 2020, the COVID-19 pandemic negatively impacted general aviation and stifled the industry’s growth

The General Aviation Manufacturers Association (GAMA) presented the 2020 year-end general aviation aircraft billings and shipments report, during its annual State of the Industry press conference. Aircraft deliveries reached a value of $22.8 billion, a decrease compared to $27.8 billion in 2019. Piston airplane deliveries were steady, while turboprop, business jet and helicopter deliveries declined as compared to 2019.

“As expected, in 2020, the COVID-19 pandemic negatively impacted general aviation and stifled the industry’s growth. While we continue to face headwinds globally, all signs point to strong demand for our products and services that are unfortunately being constrained by pandemic induced supply chain limitations and a vast array of disjointed barriers to air travel across national borders. As we progress through the recovery process, our member companies have made the health and safety of their employees and that of their suppliers an overarching priority, and rigorously support economic policies that preserve our skilled aerospace workforce.” said GAMA President and CEO Pete Bunce. “It is encouraging to see that segments of our industry saw a solid rebound in the fourth quarter of 2020. In 2021, it will be important for the general aviation industry to work together with our commercial sector colleagues to keep our interlinked but very fragile supply chain secure, while continuing to engage global regulatory authorities to leverage their mutually recognized safety competencies to keep pace with accelerating technological innovations that improve aviation safety and environmental sustainability and facilitate industry recovery.”

Airplane shipments in 2020, when compared to 2019, saw piston airplane deliveries decline 0.9%, with 1,312 units; turboprop airplane deliveries decline 15.6%, with 443 units; and business jet deliveries decline 20.4%, with 644 units. The value of airplane deliveries for 2020 was $20 billion, a decline of approximately 14.8%.

Preliminary civil-commercial turbine helicopter deliveries for 2020, when compared to 2019, saw a decline of approximately 16.9%, with 544 units; and piston helicopter deliveries saw a decline of 20.7%, with 142 units. (Leonardo Helicopters fourth quarter data is not available at the time of publication. Leonardo Helicopters will release year-end results in March. GAMA excluded 2019 fourth quarter data for Leonardo in the comparison table).

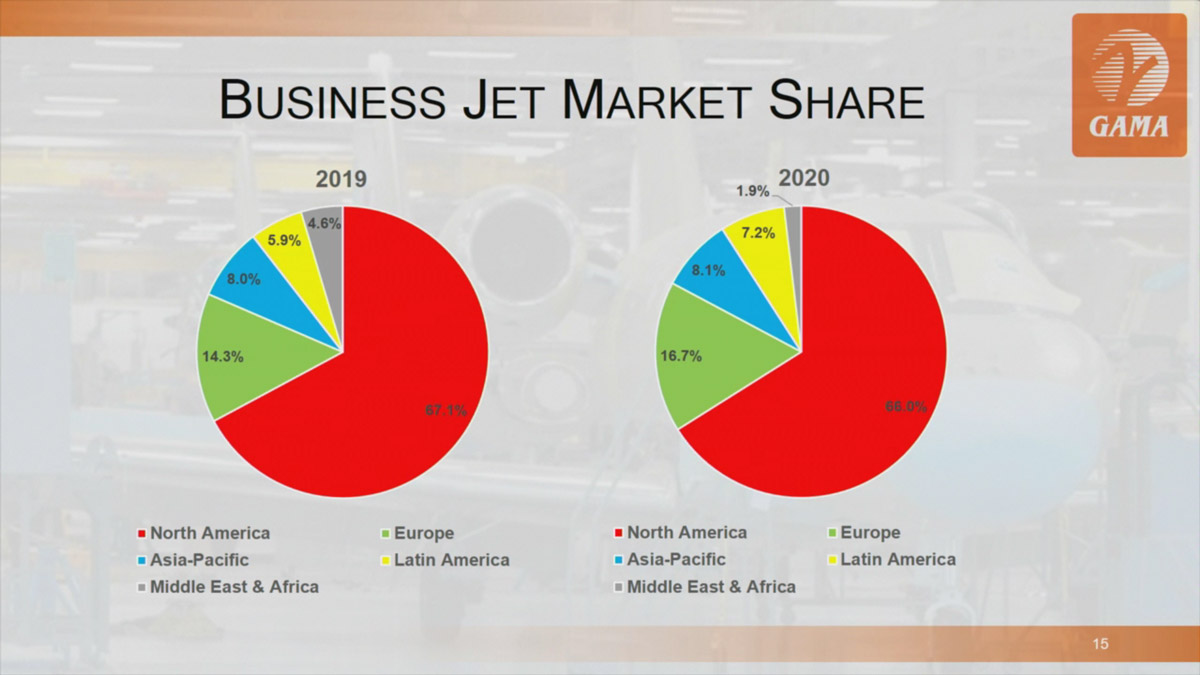

The piston engine airplane market in North America accounted for 67.9% of overall shipments. The second largest market for piston airplanes for the sixth year in a row was the Asia-Pacific market at 17.4%. Turboprop airplane shipments to North American customers accounted for 54.9% of the global deliveries. The second largest market for turboprop airplane deliveries was Europe at 14.4%. The North American market accounted for 66.0% of business jet deliveries. The second largest market for business jet deliveries during the year was Europe at 16.7%.

Year-end Aircraft Shipments and Billings

|

Aircraft Type |

2019 |

2020 |

Change |

|

Piston Airplanes |

1,324 |

1,312 |

-0.9% |

|

Turboprops |

525 |

443 |

-15.6% |

|

Business Jets |

809 |

644 |

-20.4% |

|

Total Airplanes |

2,658 |

2,399 |

-9.7% |

|

Total Airplane Billing |

$23.5B |

$20B |

-14.8% |

|

Piston Helicopters |

179 |

142 |

-20.7% |

|

Turbine Helicopters |

640 |

532 |

-16.9% |

|

Total Helicopters |

819 |

674 |

-17.7% |

|

Total Helicopter Billing |

$3.2B |

$2.7B |

-16.2% |