The start of 2023 feels like the start of a rollercoaster. As we crank up the lift hill to the first rush of excitement, what ups and downs – maybe even some loop the loops? – are coming our way in 2023, and what did the last lap of the 2022 track tell us?

By Harry Clarke, Head Of Insight & Analytics

This article will look at demand and pricing trends in Europe, the US and the Middle East, based on data from the Avinode marketplace.

At the Avinode 20-year celebratory webinar in mid-November, we predicted that charter demand within Europe in December 2022 wasn’t going to be as poor as feared. We had seen several months of decreasing demand through the autumn, but forward demand for December was holding up reasonably well compared to 2021. That prediction came true – demand within Avinode finished down only 1% year over year, compared to down 15% in November.

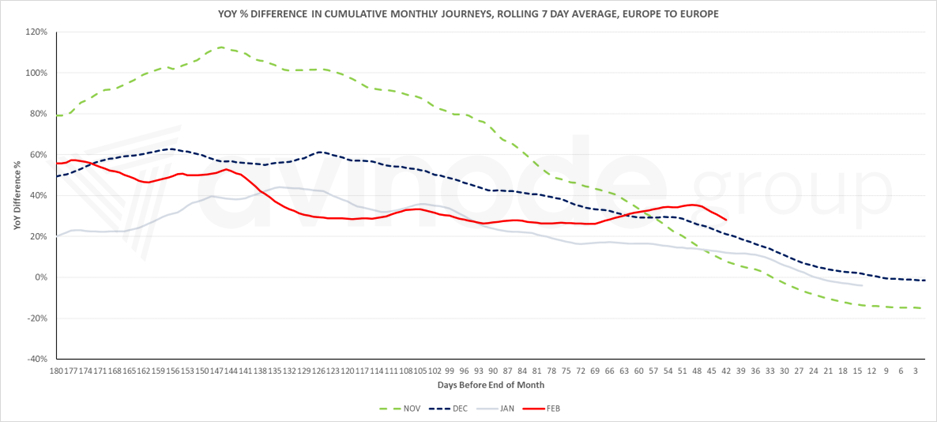

EU domestic journeys in the Avinode Marketplace. Year over year difference in cumulative demand, 7-day average, for IntraEuropean trips.

The chart above shows the forward demand trends for January and February 2023 in the European market, with November and December 2022 included for comparison. Each departure month is grouped, and cumulative demand is totalled by day; you can use this chart to understand how demand for a month is building over the course of 180 days. It gets more accurate as it gets closer to the end of the month due to so much private charter being sourced at short notice.

January 2023 has dipped and sits between where November and December 2022 were at the same number of days before end of the month. We expect it to finish worse year over year than December, but better year over year than November. February 2023 was looking more positive, with numbers being boosted by stronger early demand for ski trips from the UK to Switzerland and France, outbound the weekend of 11th February and returning a week later. However, it has started to drop more sharply and so we should expect it to end at a similar position to January, at this point.

EU Pricing trends in the Avinode Marketplace. Rolling 14-day index of hourly rates for IntraEuropean jet trips. Index = 100 is 1st January 2018.

US Pricing trends in the Avinode Marketplace. Rolling 14-day index of hourly rates for US domestic jet trips. Index = 100 is 1st January 2018.

According to the Avinode Pricing Index, hourly rates increased substantially in the first half of 2022 in Europe and the US, before decreasing as the autumn wore on. Rates increased again over the Christmas and New Year peaks. Much of the pricing trend is driven by fuel prices, but as ever in Europe, we should expect to see pricing peak in the summer in 2023.

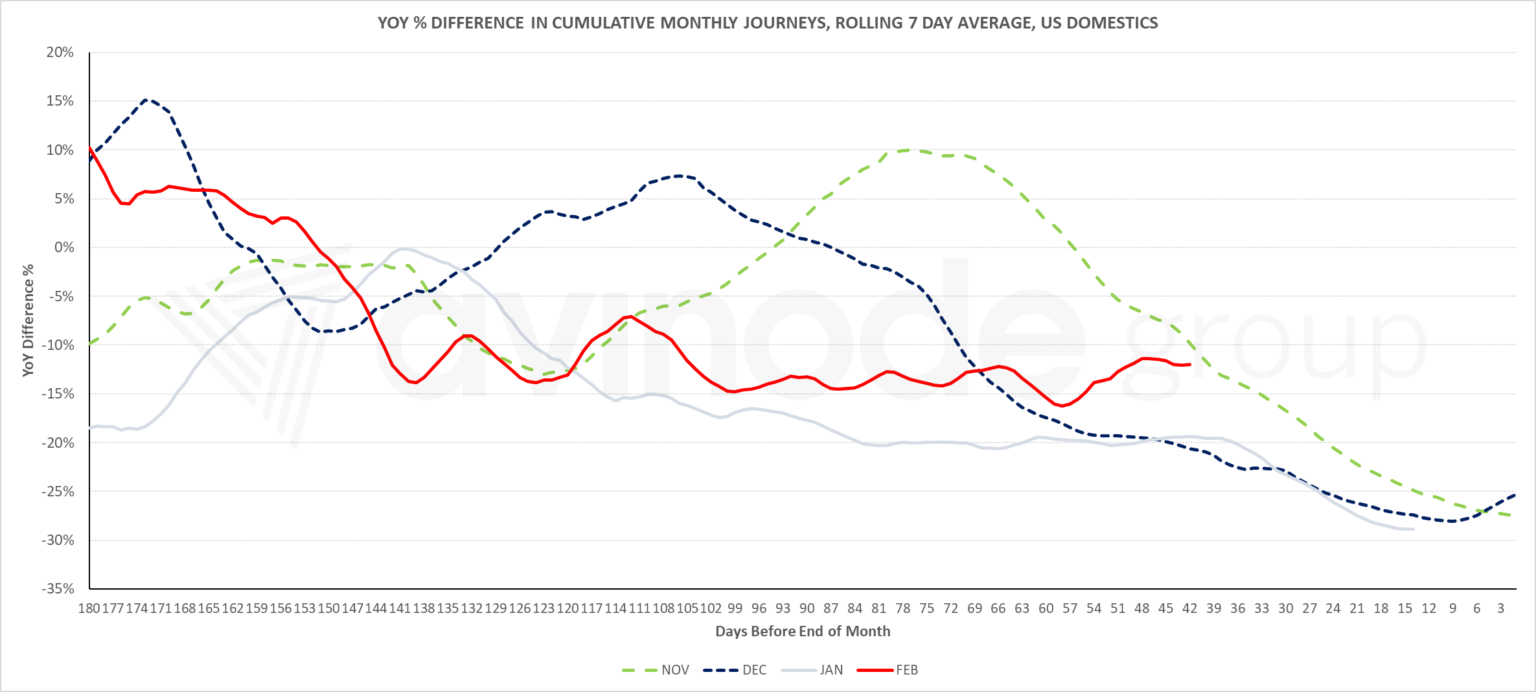

US domestic journeys in Avinode Marketplace. Year over year difference in cumulative demand, 7-day average, for US domestic trips. Note the very different y-axis scale compared to the European chart.

Across the pond, the scale of year over year decreases in charter demand for US domestics for November and December 2022 were much higher, with December finishing 26% lower according to Avinode data. Both months seemed quite flat early on before dropping rapidly.

January and February 2023 have been consistently down year over year for several months now. I think both months will see large year over year decreases, but February won’t be as severe as January. International demand to the Caribbean and Mexico looks to be more robust after a strong Christmas; Mexico and the Bahamas dominate.

Looking more globally, transatlantic demand for January and February is flat year over year, sectors between the US and UK leading the way in volume but between France and the US showing the most growth. After the huge charter surge for the world cup in Qatar, demand between Europe and the Middle East is more normal again!

Looking at January and February, demand is flat between the Middle East and Europe, dominated by demand between Dubai and the UK, Switzerland, and France. However, according to Avinode data, the most popular destination for the next two months from the UAE is Saudi Arabia. This has been driven by late demand, with the early demand favouring the Maldives. Saudi domestics are noticeably stronger than last year.