WINGXТs weekly Business Aviation Bulletin.

Summary

There is some solidity in market trends as we hit the summer peak, with Europe 10% up on pre-Covid summer 2019, though 10% down on last year; North America more robust, at just 4% below last year’s peak, up 16% up on July 2019. Business jet traffic in the Middle East is a little off last yearТs records, but still 38% ahead of demand 4 years ago.

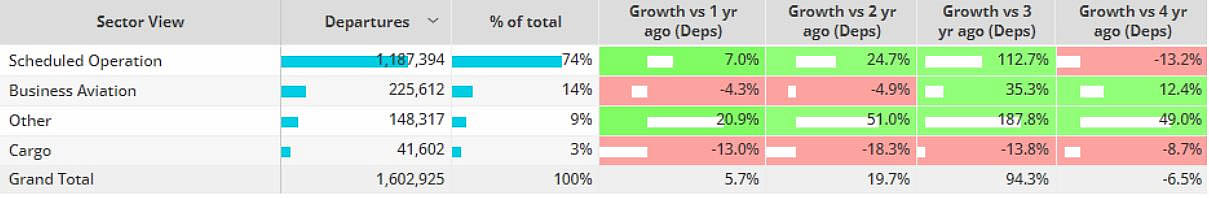

Global

16 days into July, global business jet and turboprop sectors are 4% behind comparable 2022, however, 12% ahead of 2019. Focussing on just business jets, activity in terms of departures is 5% behind July last year, although 17% ahead of 2019. Year to date business jet sectors are 5% behind comparable 2022, 19% ahead of 2019. Scheduled airline sectors so far this month are 7% ahead of 2022, still down 13% compared to July 2019. The trend for the top 5 business airlines (Southwest, American, Delta, Ryanair & United Airlines) is better, sectors 9% ahead of July 2022, 8% ahead of 2019. Global cargo sectors are seeing double digit declines compared to July last year, now 9% below 2019.

Chart 1: Global fixed wing flights by sector, July 2023 compared to previous years. (Note business aviation includes turboprops)

North America

In Week 28, ending July 16, business jet activity rebounded 26% above the typical holiday declines of Week 27, 1% ahead of the same dates in 2022, the 4-week trend now 3% behind comparable 2022.

The business jet trend across North America this month is 4% below July last year, 16% ahead of 2019. New York, Los Angeles and Chicago are the top departure metro areas. Departures from Los Angeles and San Francisco airports are seeing double digit declines compared to last year. Elsewhere, Florida airport outbound business jet traffic is 1% ahead of July last year.

Teterboro is the top bizjet airport this month in North America, bucking the regional trend, bizjet departures are 13% ahead of last year, 2% ahead of 2019, contrast second busiest Las Vegas McCarran, seeing double digit declines vs last year.

Chart 2: Top 20 North America busiest departure cities

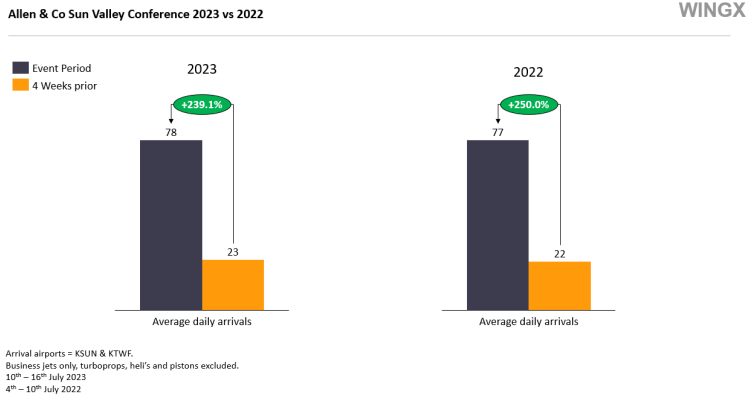

Friedman Memorial Airport (KSUN) and Magic Valley Regional Airport (KTWF) saw significant increases in bizjet arrivals last week (10th – 16th July), due to the hosting of the Allen & Co Sun Valley conference. Combined, the airports saw a triple digit increase in average daily arrivals compared to the average daily arrivals in the previous 4 weeks, and a 2% increase in overall arrivals compared to the 2022 event. KSUN drew the most traffic, seeing 496 bizjet arrivals during the event week, Teterboro the busiest departure airport, NetJets the busiest operator. Almost 60% of arrivals into KSUN during the event week were flights under 90 minutes in duration.

Chart 3: Sun Valley Conference 2023

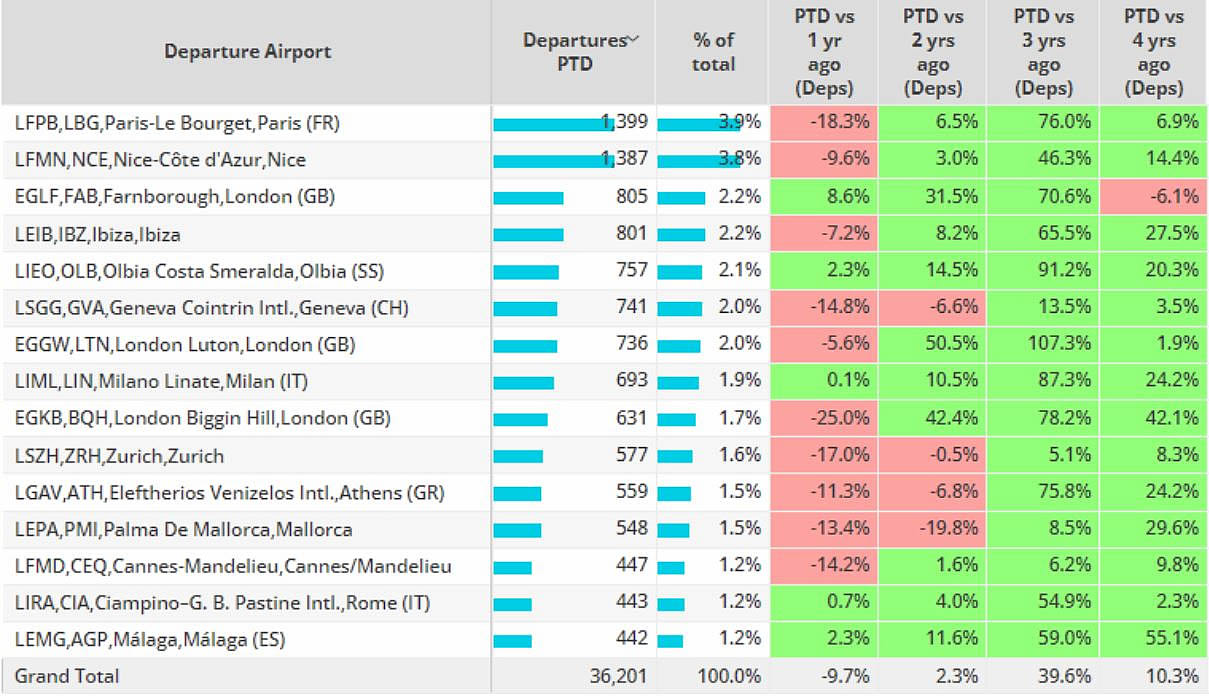

Europe

In Week 28 European business jet sectors dipped 1% behind the previous week, 10% behind the same dates in 2022. The 4-week activity trend is 8% behind 2022.

Business jet activity across Europe this month is 10% behind July last year, 10% ahead of July 2019. Light jets are the busiest aircraft segment this month in Europe, although departures are down 18% compared to last year, 10% ahead of 2019. Heavy Jets, Midsize and Bizliners are seeing double digit declines compared to 2019. Ultra Long-Range jets are the only aircraft segment to see growth compared to July last year.

Le Bourget, the busiest airport this month is seeing 18% fewer departures compared to last year, second ranked Nice 10% behind last year, third ranked Farnborough 9% ahead of 2022.

Chart 4: Bizjet trends by airport, Europe 1st Ц 16th July 2023 compared to previous years.

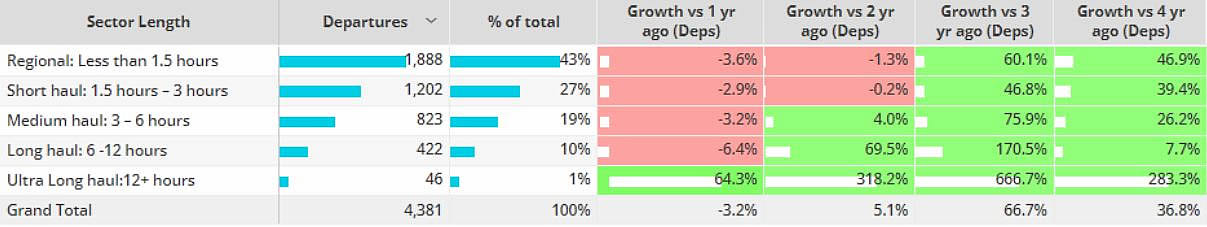

Asia

Across Asia, business jet departures in July are 3% below last year, 37% ahead of 2019. India is the top market, departures 4% ahead of last year, triple digit growth compared to 2019. Elsewhere departures from Japan are 40% ahead of last year, China 6% ahead of last year. 43% of bizjet flights across the region this month are less than 90 minutes in duration, departures of this duration down by 4% compared to last year. Contrast Ultra-Long-Range (12+ hours) flights, departures are up 64% compared to last year.

Chart 5: Business jet sectors by duration, Asia, July 2023 compared to previous years.

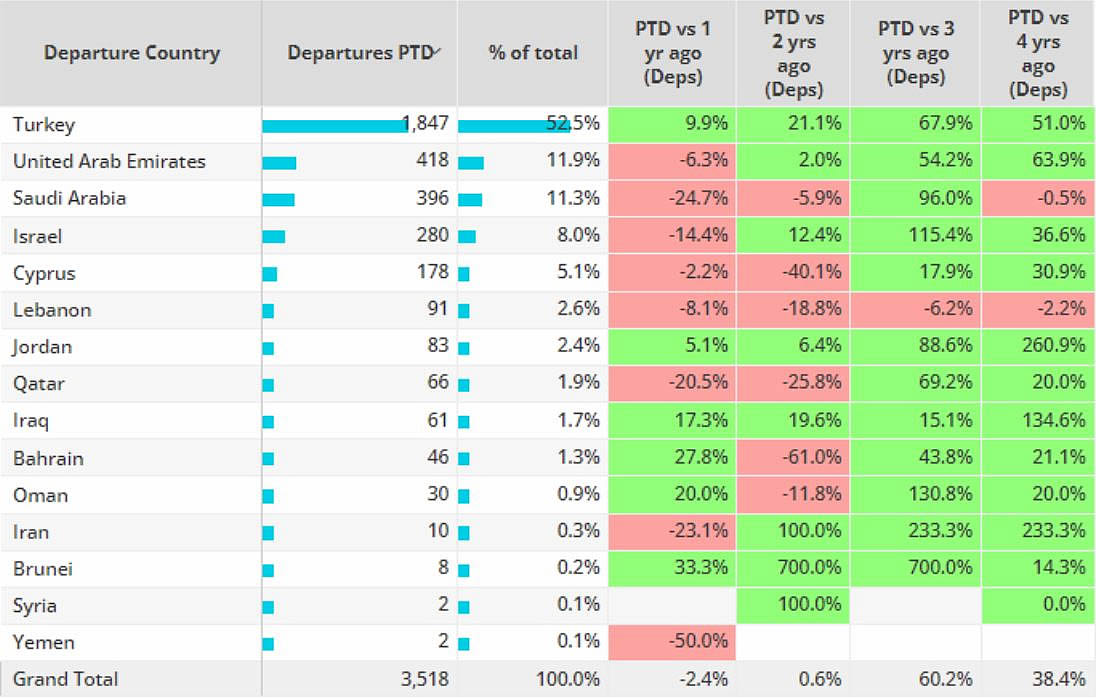

Middle East

Business jet activity in the Middle East is 2% behind July 2022, 38% ahead of 2019. Turkey is the top market, activity 10% ahead of last year, 51% ahead of 2019. Contrast United Arab Emirates, departures down 6% compared to last year, Saudi Arabia 25% behind last year, Israel down 14%. Ataturk is the busiest bizjet departure point in the region, activity 16% ahead of last year, 74% ahead of 2019. The Bombardier Challenger 600 series is the busiest aircraft type in the region this month, activity 19% ahead of last year, 32% ahead of 2019.

Chart 6: Top business jet country trends, July, Middle East compared to previous years