Bizjet activity week 19 2024 is flat overall, with some significant regional divergence, noting significant weakness in Germany, Middle East, Africa and Asia, but strength in Texas, Switzerland and Brazil.

Global

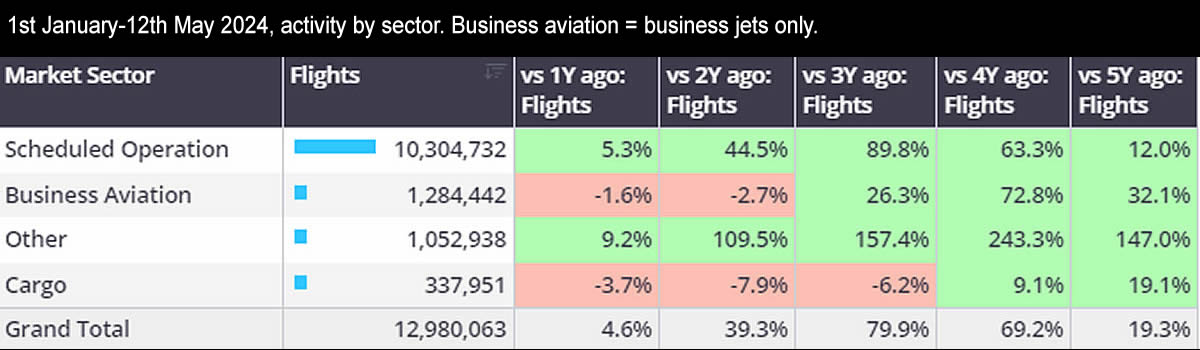

In Week 19 (6th– 12th May), just under seventy-one thousand global bizjet sectors were flown, on par with the previous week, up 1% compared to week 19 in 2023. Part 135 & 91K sectors increased 1% compared to the previous week, 1% below Week 19 in 2023. So far this year (1st January Ц 12th May), global bizjet activity has fallen 2% compared to last year. Over the same period, scheduled airlines are flying 5% ahead of last year. In contrast, dedicated freighters are flying 4% fewer flights than last year.

So far this month (1st Ц 12th May), global bizjet activity is 4% behind comparable May last year, European bizjet activity has slipped 7% behind last year, US trending 3% behind last year, Africa notably weaker, 28% fewer flights than last year.

Chart 1: 1st January Ц 12th May 2024, activity by sector. Business aviation = business jets only

United States

In Week 19, bizjet activity fell 3% compared to the previous week (Week 18), 1% more than Week 19 in 2023. Part 135 & 91K activity in Week 19 fell 2% compared to the previous week, 3% ahead of Week 19 in 2023. Florida has seen activity drop 3% compared to the previous week, although 2% ahead of Week 19 in 2023. California and Texas are both up 3% compared to Week 18, 2% and 1% ahead of Week 19 last year respectively.

So far this year (1st January Ц 12th May), bizjet activity in the US has fallen 1% compared to 2023, -6% compared to 2022, however 28% ahead of comparable 5 years ago. In terms of flight hours, US bizjet activity has fallen 2% YOY, 32% ahead of comparable 5 years ago.

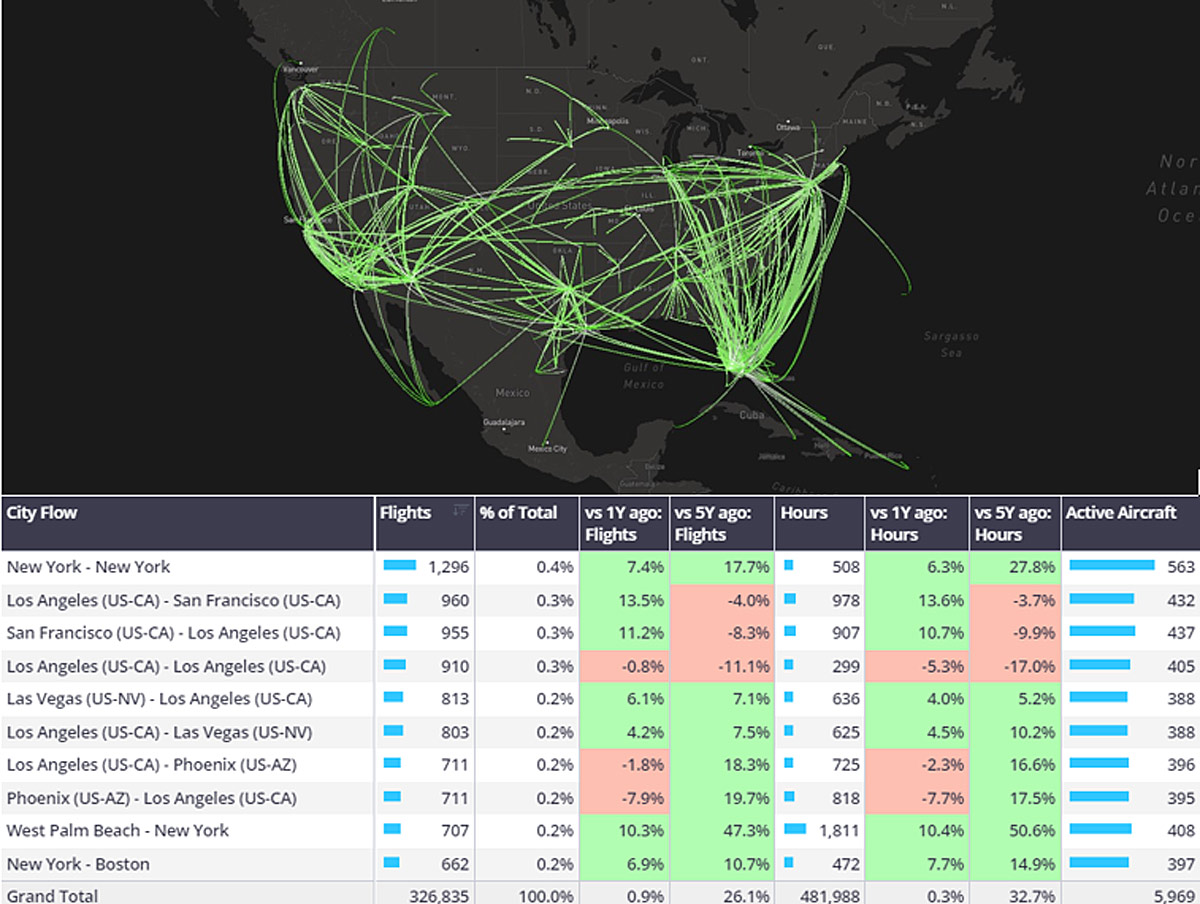

Cessna bizjet types are flying the most hours so far this year, just over 481,000 flight hours flown between 1st January and May 12th, on par with last year, 33% ahead of comparable 2019. Los-Angeles to San Francisco is the busiest city pairing for Cessna bizjets so far this year, demand ahead of last year but trailing 2019. Bombardier bizjets are flying 7% more hours than last year, 39% more than 2019. Gulfstream and Dassault types are flying fewer hours than last year, -3% and -7% respectively.

Chart 2: Cessna Bizjet city flows, 1st January Ц 12th May 2024.

Across the aircraft segments this year, super midsize activity is up 9% YOY in terms of sectors and up 8% in terms of flight hours.† Ultra-long-range jets are also flying more sectors and hours than last year, other types slipping, notably bizliners. Bizliners in the US are flying 16% fewer flights than last year, 27% fewer flight hours than last year. 85% of US bizliner flights are domestic, sectors 21% behind last year, international connections to Canada and Cuba well ahead of previous years.

Europe

In Week 19, European business jet activity jumped 20% up compared to the previous week, 1% below comparable Week 19 2023. Aircraft on operating certificates (AOC) also saw a significant jump in week-to-week activity, 19% more flights year on year, although 7% fewer flights compared to Week19 2023. Compared to Week 19 last year, Germany saw a 17% drop in bizjet traffic, in sharp contrast to Italy, which saw a 13% rise in traffic. Elsewhere France and the United Kingdom saw a 2% and 1% drop compared to Week 19 last year.

So far this year, European bizjet activity has fallen 3% compared to 2023, 2% ahead of 2019. Flight hours have fallen 2% YOY, 3% ahead of 2019. London is the busiest departure city this year, almost twice as many bizjet departures as second ranked Paris, both metro areas in decline compared to last year. 20% of bizjet departures out of London airports this year have been domestic flights, domestic flights falling 5% compared to last year, domestic flight hours falling 7% compared to last year.

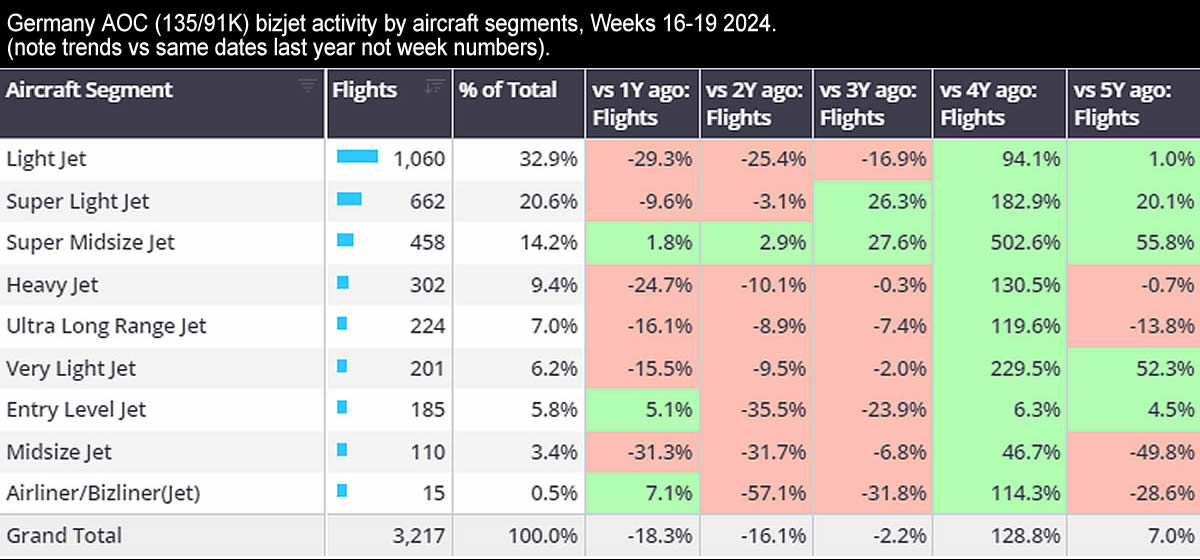

In the last 4 weeks (Weeks 16 Ц 19) Germany has seen an 18% drop in bizjets flights on operating certificates (AOC). This activity, largely charter demand, has seen biggest drops compared to last year in Light Jet segment. Notably, Ultra Long Range bizjet departures are trending 14% below 2019 levels.

Chart 3: Germany AOC (135/91K) bizjet activity by aircraft segments, Weeks 16-19 2024 (note trends vs same dates last year not week numbers)

Elsewhere across Europe, Paris-Geneva connections have fallen 12% YOY, also down 1% compared to 5 years ago. Similarly, Geneva Ц London connections have fallen 21% YOY, down 15% compared to 5 years ago. Busiest Trans-Atlantic connection is London Ц New York, well ahead of last year and 5 years ago.

Rest of World

In Week 19, bizjet activity in the Middle East fell 4% compared to the previous week, 9% below compared to Week 19 in 2023. So far this year activity in the Middle East has fallen 8% year-on-year, although 47% ahead of 2019. Domestic bizjet activity in Turkey has fallen 10% compared to last year, although 34% ahead of 2019. Saudi Arabia has seen a large drop in domestic bizjet activity, sectors down 31% compared to last year. Busiest international flow in the region is Saudi Arabia Ц United Arab Emirates, flights down 0.4% compared to last year. Elsewhere flights from Israel Ц Cyprus are 76% ahead of last year, Turkey to Russia and United Arab Emirates to Russia connections are 34% and 22% ahead of last year.