Business jet fleets have seen a boost in demand in the second half of the October, notably in the US and notably in California. NFL Games have been a draw, as have the GPs in Mexico and Texas. US presidential campaigning may also have spurred activity. The European market was also head-above-water, in contrast to a further slide in activity in the Middle East.

Global

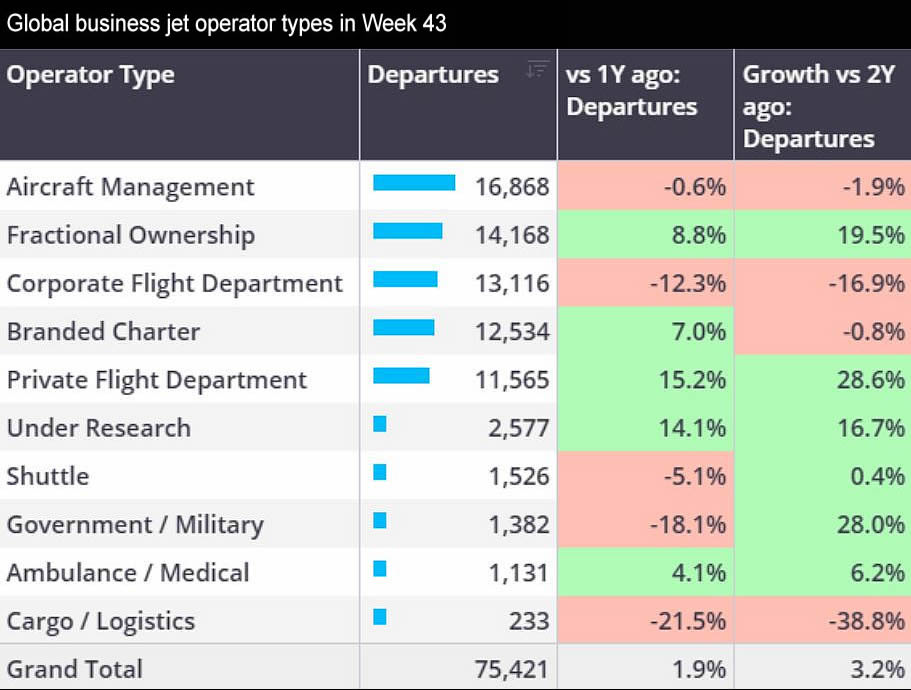

In Week 43 (21st to 27th October), there were 75,421 business jet flights operated globally, 1% fewer than the previous week, a 4% uplift on Week 43 2023. The Week 43 gains are well above the year-to-date trend, 1% below last year. Growth in Week 43 also reversed a negative trend in the first half of the month, with the full month tending towards 2% deficit compared to October last year. By operator type, Aircraft Management fleets were busiest, slightly off YOY whereas global Charter, Fractional and Private operations were all well up YOY.

Chart 1: Global business jet operator types in Week 43

North America

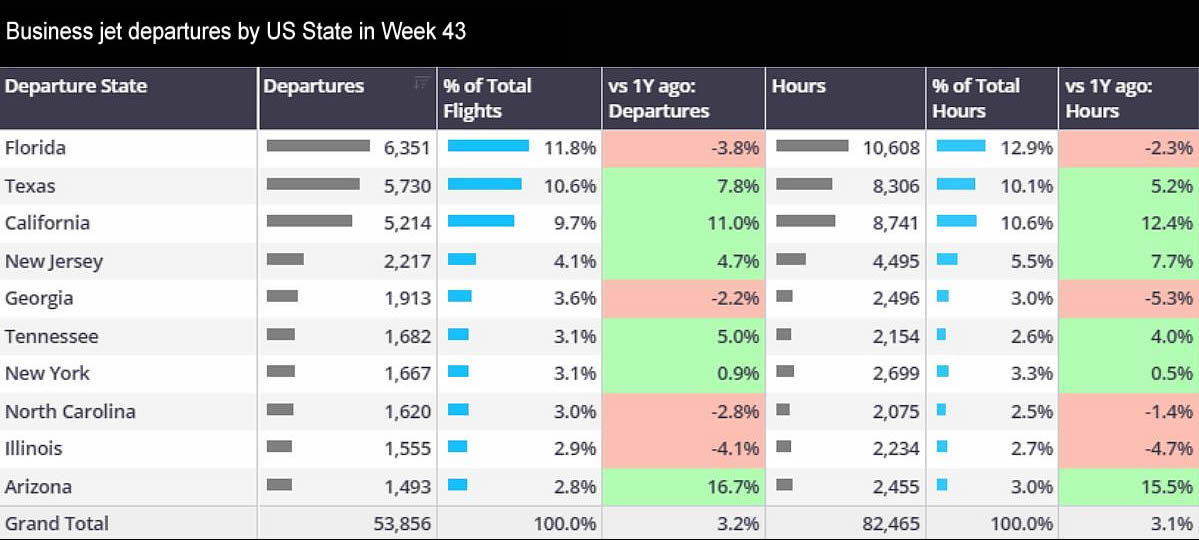

Week 43 saw 55,471 business jet sectors flown from airports in North America, 6% up YOY and only 1,000 fewer flights than peak week 26. In the last 10 weeks only 3 weeks have seen a YOY increase, two consecutively in the second half of October.† By State, Florida was the busiest, just under 10% of national activity, 4% down on last year. In contrast, Texas, California and New Jersey saw strong activity, well up on Week 43 last year. In California the W43 activity tended towards larger cabin jets; entry level, very light and light jets saw year on year decline. Last week, Las Vegas hosted the NBAA Business Aviation Convention & Exhibition, Henderson airport (KHND) played host to the static display, almost 800 bizjet departures so far this month, 1% fewer than last year, the year-to-date trend on par with last year.

Chart 2: Business jet departures by US State in Week 43

Year to date, just 7% of bizjet departures out of North American airports have been non-US registered. The US registered active fleet has increased 1% compared last year, standing at 16,704 active tails in North America this year. Despite this, US registered bizjets have made just under 2 million departures out of North America airports this year, 1% fewer than last year. Globally there are 16,988 US registered tails operating this year, with a strong bias towards light jets, almost 5,000 in operation this year. The N-reg super midsize fleet has grown by 5% compared to last year, Cessna has a 35% market share of all N-reg bizjet segments active this year.

Europe

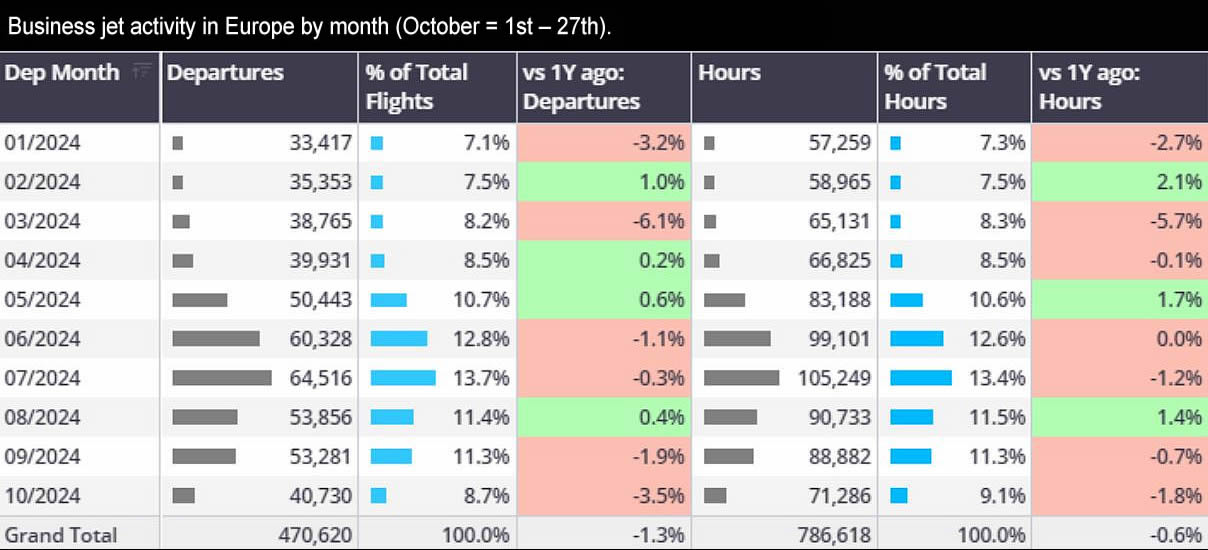

In Europe, bizjet activity grew 1% compared to W43 in 2023, the year-to-date trend now -1%, the month to date trend is -4%. As October draws to a close, it is likely bizjet activity in the region will see a 3rd consecutive month on month decline in activity since the 2024 of peak of July. With the month still yet to conclude, October’s activity has beaten the poor performing first 4 months of the year. So far this year, weekday flying in the region has been subdued compared to last year, weekend (Saturday & Sunday) activity is slightly ahead of last year, a trend that will likely continue until year end.

In Week 43 two of EuropeТs busiest markets, France and the United Kingdom, saw 16% decline compared to W42, -3% and -2% behind Week 43 in 2023 respectively. The charter market in W43 saw a week to week drop compared to W42, however, small growth compared to W43 in 2023. Despite Europe wide declines this month, pockets of growth have been recorded in leisure spots Spain, Greece and Portugal. Combined, more than half of bizjet arrivals into Spain, Greece and Portugal are from aircraft on a commercial AOC.

Chart 3: Business jet activity in Europe by month (October = 1st – 27th).

Rest of World

Outside of North American and Europe, there were 6,350 bizjet departures in Week 43, the most severe declines coming from the Middle East (-10%) and South America (-13%). Airports in Mexico City (MMMX & MMTO) welcomed the hosting of the F1 Grand Prix last weekend (October 25th Ц 27th). Over the Grand Prix weekend, there were 192 bizjet arrivals into MMMX and MMTO airports, up from 117 over the previous Friday Ц Sunday period. MexicoТs month to date trend is currently 10% below last year. Elsewhere in the Rest of World region, Australia is experiencing amble growth year on year, India seeing 22% growth compared to last year. In contrast, China departures are down 14% and United Arab Emirates down 10%.

Chart 4: Bizjet arrivals into MMMX & MMTO airports during 2024 Mexico Grand Prix weekend (October 25th Ц 27th).