WINGXТs weekly Business Aviation Bulletin.

Summary

With a 7% deficit year-on-year and a 18% growth compared to June 2019, the key US market on par with recent trends, indicating a stabilisation since the pandemic.† In the European region, Central Europe is seeing some significant deficits compared to last year, but the Med tourist spots are still well ahead of 2019. Fractional and Private flight departments are seeing more activity than ever, with the declines on last year mainly coming in Charter.

Global

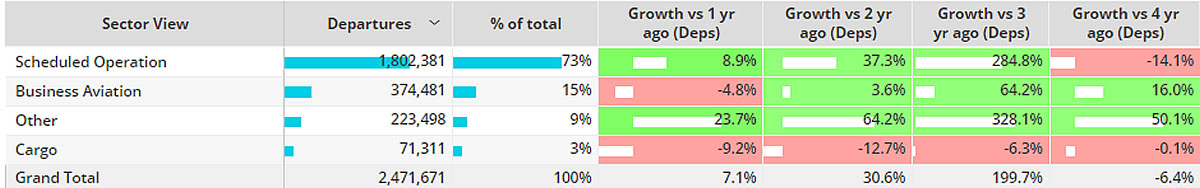

In Week 25 (ending 25th June), global business jet departures rose 2% compared to the previous week, fell 5% below the same dates in 2022. In the last four weeks business jet departures have fallen 5% compared to the same period of June 2022. This is in line with month-to-date global business jet and turboprop activity which is trailing 5% compared to last year, though still 16% ahead of pre-pandemic June 2019. Scheduled airline activity has rebounded 9% compared to June 2022, still 14% behind 2019. The top 5 busiest airlines (Southwest Airlines, American Airlines, Delta Airlines, Ryanair, United Airlines) are performing well above the global trend for airlines, sectors up 11% compared to June last year, 7% ahead of June 2019.

Chart 1: Global fixed wing flights by sector, 1st – 25th June 2023 compared to previous years. (Note business aviation includes turboprops)

North America

In Week 25 across North America, business jet activity grew 2% in terms of sectors flown compared to the previous week, 6% behind the same dates in 2022. In the last four weeks flight volumes are down 5% compared to the same dates in 2022. The June month-to-date is up 19% compared to June 2019. June 2023 activity in the US is 7% down on last year, whereas flights are up by 8% in Costa Rica, with flat YOY trends in Canada, and 3% decline in comparable flights in Mexico.

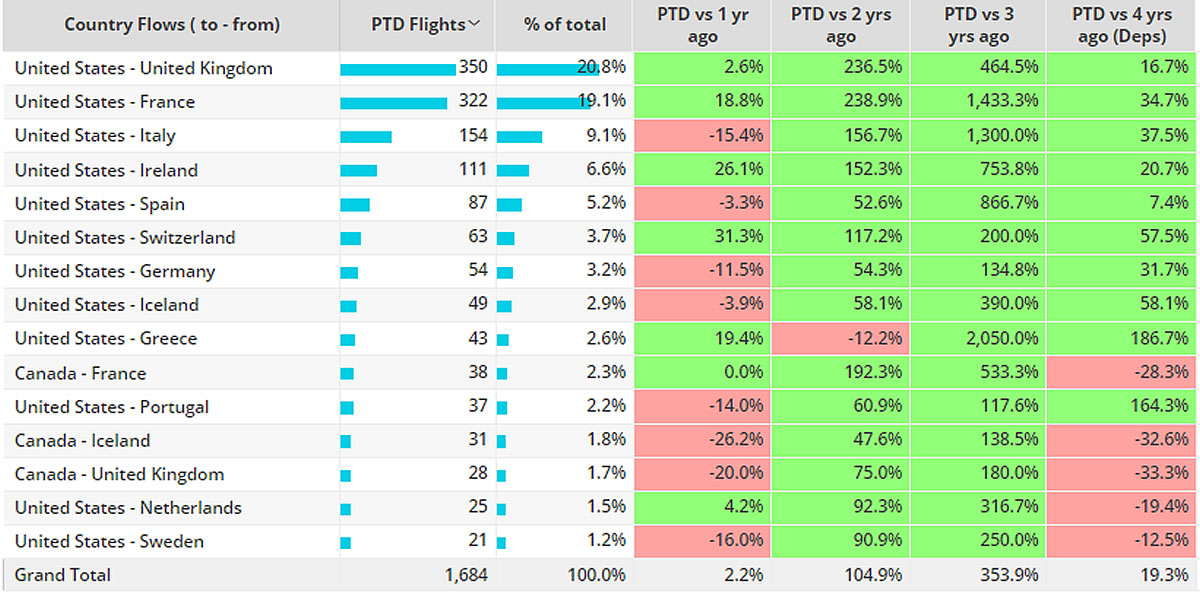

Throughout June activity in North America has fallen 7% compared to June last year, 19% ahead of 2019. All top markets are seeing declines in bizjet activity, notably the US where sectors have fallen 7% behind comparable 2022. Ultra-Long-Range flights (12+ hours) have seen the largest declines compared to last year, flights of this duration down by 20% compared to last June. Short haul flights (1.5 Ц 3hours) have seen the largest rebound compared to 2019, departures up 29%. Transatlantic business jet activity is busier than June last year, sectors 2% ahead of 2022, 19% ahead of 2019. Bizjet flights between the United States and United Kingdom are up 17% compared to 2019.

Chart 2: Transatlantic business jet country flows, June 2023 compared to previous years.

Europe

In Week 25, European business jet sectors grew 6% compared to Week 24, although 4% behind the same dates in 2022. In the last four weeks bizjet activity in Europe has fallen 9% behind the same dates in 2022. Throughout June activity has fallen 7% compared to June last year, still 11% ahead of 2019. All leading bizjet airports in the region are in decline compared to June last year. Le Bourget, the busiest airport, has seen activity drop 10%, leisure hotspots Ibiza and Palma De Mallorca also seeing double digit declines. Contrasting the regional trend, Madrid-Barajas, London Luton and Farnborough airports are seeing declines compared to 2019.

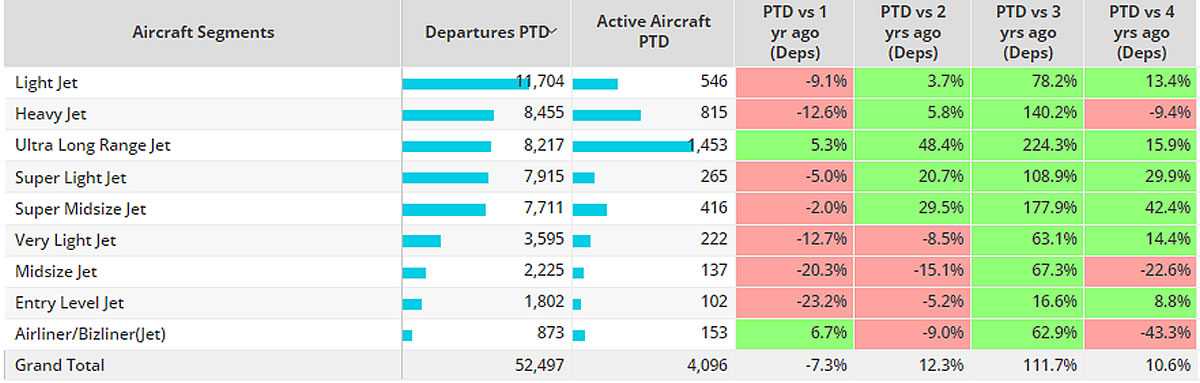

Light Jets are the busiest aircraft segment in Europe so far this month, departures down 9% compared to last year, 13% ahead of 2019. Ultra-long-range jets and bizliners are the only aircraft segments to see growth compared to last year, 5% and 7% respectively.

Chart 3: European Aircraft Segments, June 2023 compared to previous years.

Rest of World

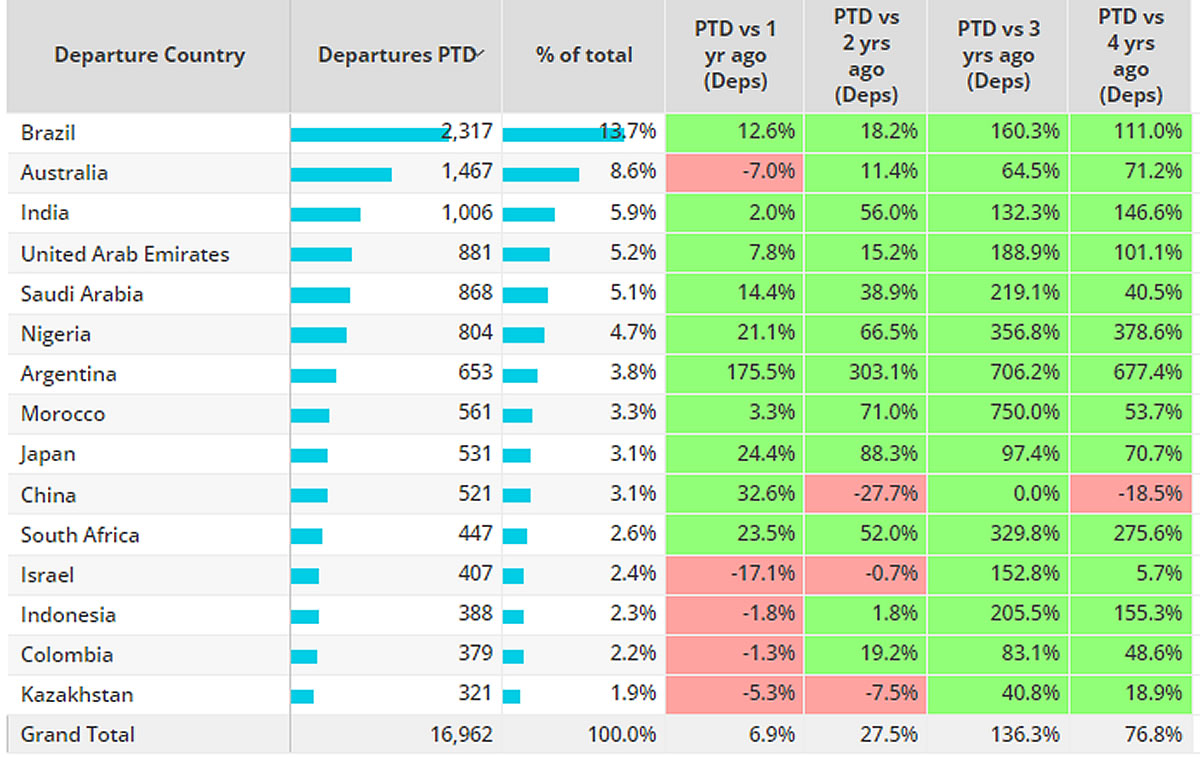

Business jet activity outside of North America and Europe is 7% ahead of June 2022, 77% ahead of 2019. Brazil remains the busiest market, departures 13% ahead of last year, triple digit growth compared to 2019. Australia is the only top 3 market to see declines compared to last year, departures down 7% compared to June 2022. China remains 19% behind pre-pandemic June 2019, although 33% ahead of last year.

Chart 4: Rest of World Countries June 1st Ц 25th 2023 compared to previous years.