WINGX’s weekly Business Aviation Bulletin.

Overall Comment

The market´s record flight activity is reflective of buoyant growth signals across the industry, with just the last week seeing NetJets confirm record demand, Wheels Up going public, Flexjet expanding its fleet in Europe. If anything, the most obvious limitation to continued growth will be a shortage of available aircraft. Then again, there is some caution around the resurgence of Delta variant infections which may require the reimposition of some restrictions in the US and Europe.

Global

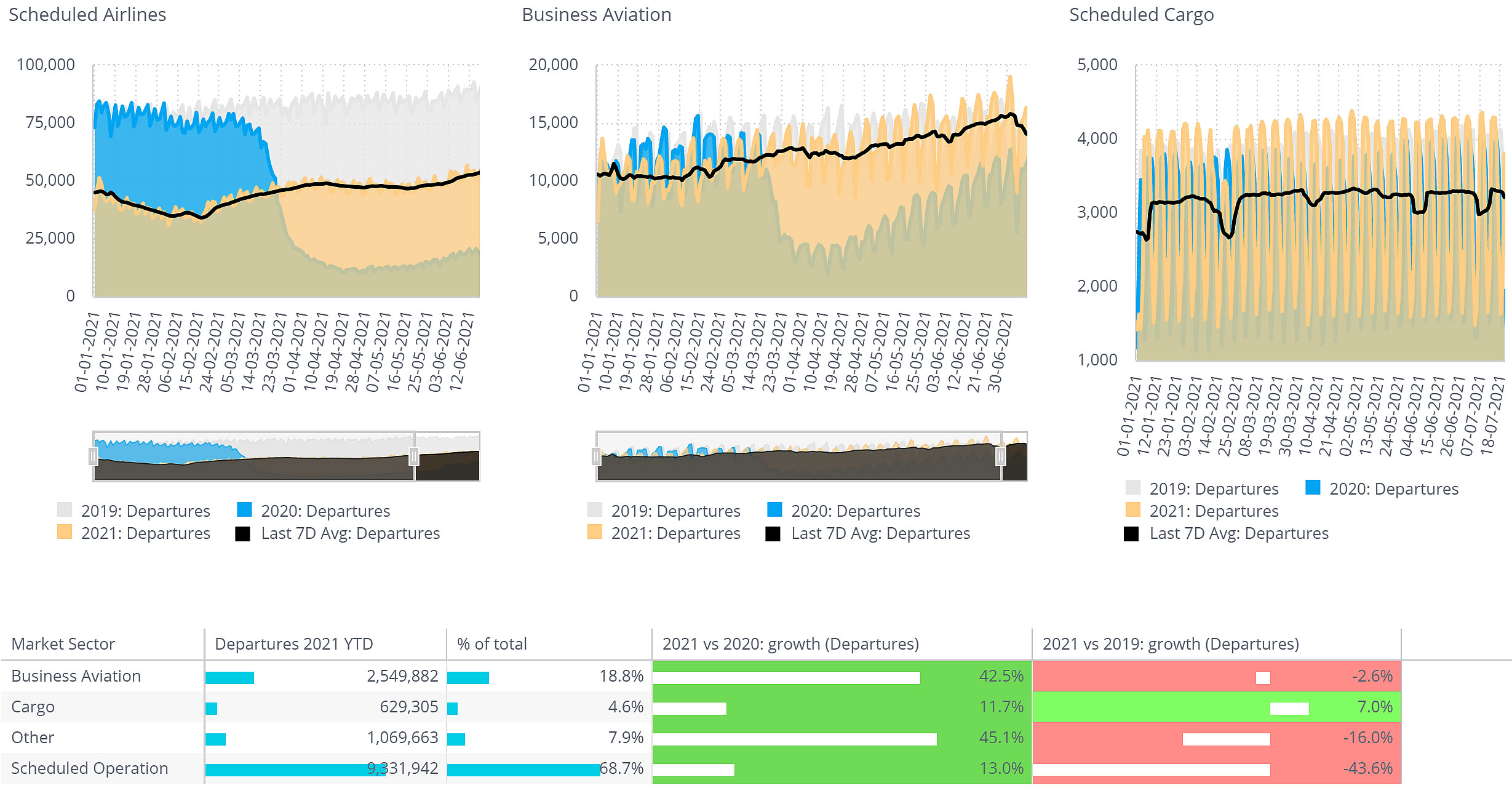

There were 302,288 business jet and turboprop sectors flown worldwide in the first 20 days of July 2021, 13% more activity than the same period in 2019, 44% up on last year. Comparatively, the commercial airlines are gradually coming back, with same period global activity trailing July month-to-date 2019 by 33%, even if two-thirds up vs July last year. The US has the lion´s share of the global business aviation activity and is leading the rebound, with an additional 15% in flight activity this month compared to 2 years ago, jet sectors now running 5% ahead of comparative activity for the first 7 months of 2019. Business aviation activity is taking longer to recover in Europe, still 9% down for the year so far, but up 12% versus July 2019.

Global Business Aviation, Scheduled, Cargo flight activity in 2021 YTD

Vaccinations

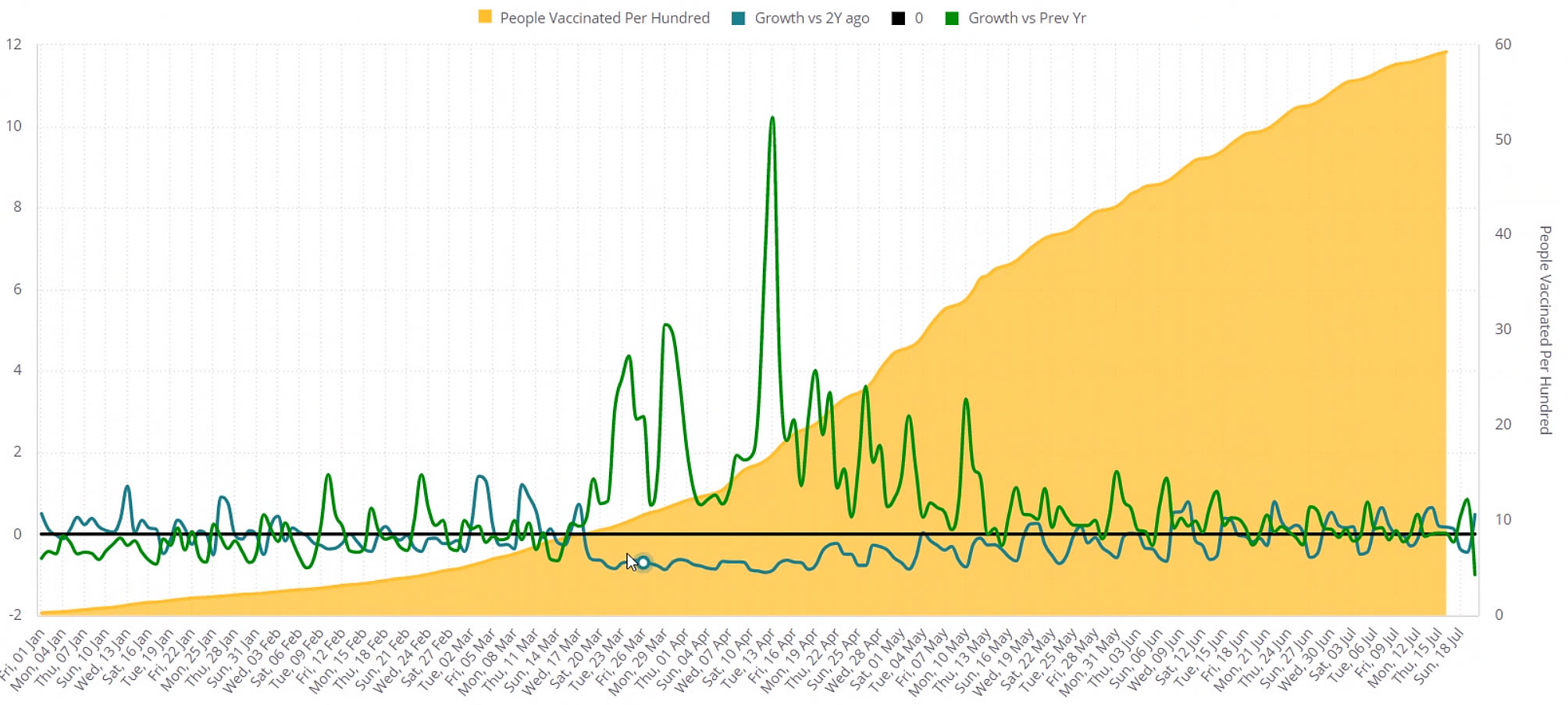

As expected, there is a solid correlation between vaccination rates and recovery in business aviation activity, with the inter-related factors being the relative rate of restriction-lifting on economic activity in general and travel particularly. This applies mostly in North America, Europe, and Middle East where vaccination is well progressed. In most of these countries, once certain vaccination thresholds have been passed, lockdowns have lifted and evidently enabled surge in flight activity, followed by a more gradual recovery against pre-pandemic trends. In the US, the correlation is less clear, as the vaccination rates are still overall somewhat lower than in Europe, but lockdowns were nonetheless lifted earlier.

For international flights, the recovery is being impeded by the diversity in national covid regulations, and furthermore, the stop-go progress country-by-country. This is particularly true in Europe. For example, flights to Spain and Portugal have surged this year, beyond the 2019 trends, but now hitting roadblocks as infections recur due to variants. There are signs that variants may also trigger backwards steps in the US this summer. Chart 2 below shows that for Germany, vaccinations prompted a big rebound in business aviation activity in early summer, but growth has since tapered. The diminishing year on year improvement also reflects the fact that, even without vaccines, last summer travel restrictions in Europe were much lighter than now.

Cumulative vaccination rates and comparative business aviation activity in Germany

Europe

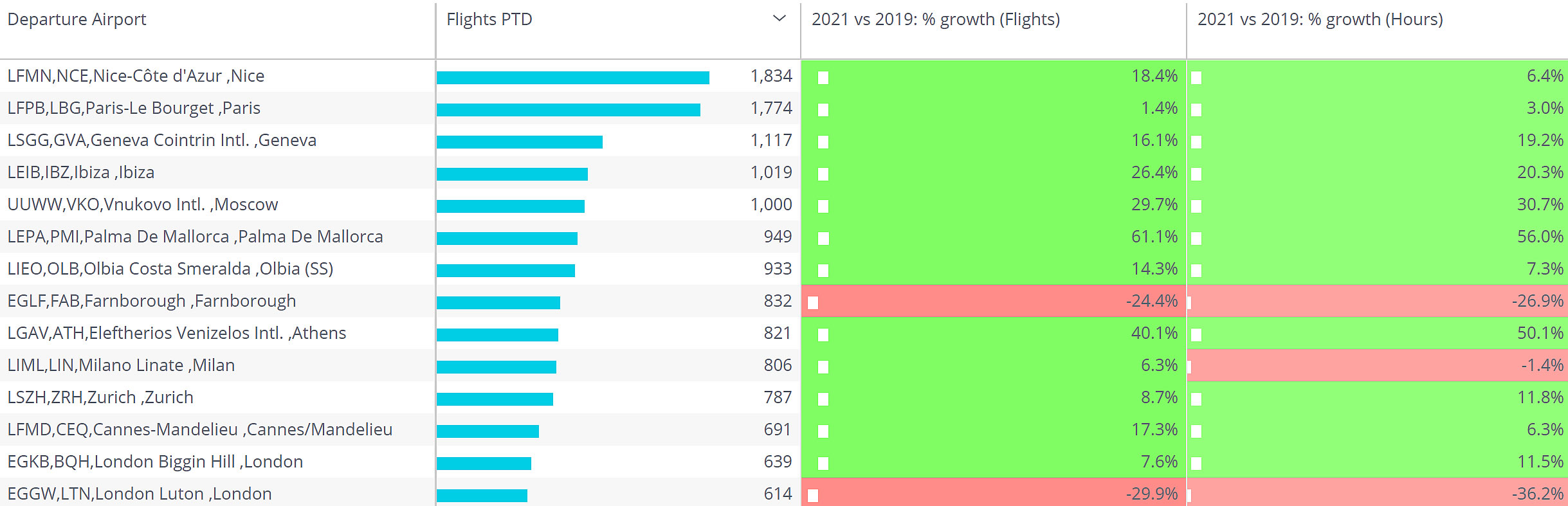

The big resurgence in business aviation traffic in Europe is now clear across the previously stagnant West and Central regions, with France, Italy, Germany all seeing at least 5% gains on July 2019, Spain and Switzerland getting 20% more movements and traffic in and out of Austria up by a third compared to pre-pandemic July. The laggards are in northern Europe, with flights from Norway down by 10% vs summer 2019, flights form the UK trailing by 13%. The rebound in activity is still firmly aligned with leisure trips, with the most popular summer resorts seeing record breaking visitors: arrivals into Ibiza are up 20% on July 2019, and Mallorca has seen an increase of more than 50% vs the first 3 weeks of July 2019. Even the main hubs are seeing a strong comeback, with Nice and Le Bourget back up. The UK airports are behind trend, although Biggin Hill an exception, departures up 8% vs July 2019.

Business Aviation activity at top European airports July 2021 vs July 2019

North America

In the United States, business jet activity has been particularly strong, with 27% more sectors so far this July versus July 2019, effectively breaking historic records. The Charter market is hottest, 40% busier than July 2019. Even the Private and Corporate flight departments are seeing more activity, with 25% more activity than 2 years ago, so far this month. Ultra-Long-Range jets have seen a massive pick-up in activity this summer (since June 1st), with 34% more activity vs 2 years ago, trending down 3% for the year-to-date. ULR jet movements have doubled from Westhampton Beach, up 75% at Miami-Opa, West Palm Beach and Fort Lauderdale. The busiest ULR jet type this month is the Global 6500, flight hours up 8%. Thirty-eight active Global 7500 jets have operated 430 sectors since June 1st.

Other

Outside the US and Europe, business jet sectors are up 8% this month versus July 2019, but across these regions, Ultra Long-Range sectors are still trailing 2019 by 8%. For all aircraft segments, Canada and Mexico are the busiest countries, despite lagging-behind 13% and 34% respectively vs summer 2019. In the European area, Russia and Turkey continue to see sustained growth over pre-pandemic trends, respectively posting 20% and 27% increases versus July 2019 so far this month. The same goes for China, business jet sectors up by 30%, although almost all domestic, with flight hours down by 18% compared to July 2019. Several countries have seen a doubling in business jet movements this month from pre-pandemic July, including Argentina, Turks and Caicos, Puerto Rico, and Nigeria.