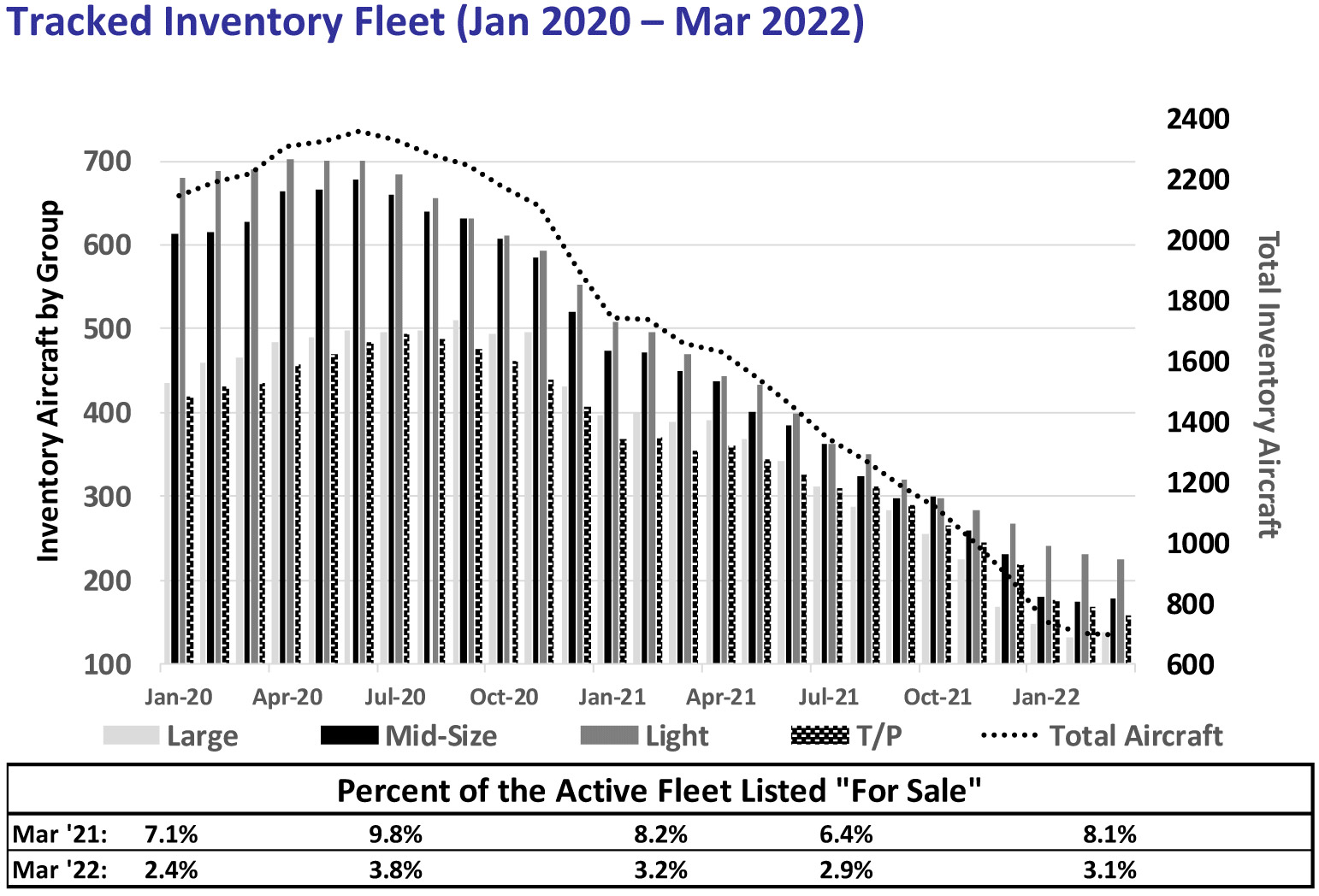

Fueled in large part by first time buyers, the pre-owned business aircraft market set new records for demand during Q1 2022, resulting in just 3.1% of the active aircraft fleet available for sale, as of March 31, reports the Asset Insight AI2 Market Report.

The Quality Rating of the for-sale fleet reached a 12-month high/best figure, signifying fewer near-term maintenance events and proving Maintenance Status is not directly related to aircraft age. However, Maintenance Exposure (the cost of embedded/accrued aircraft maintenance) approached a 12-month worst figure, signifying upcoming events for the listed fleet, while fewer in number, will be more expensive to complete. The Q1 2022 AI2 Market Report covers 134 fixed-wing models and 698 aircraft listed for sale.

As expected during a high-demand market, posted ask prices rose in Q1, up more than 14% year over year. Young, low-time aircraft continued to sell quickly, many without a formal listing, with sellers often generating final transaction values that met or exceeded their ask price.

“Two years ago, as we headed into the COVID-19 pandemic, nobody foresaw the frenetic buying environment we continue to experience. Twenty-four months later, the pre-owned business aircraft market has achieved record high transaction rates, and a record-low inventory level,” said Tony Kioussis, president of Asset Insight, LLC. “Buyers are obtaining their ask prices, if not more, and owners of high-quality, low-time, recent model aircraft may not even have to list their asset to secure a sale.

Only 3.1% of Asset Insight’s tracked fleet was on the market at the end of March, compared to 8.1% in 2021. Large Jets and Turboprops have only 2.4% and 2.9% of the active fleet listed for sale, respectively, while just 3.8% of Mid-Size Jets and 3.2% of Light Jets are available for sale, down impressively from the March 2021 figures of 9.8% and 8.2%, respectively.