WINGXТs weekly Business Aviation Bulletin.

Summary

The post-pandemic rebound in business aviation is taking on regional characteristics with the US market holding onto most of its gains, European demand visibly sliding back, although we are seeing record transatlantic connections. There is also strong growth persisting in other regions of the world, notably in Africa and parts of Asia. The charter market, red hot for much of the last 18 months, is clearly tapering. But in the US at least, the slowdown in charter is being offset by strong growth in activity for Private and Corporate flight departments.

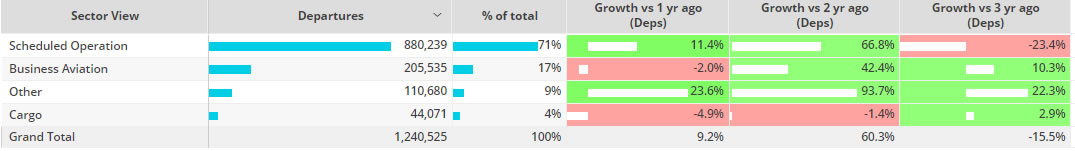

Global

Fourteen days into November, business jet and prop activity is 2% behind the same November period last year, 10% above pre-pandemic comparable November 2019. For business jets only, flights are 3% below last year, 13% ahead of three years ago. Looking back at the last four weeks, flight activity is 3% below the same period in 2021. For week 45 ending 13th November, worldwide flight activity is down 1% compared to the previous week, 6% down on week 45 last year. Global airline activity is 11% up on November 2021, 23% behind November three years ago. Focusing on the top 5 global airlines (Southwest Airlines, American Airlines, Delta Airlines, Ryanair, United Airlines), flight activity is 9% above last year, 2% below three years ago. Dedicated freight activity is 5% below the November last year, 3% ahead of three years ago.

Global Fixed Wing activity November 2022 compared to previous years

North America

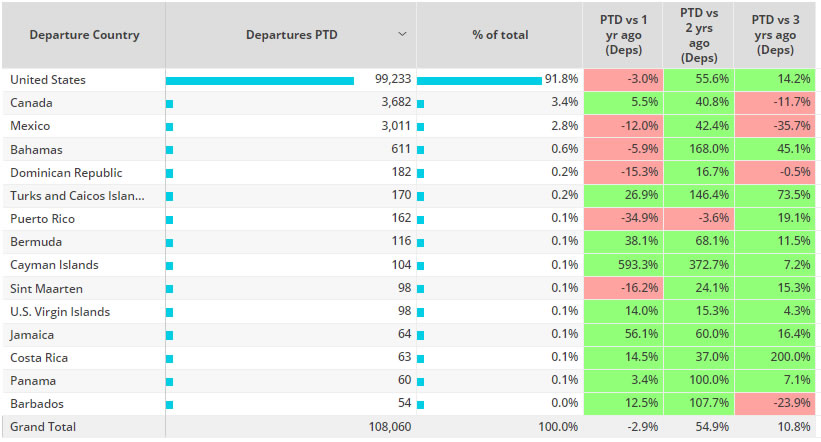

Fourteen days into November, North American business jet activity is trailing last year in terms of flights operated by 3%, although 11% above three years ago. In the last four weeks activity is 1% trending behind last year. In Week 45 activity dropped 3% on week 44, and 6% on week 45 2021.

North American Business Jet outbound flight activity by country, 1st – 14th November 2022 compared to previous years

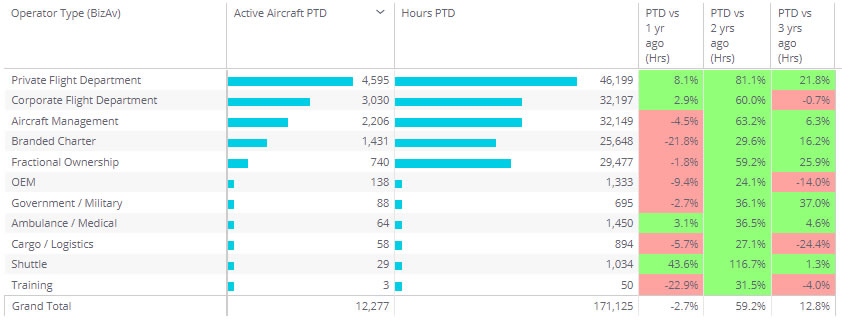

Private and Corporate flight departments are the busiest fleets in November 2022, flying more hours than last year, 8% and 3% respectively. Private Flight departments are flying 22% more hours compared to November three years ago, Corporate Flight Departments are flying 1% fewer hours than in November 2019. Aircraft Management Operators, Fractional Operators and especially Branded Charter Operators are seeing sizeable year on year declines in hours flown this November. Branded Charter flight hours are still up 16% versus November 2019.

North American Bizjet Operator types, ranked by active aircraft November 2022 compared to previous years.

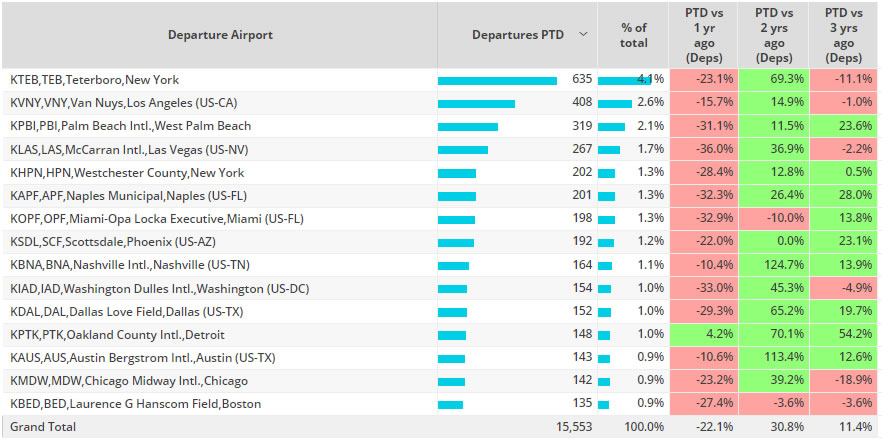

Teterboro is the largest departure point for branded charter fleets this month, though departures are 23% below November last year, still 11% fewer outbound flight hours than November 2019. Van Nuys and McCarran are also significant Branded Charter airports seeing dips in activity compared to three years ago. Domestic United States charter flights are 23% below last year, 11% higher than November three years ago. Flights between United States and Canada has seen a large increase year on year, with flights up 37% versus the same November period last year, 10% higher than three years ago. Flights between United States and the United Kingdom are seeing triple digit growth compared to three years ago, 42% growth compared to last year. More broadly, trans-Atlantic (North America Ц Europe) Branded Charter activity is 5% above last year, 76% above three years ago.

North American Branded Charter bizjet activity in November 2022 compared to previous years.

Europe

So far this month business jet activity in Europe is 15% below November last year, though activity is still trending 10% above November 2019. In the last four weeks, flight activity has dropped 17% compared to the same period last year. In week 45 flight activity dipped 2% compared to the previous week, 15% below the same week in 2021.

Looking at the busiest airports, London Luton is the only airport in the top 10 to see activity decline compared to 3 years ago, Ataturk is the only airport in the top 10 to see an increase in bizjet activity compared to last year.

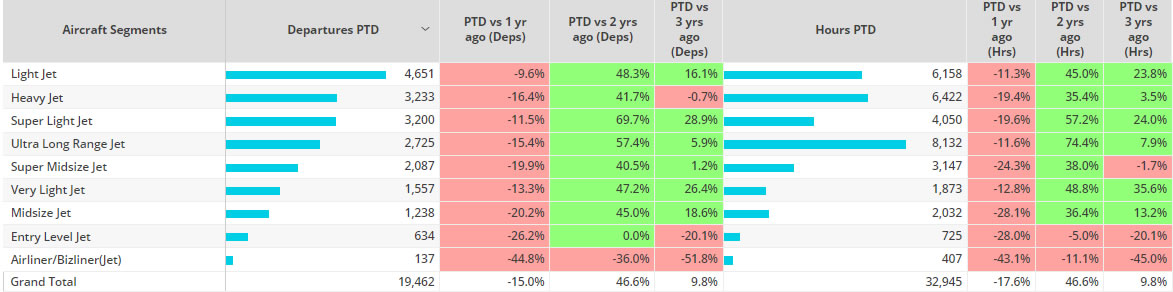

Light jets are driving demand so far in November, followed by heavy jets. All aircraft segments are seeing double digit declines in activity compared to last year. Bizliners have seen the largest decline in departures, 45% fewer than last year. Heavy jets are flying 1% fewer flights than November 2019, although flight hours are 4% above that period.

European Bizjet operator types, ranked by departures November 2022 compared to previous years.

Rest of World

Outside of North America and Europe business jet activity is 24% above last year, 55% above three years ago. In the last four weeks activity in Asia is 23%, Africa +16%, South America +6% and the Middle East +5%.

Fourteen days into November business jet arrivals into Qatar are 21% below last year, although triple digit growth compared to three years ago. Arrivals in the coming days are expected to rise significantly with the country hosting the FIFA Men’s World Cup.

Last weekend (11th Ц 13th November), Brazil hosted the latest round of the F1 calendar. Airports nearby (SBSP, SBMT, SBGR) saw 68 active bizjets arriving during the Grand Prix weekend this year, 70% more than the 2019 Grand Prix weekend.

Arrivals into Brazil F1 Grand Prix airports