WINGX’s weekly Business Aviation Bulletin.

Summary

The US market has seen a substantial bounce in business jet demand compared to the first week of October when flights were heavily disrupted by Hurricane Ian. But the underlying slowdown in the Charter market is now clearly stalling the market. Charter demand is more obviously suffering in Europe, particular in Central Europe where we are seeing double digit declines in flights compared to October 2021.

Global

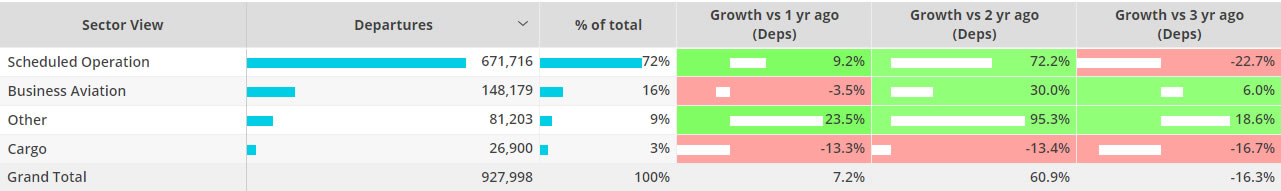

In the opening 10 days of October business jet and prop sectors were 3% below October last year, 6% above pre-pandemic October 2019. Focusing on business jets, flights so far this month are down 5% compared to last year, although still up 12% up on three years ago. Scheduled aviation is 9% busier so far this October versus last year, still 23% below three years ago. Focusing on the top global airlines Southwest Airlines, American Airlines, Ryanair, Delta Airlines and United airlines, passenger airline flights at the start of this month were 16% up on September last year, 2% less than three years ago.

Global Fixed Wing activity October 2022 compared to previous years

North America

Trends in business jet activity in North America took a major hit at the start of the month due to Hurricane Ian but has recovered, with this October 11% busier than October 2019, 3% short of last year’s record-breaking month. Light jet activity was substantially slowed by the hurricane, activity so far this year down 11% on three years ago. Hurricane-ravaged Florida saw a 52% recovery in week 40 (ending 10th October) compared to week 39, with overall business jet flights in the Sunshine State up by 1%. Part 135 and 91K flight demand is sagging compared to last year, 9% fewer sectors than in October 2019. Both California and Florida have seen more than 10% decline in commercial flight activity in the last 4 weeks, compared to same period 2021.

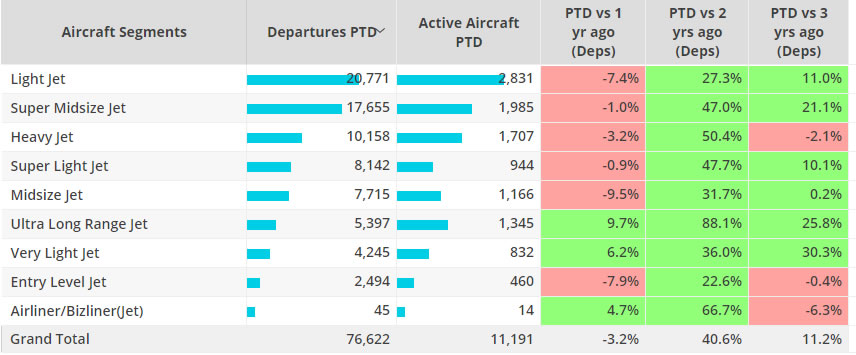

There is considerable variety in flight trends across business jet segments in North America. In the first 10 days of October, business jet flights across the board are up 41% on 2020, up 11% on October 2019. But heavy jet activity has fallen behind pre-pandemic peaks, sectors down by 2%. Bizliners and Entry Level Jets are also flying less than three years ago. Ultra-Long Range jets are the strongest segment this month, with 5,397 flights through October 10th, up 10% on October last year, up 26% on October 2019. The biggest growth over October 2019 is coming at the other end of the spectrum, with Very Light Jets flying 6% more than last year, 30% more than three years ago.

North America, Bizjet segments, October 2022 vs previous years

Europe

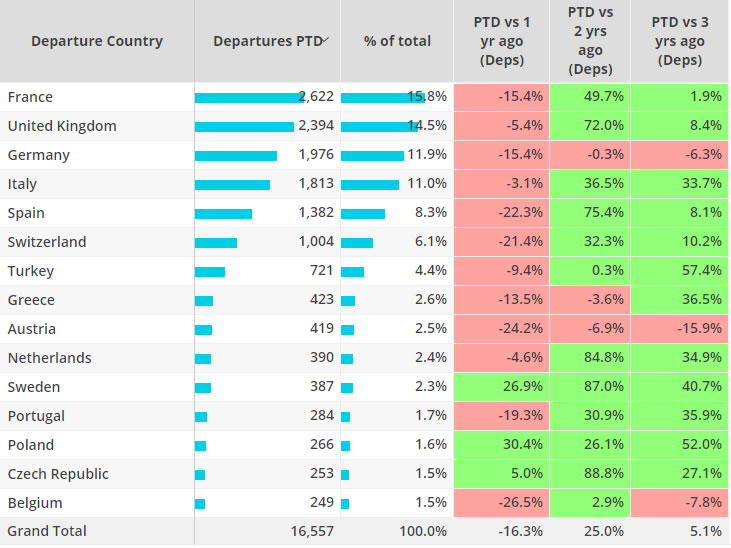

The business jet market is most obviously slowing down in Europe. Business jet sectors flown in just the first 10 days of October are down 16% compared to October 2021. That still leaves some growth compared to 2019, flights higher by 5% compared to October 2019. The biggest slowdowns are in the Charter and Fractional markets. Fractional and Private flight department activity has stayed relatively resilient. The biggest drop offs this month, compared to October last year, have come in France, Germany, Spain, Switzerland, and Austria. Compared to October 2019, business jet flights in Italy are still up by 33%.

Business jet activity trends by European country in October 2022

Rest of World

Business jet activity outside of North America and Europe is still trending up, with 6,418 flights operated between October 1 and 10, 13% up on October 2021. Some airports aren’t seeing the same peaks as last year, with Congonhas, Sao Paulo and Ben Gurion, Tel Aviv movements down by 20% versus October 2021. But Seletar activity is booming, up by more than four times compared to October last year. Mumbai, Marrakech, Bangkok are all seeing more business jet activity than ever. Heavy jets are the busiest aircraft types in the ROW region, almost 1,500 flights so far this month. Ultra-Long Range jets are the next busiest segment, flights 23% up on last year, 16% more than three years ago.