WINGXТs weekly Business Aviation Bulletin.

Summary

The business jet market has seen peak demand taper across almost all indicators but it’s not yet clear whether this has merely eased capacity constraints, or now threatens to undermine business plans created in the last 2 years on the expectation of continued record growth. The charter market is clearly subsiding fast in Europe but still well above 2019 levels elsewhere.

Global

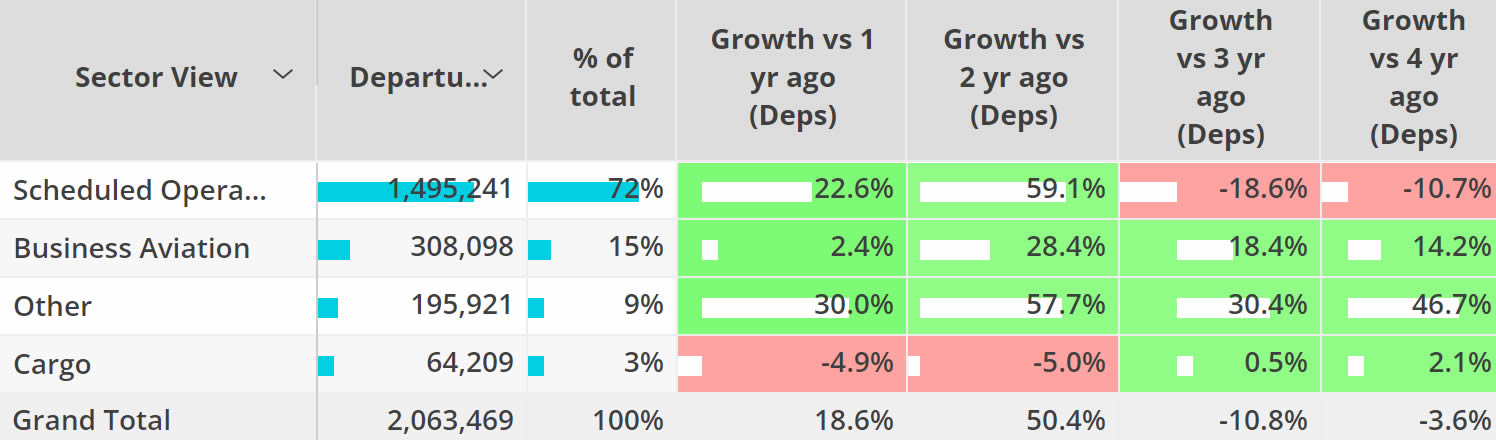

23 days into January business jet and turboprop sectors were 2% ahead of the same 23-day period in 2022, 14% ahead of 2019. Business jet activity is on par with the same period last year, sectors are 1% above 2022, 17% above January 2019. Looking back at the last three months (23/10/22 – 23/01/23), business jet activity is 2% below comparable last year, 18% above three years ago.

Turboprop sectors are 6% ahead of January last year, 9% above 2019. Scheduled airline sectors are 23% ahead of January last year, 11% below January 2019. Despite 2% growth compared to 2019, dedicated freighter activity is 5% below the same period in January 2022.

Global fixed wing flights, 1st Ц 23rd January 2023 compared to previous years. (Note business aviation includes turboprops)

North America

163,000 business jet sectors departed North America between 1st Ц 23rd January, on par with the same period in January 2022, 15% above 2019. Flight hours for the same period are 27% above 2019, 1% below last year. In the last four weeks sectors are on par with one year ago.

Demand continues to be driven by private flight departments this month, sectors are up 9% compared to the same period in January last year, 21% above 2019. Aircraft management programmes are seeing a 5% drop in sectors compared to last year, although 12% above 2019. Branded charter flights are down 19% compared to the same period in January 2022, although 13% above four years ago.

Looking at 135/91k bizjet activity, flights in North America were up 4% in week 3 ending 22nd January compared to the previous week, down 1% compared to the same week last year. In the last four weeks activity has dropped 5% compared to the same period last year.

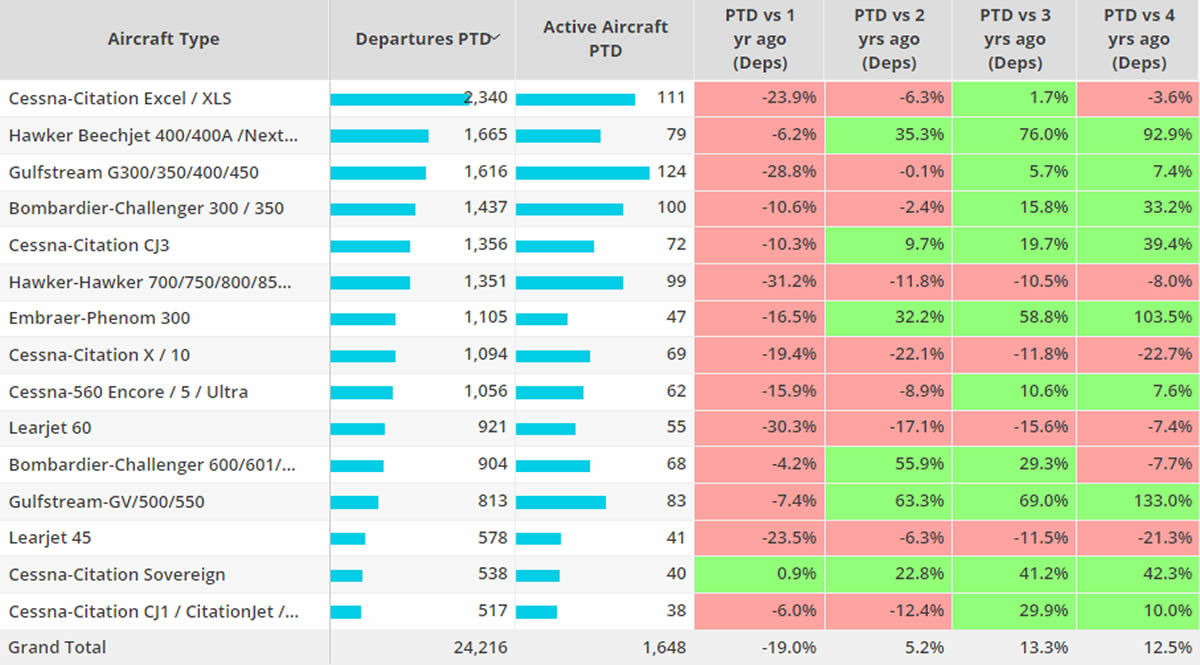

The Cessna Citation Excel /XLS is the busiest branded charter aircraft type so far this month. Flights on the type are down 24% compared to last year, 4% below 2019. Van Nuys Ц Las Vegas McCarran is the busiest branded charter airport pair, although flights are down 5% compared to last year.

North America branded charter bizjets ranked by departures, January 1st Ц 23rd 2023, compared to previous years.

53% of bizjet flights in North America this month have been less than 1.5 hours in length, flights of this duration are up 3% compared to 2022, 10% above 4 years ago. Long haul flights (6-12 hours) still lag behind 2019 by 6%, although 18% above last year. Bizjet flights over 12 hours are down 13% compared to January last year, 20% above 2019. Trans-Atlantic bizjet sectors (North America Ц Europe) are 28% above the same period in 2022, 16% above pre-pandemic 2019.

Business Jet sectors by duration, Branded Charter North America, 1st Ц 23rd January compared to previous years.

Bizjet activity varies by state so far this month. Florida is the busiest state so far this year, although flight sectors are down 7% compared to January last year, flight hours down 6% compared to last year. Texas is seeing a 2% increase in flights this year versus last, California a 3% decline.

Europe

23 days into January business jet flights in Europe are down 8% compared to the same period last year, 6% ahead of pre-pandemic January 2019. In the last four weeks sectors are down 9% compared to one year ago. Excluding Russia, bizjet demand is down just 3% compared to last year, 10% ahead of pre-pandemic January. 64% of bizjet flights this month are less than 90 minutes in length, flights of this duration are down 1% compared to last year, 7% above 4 years ago. Medium haul flights (3-6 hours) are in the largest decline compared to last year, sectors are down 37% compared to last year, 19% down compared to 4 years ago. Long haul and Ultra-long-haul flights have rebounded well above pre-pandemic January 2019. Flights between 6-12 hours are up 17% compared to last year, 31% above 2019.

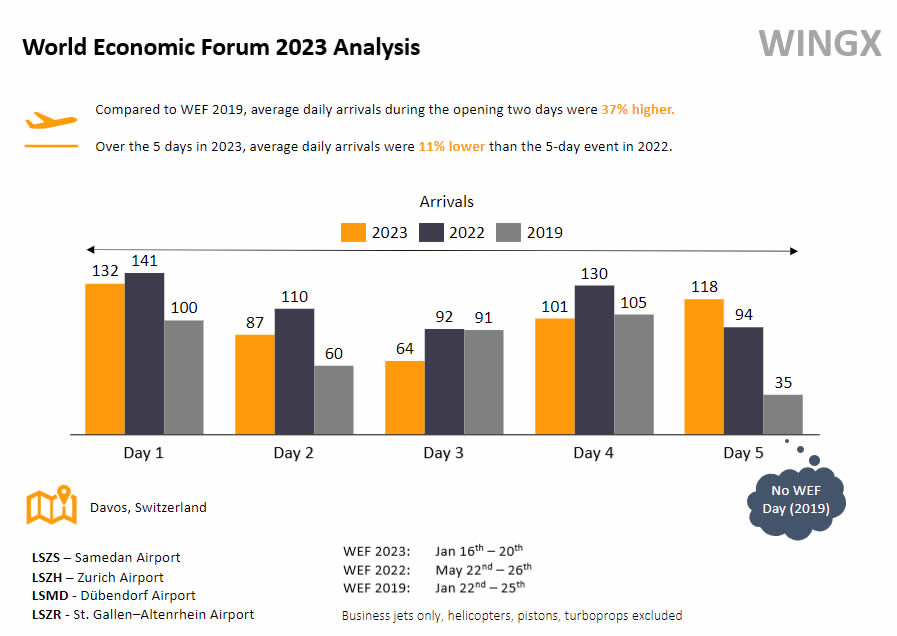

Davos hosted the World Economic Forum last week (January 16th Ц 20th). Business jet arrivals into nearby airports (LSZS, LSZH, LSMD, LSZR), across the 5-day event this year were 11% lower than the 2022 event. There were 372 active bizjet aircraft arriving into WEF airports during the event period this year, a 12% decrease compared to the 2022 event. Comparing average daily arrivals during the event period, the 2023 edition saw 1% more active aircraft than the 2019 event, 12% fewer than the 2022 event. The Bombardier Global Express was the aircraft with the most flight arrivals into WEF airports during this yearТs event. LFSB (EuroAirport Basel) to LSZH (Zurich) was the busiest airport pair.

WEF 2023 Analysis

Rest of World

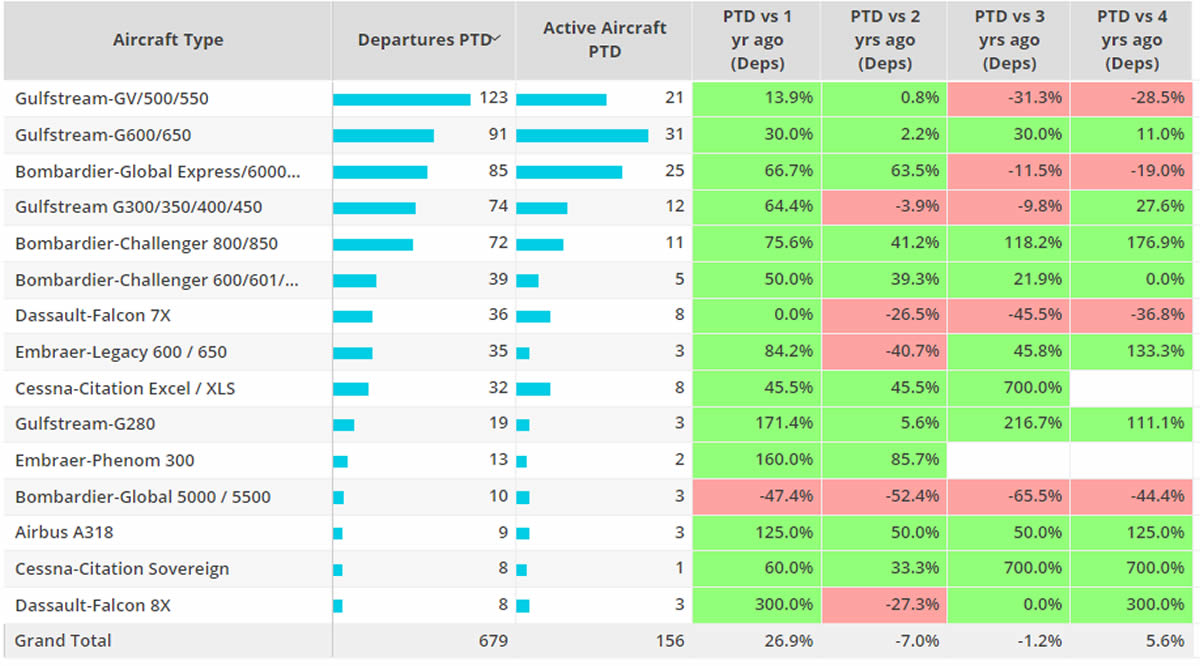

Outside of North America and Europe, bizjet activity is trending 31% above the same 23-day period in January last year, 81% ahead of pre-pandemic 2019. In the last four weeks activity in Africa is up 17% compared to a year ago, Asia and South America up 34%. The Middle East is saw activity in the last four weeks rise by 8% compared to a year ago. Ultra-long-range jets are now seeing big increases in activity in China, flights up 26% compared to last year, 17% below three years ago. Heavy jets are seeing strong growth compared to pre-pandemic January, flights are up 56% compared to 2019, 64% above last year.

Bizjet aircraft types, ranked by flights, China, 1st Ц 23rd January 2023