WINGXТs weekly Business Aviation Bulletin.

Summary

Global business jet activity is flat this February compared to February last year, which maintains a healthy 12% gain over February 2019. Charter is the relative weak spot, coming off huge highs in the last 12 months. The earthquake disaster in Turkey and Syria has catalysed very high levels of medical and ambulance specialist bizjet activity, representing more than 20% of total activity out of Turkey this month.

Global

Worldwide business jet sectors in week 6 of 2023, 6th February through 12th February, amounted to 67,178 sectors, an 11% increase compared to week 5 2023, and a 3% decrease compared to the same week 6 in 2022, a 34% increase compared week 6 2021 and 20% ahead of week 6 in 2019. The global trend in the last 4 weeks is 1% ahead of comp 2022. For commercially certified business jet traffic, including Part 135 and Part 91K, the week 6 trend was down 9% compared to the same dates in 2022. Business jet and turboprop activity in the first 13 days of February is 1% ahead of the same 13-day period last year, 13% above 2019. Between 1st – 13th February, scheduled airline traffic is up 27% compared to February 2022, 16% below 2019 levels.

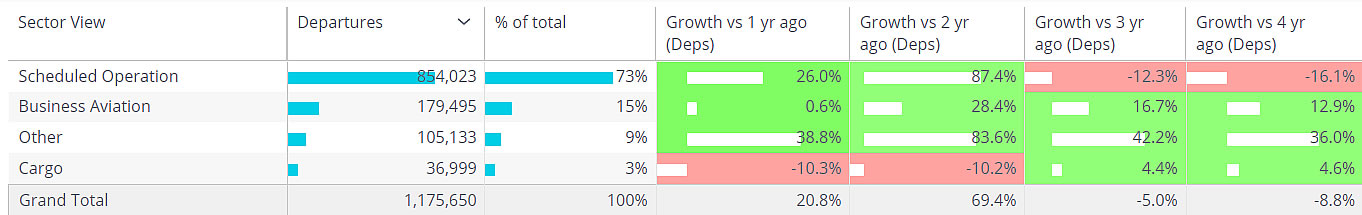

Global fixed wing flights, 1st Ц 13th February 2023 compared to previous years. (Note business aviation includes turboprops)

North America

52,133 bizjet sectors were flown in week 6, a 10% increase compared to week 5, a 6% decrease compared to the same dates in 2022. In the last four weeks activity has dipped 1% behind last year.

93,500 business jet sectors have flown out of airports in North America in February 2023 so far, 1% below the same 13-day period in February 2022, 12% more than 2019. So far this month private flight departments and fractional sectors are up 7% and 14% compared to last year respectively, 17% and 36% above 2019. Corporate flight departments are flying 5% less than in February 2019. Branded charter sectors down 17% compared to February last year, although 13% above 2019.

Super Bowl LVII was held in Glendale last weekend (Sunday 12th February), nearby airports (KGEU, KLUF, KGYR, KDVT, KPHX) saw an influx of business jet arrivals over the event weekend. 228 bizjets were parked at nearby airports 2.5 hours prior to kick-off, decreasing to 67 parked bizjets 19.5 hours after kick-off. This year’s event was the fourth busiest in the last 5 years for bizjet arrivals during the event weekend, arrivals to event airports were down 25% compared to the 2022 event in Los Angeles. The 2020 Super Bowl in Miami has the record number of arrivals into nearby airports during the event weekend.

Business jet arrivals into Super Bowl airports 2019 through to 2023.

Europe

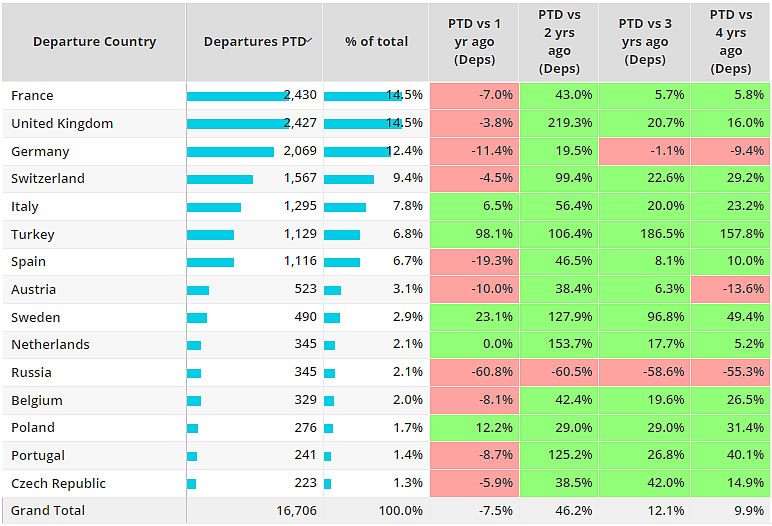

9,690 bizjet sectors were flown in week 6, a 19% increase compared to week 5, a 4% decrease compared to the same dates in 2022. In the last four weeks activity has dipped 5% behind last year. In the opening 13 days of February 2023, bizjet activity is trailing last year by 8%, although 10% above 2019. Germany and Spain are the weakest markets compared to last year. Excluding Russia, activity in Europe is 5% below last year, 13% ahead of 2019. Year-to-date bizjet sectors from Russia are down 70% compared to comparable 2022, down 62% vs comparable 2019.

Business jet markets, Europe, 1st Ц 13th February 2023, compared to previous years.

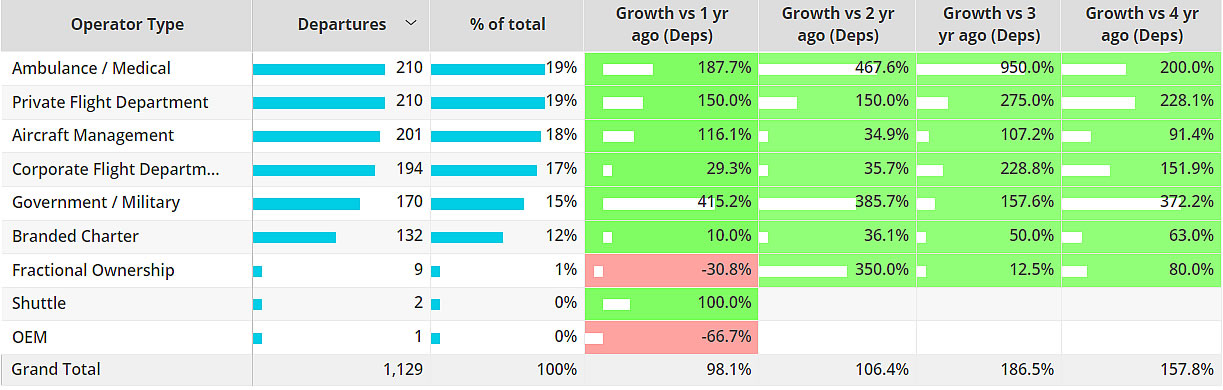

Activity in Turkey is almost double compared to the same 13-day period in February 2022. Following the TurkeyЦSyria earthquake earlier this month, bizjets have been assisting with humanitarian efforts. Ambulance / Medical operators are flying 188% more sectors this month compared to last year, Government / military operators up 415% compared to last year.

Business jet operator types, Turkey, 1st Ц 13th February 2023 compared to previous years.

Business jet flights trends, Turkey, 1st Ц 13th February 2023 vs previous years.

Rest of World

In Week 6, 6th February through 12th February, activity in Africa was 17% ahead of the same dates last year, Asia 31%, Middle East was 56% and South America was 35%. ROW countries with the largest gains over pre-covid February 2019 are Brazil, India and Australia. Year-to-date bizjet sectors in China are 25% above comparable last year, 4% above comparable 2019. The busiest airport for business jet departures so far this year in China is Beijing ZBAA, 229 outbound flights up 19% compared to last year.