WINGX’s weekly Business Aviation Bulletin.

Overall Comment

The summer season is up and running in Europe, with demand accelerating beyond 2019 levels across many of the usual VIP hot spots. The European market may have much further to run if it follows the US out of the pandemic, with almost all US States now seeing record business jet activity. The recovery in international flights is under way, notable in Caribbean and Middle Eastern connections. Scheduled airlines are recovering fast, but far enough behind to give business aviation lots of connectivity gaps to fill this summer.

Global

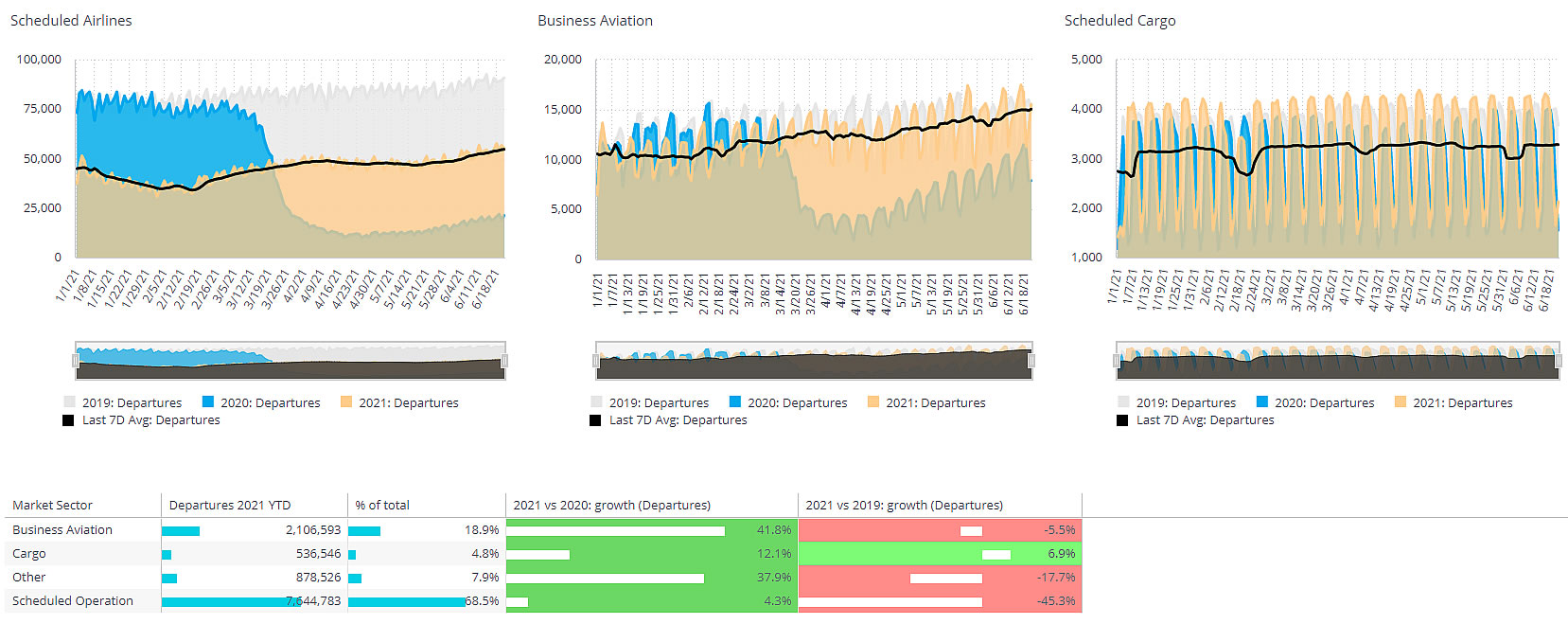

There were 2,634 business jet and turboprop sectors flown in Europe on June 21st, 2021, 95% busier than the summer solstice last year, and almost exactly matching June 21st, 2019. For the first three weeks of June, business aviation activity in Europe is down only 1% vs June 2019. That trails the global trend, with worldwide business aviation activity 7% higher in June 2021 than in June 2019. Scheduled airline activity is picking up but still 40% behind compared to 2019. Commercial airlines in the US are only 20% behind comparable 2019, but way behind business jet traffic, which is running at 20% above the levels back in June 2019, and two thirds busier than in June 2020.

Global Scheduled Airline, Cargo and Business Aviation activity Jan through June 21st, 2021

Europe may be trailing the stellar growth in business jet travel across the Atlantic, but as travel restrictions are lifted and the summer season starts, many European destinations are seeing stand-out demand. Business jet arrivals into Greece are up 51% compared to June 2019, arrivals to Portugal up 66%. Departures from Austria are up 17%, and up 5% from Germany. Hungary, Serbia, Iceland, Cyprus are all seeing double-digit growth in flights compared to 2 years ago back in June 2019. Other countries are yet to see this strong recovery, with bizav flight activity in France trailing June 2019 by 14%, and business aviation departures out of the UK 27% below June 2019, even if 94% up vs June last year.

As the market recovers in Europe, the pattern continues of traditional busier airports struggling to regain business aviation activity, whilst smaller airports flourish. Traffic at Geneva, Le Bourget, Nice, Luton is still well below normal, whilst aircraft movements at Vienna, Prague, Hamburg all move ahead of 2019 trends. Pent-up leisure demand is surging across the classic Mediterranean resorts, at Malaga, Ibiza, Olbia, Mykonos. Taking Malaga as an example, business jet arrivals from Switzerland, Portugal and Germany have more than doubled this month compared to June 2019. Business jet arrivals from airports in Russia into Malaga are up four times compared to two years ago. Business jet demand in both Russia and Turkey is soaring, with Vnukovo departures this month up by 40% compared to June 2019, Pulkovo up 14%, Ataturk up by 28%.

In the US, a resurgence in travel demand is demonstrable in unlocked States, Florida leading the way, business aviation activity up 54% compared to June 2019. Of the busiest 10 States, only Illinois and New Jersey have less traffic than in June 2019. Teterboro, Dulles and Chicago are amongst the only top airports not to be seeing more activity than in June 2019. Miami-Opa Locka has almost double the flights this month than in June 2019, with Palm Beach up 60%. McCarran Las Vegas is sharply up this month, movements 22% higher than in 2019. Top airports like Van Nuys and Westchester are seeing 20% more traffic than pre-pandemic. International flights from the US are still down 12% vs June 2019, but an improvement on the 20% deficit for the year-to-date vs 2019.

Business aviation activity during weekends and weekdays in the US in 2021 vs 2020, 2019

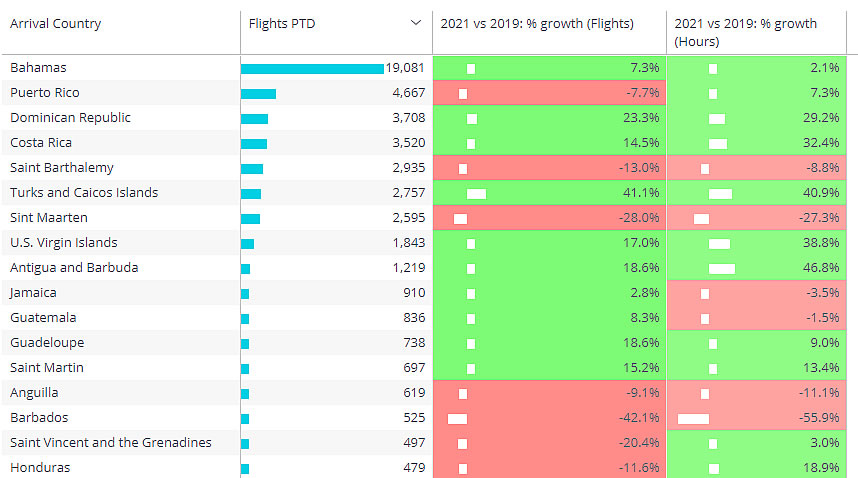

International trips from the US this month have favoured Caribbean destinations with arrivals into Puerto Rico, US Virgin Islands, Turks and Caicos, Dominican Republic all much higher than in 2019. Global business jet arrivals into the Caribbean are up by 53% so far this month compared to June 2019, with a positive trend of 1% year to date. The Middle East is another region seeing strong growth in business jet arrivals, 21% up from 2 years ago. Saudi Arabia is just about back to pre-pandemic demand, whilst Qatar, UAE, Jordan and Bahrain seeing double-digit gains over 2019. The Asia- Pac market is also well recovered, with business jet flights out of China up by 12% vs June 2019, although flight hours are still trailing pre-pandemic by 30%, reflecting the deep erosion in international connections.

Business aviation arrivals into Caribbean destinations in 2021 YTD vs 2019.