WINGX’s weekly Business Aviation Bulletin.

Overall Comment

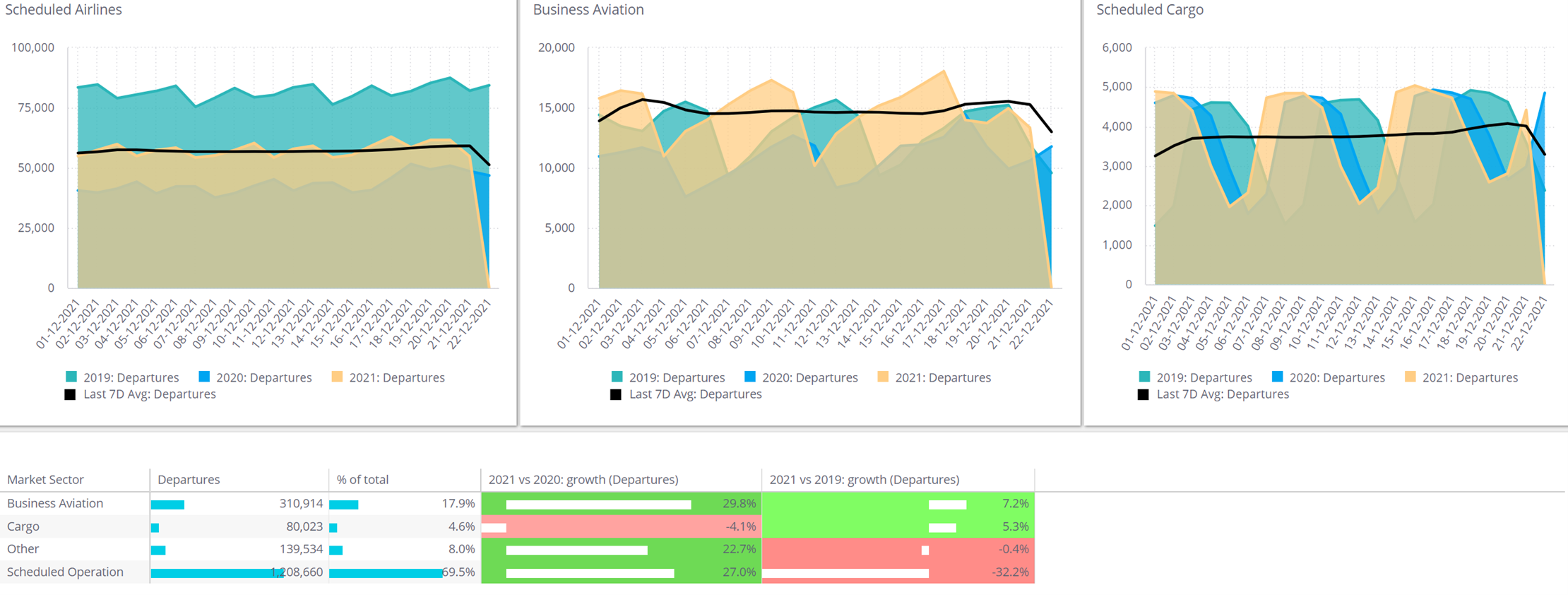

Business jets and turboprops have flown 310,914 sectors in December 2021, up 30% on December 2020 and 7% more activity than in December 2019. Global cargo operations are also up, 5% more sectors than in December 2019. Scheduled airline traffic is trailing by 32% compared to December 2019, even though airline traffic is up 27% year on year. For the full year to-date, business aviation traffic is up 3% on 2019, up 6% for the business jet platforms, which will make it a record year. In the meantime, global scheduled airline activity is up 26% on last year, still down 38% on 2019.

Business Jet sectors flown vs Scheduled and Cargo activity 2019 – 2021

North America

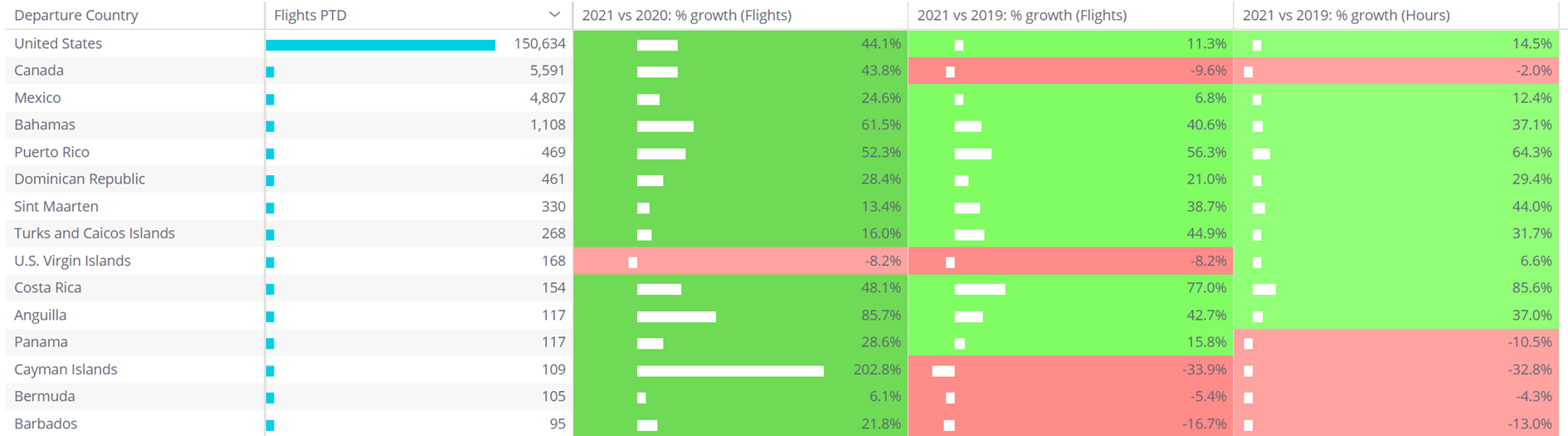

The North American region has seen 165,000 business jet departures so far this month, up 11% on December 2019. Scheduled airline traffic has climbed back to within 25% of 2019 levels, up 47% on last year. The United States is the busiest business jet market in the region, with sectors flown up by 11%, flight hours up 15%, both with reference to December 2019. Five of the top 15 countries in North America are still trailing December 2019, the biggest being Canada. For the full year, flight hours on business jets in the US are up by 10%. Mexico and Canada will end 2021 with sizeable ongoing deficits versus 2019. Besides the US, the biggest growth in North America in 2021 has come from Bahamas, Puerto Rico, Turks and Caicos Island, Sint Maarten and Costa Rica.

Top 15 North American countries for business jet departures in December 2021

Within the US, Florida is the busiest state, with business jet traffic storming ahead of 2019 levels, 35% up versus December 2019. Texas, California, and then Georgia, Colorado and Arizona are all seeing double digit increases in bizjet demand versus December 2019. The only busy US State where the Omicron variant impact is evident is New Jersey, where traffic has fallen 3% below December 2019. In terms of aircraft segment, the demand is tilted towards lighter aircraft, with Light, Super Light and Midsize Jets flying almost 20% more than in December 2019. Ultra-Long Range jet activity is up 10% compared to December 2019. For the full year, ULR Jet sectors are down 1%, hours down by 9%.

Europe

Despite the onset of Omicron, business jet activity in Europe in December 2021 is 4% up on comparable December 2019. Very Light Jet sectors are up almost 30% versus pre-pandemic December 2019, and the light through midsize segments are seeing almost 20% growth this month vs 2 years ago. Growth in business jet activity appears to be concentrated in peripheral European countries, most obviously Russia and Turkey, both countries seeing more than 25% increase in demand versus December 2019.

As during the earlier phase of the pandemic, business jet demand in the UK has wilted first from the renewed virus wave, with the first 3 weeks of December seeing 3% dip in activity compared to pre-pandemic December 2019. Denmark, Ireland, Belgium, and Norway are also all experiencing a fall in demand as travel restrictions are renewed. Conversely, Spain continues to see a very strong demand for business jet traffic, flights up by 35% vs 2019. Portugal and Greece also continue to see very strong growth this December. Croatia, Serbia, Hungary, and Cyprus are seeing upwards of 30% growth in business jet activity versus December 2019.

Rest of the World

Outside Europe and North America, business jet traffic in December 2021 is up 29% compared to December 2019. Brazil, India, Nigeria, UAE are all seeing much stronger levels of demand than two years ago. Despite being the country where Omicron was recently identified, South Africa has seen a doubling in business jet traffic this month compared to December 2019. Most of the increase in activity is coming from Private Flight Departments and Aircraft Management Companies. Singapore, Japan, and China have, conversely, seen a big slowdown in business jet traffic throughout the fourth quarter of 2021, with no sign of recovery this December.