WINGX’s weekly Business Aviation Bulletin.

Summary

Business aviation activity growth has stalled, with August this year modestly slower than August last year. The declines have deepened in the US, especially in California, and in the charter market more generally. Europe is now also seeing fewer business jet flights than last year, notably in France and Spain. We expect that flight demand will trend down by at least 5% this month compared to August last year.

Global

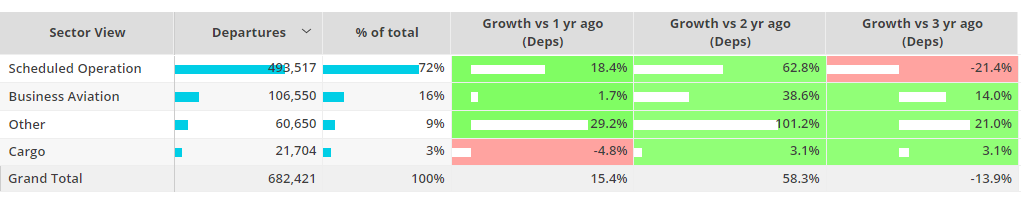

In the first 7 days of August 2022, global business aviation flights – jets and props – were up 1.7% on August 2021, 14% higher than August 2019. Comparing week 31 in 2022 versus week 31 in 2021, activity slightly declined, though still up 0.4% for business jets. That´s down on the 3% growth trend in 2022 vs 2021 over the last 4 weeks. For Jan 1st through August 7th 2022, bizjet flights are still 22% up on last year, 21% above three years ago. By comparison, global commercial airline activity was up 18% on last year, down 21% on 2019. But the top 5 busiest commercial airlines (Southwest Airlines, United Express, American Airlines, Ryanair, Delta Airlines) have flown only 9% less than in August 2019.

Business Jet departures globally in Jan 2019 through July 2022

North America

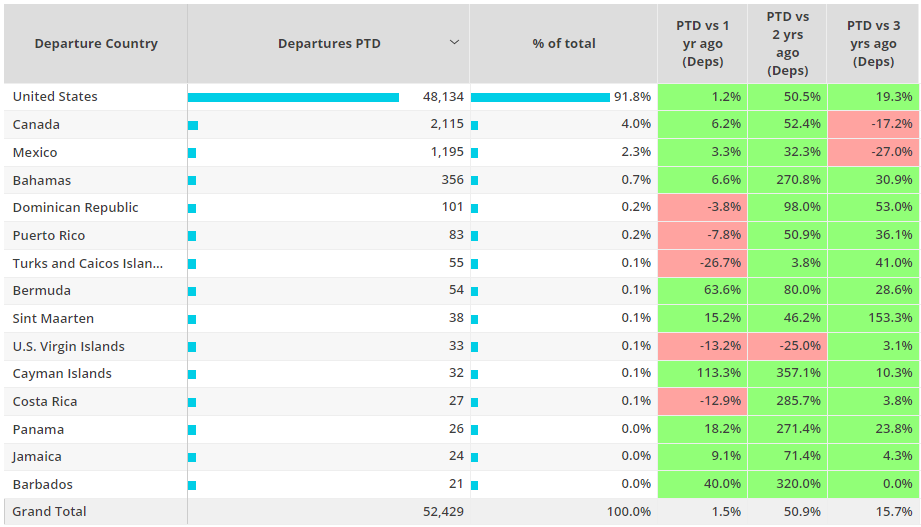

Business jets flew 52,000 sectors in the first 7 days of August, 1% more than in August last year, 15% more than August three years ago. In the United States, flights are trending up 1% compared to August last year, 19% above three years ago. Canada and Mexico show stronger trends in flights this August vs last August, but still have some way to catch up with pre-pandemic activity. Some countries in the region are seeing a decline in flights this month, notably the Dominican Republic, Puerto Rico and Turks and Caicos Islands.

Business jet departures North America 1st – 7th August 2022 (PTD) vs previous years

The trends in business jet demand in North America are somewhat weaker measured on a comparative week basis: week 31 2022 saw 4% fewer flights than week 30 and were 0.1% down on week 31, 2021. The Part 135 and 91K operators are slowing by most, with week 31 flights down 7% year on year, accelerating a 3% slide over the last 4 weeks. In the US, Part 135 and 91K flight slipped 8% in week 31 year-on-year, with California seeing a 10% drop. Branded charter operators are flying 17% less than same week in 2021. Not all operator types are flying less: corporate flight departments flew 7% more, private flight departments up 13%, with respect to week 31 year on year. There is a lot of variance by airport pair, for example Bedford to Nantucket flights are up 67% this month, contrast 7% dip in flights from Van Nuys to McCarran.

Europe

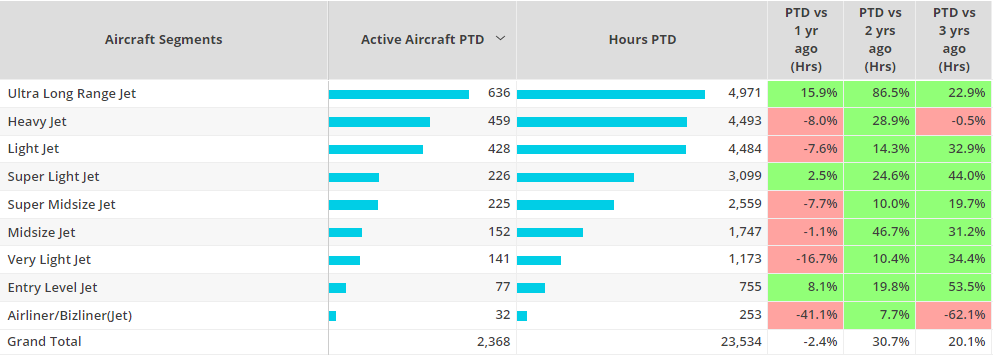

Business jet flight demand is slipping in Europe this month. Compared to August last year, flights are down 2%, and for comparable week 31, down by 3%. This contrasts with a 5% gain vs 2021 over the last 4 weeks. Business jet flights in France in week 31 were 21% down on week 30, which is a seasonably typical fall but still 6% down on week 31 last year, in contrast to a 9% upswing in the last 4 weeks. Business jet flights in Italy were down 8% in week 31, flat in Germany, and still up in the UK, 36% more than in week 31 2021, although slower than the 52% growth over the last 4 weeks. By aircraft segment, the lightest aircraft have the biggest gains on August 2019, although there are substantial declines so far this month compared to August 2021 in Heavy, Light and Very Light Jet movements.

Business jet segments by hours in Europe in August 2022

Rest of World

Outside Europe and North America, bizjet activity was up 21% compared the first 7 days of August last year, 55% above three years ago, in line with the year-to-date trend. At a regional level, comparing week 31 this year and last year, business jet flights are up 3%, 2%, 12% and 25% for Middle East, Africa, Asia and South America respectively. Apart from South America, these regional trends are slowing on the last 4 week trend. Brazil is the busiest ROW market so far this in August 2022, flights up 25% vs pre-pandemic August 2019. The busiest pairs so far this month across ROW are Lagos-Abuja (declining compared to August last year), Jeddah-Riyadh (increasing) and Sao Paulo-Rio de Janeiro (increasing).