Week 44 capped a topsy turvy 4 weeks in the key US market, with much of October flat-to-negative, but strong gains this week, notably in Florida, also in the US election Swing States, suggesting that the elections may have directly boosted utilisation. The largest European markets are on a stagnant trajectory, with Italy the obvious exception. This week also saw a big increase in year-on-year bizjet traffic in Saudi Arabia.

Global

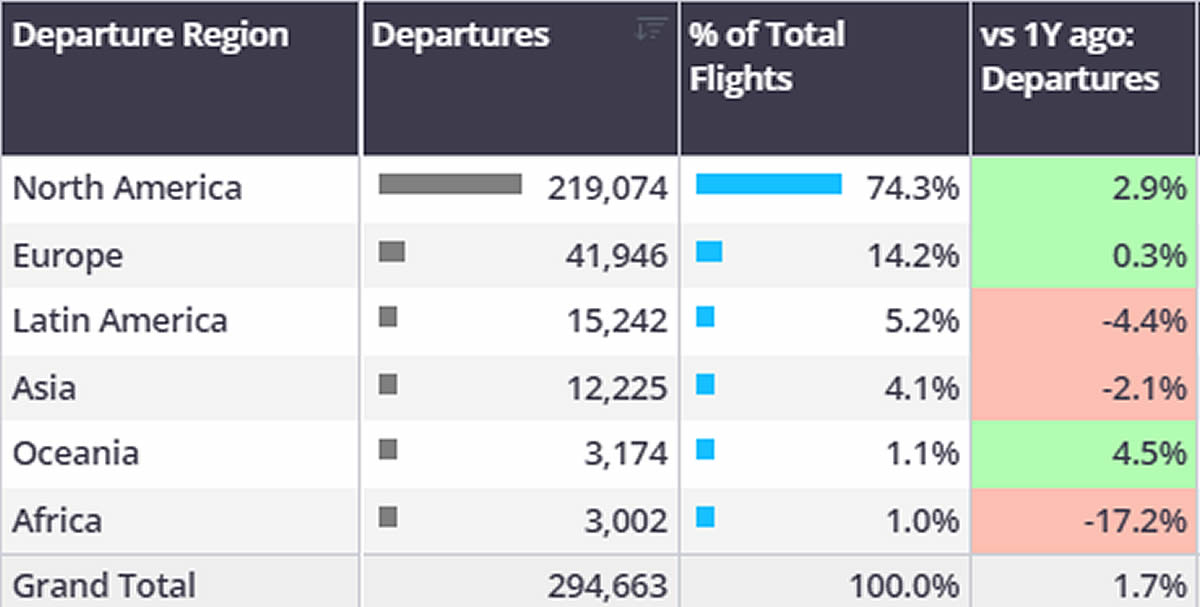

In Week 44 (28th October – 3rd November), there were 69,269 business jet flights operated globally, a 5% uplift compared to W44 last year, the 3rd consecutive week with YOY increase, and the highest single week YOY growth since week 5. The last 4-week trend for global bizjet activity is 1.7% up on same period last year, contrasting with the 1% dip in year-to-date trend. Globally, October’s bizjet activity finished 1% ahead of October 2023, and was the busiest month in terms of departures for the global bizjet fleet this year.

Chart 1: Global business jet departures by region, last 4 weeks (7th October – 3rd November 2024)

North America

In the run up to the US election, business jet activity in the key Swing States over the last four weeks were mostly well ahead of last year. In Pennsylvania, several cities saw large gains, with Williamsport up 38% year on year, State College up 61% increase and Altoona up 76% increase. Aircraft management fleets had the largest market share of departures in Pennsylvania in the last four weeks, however, fractional fleets saw the largest increase in activity, 26% more departures in the last four weeks than comparable last year. The Boeing 737 aircraft reportedly used by JD Vance for the campaign trail has made 67 departures nationwide in the last 4 weeks, 9 recorded out of Pennsylvania.

Chart 2: Business jet departures, US election Swing States.

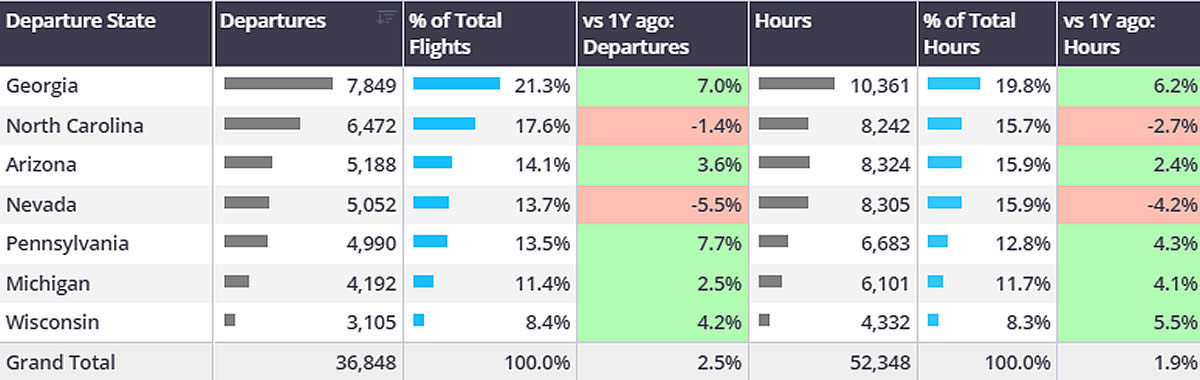

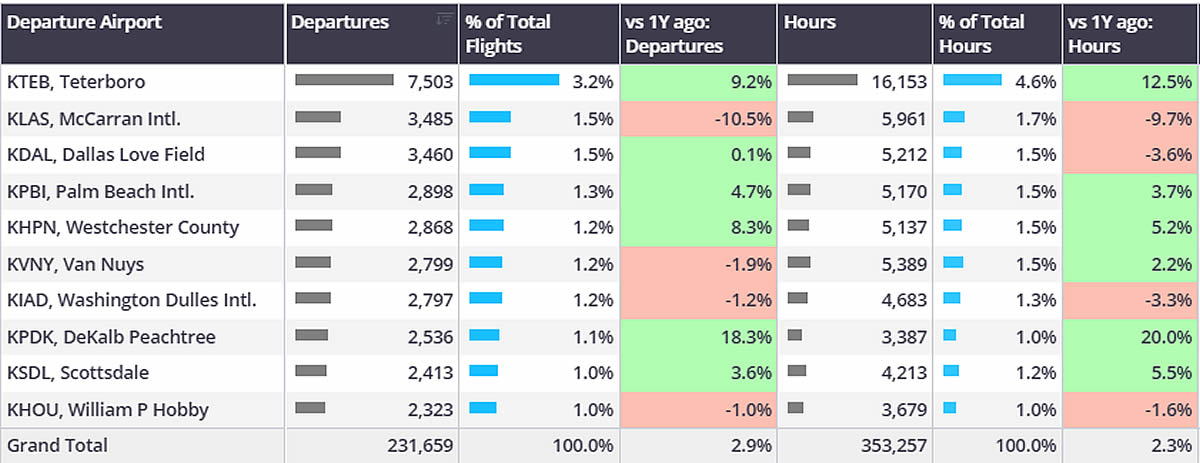

The last four-week trend across North America is 3% ahead of last year, 1% ahead of the global 4-week trend. Florida, the busiest state, saw a 5% rebound compared to Week 43, and 11% gain in bizjet sectors year on year. In contrast, California and Texas saw hefty declines compared to week 43, respectively 5% up and flat compared to same week last ear. For the full month of October, bizjet activity was up 2.9% on last year. Top ranked Teterboro (KTEB) saw 9% growth year on year, Las Vegas McCarran (KLAS) saw the largest drop off in activity in October, 10% fewer departures than October 2023.

Chart 3: Business jet departures by US airport in October 2024.

Europe

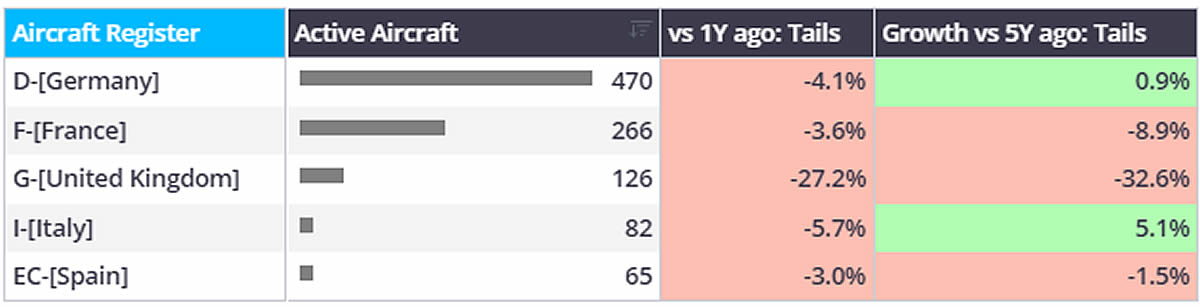

In Europe, bizjet activity grew 11% compared to Week 44 in 2023, well ahead of the year-to-date trend of -1%, although this may be an anomaly in the crossover from October to November. Over the last 4 weeks, European bizjet activity is up 2%, with Italy providing the main boost, flights up by 8% YOY. Even if UK, Germany and France got a boost this week, their 4-week trend is flat or negative, with Germany still lagging 2019 activity levels. In terms of fleet size, the German registered fleet is slightly up on 2019, in contrast to a notable decline in France-registered jets over the last 5 years, and a startling 33% drop in the G Register bizjet fleet over the same period.

Chart 4: Top 5 European bizjet markets, registered active tails in 2024 vs previous years.

Rest of World

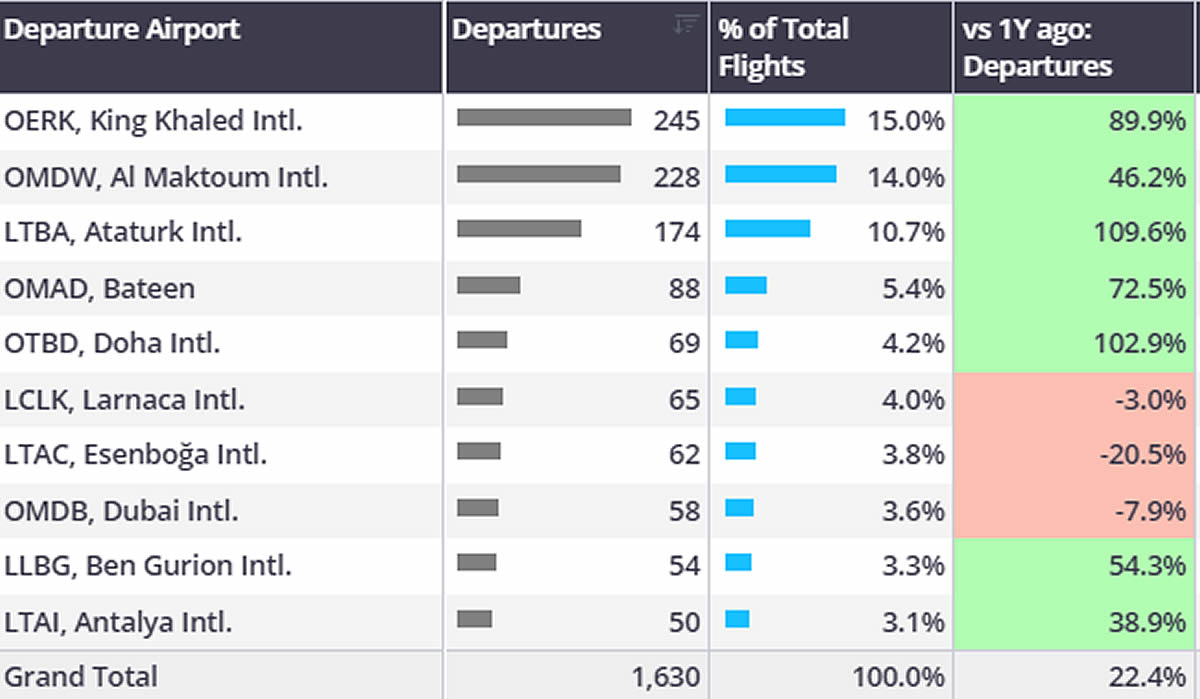

In Week 44, activity in the Middle East was up 22% compared to last year, a stand-out contrast to the previous 4-week trend, declining 2%. Bizjet activity out of Africa was also up in Week 44, 10% increase contrasting with a 17% dip over the last 4 weeks. Bizjet activity in Asia slipped by 1.5% this week, in line with the recent trend. 16,000 bizjet departures have been recorded from airports in China so far this year, 14% fewer than last year. Bizjet activity in South America also saw a healthy growth, 13% more jets than Week 44 in 2023.

Chart 5: Bizjet departures from Middle East airports, Week 44 2024 (trends vs same dates last year).