WINGXТs weekly Business Aviation Bulletin.

Summary

The downwards slide in bizjet demand is steepening, especially in charter, but there are still comfortable gains compared to 2019. The US and Middle East markets standout. In Europe, the growth is most evident in Super Light Jets, whereas in the US, the biggest gains are in Ultra Long Range, Very Light and Super Midsize.

Global

Worldwide business jet sectors in Week 8 of 2023, 20th February through 26th February amounted 70,453 sectors, a 1% decrease compared to Week 7 2023, an 8% decrease compared to the same dates in 2022. The global trend for the last 4 weeks is 4% below the same dates in 2022. Global Part135 and Part91K bizjet activity in week 8 was 17% down compared to the same dates last year, 29% above the same dates in 2019. Flight hours for the same week were down 18% compared to the same dates in 2022, 33% ahead of 2019.

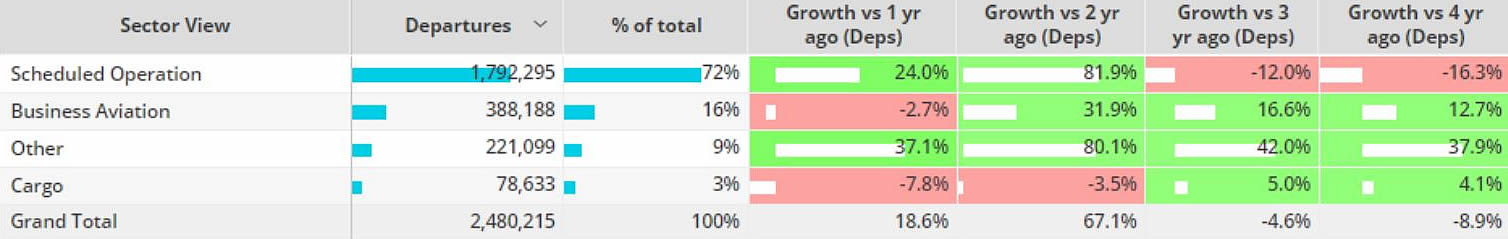

Combined business jet and turboprop activity between February 1st and February 27th was 3% down compared to last year, year to date the trend is -0.1% compared to last year, 13% ahead of 2019. Focussing on the top 5 busiest airlines (Southwest Airlines, American Airlines, Delta Airlines, United, Ryanair), sectors so far this month are 15% ahead of last year, 5% more than 2019.

Global fixed wing flights, 1st – 27th February 2023 compared to previous years.†(Note business aviation includes turboprops)

North America

In Week 8, 56,274 bizjet sectors departed North American airports, 1% more compared to Week 7, 7% below the same dates last year. In the last four weeks activity is 5% behind the same dates last year. Part135 and Part 91K activity during week 8 was 2% down compared to week 7, 15% below the same dates in 2022.

So far this month bizjet activity is 6% behind compared to February last year, 13% ahead of February 2019. Year to date the trend is 3% below last year, 14% ahead of 2019. Year to Date the top North American market trends are mixed, United States activity is 4% behind last year, 17% ahead of 2019, Canada rebounding 14% above last year, although still down 15% compared to 2019 and Mexico 3% ahead of last year, 27% below 2019.

So far this month in the United States domestic bizjet sectors account for 94% of overall activity, the majority of departures from United States airports are less than 90 minutes in duration. Bizjet sectors are down 6% this month compared to February last year, although activity is 16% ahead of pre-pandemic 2019. All top bizjet hotspots have seen an erosion in activity compared to last year, Teterboro seeing activity fall behind 2019. Florida is the busiest state so far this month for both sectors flown and flight hours, both hours and sectors are down 11% compared to last year. California, the second busiest state is falling further behind last year, sectors are 13% behind 2022, hours are 15% behind 2022.

United States top bizjets airports, February 1st Ц 27th 2023, compared to previous years.

Europe

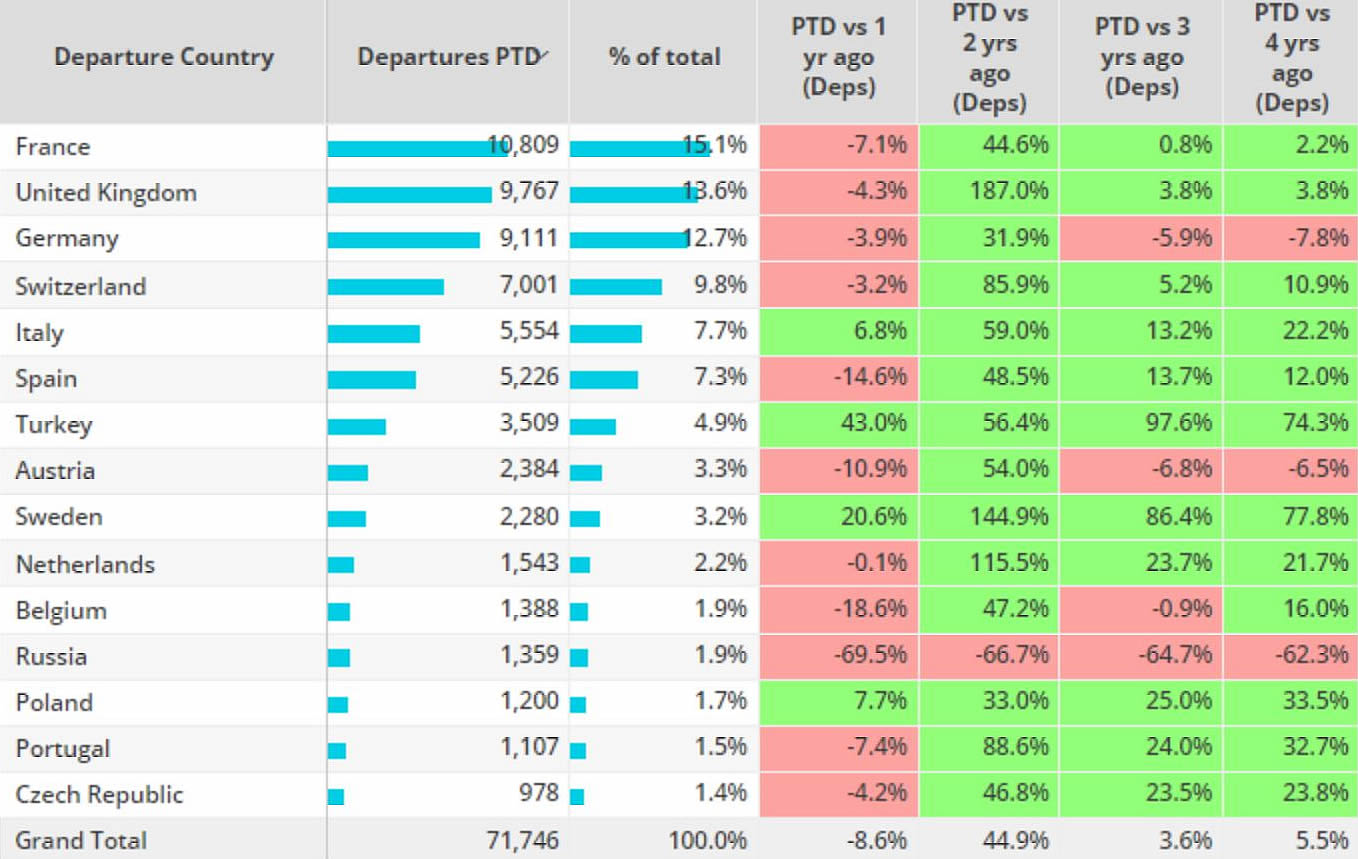

In Europe, 8,935 bizjet sectors were flown in week 8, 12% fewer than week 7, 20% fewer than the same dates in 2022. In the last four weeks activity is 9% below the same dates in 2022. So far this month bizjet sectors are 10% below last year, although 6% ahead of 2019. Year to date sectors are 9% below last year, 6% ahead of 2019. Excluding Russia and the monthly trend is 7% below last year, 10% ahead of 2019, year to date the trend is 5% below last year, 9% above 2019.

Year to date bizjet departures from Russia are down 70% compared to the same period last year, 62% below comparable 2019. Year to date the busiest international connection was with the United Arab Emirates, flights down 55% compared to last year, 53% above 2019. Flights to Turkey are the only major international connection with growth compared to last year, flights up 25% compared to last year, 97% above 2019.

European business jet markets 1st January 2023, February 27th 2023, compared to previous years.

Year to date bizjet flights from Turkey are 43% above last year, 74% above the same period in 2019. Business jet’s immediate response to the Turkey Ц Syria earthquake has started to taper off, between February 1st Ц 27th bizjet sectors were 71% ahead of last year, 116% ahead of 2019.

The 2023 Munich Security Conference held on 17th Ц 19th of February appeared to have a positive influence on bizjet arrivals into EDDM (Munich airport). On the day before the event, February 16th, there was 47 business jet arrivals into EDDM, 285% more than the average daily arrivals between 1st Ц 27th February.

Rest of World

In Week 8 of 2023, 20th February through 26th February, activity in Africa was 31% ahead of the same dates last year, Asia up 17%, Middle East up 10% and South America down 6%.

In the last 27 days of February, bizjet departures from the ROW region are 20% ahead of comparable last year, 77% ahead of 2019. The top two airports in the region this month have seen a decline in departures compared to last year, Al Maktoum down 3% vs 2022, Congonhas down 9% vs 2022.

Bizjet sectors in China this month are 6% above last year, although 6% below 2019. Private flight departments are driving demand, these flights are up 29% compared to last year, 25% ahead of 2019. Branded charter is seeing triple digit growth compared to last year, Aircraft management fleets flying 29% less than last year.

ROW Aircraft Segments, 1st January Ц 27th February 2023 compared to previous years.