WINGXТs weekly Business Aviation Bulletin.

Overall Comment

As the industry gets its first post-pandemic NBAA up and running in Las Vegas this week, there will be a lot of excitement around the sustained growth in business aviation demand this year. Multiple announcements, from deliveries to orders to new concepts are riding a wave of optimism. The activity rebound in 2021 is increasingly being seen as a green light for faster industry growth the next few years, not just a one-off bounce from the pandemic.

Global

In the first ten days of October, global business jet and turboprop activity was up by 7% compared to comparable October 2019, bouncing up 35% versus October 2020. Scheduled airline activity is running 30% behind the same trend in October two years. Cargo traffic has fallen back 8% during the same comparable period. Since the start of the summer, business aviation activity is up 10%, up 14% in terms of business jets only. Scheduled airline sectors were down 34% during the same period. So far this year, after just over 9 months, business jet sectors are up 3% compared to 2019, the equivalent of 73,000 additional sectors flown compared to the first 9 months of 2019.

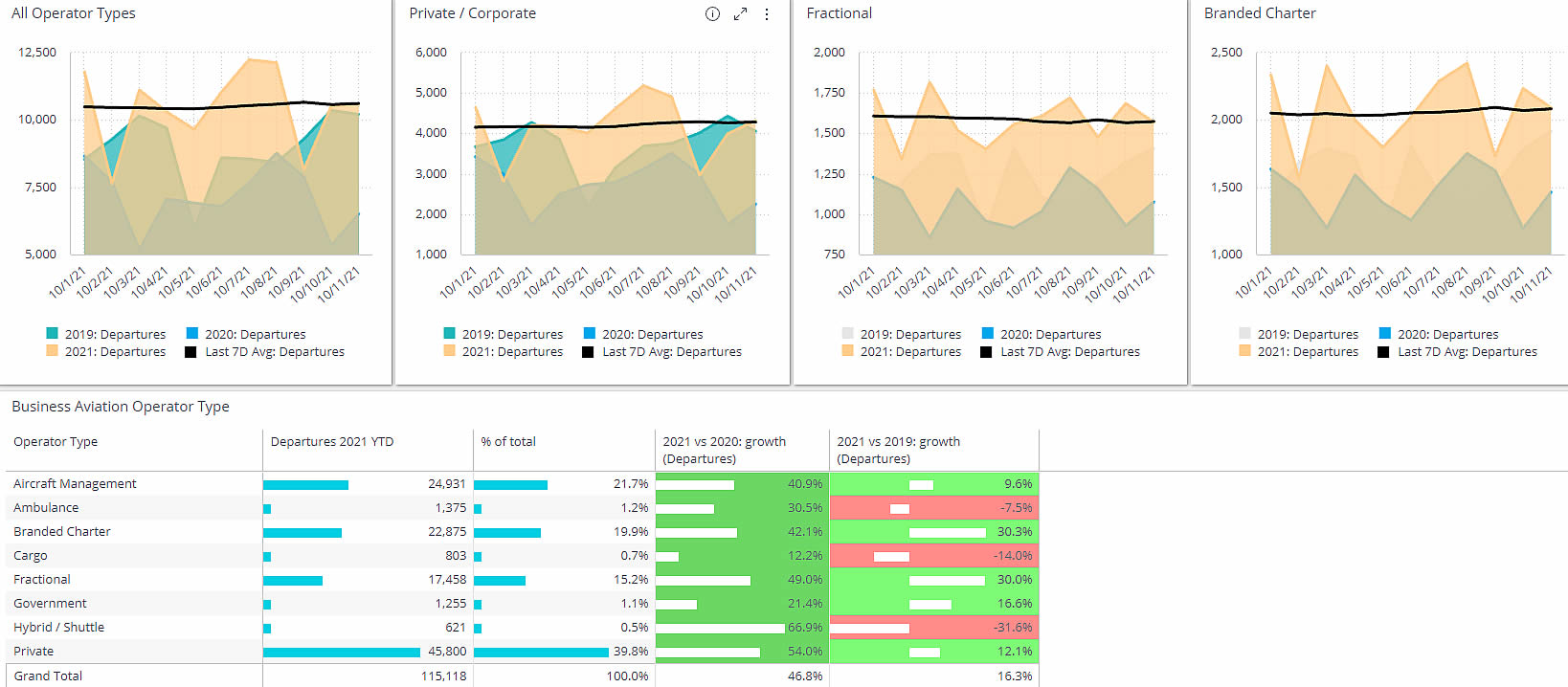

US business jet activity by Operator Type, October 1-10th 2021 vs 2019

North America

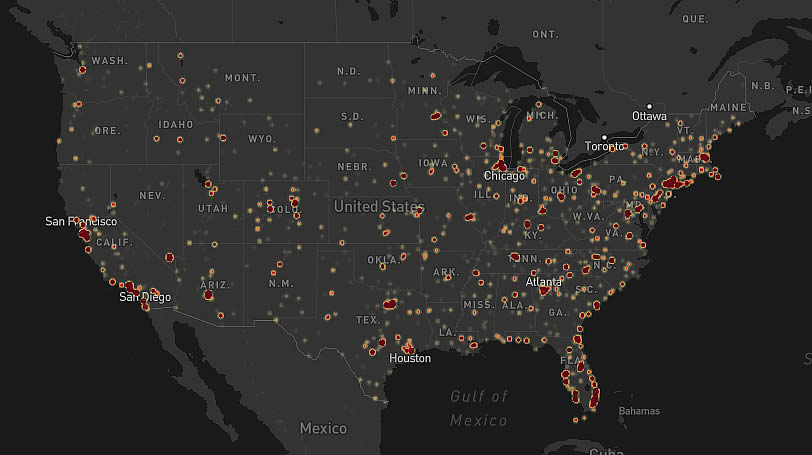

The US is heading into October with a business jet trend some way ahead of volumes in October 2019, which was itself the strongest activity month since 2008. Business jet flight hours are up 16% in the last ten days versus comparable October 2019. The Commercial Airlines are coming back, within 20% of pre-pandemic levels in October 2019. Florida is the busiest US State this month, continuing to see record numbers of business jet departures, running 40% above the first ten days of October 2019. California has seen 8,142 business jet departures this month, up by 17% versus 2 years ago. Jet sectors flown out of New Jersey this month are down 3% compared to 2 years ago.

The US charter market continues to drive the market, with demand surging 32% above comparable levels in 2019. Fractional operations are almost as hot, with no sign of activity slowing as the leading operators restrict new registrations. Aircraft Management operators are also flying more, sectors up 15%, and Private activity, including corporate and individual flight departments, are now recovering as well. Almost all of the US activity is domestic, with 17% growth in sectors, 22% growth in terms of flight hours. The average sector length is just 277 nautical miles. International sectors are still much weaker, with 8% fewer international flights compared to 2019.

Hot spots for Branded Charter operations in the US in October 2021

Europe

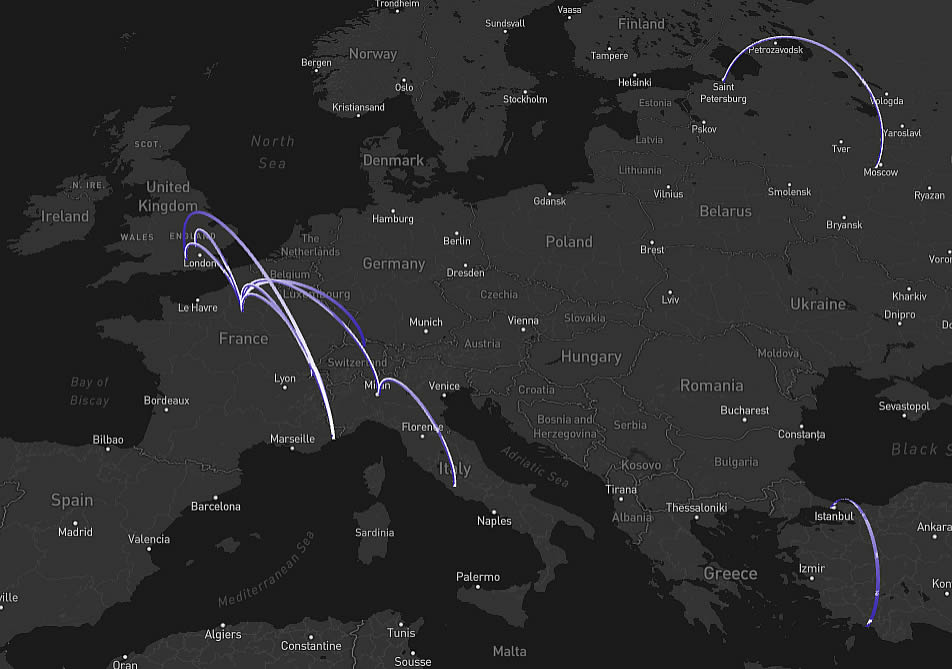

International activity is on a different trajectory in Europe, rebounding 24% in the first 10 days of October compared to two years ago, and well ahead of the 15% trend for domestic business jet activity. The top 7 country flows are all domestic, with intra-Germany business jet flights somewhat slower than two years ago, but UK, Spain, and especially Russia and Turkey well up compared to same days in 2019.

The busiest international sectors for business jet flights are to and from France, from the UK, Italy and Switzerland. Some airports are seeing a very big increase in international connections in early October versus 2 years ago: Biggin Hill up by 60%, Zurich by 70%. Airports in and near Istanbul have seen a 60% increase in flights versus October 2019, partly reflecting last weekend’s Grand Prix.

Top business jet pairs in Europe in October 1-10th 2021

Rest of World

Outside Europe and the US, October is slightly weaker than it was in 2019, 3% fewer flights, even if the rebound on October 2020 is impressive, flights up almost 40% Year on Year. Canada and Mexico are doing much better than last year but still a third down on 2019. Brazil has steadily grown activity during the pandemic and this month flights are up 40%, elevating it above Australia for overall business jet utilisation. With travel restrictions still in place, AustraliaТs business jet movements are down by 6% vs comparable October 2019. China, India, UAE and Bahamas are busy markets, sectors above pre-pandemic levels. The Challenger 600 is the busiest business jet across these regions so far in October, almost 1,000 sectors flown, up 31% versus October 2019, still down 11% compared to two years ago.