WINGX’s weekly Business Aviation Bulletin.

Overall Comment

We have seen a significant milestone this month with business jet activity in the US, year-to-date, surpassing comparable 2019 levels. The rate of the rebound is gathering pace in the US, and Europe may be following in its wake. The UEFA EURO host cities have seen big spikes in business jet arrivals, and the summer season has opened up for the first time in two years, with a surge of high-end tourists heading to the Med’s most famous resorts.

Global

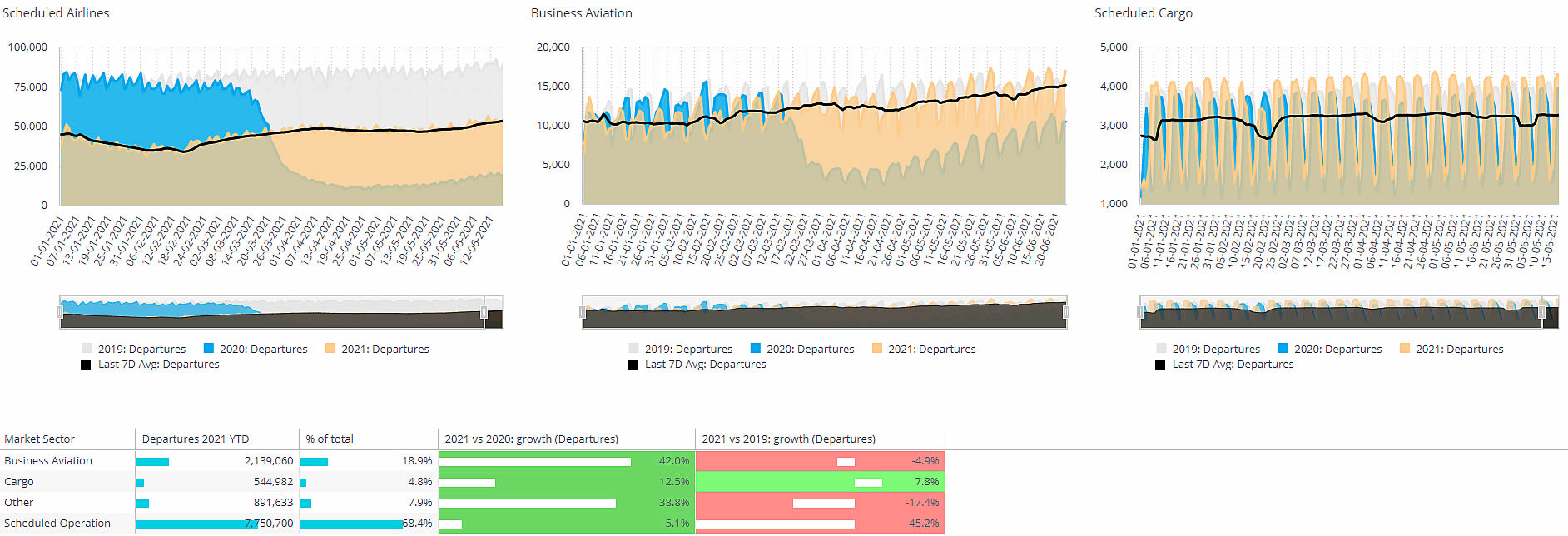

Global business aviation traffic has increased by 6% in June 2021 compared to June 2019, effectively setting record levels of activity. This compares to the commercial airlines, still flying 40% less than pre-pandemic. That trend has only modestly recovered on the year-to-date deficit of 45%, whilst business aviation traffic is just 3% off the comparable activity levels in the first half of 2019, and 41% above the Jan-June period of 2020. And in the surging US market, business jet activity is now edging ahead of the first 6-month volume in 2019. Meanwhile the cargo market is continuing to see gains, flying 5% up compared to June 2019 and 6% ahead for the first half of 2021 vs 2019.

Global Scheduled Airline, Cargo and Business Aviation activity Jan through June 28th, 2021

Business aviation activity has surged back in Europe this month, with 6% more flights in the last two weeks than in the same two weeks back in 2019. For example, business jet and prop departures from airports in Germany are up by 16% compared to same fortnight in June 2020, and up 9% versus comparable June 2019. Switzerland has similar growth, Spain’s traffic has soared 18% above June 2019, Portugal is 42% ahead, and Greece has an additional 55% in business aviation traffic. Belgium and Netherlands both have almost 20% more jet and prop flights this month than in June 2019. Business aviation activity still trails 2019 in France and Italy this month, but only by 3%, whereas flight activity in the United Kingdom is still 23% below 2019 levels, although double where it was last year.

Business aviation vs Scheduled aviation, Baku, 2021 vs 2019

The UEFA EURO 2020 Football Championships has clearly been a catalyst for the European recovery, with the host cities seeing very strong growth compared to June 2019: arrivals into Baku this month are up by 80%, with inbound sectors from Turkey up by 174%, 54% growth in arrivals from Russia, even 24% growth in flights from the UK; flights into Budapest are up 72% this month; into Bucharest, June arrivals are up by 40%, with almost 300% growth in visitors from Italy; activity into St Petersburg are up 11% this month, with 50% increase in arrivals from airports in Russia; arrivals into Munich were up 1% on June 2019, with inbound visitors from France and Spain 30% higher than normal; Seville saw 146% boost in arrivals, with double the usual number of arrivals from the UK. The only location to see no effect was Glasgow, although its bizav connections with Portugal are up 18% this month.

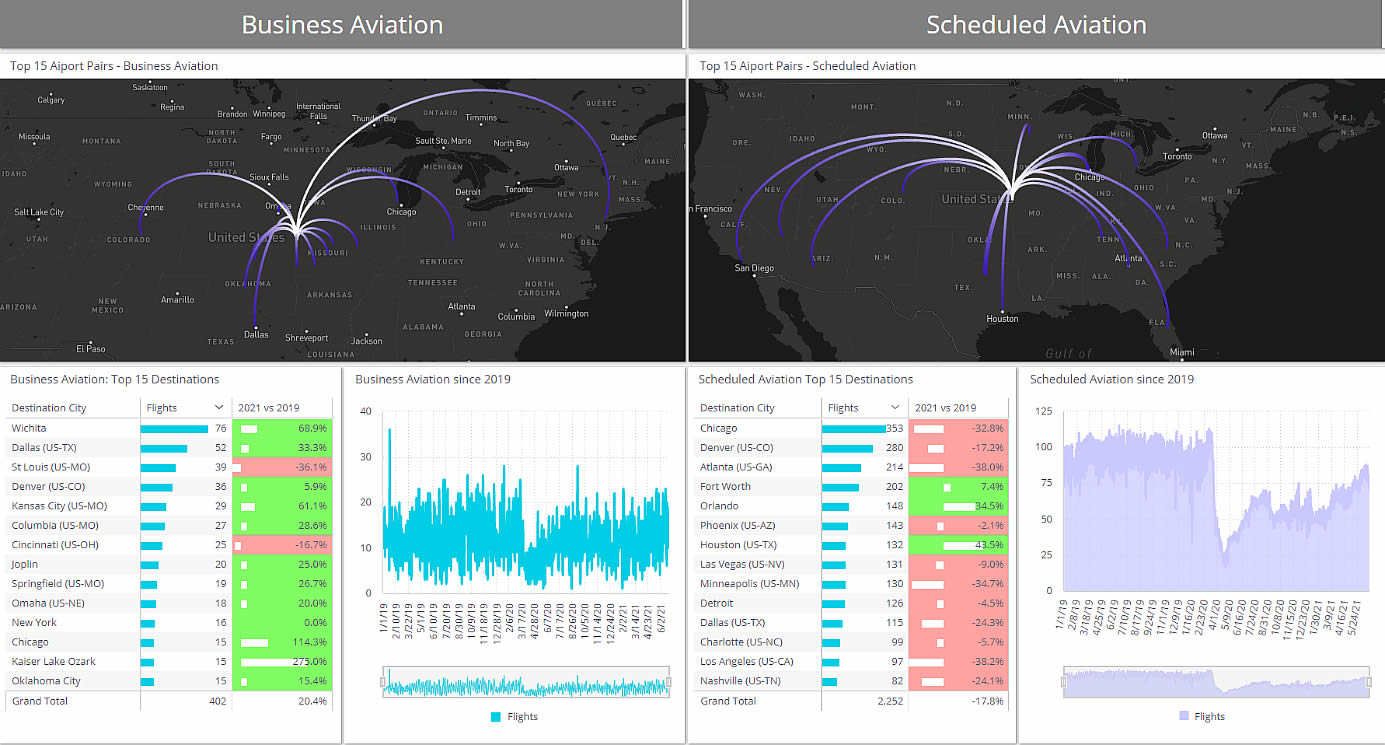

The US business aviation market continues to break records, with business aviation flights in June up by 11% compared to June 2019, 54% up on last year. For just business jets, the lead is even larger, 20% more sectors flown this month than in June two years ago. Year to date, at almost the half-way point of 2021, business jet activity is 2% ahead of 2019. More than half the traffic is Private flight activity, and that’s still trailing 2019 levels. June’s growth is coming from the charter and fractional operators, these sectors more than 20% above normal levels. Business jet flights within the US are up 23% this month, and international connections are picking up, flights to Mexico up 40%, to Bahamas, up 60%, to Turks and Caicos, more than doubled compared to June 2019. Flights to Canada are still 70% below normal, and transatlantic flights are still half of what they were.

Outside Europe and the US, business jet flight this month are trending up by 85% on last year, 4% below where they were in June 2019. This compares to a year-to-date deficit of 12% compared to the first half of 2019. Canada and Mexico are the backmarkers, business jet sectors still a third behind June 2019 levels. Morocco and Japan are two other countries with incomplete recoveries. Some countries have seen rebounds well above June 2019, notably Brazil, India, UAE, Nigeria, and Indonesia. The busiest business jet across these markets this month is the Challenger 600 series, operating some 3,000 sectors, 2% less than in June 2019. The Embraer Legacy platform is 60% more active than in June 2019. Airports with well above normal flight activity this month include Los Cabos, Al Maktoum and Abuja.

Business aviation vs Scheduled aviation from Kansas City, 2021 vs 2019

International trips from the US this month have favoured Caribbean destinations with arrivals into Puerto Rico, US Virgin Islands, Turks and Caicos, Dominican Republic all much higher than in 2019. Global business jet arrivals into the Caribbean are up by 53% so far this month compared to June 2019, with a positive trend of 1% year to date. The Middle East is another region seeing strong growth in business jet arrivals, 21% up from 2 years ago. Saudi Arabia is just about back to pre-pandemic demand, whilst Qatar, UAE, Jordan and Bahrain seeing double-digit gains over 2019. The Asia- Pac market is also well recovered, with business jet flights out of China up by 12% vs June 2019, although flight hours are still trailing pre-pandemic by 30%, reflecting the deep erosion in international connections.