As the summer comes into view, especially with the Olympics in France, we would expect to see an uptick in international arrivals into Europe. Sure enough, total transatlantic bizjet flights from the US to Europe are up by 5% this month, and into France up by 26%. WeТd expect the high-end tourist demand to be a strong stimulus for the European charter market, lifting a sector which has otherwise sagged this year.

Global

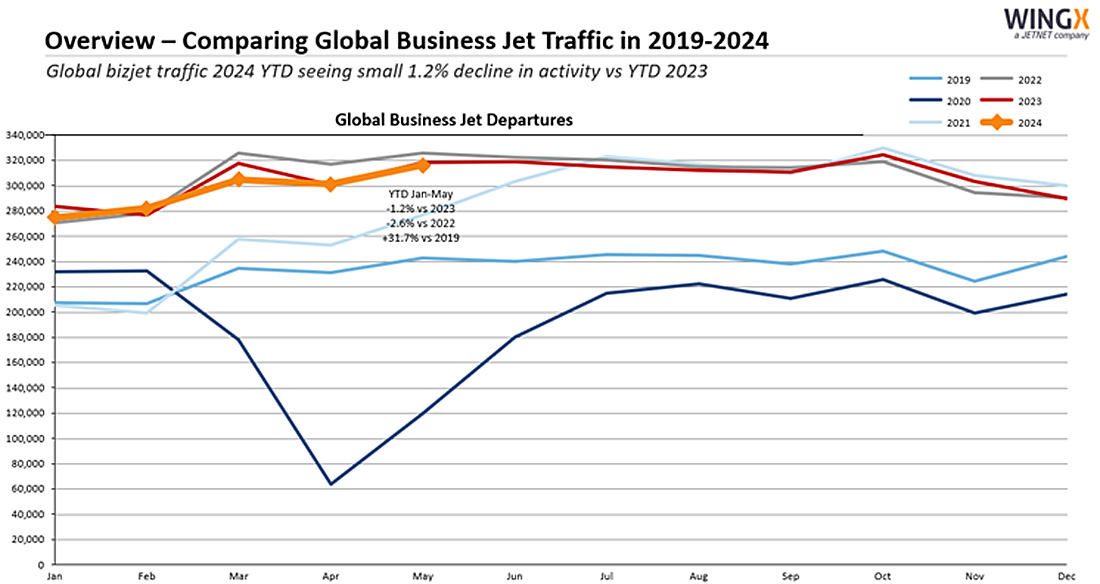

In Week 24 (10th – 16th June), 73,023 global business jet sectors were flown, 1% below Week 24 in 2023. For context, the last 52 week high was week 26 last year was 76, 521 bizjet sectors. Week 24 was an improvement on the start of June, with the midpoint of the month trending down by 3% compared to last year, and down 5% versus June 2022 . Year to date, global bizjet sectors are down 1.2% compared to 2023 and down 2.4% versus 2022, but up 30% compared to 2019.

Chart 1: Bizjet sectors flown YTD May-24

United States

In Week 24 (10th Ц 16th June), bizjet activity in the United States was 1% behind Week 24 last year. Thirty percent of bizjet flights in the US originated in three US States, Florida, California, and Texas. The busiest US State was Florida, with activity up by 2% year on year. In contrast, bizjet flights from California were down by 7% year on year, with a last four-week trend dipping by 5%. The last highpoint for California was back in June 2021; so far this month, bizjet activity in California is down 16% compared to same period 3 years ago.† Bizjet demand in Texas flagged by 2% this week, though Part 135 and 91K flights in the Lone Star State pipped up by 1%. More broadly, fractional operations are continuing to prop up the US market, comprising 19% of all flights this month and up by 12% compared to last year. Amongst the Fractional Operators, NetJets and Flexjet make up 75% of activity, both fleets flying 10% more than last year. AirSprint also has double digit growth this month. Notably, it’s the 1-2 hour sectors which appear to be most popular, as shown below.†

Chart 2: US Fractional bizjet departures by flight duration, 1st Ц 16th June.

Europe

European bizjet activity has bumped along this year, only 1-2% down on last year in terms of bizjet sectors flown, but only 5% ahead of volumes in 2019. France and Germany both saw upticks this week, week 24, which goes against the grain of declines in the last 4 weeks, and indeed year-to-date. Clearly this uptick owes to the EURO Championships hosted in Germany, and the run up to the Olympics opening in Paris. Conversely, Switzerland, Spain and Italy are seeing fewer bizjet flights than in June last year, although the latter two countries, as well as Greece are well ahead of 2019. Greece is continuing to show impressive growth this year, with bizjet arrivals month-to-date up by 10%. Arrivals into Greece from the UK are up by 67% this month, whereas arrivals from Italy are down by 27%.

Chart 3: Business jet arrivals into select leisure destination airports, June 2024 vs previous years.

Rest of World

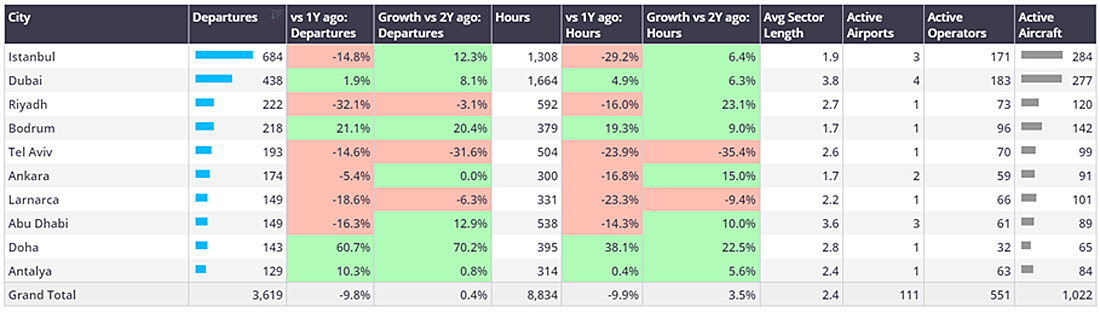

In Week 24 bizjet activity in the Middle East rose 5% compared to Week 24 last year; this bucks a 4-week trend of 7% decline compared to last year. Within the Middle East, so far this month, there is considerable variance: bizjet departures out of Istanbul and Riyadh are well down on a year ago; Bodrum is seeing a big uptick in tourist activity; Doha bizjet activity is up 60%; Dubai continues to inch up new record activity. Outside EMEA and the US, bizjet activity was well up in South America, notably Sao Paolo, and up 10% in Singapore. China ranks 7th in busiest countries in these regions, with activity in June down 4% year on year but up 250% compared to the lockdown period still prevailing 2 years ago.

Chart 4: Business jet departures by City, June 2024.