WINGX’s weekly Business Aviation Bulletin.

Overall Comment

The tide is turning as vaccination programs start to release restrictions on all aviation activity, with an emphasis on leisure and domestic trips. This was demonstrated during Memorial Day in the US. Business aviation flight activity during the recent Monaco Grand Prix and UEFA Finals was still pretty modest compared to pre-pandemic, underlining the recovery lag in Europe. Elsewhere there are much stronger rebounds, with the Middle East standing out.

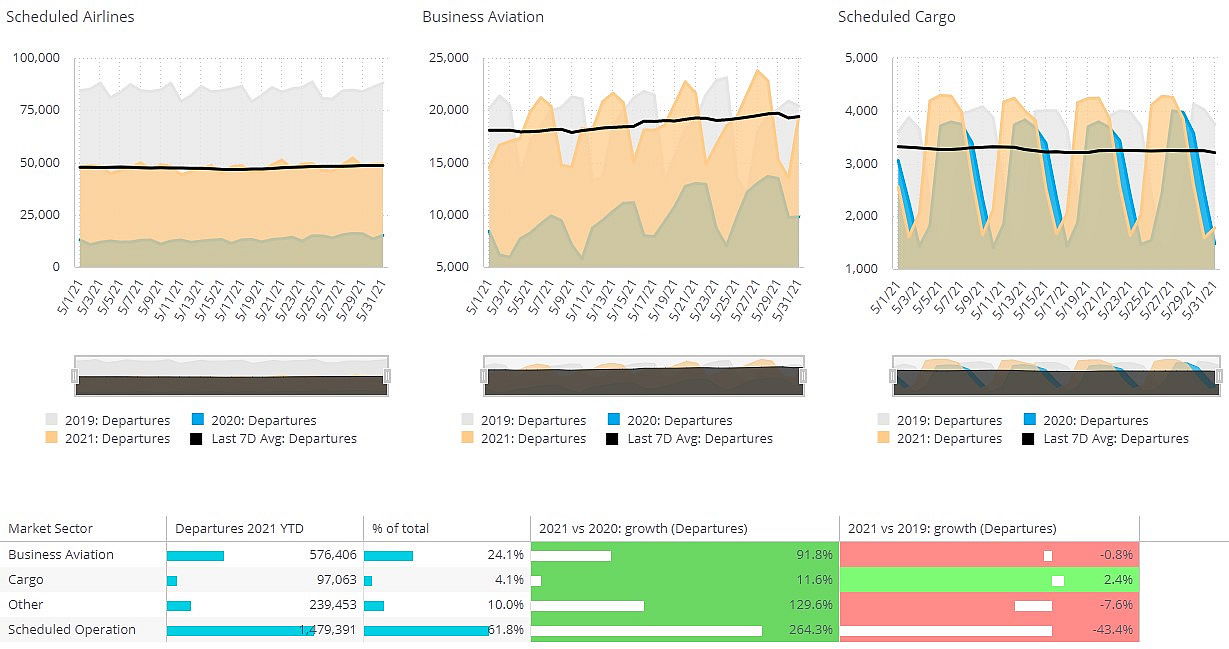

Global

May was a strong recovery month for global aviation activity, with total fixed wing activity up by 166% Year on Year, down by 37% compared to May 2019. Global scheduled airline operations last month lagged May 2019 by 43%. Worldwide cargo fleets continue to rack up more activity, 2% up vs May 2019. Business aviation activity in May 2021 was less than 1% off May 2019. For the year so far, almost 2.5 million business jet and prop sectors account for 23% of all fixed wing activity, this activity trailing the comparable 5-month period of 2019 by less than 5%. In contrast, global airline sectors are still almost 50% behind compared to 2019. In the business aviation sector, branded charter and fractional operations are now moving ahead of comparable 2019 volumes.

Global business aviation versus other fixed wing sectors, May YTD vs 2020 and 2019.

North America

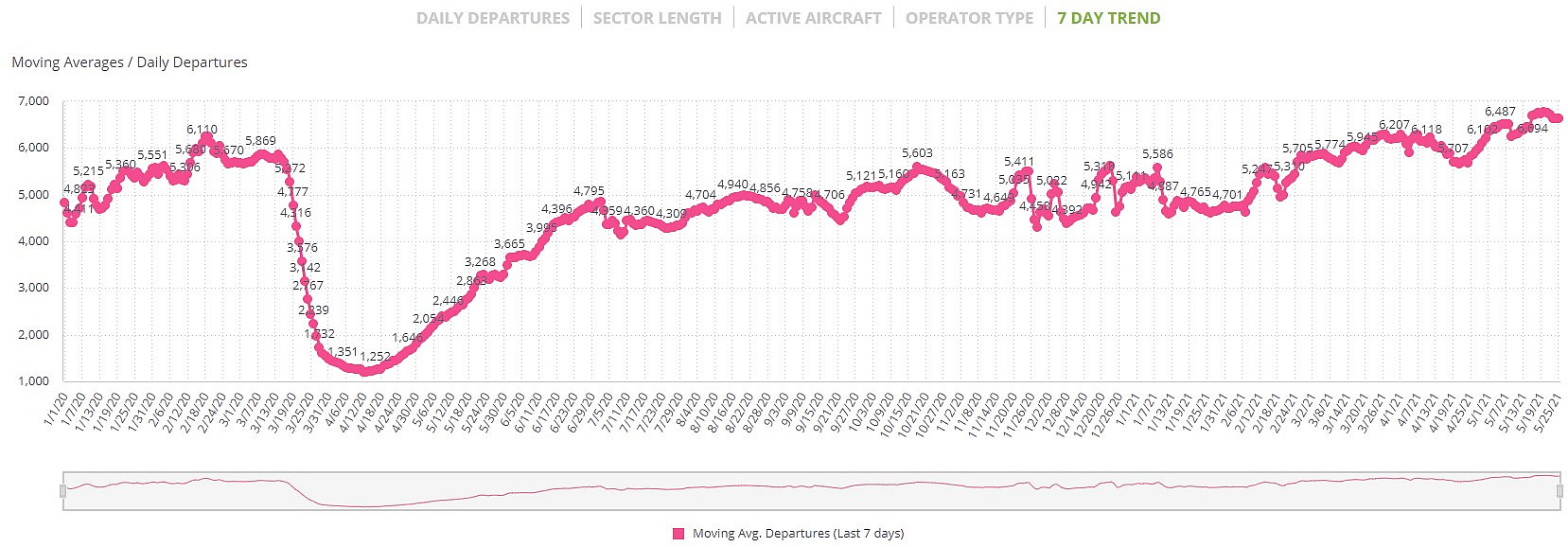

Memorial Day weekend saw a substantial increase in business aviation flight activity, with 32,000 flights in the Friday to Monday period, compared to just 17,000 in 2020, with this year’s holiday racking up 4,000 more departures than Memorial weekend back in 2019. Scheduled airline traffic, by comparison, was 25% up on the 2020 Holiday but still 28% down on the Holiday period in 2019. For business aviation travellers, the most populate destinations were Nantucket, Martha’s Vineyard, Las Vegas, Saint Simons, Albuquerque, Miami-Opa Locka, Westhampton Beach. This Memorial Day, there were 52 flights from White Plains into Nantucket Memorial, with the same pair seeing only 9 flights last year, and 54 arrivals back in 2019.

Business jet traffic rolling 7-day activity in the US since January 2020

At the regional level, the US is continuing to see a very strong recovery in the South West, with Florida the busiest global hub, seeing almost fifty thousand more business aviation departures in the month of May than next busiest State, Texas. Moreover, business jet and prop activity out of airports in Florida is running 34% ahead of May 2020, and 18% ahead of May 2019. New Jersey is the only top ten State which is not yet ahead of 2020 this year. Apart from Florida, both Colorado and Arizona saw more business aviation arrivals in May 2021 compared to May 2019. In 2021 to-date, Part-135 and 91K activity is setting new records, busier than 2019, Private activity is still lagging. Light and Super-Mid activity is dominant, busier than ever, whilst Heavy Jet movements languish 14% below 2019 levels.

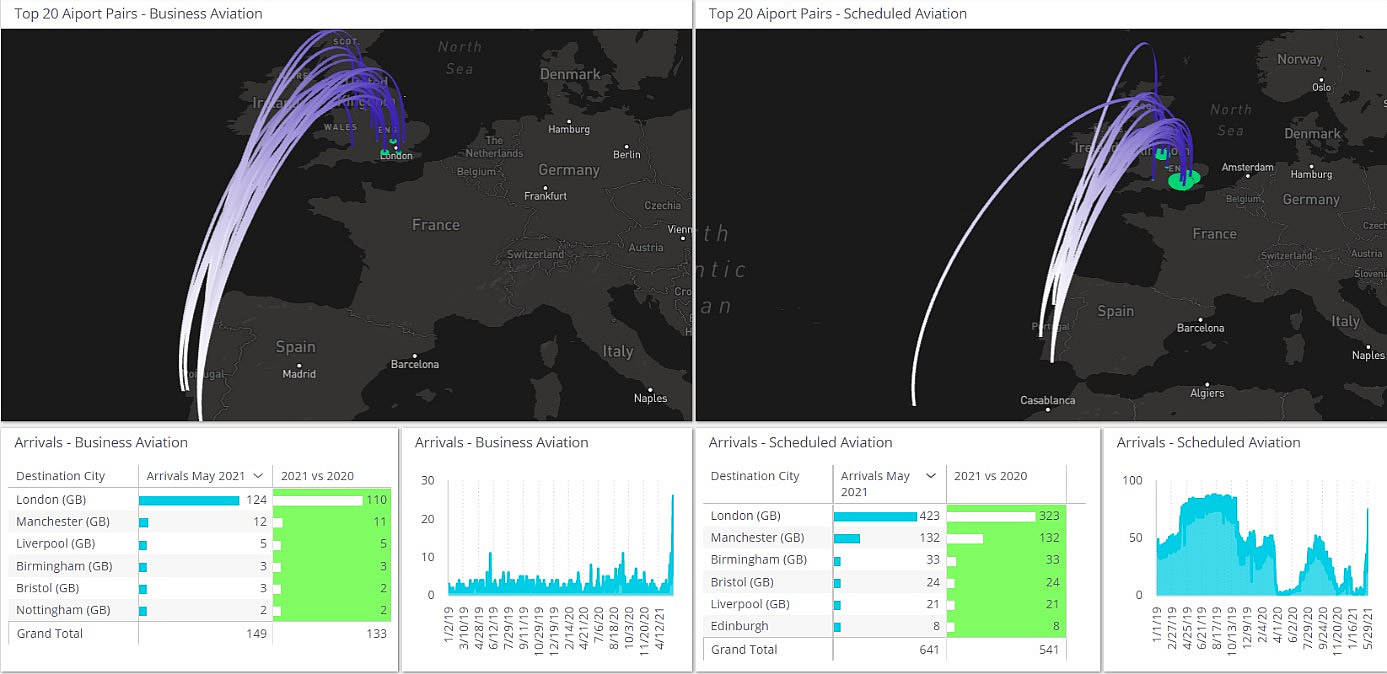

Europe

The recovery in business aviation in Europe is slower but starting to pick up pace. For the month of May, flights were up by 30% compared to 2020, still 17% below 2019. Spain was the biggest market to see May 2021 levels surpass 2019, whilst bigger markets France and Spain lagged 2019 activity by 20%, and the UK still trails 2019 by 46%, behind comparable 2020 by 14%. The Champions League between two English teams in Porto nevertheless drew strong demand from the UK, with more than 80 business aviation movements between UK airports and Porto over the weekend. The Monaco Grand Prix also drew a relatively large number of business aviation flights, 508 arrivals during the 5 days, compared to just 78 last year, although still 29% down on the 2019 event. There were exceptions; arrivals from Majorca into Nice were up 71% compared to the same period back in 2019.

Business aviation vs Scheduled airline departures from Portugal to May YTD 2021

Rest of World

Outside the US and Western Europe, stand-out growth in business aviation in Turkey and Russia continues, trends respectively gaining 16% and 32% on 2019. Russia domestic flights account for 40% of the country’s departures, and these doubled in May 2021 compared to May 2019. There have been even larger increases in connections between Russia and UAE, Kazakhstan, Greece and Serbia. The UAE has been consistently growing activity this year, with May’s activity up 80% on May 2019. The busiest connections from UAE have been with India, Russia, Saudi and Bahrain. Elsewhere, business jet travel is still far behind 2019 in Mexico and Canada, although flights from Mexico to the US are up 20% on 2019. Business jet activity in Saudi has now fully recovered, and China’s domestic activity has doubled compared to May 2019.