In Week 28 (8th – 14th July), total global business jet departures were down 2% compared to Week 28 in 2023, equal to the last 4-week trend of 2% decline. Global Part135 & 91K activity on par with W28 in 2023, the 4-week trend 1% ahead of last year. So far this year the global bizjet fleet has flown just under 3.2 million flight hours, 2% fewer than last year. Across the 15,600 active operators there have 25,000 active business jets flying from January 1st through to July 14th. The global bizjet fleet has had a fair start to July, departures flown just -0.5% behind comparable July last year.

Chart 1: Global bizjet overview Week 28 2024 vs comparable 2023.

United States

In the United States, bizjet activity in Week 28 dropped 1% compared to Week 28 in 2023, the last four-week trend now 1% behind last year. Part 135 & 91K activity grew 2% in Week 28 compared to Week 28 last year, the four-week trend is now 3% above last year. Florida, California and Texas were all behind Week 28 in 2023, Part135 and 91K activity in Texas 2% ahead of W28 last year.

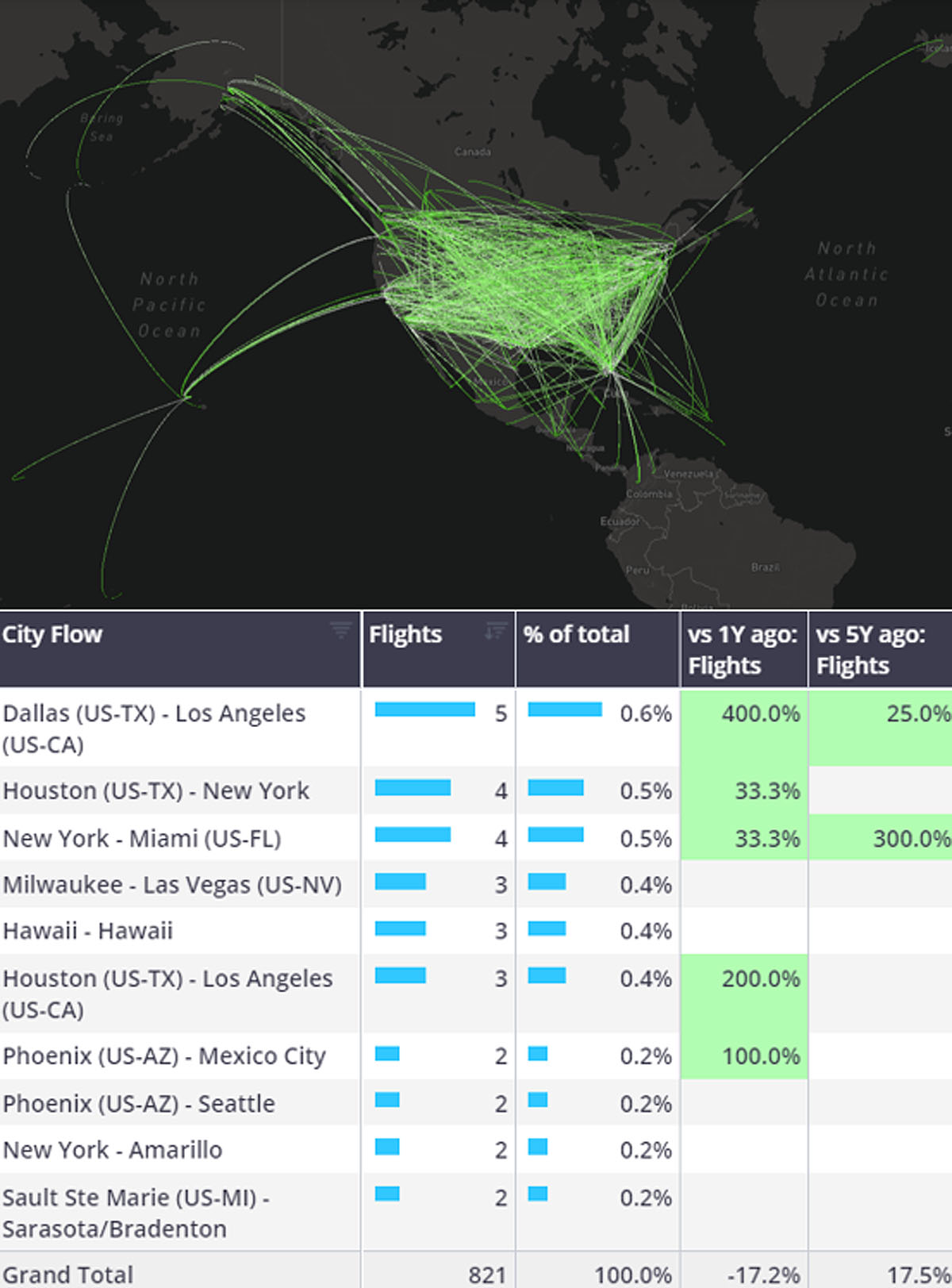

As the second week of July concluded, US bizjet activity was 1% ahead of last year, 29% gains over 5 years ago. Light jets are by far the most active bizjet type, just over 3,000 active tails two weeks into July, almost 900 more than second most active segment Super Midsize. Across the light jets in the US the average sector length is 401nm this month, Fractional Programs operating the largest number of light jet sectors. Out of the 22,780 light jet departures this month, 821 have been on flights longer than 3 hours, select standout connections are from the US mainland to airports in Hawaii.

Chart 2: US Light Jet city pairs, flight length 3+ hours, 1st – 14th July 2024

Several States stand out against the US wide trend this month, notably Georgia which is down 3% year on year and New York States which is 9% ahead of last year. Across New York State several airports are seeing large YOY gains, notably East Hampton and JFK both up +28%, Elmira Corning Regional +73%. Westchester County, New York State’s busiest bizjet airport is 7% ahead of last year, the airports top operators NetJets and Flexjet are flying 23% and 55% more departures YOY, Wheels Up bizjet fleet flying 20% fewer departures than last year.

Europe

In Week 28 European bizjet activity dropped 1% compared to Week 28 in 2023, the last 4-week trend 2% down compared to last year. As the UEFA EURO tournament concluded last week, Germany’s W27 activity rose 24% above W28 in 2023. In contrast to most major European markets, the UK saw a 4% uplift in Week 28 compared to Week 28 in 2023.

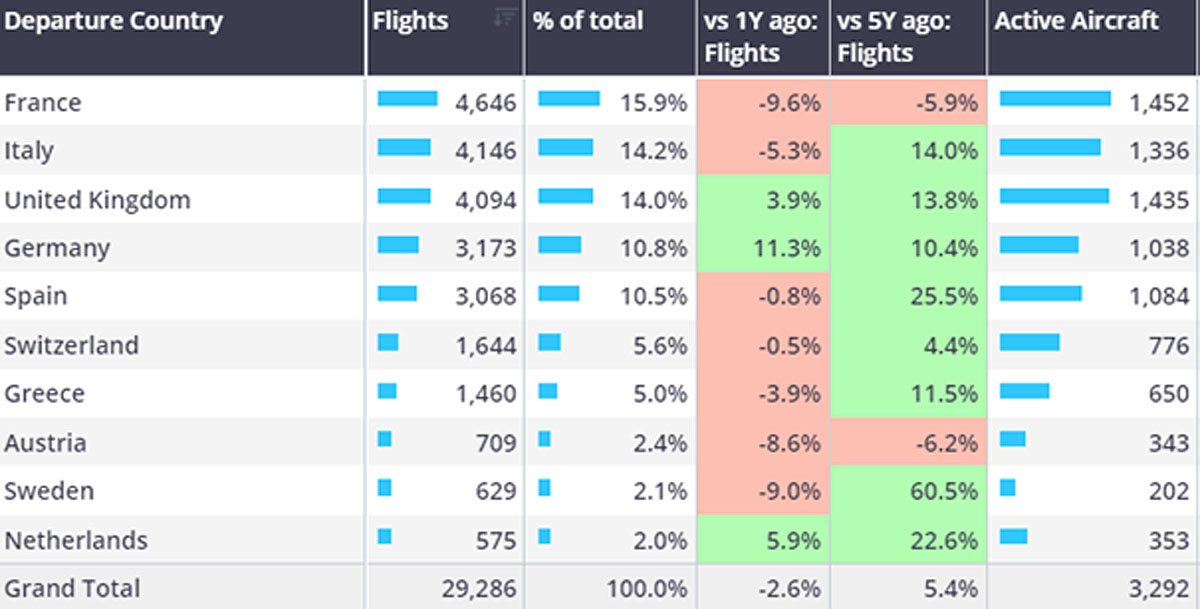

European bizjet activity is 3% behind last July, 5% ahead of July 2019. So far this month the average sector length of European bizjet activity is 537 nautical miles. Top market France and 8th ranked Austria are in 6% decline compared to July 2019, France would expect a rebound towards the end of the month as the Olympics begins. In the UK the main London bizjet airports are seeing steady Year on Year increases in departures, however, Stansted has seen 12% fewer bizjet departures compared to last year. As the UK moves closer to school summer holidays, several leisure destinations have seen rises in arrivals from the UK, particularly Malaga and Ibiza which are 4% and 3% ahead of last year.

Chart 3: European Business jet departures by countries, 1st – 14th July 2024.

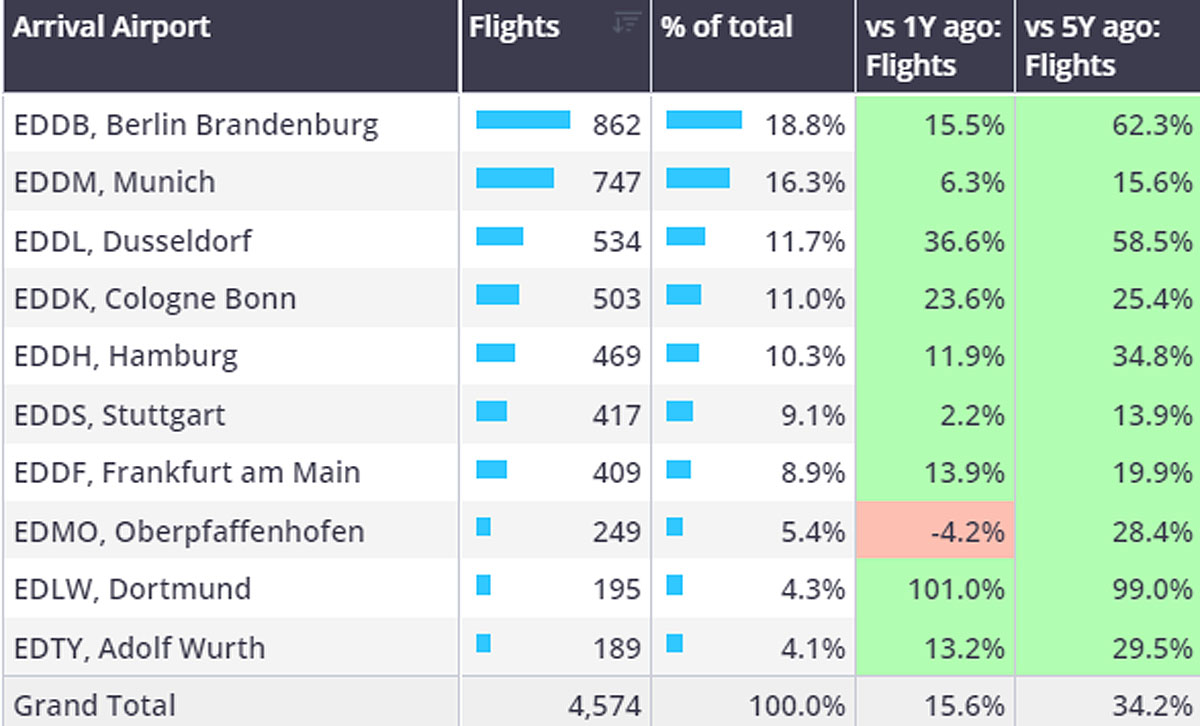

As the UEFA EUROs tournament concluded on 14th July, Germany’s bizjet market has benefited from hosting the tournament. During the duration of the tournament (14th June – 14th July), airports near the 10 host cities saw a 16% rise in arrivals compared to the same dates last year. Country wide the tournament lifted German arrivals by 9% compared to the same dates last year, for context, bizjet arrivals into Germany have been in YOY decline from January through May. Almost a third of arrivals into host city airports came from other German airports, top international connections were the UK, France and Italy. Between them, Aircraft Management and Branded Charter fleets accounted for nearly two thirds of all arrivals into host city airports. Over the weekend (July 12th – 14th) there was an influx of bizjet arrivals from the UK into Berlin Brandenburg airport where the tournament final was played on Sunday 14th. UK bizjet arrivals accounted for 20% of arrivals into EDDB on the weekend of the final, London Luton the busiest origin airport.

Chart 4: Bizjet arrivals into airports near UEFA EUROS football tournament stadia, 14th June – 14th July 2024

Rest of World

In Week 28, Middle East bizjet activity fell 10% YOY, so far this month bizjet trends in Tel Aviv, Riyadh and Abu Dhabi are particularly weak. Departures this month out of Jeddah have been eroded by almost two thirds compared to last year, largely due to a collapse in domestic bizjet flights. Elsewhere in Week 28 departures out of Africa fell 27% compared to W28 last year, Asia and South America 5% and 3% ahead respectively.