The latest week shows stable activity compared to last year, with fractional activity still booming, in contrast to some weaker charter demand, particularly at the light end of the market. Various gala events will see peaks in traffic in Europe in the next few weeks, starting with the Champions League Finals bringing visitors to London airports next week.

Global

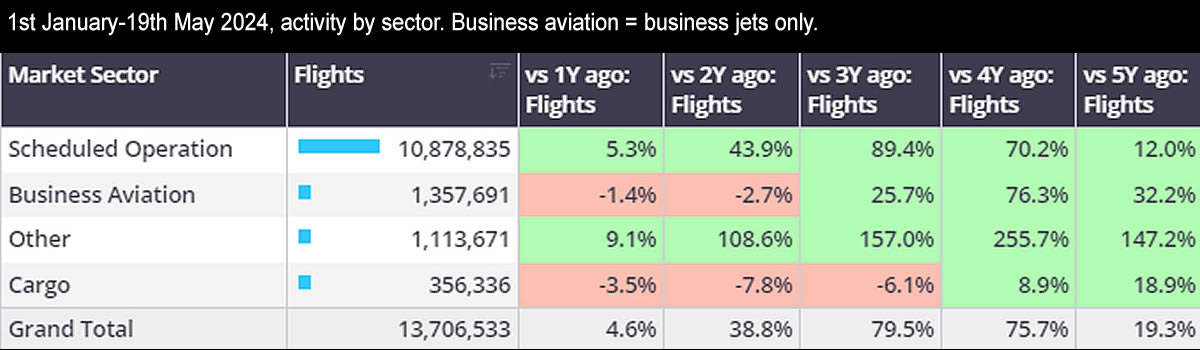

In Week 20 (13th– 19th May), seventy-three thousand global bizjet sectors were flown, 3% ahead of the previous week, down 1% compared to week 20 in 2023. Part 135 & 91K sectors increased 2% compared to the previous week, 2% below Week 20 in 2023. So far this year (1st January Ц 19th May), global bizjet activity has fallen 1% compared to last year, down 3% compared to May 2022. Over the same period, scheduled airlines are flying 5% ahead of last year, 44% ahead of May 2022. In contrast, dedicated freighters are flying 4% fewer flights than last year.

Chart 1: 1st January Ц 19th May 2024, activity by sector. Business aviation = business jets only

United States

In Week 20, bizjet activity grew 2% compared to the previous week (Week 19), 1% less than Week 20 in 2023. Part 135 & 91K activity in Week 20 grew 2% compared to the previous week, on par with Week 20 in 2023. Bizjet activity out of Florida dropped 10% compared to the previous week, although on par with Week 20 last year. California also saw week to week declines, dipping 1% below W20 in 2023.

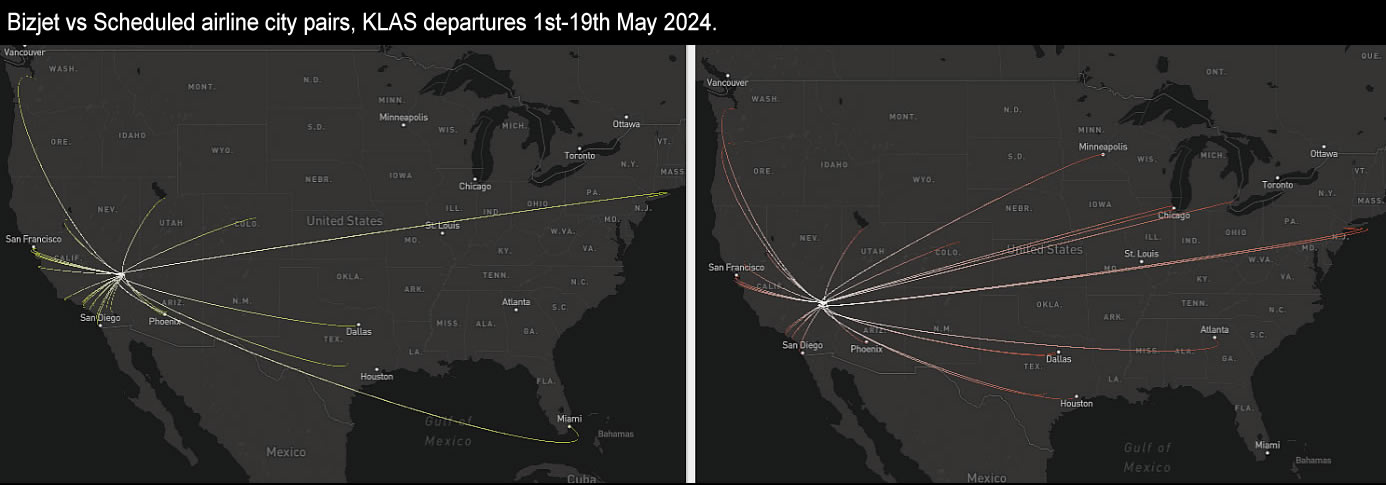

Across the United States this month bizjet activity is 1% below May last year. Las Vegas Harry Reid (KLAS) is an outlier this month, seeing strong bizjet growth compared to May 2023. Almost 2,000 bizjet flights have departed KLAS this month, 16% more than May last year. Sundays and Fridays are the two busiest departure days so far this month, suggesting leisure oriented travel. Los Angeles is the busiest connection, over 3.5x more flights than second busiest connection San Francisco. Activity on both city pairings up 15% and 30% YOY respectively.

Chart 2: Bizjet vs Scheduled airline city pairs, KLAS departures 1st Ц 19th May 2024

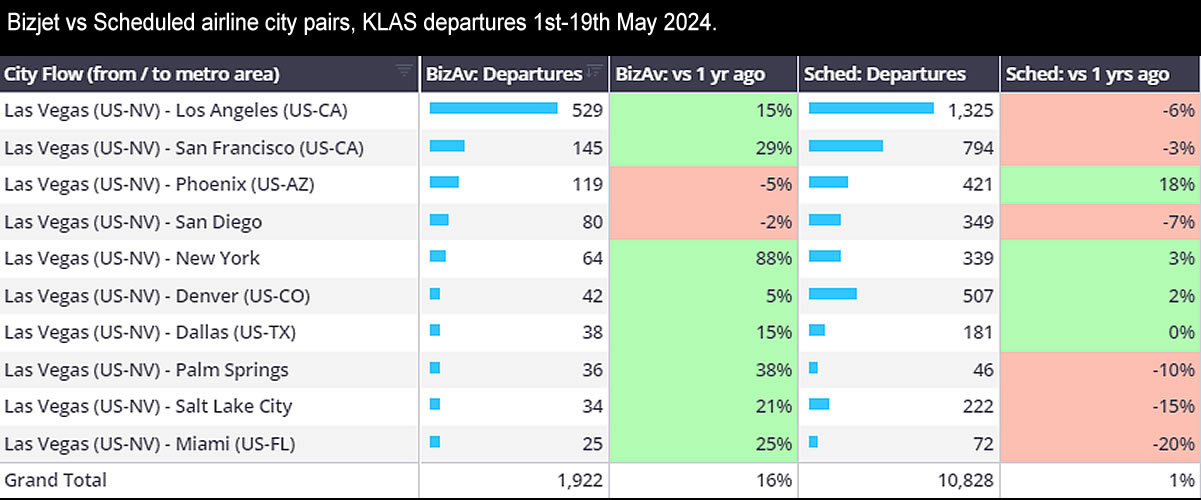

Across the US fractional fleets are busier than any May in the last 5 years, corporate flight departments and branded charter fleets flying 18% and 11% fewer flights than last year.

Chart 3: US Bizjet departures by Top Operators since 2019 through April 30th 2024.

Europe

In Week 20, European bizjet activity rose 6% ahead of the previous week, 3% below W20 in 2023. Aircraft on operating certificates (AOC) rose 4% compared the previous week, 7% below W20 in 2023. In Week 20 Germany saw bizjet sectors jump 18% compared to the previous week, 11% ahead of W20 2023. Top airport Munich saw 27 additional flights in W20 compared to W19, Frankfurt am Main saw an additional 22 flights. Elsewhere Hamburg and Cologne Bonn saw week to week declines. So far this month activity in Germany has fallen 9% YOY, -25% vs May 22, -7% vs May 19. Elsewhere France saw 12% additional flights compared to W19, 7% ahead of W20 2023.

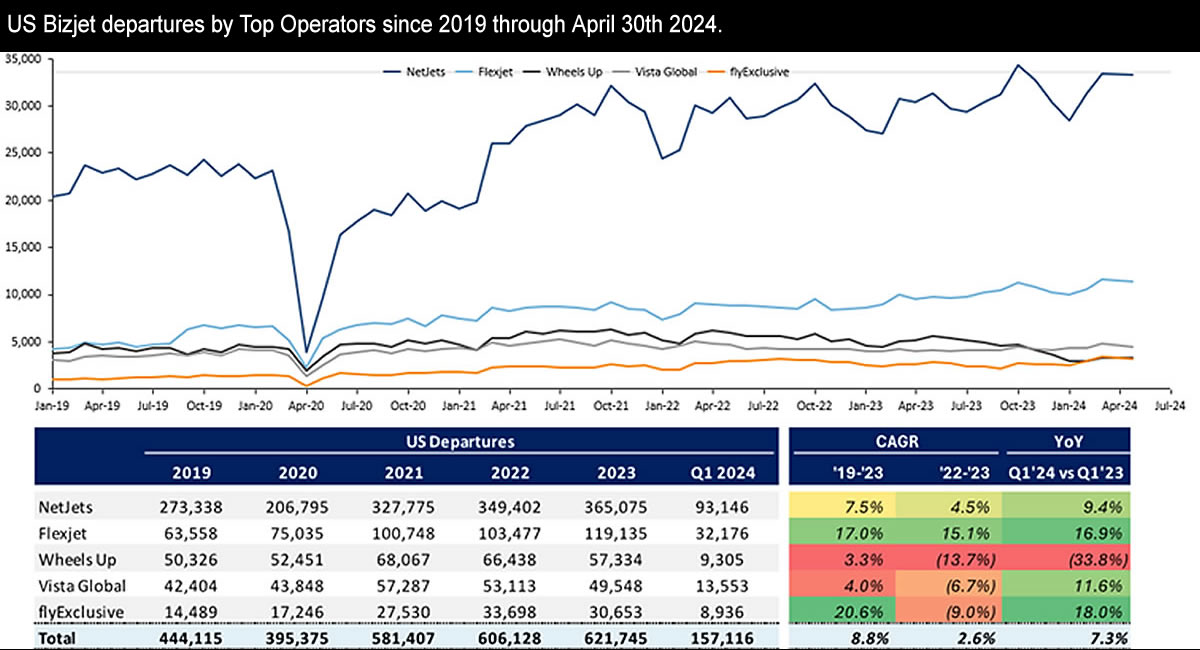

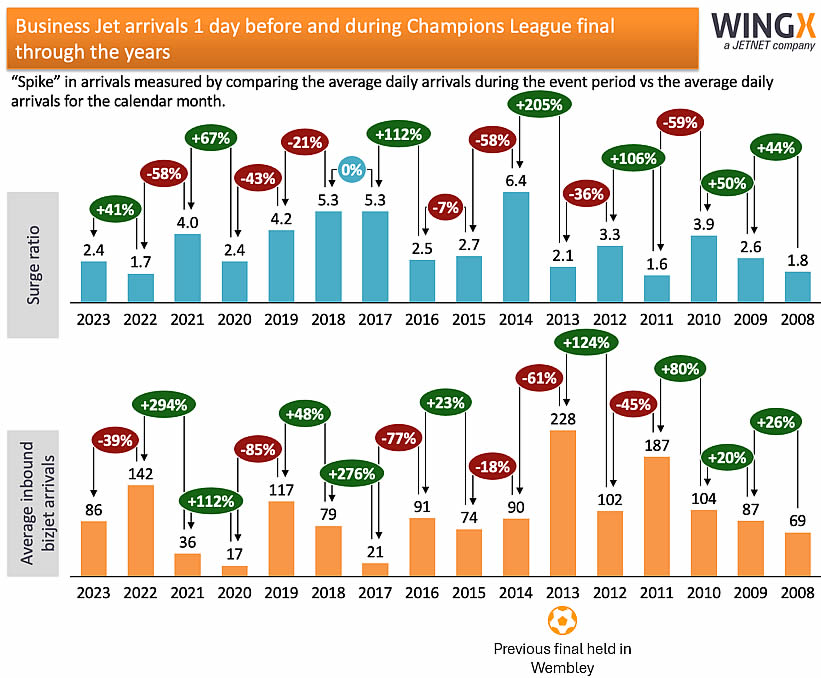

So far this month European bizjet activity is 1% below last year, flight hours are on par with last year. Several European cities are in decline compared to last year, Paris down 5%, Zurich down 4% and Rome down 2%. Bizjet activity in London is 2% ahead of last year, busiest airport Farnborough ahead of last year by 1%, Luton up 14%. In contrast, Biggin Hill and Stansted seeing 7% and 13% declines YOY. At the start of next month London will host the 2023/24 UEFA Champions League final at Wembley Stadium. London last hosted in 2013, when average daily business jet arrivals on the day before and the day of the final where 2.1x higher than the daily average for the month.

Chart 4: Business jet impact on hosting the Champions League Final 2008 Ц 2023.

Rest of World

In Week 20, bizjet activity in the Middle East grew 9% compared to the previous week, 4% ahead of W20 in 2023. Sectors in Africa jumped 23% week on week, although 12% below W20 in 2023. In Asia bizjet sectors grew 6% week on week, falling 6% compared to W20 last year. So far this month Middle East activity has fallen 4% YOY. United Arab Emirates bucks the regional trend, 8% ahead YOY, contrast Saudi Arabia down 23% YOY. Cyprus and Qatar well ahead of last year, Bahrain and Kuwait seeing declines. Turkey to Russia connections are 20% up YOY compared to May 2023, UAE to Russia connections up 55% YOY.