WINGX’s weekly Business Aviation Bulletin.

Overall Comment

August is seeing the same stellar growth in business jet demand as we saw in July, with Europe seeing the biggest bump this month. The demand is clearly leisure-focused and rather seasonal, but the longer it endures, the more bizav looks to be on a sustainable growth path. Outside the leisure and corporate markets, business jets and other aircraft are also seeing growth in unscheduled operations across government, cargo, logistics and humanitarian sectors.

Global

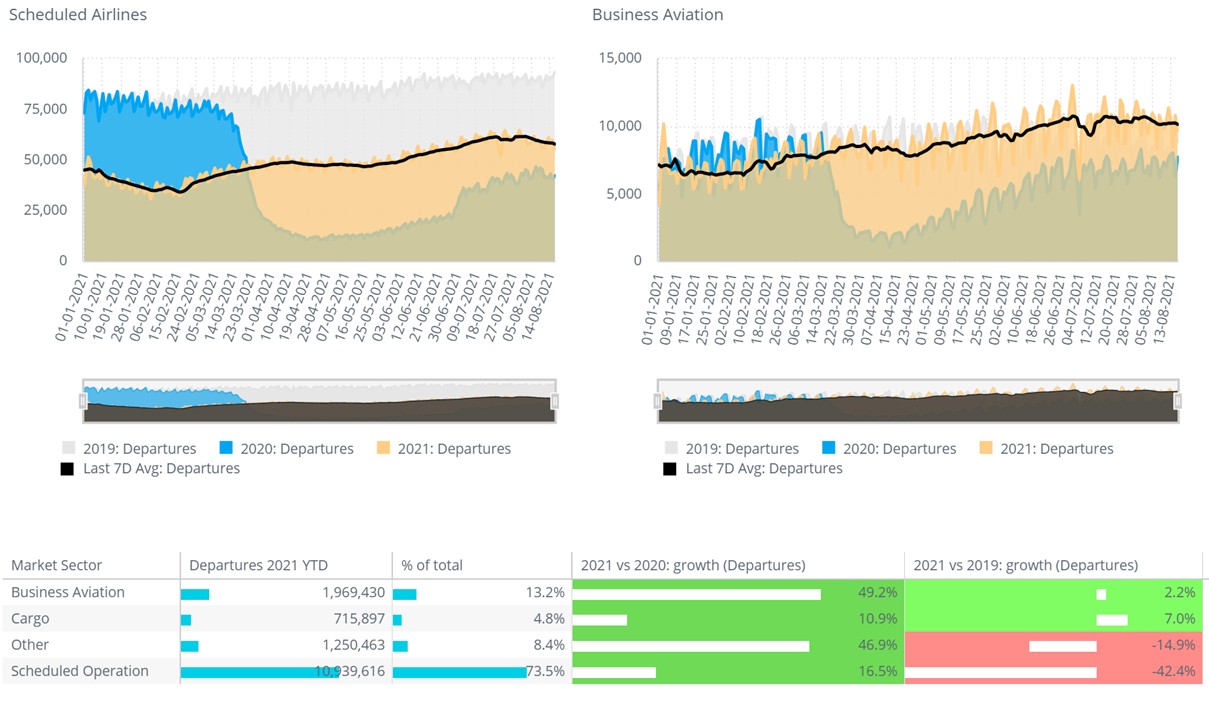

Business jet activity is moving ahead of 2019 in terms of sectors flown so far in 2021, 2% ahead of Jan-Aug two years ago, as of mid-month. This upwards trend contrasts with 42% deficit for scheduled airlines. Indeed, the airlines are flying only 17% more than during the same year-to-date period in 2020, whilst business jet activity has bounced up 49% compared to last year. Charter and Fractional business jet operator activity is up more than 10% this year compared to two years ago, with Private flight departments now back on trend, Aircraft Management operators still trailing by a couple of points. Much of the rebound has come in the last two months, with the first half of August showing that all business jet sectors, 164,000 sectors, up by 18% compared to August 2019.

Global Business Jet flight activity in Jan 1st – August 16th, 2021

Europe

August is seeing a very hot month for business aviation activity in Europe. August last year saw the first post-pandemic bump, premature as it turned out, but August 2021 so-far is up by 23% on last August and up by 28% on August 2019. France, Germany, Italy and Spain are all seeing 20% growth in bizav activity in the first half of August. Only the UK is behind 2019 trends, and now only slightly, -1% vs comparable August 2019. Greece, as well as Switzerland and Belgium, are seeing 40% more flights than before. In terms of sectors flown, Scandinavia, which has lagged the recovery this summer, is now posting 6% more activity than August 2019. Nice is the summer hub for business jet demand, as usual, this month flights are up almost 30% versus 2 years ago. Zurich is the airport with strongest summer growth, flights up 40% this month versus August 2019.

North America

The North American region is driving the global growth, with 75% share of activity, and a 17% growth this month versus two years ago. The charter market is particularly hot, with 30% more sectors flown than in August 2019, fractional traffic not far behind on 25% gains. There is strong growth across all aircraft segments, although it´s notable that the larger cabins are now seeing the biggest gains on pre-pandemic: ultra-long range jets are flying 25% more than in August 2019, Super Midsize up by 22%. Fifty four percent of the ULR Jet activity this month in North America is being operated by Private Flight departments, this up by 23% compared to 2019. Gulfstream 600/650 flights are up 65% compared to August 2019, up 54% in terms of hours flown.

The United States is doing far better in terms of flight demand than the other large countries in the North America region, with Mexico and Canada still making up the gap on 2019. So far in August, business jet flights are up 21% compared to two years ago. Turboprop and Piston flights are yet to fully recover, but light jet demand is very solid, up 20% on 2019. California is back to top-ranking as the busiest State, this month´s numbers up 15% on August 2019. Florida has dropped back to third, behind Texas, but flights from Florida are still resoundingly up, 34% higher than 2 years ago. All the recovery is in the domestic market, with international sectors still down by 3% versus August 2019, although that´s a big improvement on recent months. Business aviation flights from the US to Mexico are up 12% vs 2019, in contrast to flights from US to Canada, still trailing by 43%.

US State business aviation departures August 2021 vs August 2019

Rest of world

Across the rest of the world, business jet flight activity is up 26% compared to August 2019, with 54% growth in domestic sectors, although international sectors are still down by 10% Mature business aviation markets in Australia, Brazil, South Africa continue to see more activity than in 2019, whilst August has still not shown a full recovery in Mexico, Canada, Saudi Arabia. China, which has seen more business jet activity year-to-date than in 2019, has also seen a slump in flights in the last few weeks, renewed virus restrictions limiting mobility. With regards to the major international story of the week, in Afghanistan, business jet activity has been minimal, although ad hoc and emergency traffic has been intense, unsurprisingly. The busiest connections are between Kabul and India, UAE, India, Iran and Qatar.