WINGXТs weekly Business Aviation Bulletin.

Summary

In Europe, economic turbulence is clearly denting bizjet demand, with some countries seeing activity dip below 2019 levels. In the US, bizjet ops are still well above pre-Covid levels, although charter demand is fraying from post-Covid peaks.

Global

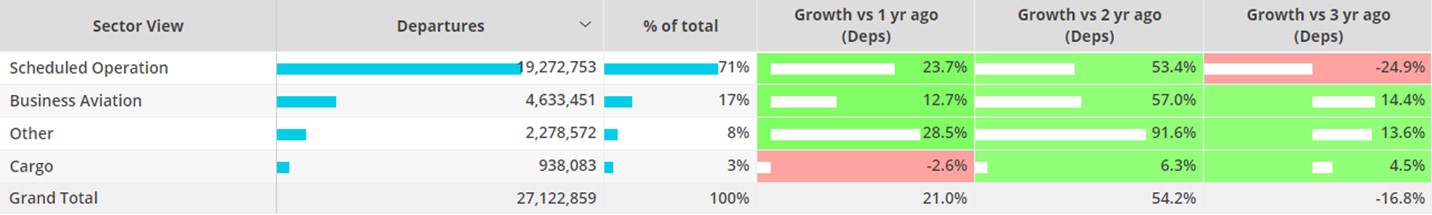

Year to date (January 1st – October 31st) global business jet and turboprop flights are 13% ahead of last year, 14% above comparable three years ago. In October, bizjet and prop sectors were down 1% compared to October last year, 11% above October 2019. So far this year scheduled passenger airlines are trending 25% below three years ago, in terms of flights operated, although up 24% compared to last year. YTD-22 dedicated freight sectors are flying 5% more than three years ago, 3% below last year.

Global Fixed Wing activity January Ц October 2022 compared to previous years.

North America

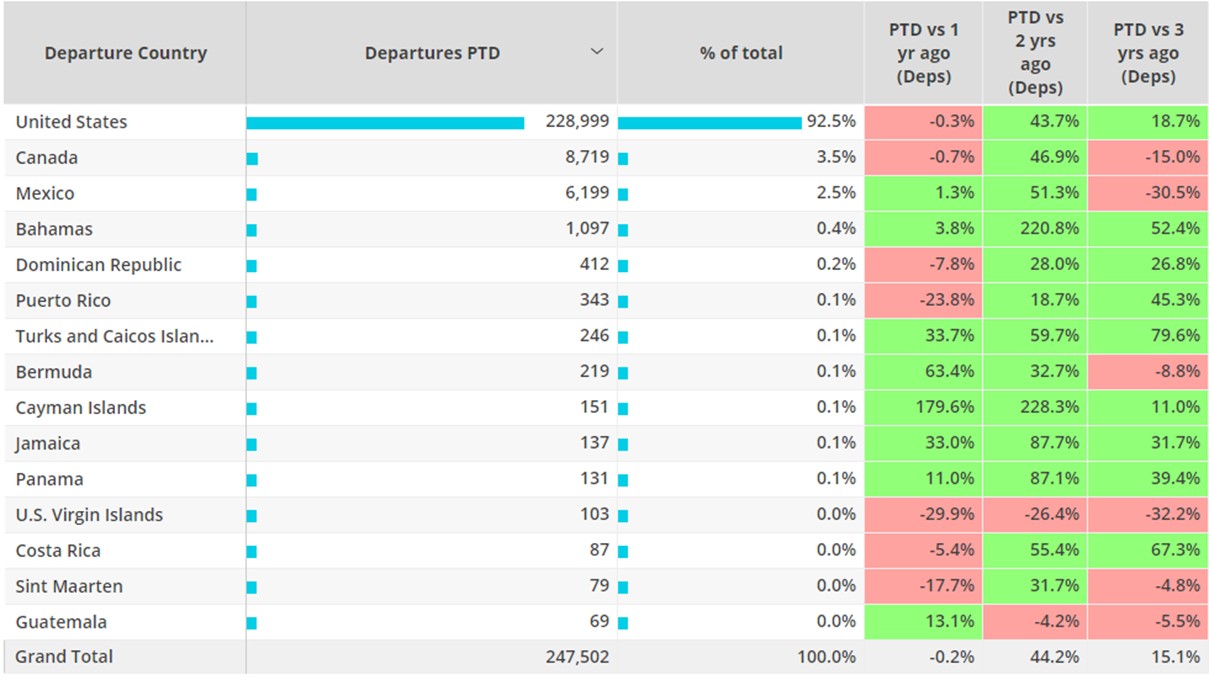

So far this year business jets are flying 15% more than last year, 18% above three years ago. Looking at the month of October, flight activity was 1% down compared to October last year, still 15% above three years ago. For Week 43, ending 30th October, activity dropped 4% compared to the previous week, 1% above Week 43 last year.

North America bizjet markets, October 2022 compared to previous years

Private flight departments, managing owner aircraft, drove the growth in the region across the month of October, with flights 12% up on last year, 23% above pre-pandemic October 2019.

Conversely, charter and fractional operators are seeing some slowdown in demand. Branded Charter operators flew 37,000 sectors in October 2022, 19% fewer than all-time high October 2021, but still up 17% compared to October 2019. Fractional operations were up 1% up on October 2021, reaching new highs, up 33% on October 2019.

North American Business jet Operator Types, October 2022 compared to previous years

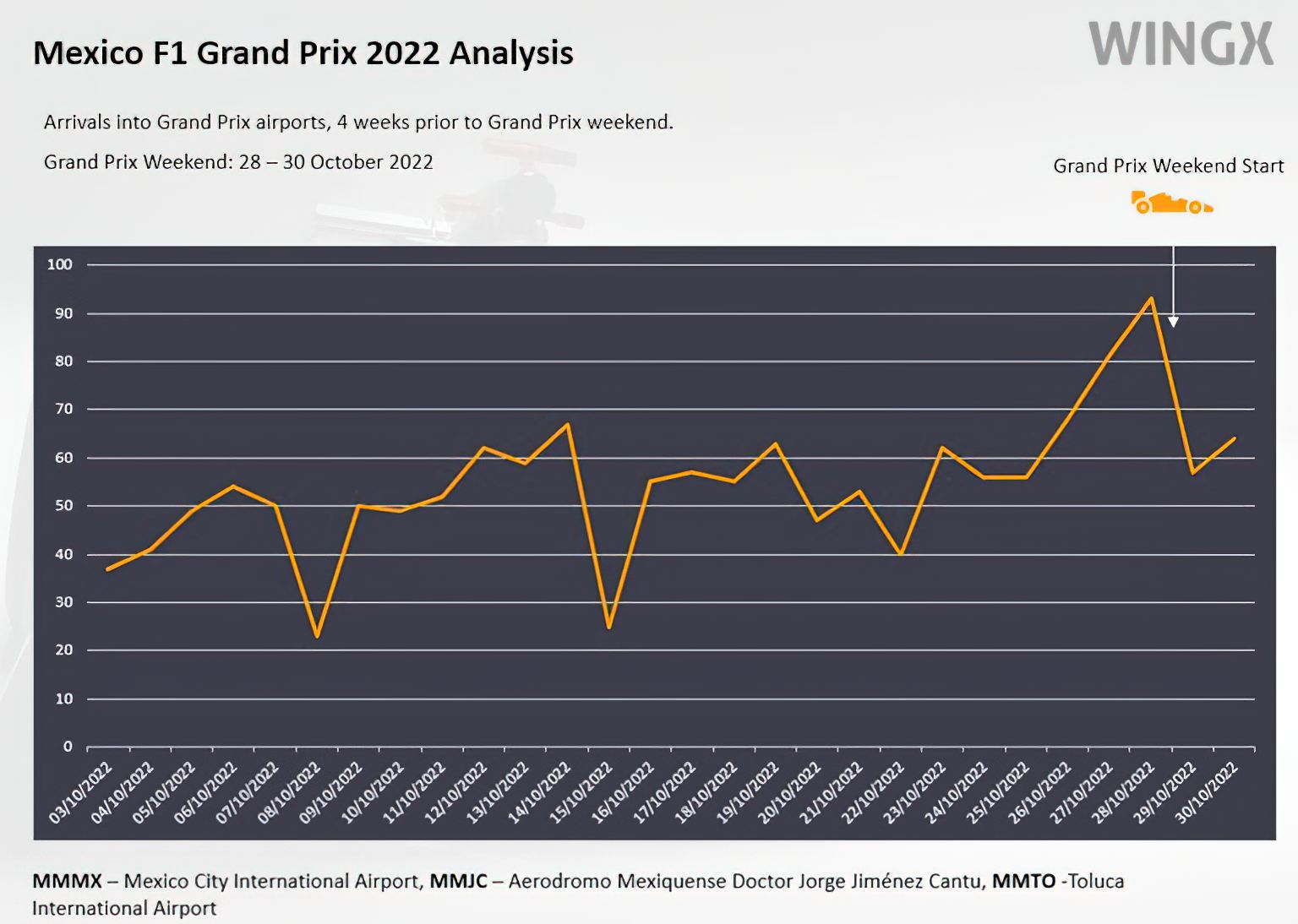

The Mexico F1 Grand Prix at Autodromo Hermanos Rodriguez held last weekend (28 Ц 30th October) drew an influx of business jets to nearby airports (MMMX, MMJC, MMTO). There were 140 active aircraft arriving at these airports during the event period in 2022, a 32% increase in active aircraft compared to 2019. Despite the increase in active aircraft, average daily arrivals during the 5 days before the event were down by 28% compared to the 2019 event.

Arrivals into Mexico Grand Prix airports, last four weeks.

Europe

Business jet sectors flown January through October 2022 were 15% above last year, 17% above comparable 2019. This belies significant decline in the last two months. Business jet sectors in October were 17% down on October last year, retaining 9% gain vs three years ago. Aircraft management and branded charter fleets saw the biggest drop in operations last month, flights down 25% compared to October 2021. Aircraft management and corporate flight departments fleets were down 3% on October 2019.

Sweden was the only leading European bizjet market to see an increase in October activity compared to October last year; all other major markets were behind last year. Austria saw flight activity dip below October 2019. Looking at the year to date, Greece is the only top 10 market to have seen a reduction in flight activity compared to comparable 2021. All top 10 markets are well above the pre-pandemic January Ц October 2021.

Year to date transatlantic travel (Europe to North America) is 21% above comparable 2019, 73% above comparable last year, underlining the rebound still-going in international traffic. YTD aircraft management programmes are flying the most on transatlantic routes from Europe, followed by private flight departments. United Kingdom Ц United States is the busiest country flow, activity 130% above comparable last year, 15% above comparable 2019. France Ц United States is the second busiest market, Ireland Ц United States completes the top 3.

Transatlantic business jet operator types (Europe to North America), January Ц October 2022 compared to previous years.

Rest of World

Business jet usage outside of North America and Europe continue to run hot. Year to date activity is 21% above comparable last year, 53% above three years ago. October 2022 ended with just over 21,000 business jet flights, 16% more than last year, 51% above three years ago. In the last 4 weeks activity in the Middle East is 2% above last year, Africa up 11%, South America up 5% and Asia up 19%. In China activity so far this year is half of last year, down 39% compared to three years ago, in October demand is down 56% compared to last year, 50% below three years ago.