WINGXТs weekly Business Aviation Bulletin.

Overall Comment

Business aviation is slowing week on week, but it’s difficult to distinguish the normal seasonal effect from the incremental restrictions from the latest Omicron virus wave. In the US, gala events such as Art Basel have seen record numbers of business jet users. In Europe, the already locked down markets such as Austria and Belgium have seen flight activity relapse, and international flights have hit a renewed slump across Europe.

Global

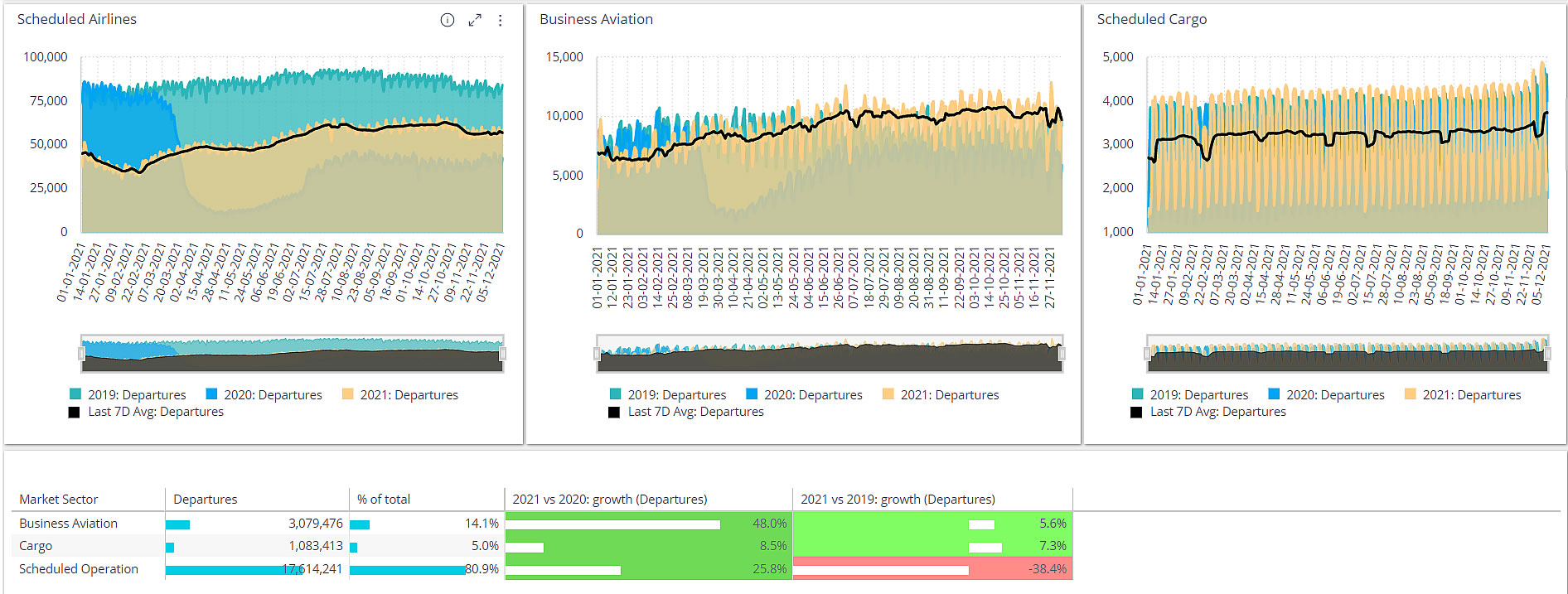

Business aviation activity is still growing compared to 2019, with the first week of December 2021 seeing 6% more sectors flown than two years ago. But this trend is perceptibly slower than the preceding week, which saw 14% growth vs 2019. Still, business aviation demand is still much stronger than scheduled passenger traffic, down by 30% compared to December 2019. Cargo traffic is also resilient this month, with 8% more sectors flown globally than in December 2019. Within three weeks of year-end, global business jet activity is up 6% compared to 2019, up 48% compared to last year. Scheduled flight activity has gained 25% on the 2020 slump but is still trending 40% below 2019 year to date levels.

Business Jet sectors flown vs Scheduled and Cargo activity 2019 – 2021

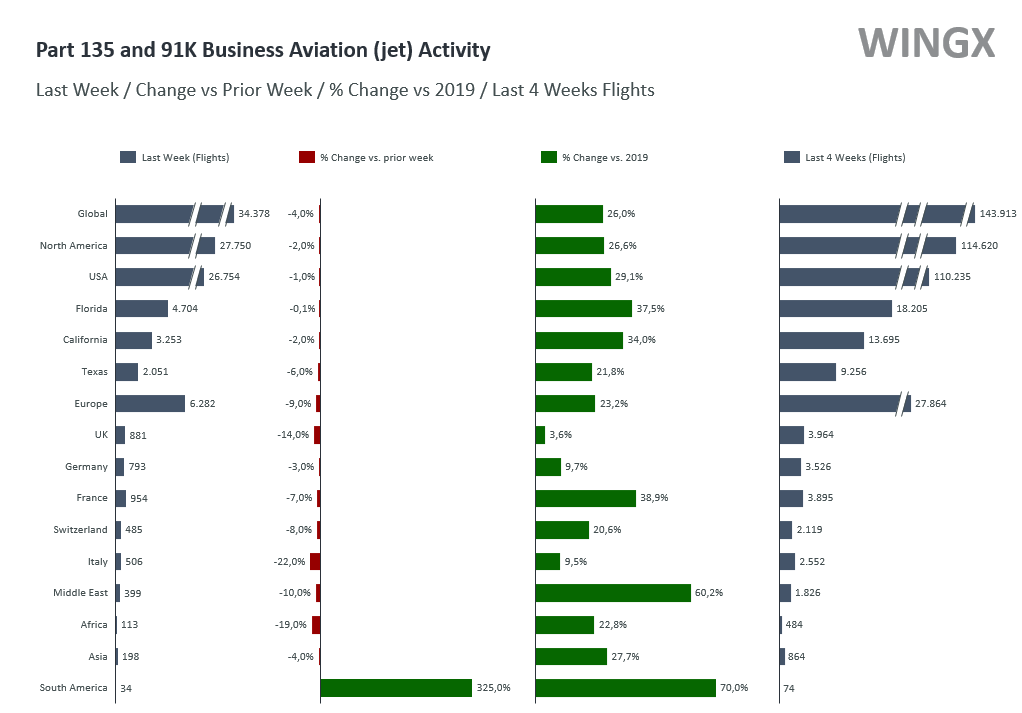

The North America region accounts for 3.5 million of the 4.6 million business jet and turboprop sectors flown so far this year and is on par with 2019 activity. The United States has the stronger growth, business jet sectors up 3% so far this year, up 5% so far in December, although that marks a slowdown from the 20% growth during the Thanksgiving period at the end of November. Fractional operators are still working hard, sectors up 13% in December compared to pre-pandemic. Charter operators have seen much weaker growth in the last week, trending up just 1% this month. International flights are seeing the swiftest recovery this month, outbound sectors 9% higher than in December 2019.

Part 135 and Part 91K Business Aviation (Jet) Activity during week 48, 2021

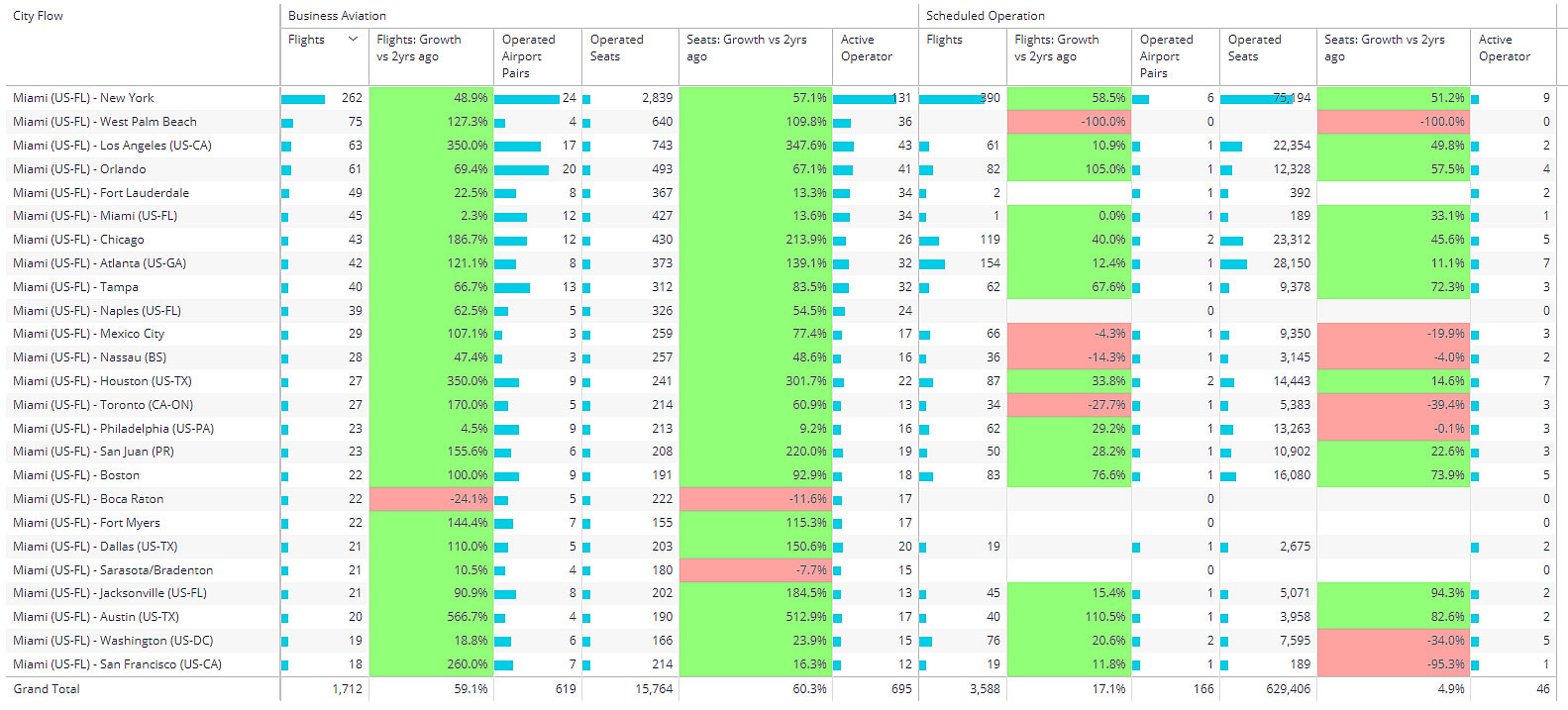

Florida is by far the busiest US State so far in December 2021, with almost 9,000 business jet flights operated through 7th December. Florida traffic is centered on Miami, which has seen a boost in traffic from the Art Basel fair, reconvening December 2-5 for the first time since 2019. Fractional operations within and from Florida are trending up by 30% this month. West Palm Beach activity has eclipsed previous records, up by 77% compared to December 2019. Miami-Opa and Naples are the next busiest airports, both with big double-digit growth in business jet movements. Inbound flights from Canada to Florida are up 72% this month compared to 2019. Dominican Republic and Puerto Rico are two other key international connections this December. Citation Latitude activity is trending up by 80% in Florida vs December 2019.

Business Jet & Scheduled airline top city pairs from Miami Airports Week 48 2021 (11/29/21 Ц 5/12/21)

Europe

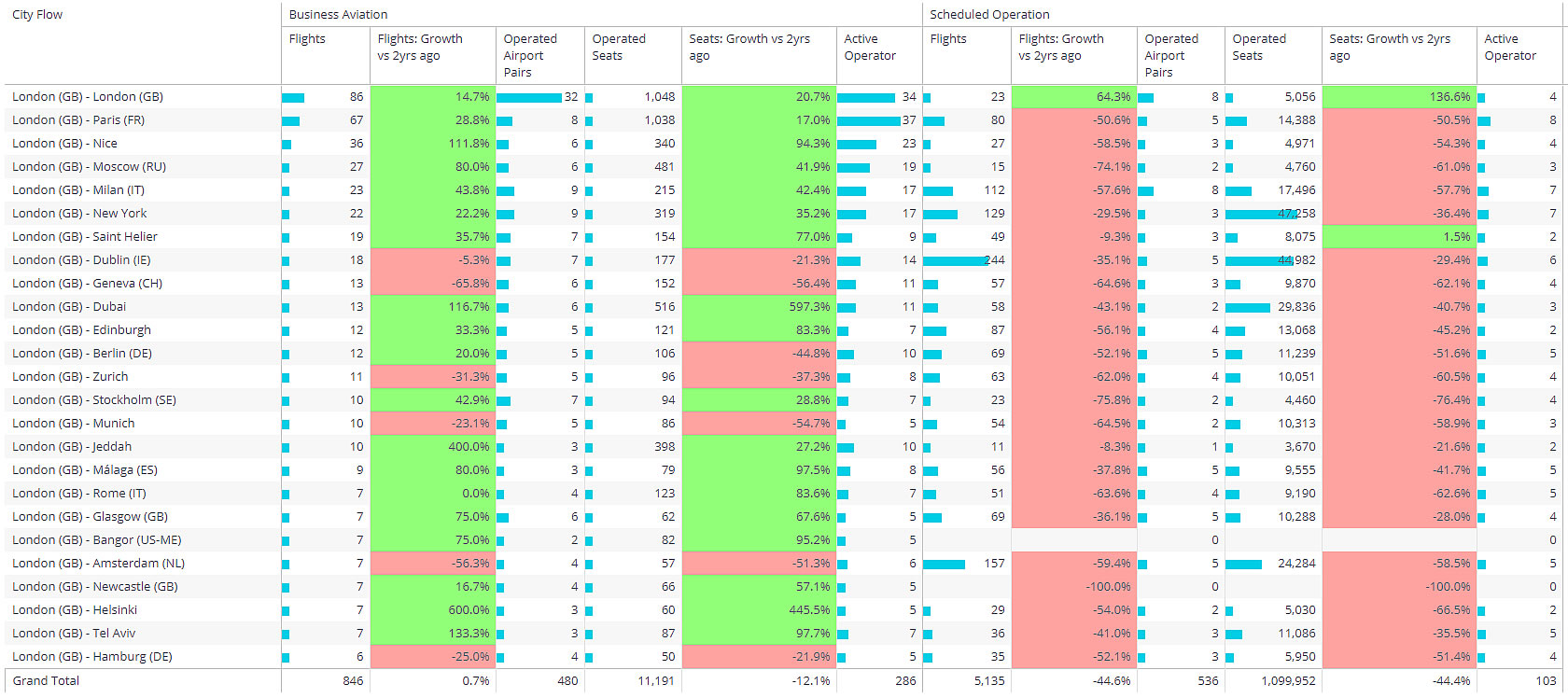

Tightening travel restrictions in Europe are unsurprisingly starting to constrain all flight activity; Eight percent growth in December so far, versus 2019, is good news but still much lower than the banner growth of almost 30% during November. The slowdown is more evident in Germany, back to pre-pandemic levels this month. Business aviation activity in the UK has stalled, with 10% fewer sectors flown this month vs December 2019. Flight demand has slumped in locked-down Austria and Belgium, with 20% deficits compared to 2 years ago. France is bucking the slowdown, with business aviation flights still up by 20% compared to December 2019. And demand in Spain continues to run very hot, 42% more flights this month vs 2019. Through November 2021, 8 of EuropeТs busiest markets are doing better than in 2019.

Business Jet & Scheduled airline top city pairs from London Airports Week 48 2021 (11/29/21 Ц 5/12/21)

Rest of world

Outside Europe and the US, the year-to-date trend in business jet flights is 4% below the comparable 11 monthsТ period of 2019. Canada, Mexico, Saudi Arabia, and Morocco have been the worst performing markets this year, with Brazil, United Arab Emirates and Turkey the strongest markets. The December 2021 view is healthier, with already 10% more activity than in December 2019, with Saudi Arabia now seeing very strong growth, although the operations of business aviation aircraft in China has slumped compared to 2020 and 2019 during the last few months.††