WINGXТs weekly Business Aviation Bulletin.

Summary

The year-on-year deficit appears to be narrowing as we come out of Spring, reflecting the fact that the first Quarter of 2022 was a one-off and exceptional spike in demand for private jet travel. Fractional operators appear to have maintained the largest gains compared to pre-pandemic. The charter market continues to look soft compared to last year.

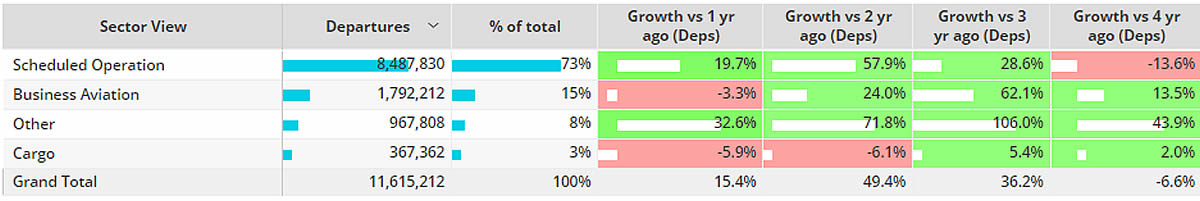

Global

In Week 18, the first week of May 2023, global business jet sectors were up 3% compared to the previous week, 5% below the same dates in 2022. In the last four weeks activity has fallen 6% below comparable 2022. So far this year (January 1st – May 7th 2023), business jet and turboprop activity is 3% behind the same period in 2022, 14% ahead of 2019. Global scheduled airline activity is still trailing 2019, but the top airlines are flying more than 4 years ago: Southwest, American Airlines, Delta Airlines, Ryanair & United Airlines departures in the opening 7 days of May are 11% ahead of May 2022, 6% ahead of 2019.

Chart 1: Global fixed wing flights, January 1st Ц May 7th 2023 compared to previous years.†(Note business aviation includes turboprops)

North America

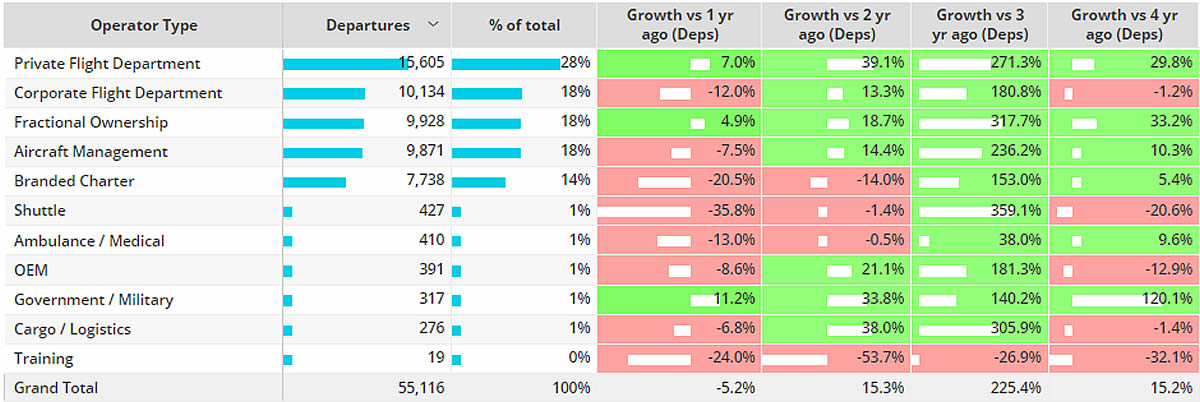

In Week 18 business jet activity in North America was 5% ahead of Week 17, 5% below the same dates in 2022. In the last four weeks activity has fallen 7% compared to the same period last year. From airports in the US, US Part 135 and 91K sectors in Week 18 were 7% ahead of Week 17, 7% below the same dates in 2022. The US market has started May relatively stronger than in April, departures down 5% for the first week, but still 16% ahead of pre-pandemic 2019. The first week of May 2023 indicates that Fractional Operators have the largest lead over the same period in 2019.

Chart 2: North America Business Jet Operator Types, 1st Ц 7th May 2023 vs previous years.

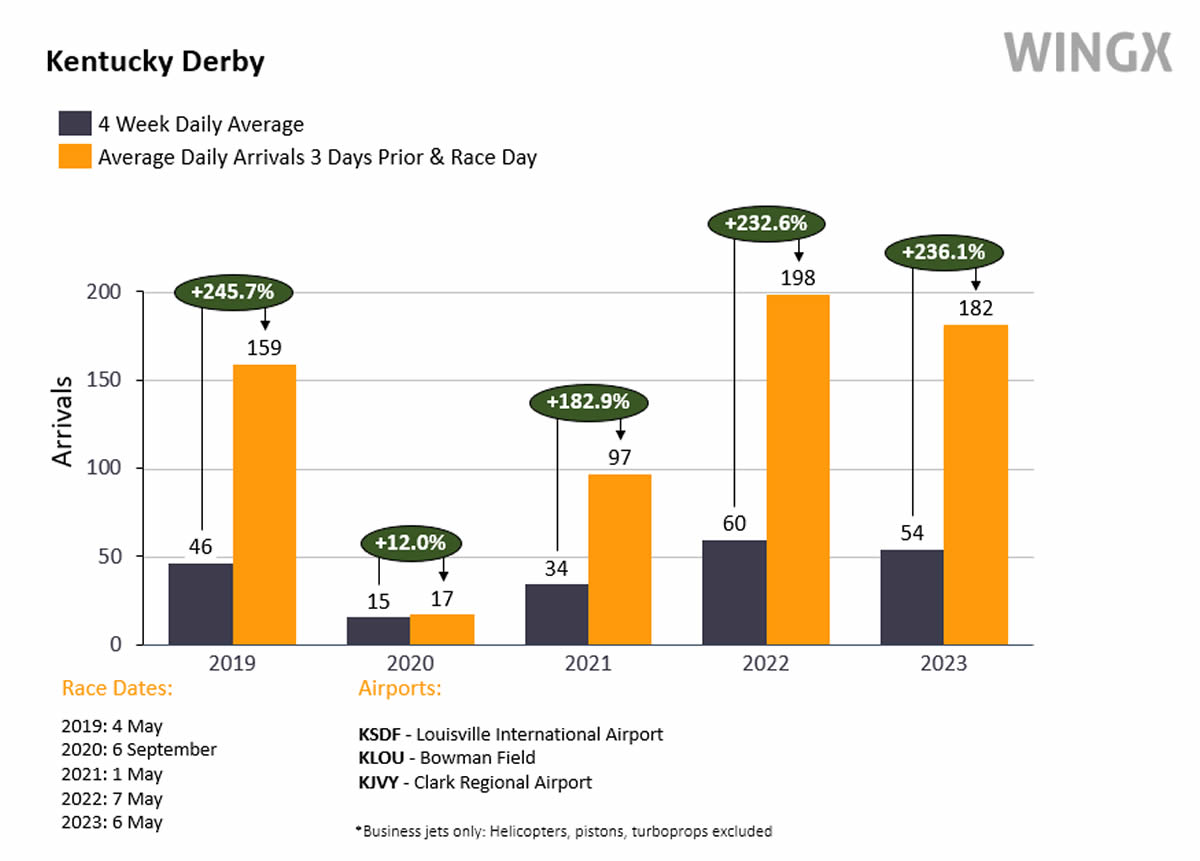

The Kentucky Derby saw a spike in business jet traffic in the US, particularly at Louisville (KSDF) also at KLOU and KJVY. At these local airports there were 726 business jet arrivals during the 3 days prior and including the event. On the event day itself, May 6th, there were 192 arrivals at the local airports, 9% fewer than the event last year. During the 3 days prior to the event and on the event day the average daily arrivals of business jets was 236% more than the daily average in the 4 weeks prior. This year’s event attracted the most business jet traffic of any of the last 5 years, with the exception of 2019.

Chart 3: Business jet arrivals at local airports to the Kentucky Derby, May 7th 2023.

Europe

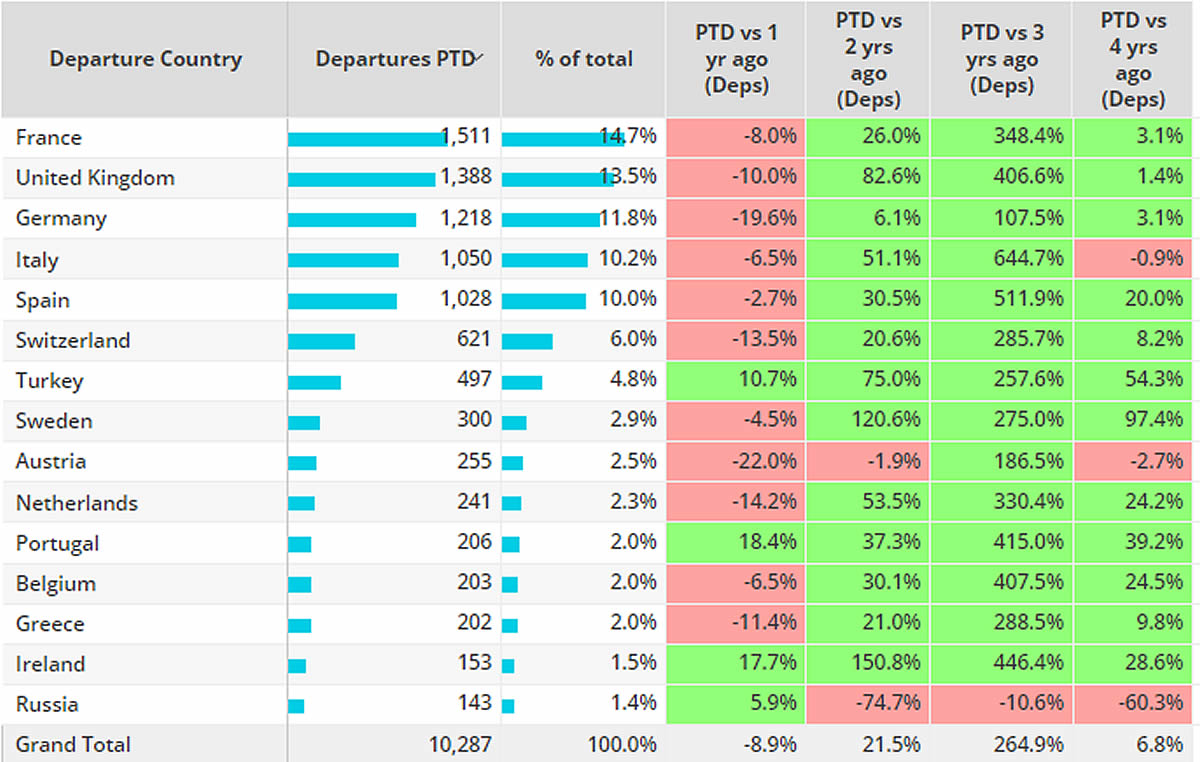

In Week 18 business jet activity in Europe declined 2% compared to Week 17, and trailed 9% below the same days in 2022. In the last four weeks the trend in business jet flight activity is 7% below the same dates in 2022. So far this year European business jet traffic is 9% behind comparable 2022, 7% ahead of 2019. France is the busiest market so far this month, although departures are 8% below comparable May 2022, 3% ahead of 2019. The United Kingdom is the second busiest market so far this month, departures 10% below last year, 1% ahead of 2019. Italy and Austria are seeing declines compared to May 2019, Italy down 1%, Austria down 3%.

Chart 4: Top European Business Jet Markets, May 1st Ц 7th 2023 compared to previous years.

Le-Bourget is the busiest airport so far in May, although activity has slipped 11% below last year, 5% ahead of 2019. Contrast Nice, where departures are 8% ahead of last year, 8% ahead of 2019. Other top bizjet airports have seen a slow start to the month. Farnborough, Geneva and Luton are all seeing declines compared to 2019, Farnborough down 3%, Geneva down 7% and Luton down 14%, all three are seeing double digit declines compared to 2022.

Rest of World

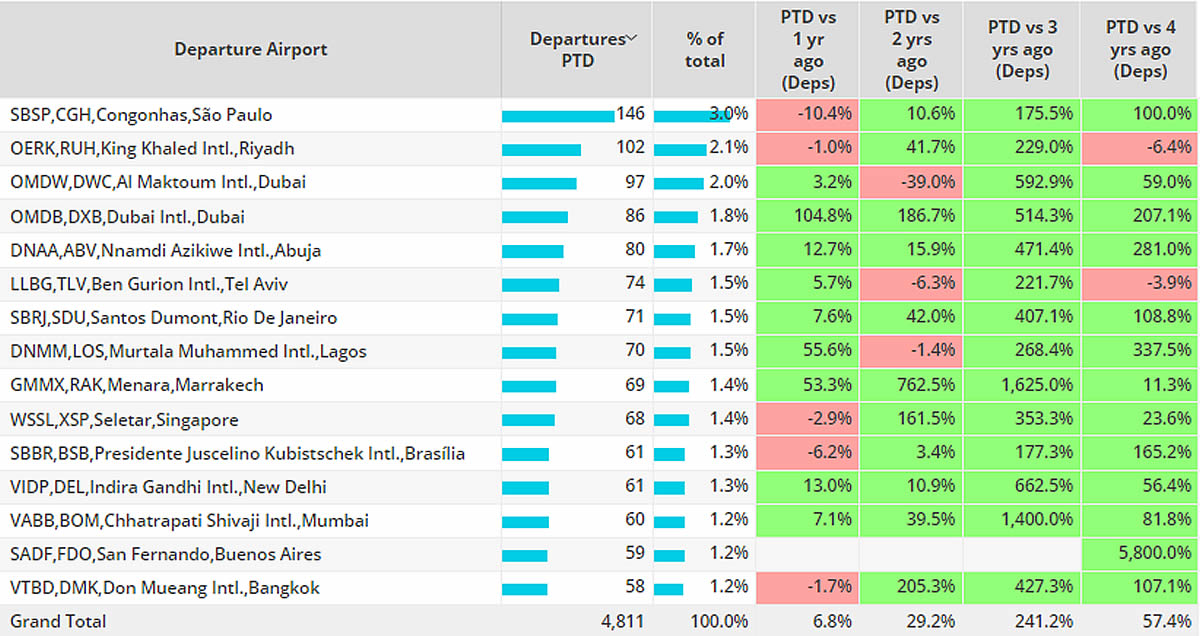

In Week 18, business jet activity in Africa was 25% ahead of the same dates in 2022, Asia up 5%, South America up 9%, Middle East up 3%. Overall, bizjet activity outside of Europe and North America is 7% ahead of last year, 57% ahead of 2019. So far this month Brazil is the busiest ROW market, departures from the country are 8% ahead of May last year, triple digit growth compared to 2019. Elsewhere Saudi Arabia has seen traffic fall 20% compared to the first 7 days of May 2022, China rebounding 71% ahead of May last year although 34% behind 2019.

Chart 5: Top Rest of World airports, bizjets, 1st Ц 7th May 2023 vs previous years.