The global headlines are focused on Russia´s invasion of Ukraine, with significant consequences emerging for the global aviation industry. In terms of flight activity, Russia, Belarus and Ukraine are seeing precipitous drops in all flight activity over the last few days.

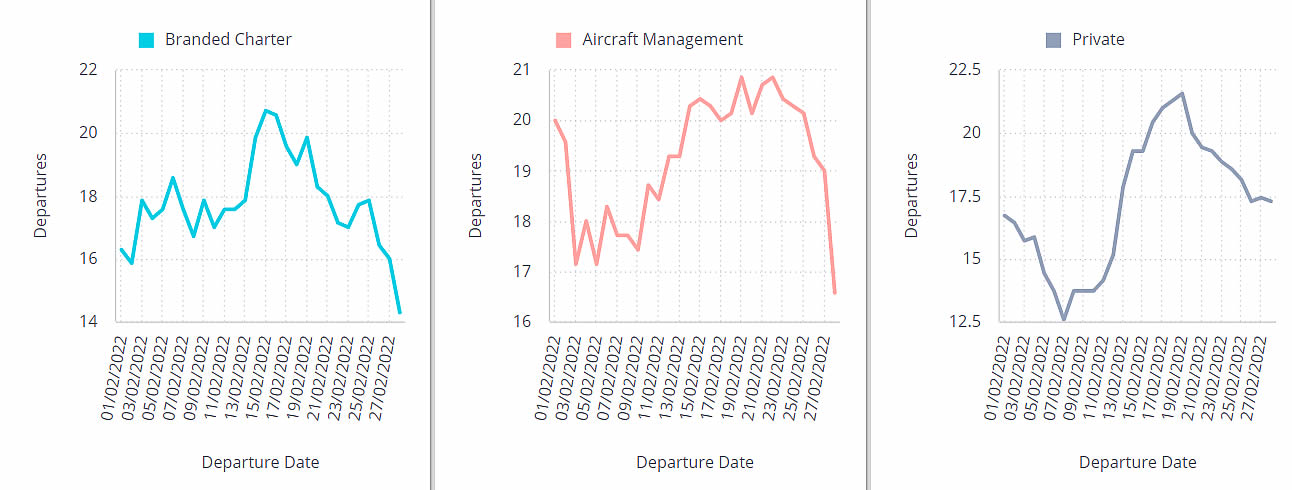

According to WINGX`s weekly Global Market Tracker published today, Charter and Aircraft Management operators are seeing the largest declines, with Private Flight Departments so far more resilient. Compared the same week in 2019, business aviation activity in Russia is now trending down by 20%.

Scheduled airline and cargo traffic out of Russia, Belarus and Ukraine is down by 35% and 23% respectively, compared to same period 2019.

Rolling 7-day average business aviation departures from Russia, Belarus, Ukraine, Feb 2022.

The size of the Russian aviation industry in the global context is small in some respects - only 0.5% of global business jet deliveries, 0.7% of the active fleet, under 100 aircraft on the Register - but Europe has relatively high exposure to business jets regularly operating out of Russia, an estimated 12% of all jets based in Europe in 2021.

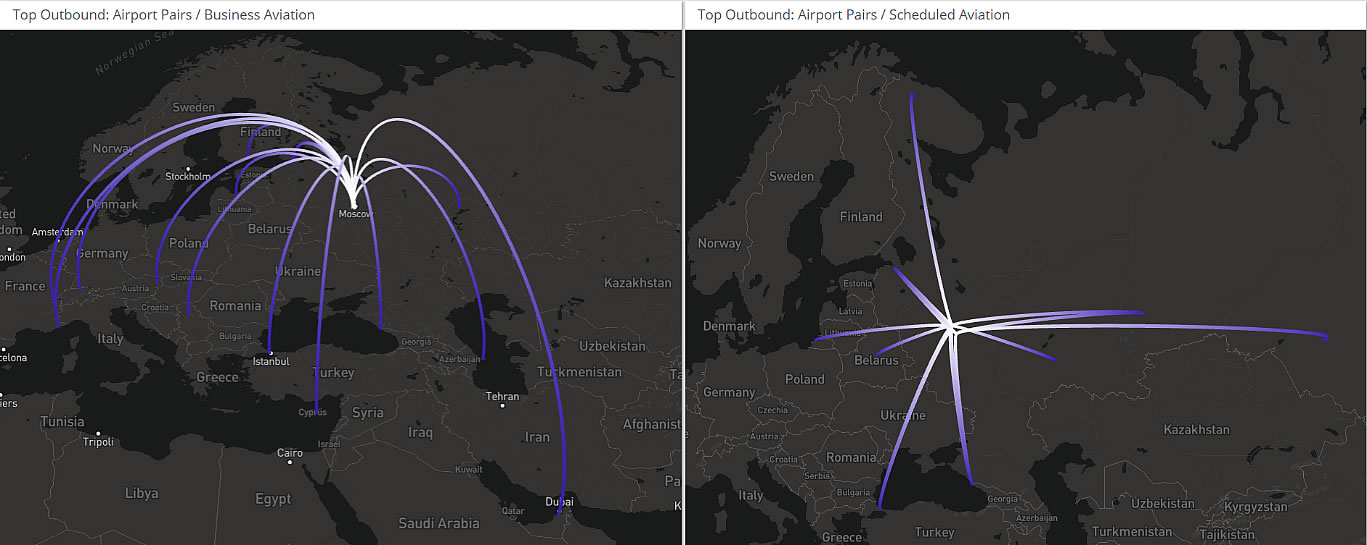

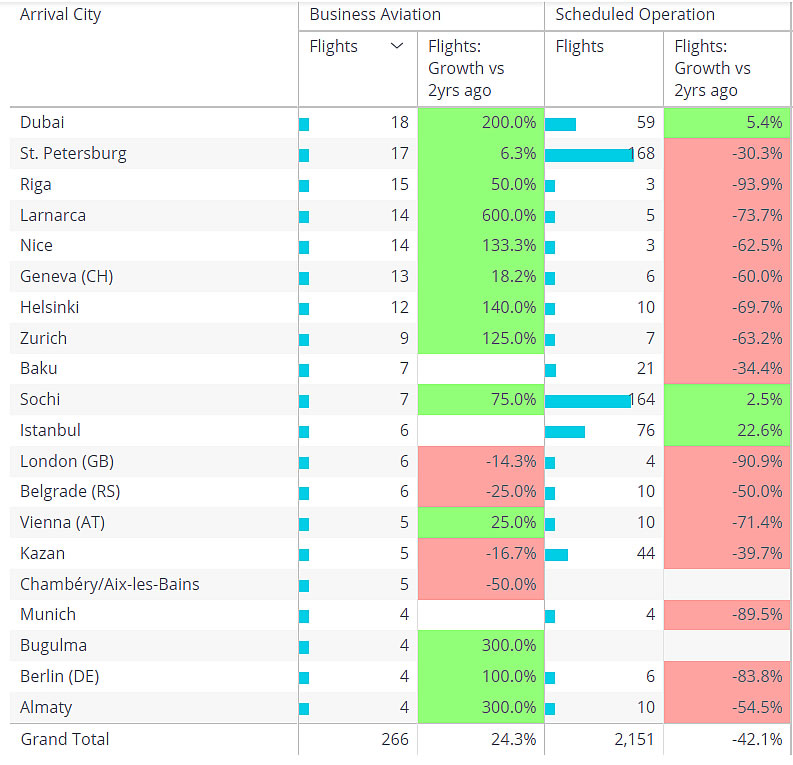

Last year, 7% of all business jet sectors operated in Europe inter-connected with Russia or Ukraine, 12% of all Gulfstream Jets, 28% of Embraer Legacy 600 jets. 12% of globally active ultra-long range jets had at least one movement in Russia during 2021. Over the last few days, Moscow airports are seeing significant outbound connections to Dubai. Connections between Russia and the Middle East have been consistently fast-growing the last two years.

Business aviation vs scheduled aviation departures from Moscow 24th Feb – 28th Feb 2022.

Rest of World

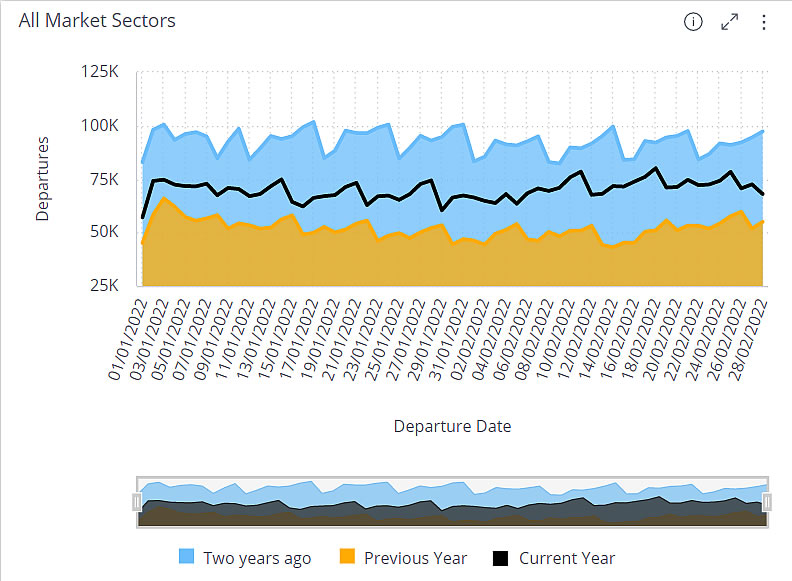

The global trend in business jet activity does not yet register any impact from the Ukraine crisis; the 2022 trend, since the start of the year, indicates a 13% increase over comparable 2019, with scheduled airline sectors still lagging by 31%, despite a 38% bounce so far this year.

Global fixed wing activity Jan-Mar 2022 vs 2021 & 2020.

The key North American market is much less exposed than Europe to direct flight connections with Russia, although overflight restrictions are now in force, and the leading US suppliers of business aviation services will be severely constrained in supporting Russian aviation concerns since widespread sanctions were implemented this week.

Within the US, the pattern of business jet demand is familiar, with Florida the hub, California and Texas back above 2019 levels, and the North-East slower to recover; New Jersey, and Teterboro in particular, are still behind 2019 activity volumes. Overall, the biggest rebound this year in the US market has been in the ultra long range jets, sectors 24% above pre-pandemic records. Private flight departments are belatedly recovering.

Managing Director WINGX Richard Koe comments “For business aviation, the Ukraine crisis is having a direct effect on a relatively small share of overall flight activity, but the proliferation of sanctions will significantly complicate the whole business aviation market, especially in Europe, across the field from flight operations to charter brokerage, aircraft financing, management and maintenance.”