The Third Quarter 2023 Market Report released by the International Aircraft Dealers Association (IADA) predicts a significantly larger market going forward. The report includes hard sales data in addition to the perspectives of IADA’s global members, who know the industry well.

“The good news is that inventories are expanding, price inflation has slowed if not slightly slipped, and supply chain quirks and bottlenecks are being ironed out industrywide,” said IADA Executive Director Wayne Starling. “Additionally, MROs and FBOs are expanding to meet the needs of aging fleets. Those factors coupled with massive new options from fleet buyers could be signals that supply and demand are rebalancing for a larger post-pandemic marketplace.”

On the other hand, as the preowned business aircraft market continues to adjust to post-pandemic conditions and a bigger market, the current assessment of the aircraft sales market and six-month outlook have slipped just slightly in the past quarter. The culprits are, in the view of IADA’s survey respondents, today’s higher interest rates, somewhat softer pricing and lingering concerns about the potential for an economic recession in the U.S.

Overall, business aircraft valuations remain relatively stable with newer models and higher pedigree aircraft coming off of their peak prices by 5 to 10 percent. Older models have dropped in value by 15-20 percent for less preferred aircraft sold over the past couple years. Aircraft utilization has remained solid, within a few percent of the third quarter of 2022 and well ahead of 2019 levels.

Third Quarter 2023 Dealer Activity by the Numbers

There were 309 used aircraft deals closed in the third quarter of 2023 with 257 aircraft sales under contract. Sixty-six aircraft were sold at a lower-than-asking price and 44 deals fell apart in the quarter. IADA dealers received 116 new acquisition agreements and were retained exclusively to sell 226 aircraft.

Year-to-Date Comparisons

So far in 2023, IADA dealers have closed 853 transactions through September, compared to 929 in the same period in 2022. IADA dealers signed 410 new acquisition agreements, compared to 519 in the prior year’s first nine months. There were 191 aircraft sold with lowered prices, compared to 59 in the first nine months of 2022, and 152 deals fell apart through September 2023 compared to 127 in the first three quarters of 2022.

The Next Six Months

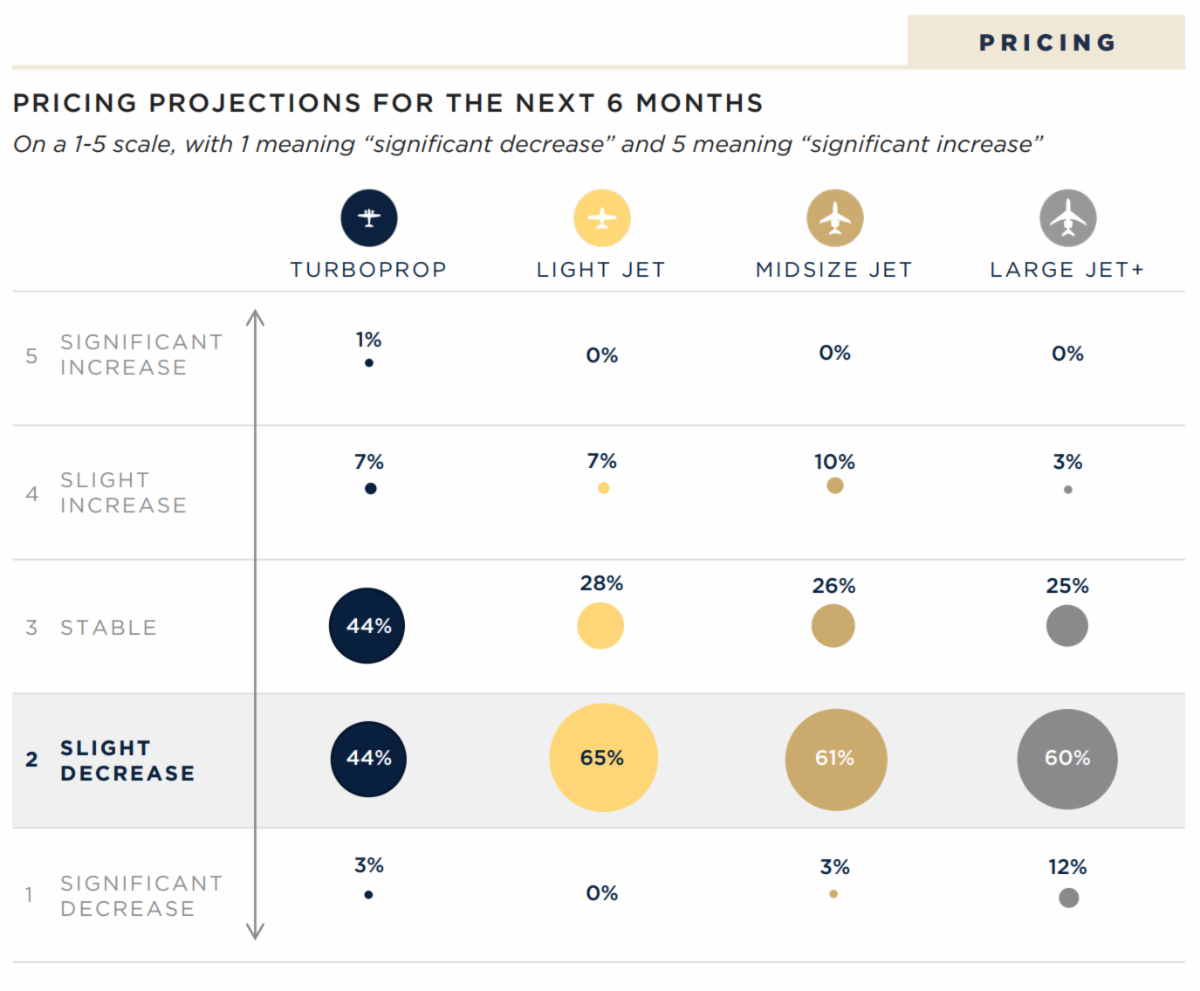

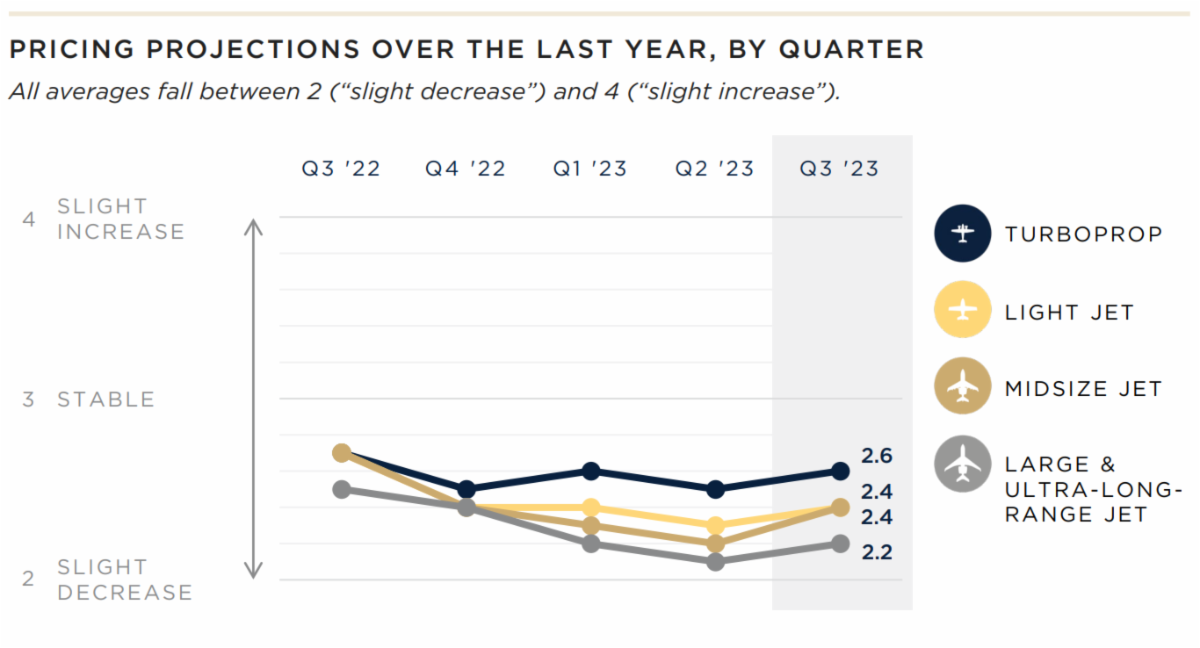

While IADA’s proprietary member surveys provide insights into present market conditions, they also reveal the directionality of market forces in the near term. Recognizing that business aircraft markets are far from monolithic, IADA analyzes and reports on projections for supply, demand, and pricing across four turbine aircraft categories: Turboprops, Light Jets, Midsize Jets, and Large and Ultra-Long-Range Jets.

Generally, pricing is expected to reflect slight decreases and supply for sale is predicted to be slightly increased across all categories. Demand projections are expected to be stable for turboprops and light jets, with stable to slightly decreased demand for mid and larger size jets.