WINGX’s weekly Business Aviation Bulletin.

Summary

Even as economic alarm bells start ringing, business jet activity continues to fly well above pre-pandemic trends, with May year-on-year only slightly below the comparable year-to-date trends. There are signs of tapering growth business jet charter activity, but the upswing in corporate and private flight departments appears to have absorbed this in terms of overall growth.

Global

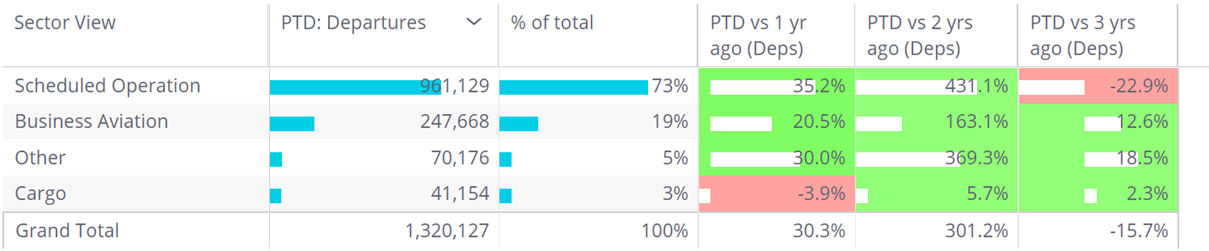

Worldwide, there have been 247,668 business jet and turboprop sectors flown in the first 16 days of May 2022, 19% of all fixed-wing flights globally, total activity up by 21% compared to last year, up by 13% compared to May 2019. Global scheduled airline operations are up 35% versus May 2021 but still down 23% versus May 2019. Cargo operators are flying less than last year but still slightly up on May three years ago. So far this year, business aviation sectors are up by 15%, up by 20% if turboprops excluded, all compared to the same January through May period of 2019.

Global fixed wing flight activity in May 2022

There is no obvious sign of incipient slowdown in business aviation demand, with flights up by 2% globally in week 19 (starting May 9th) compared to week 18 (May 2nd). Europe saw a strong week-week growth, flights up 7% in week 19 vs week 18. North America traffic growth week-to-week was modest, just under 2%. Week 19 vs Week 18 sectors flown by jets and props was sharply down in South America, but up by over 20% In Africa and Middle East, week to week. Commercially certified business aviation aircraft, including Part 135 and 91K, flew 48% of all sectors in week 19, 1% up on week 18.

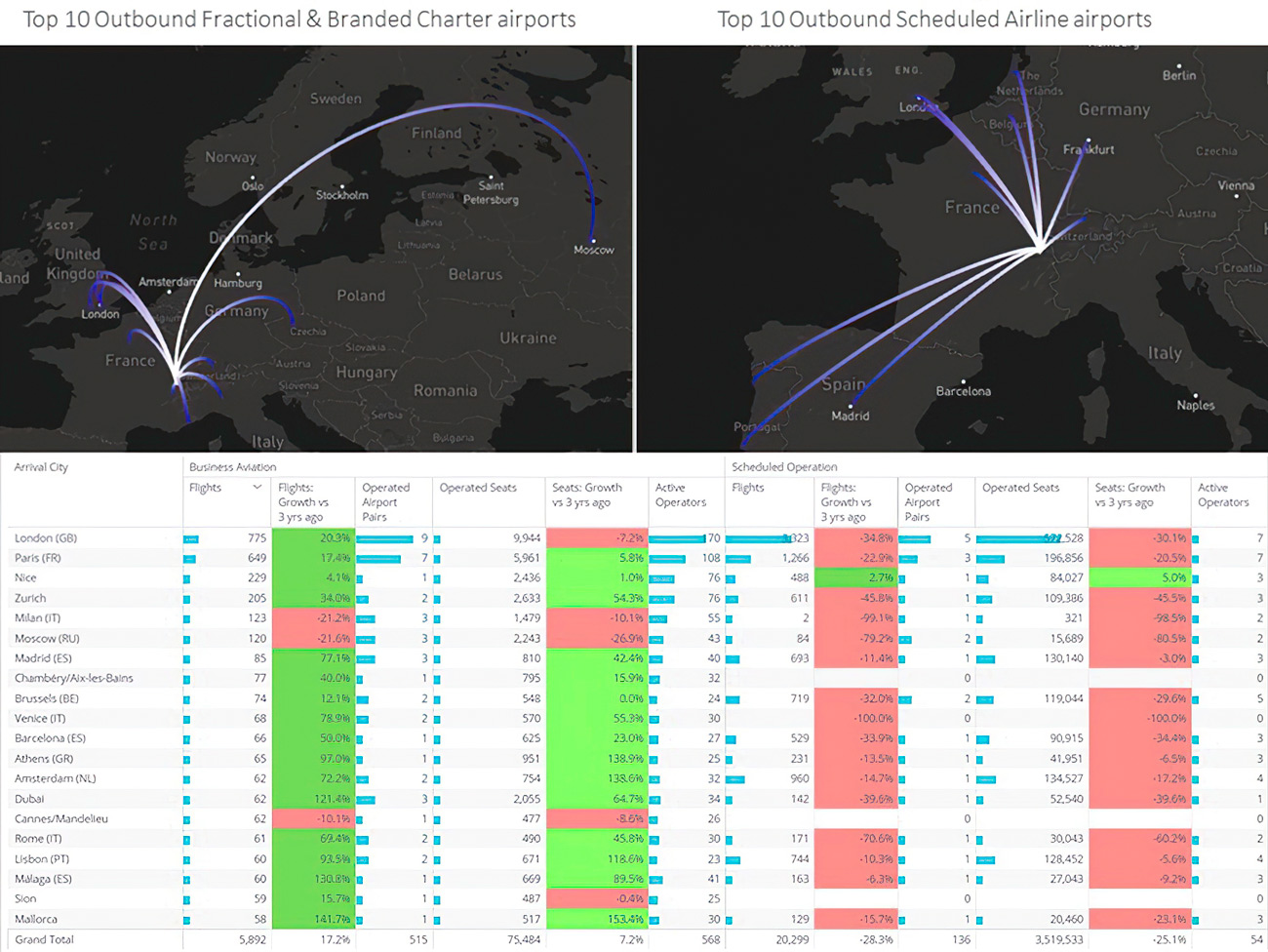

Europe

Business jet demand in Europe is at an all-time high for the month of May, enjoying the rebound from the lockdown last summer, with seasonal events including the Spanish Grand Prix, Cannes Film Festival, Roland Garros and EBACE. As an example, the eve of the Cannes Film Festival this year saw 83 business jet arrivals into Nice and Cannes, compared to 46 arrivals back in 2019. For France as a whole, business jet flights so far this month are up 40% compared to last year, up 9% versus May 2019. That trend is modest compared to several other countries with double-digit growth in business jet visitors: arrivals into Spain are up by 27%, up 31% into Greece, up 57% into Turkey.

Flights from Russia, Ukraine and Belarus into the European area have evaporated this month with 365 arrivals through mid-May, down by 63% compared to three years ago. Almost all the connections are coming into peripheral countries in the Balkans and Central Asia. Business jet flights from Russia to Turkey are up by 5% compared to May 2019. In Western Europe, the primary demand is for domestic and short international sectors: 1.5-3h sectors are up by 19% compared to 3 years ago, whereas this month´s longer haul traffic, flights over 3 hours, are still 15% behind 2019. The relatively slow recovery in airline capacity still appears to be a factor. From Geneva, fractional and charter flights are up 17% this month, whilst the airline connections, 3 years later, are still down by 28%.

Business jet vs Commercial Airline connections from Geneva

North America

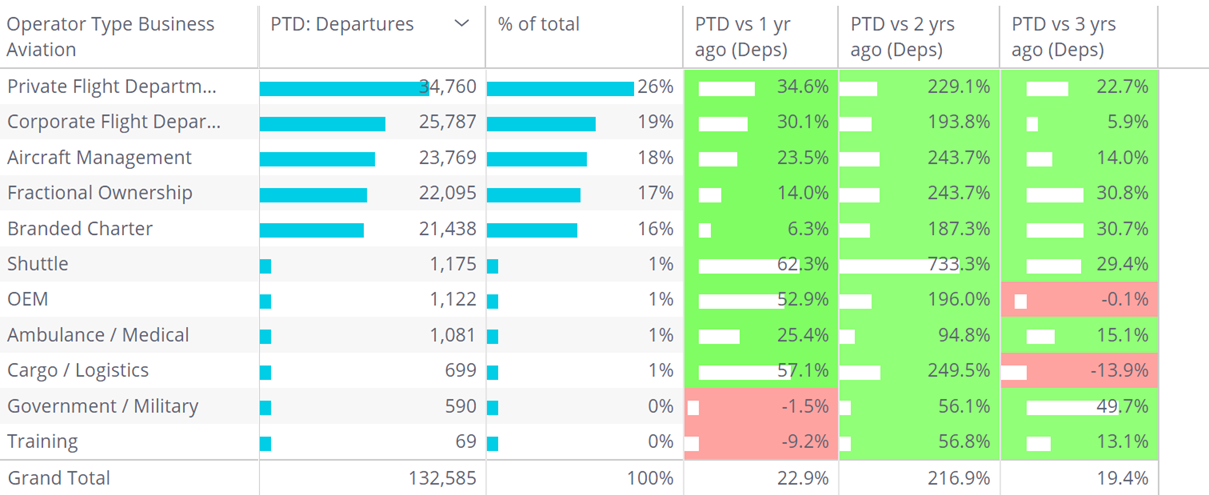

Business jet departures are up by 19% in May 2022 compared to May 2019. The US market has 90% of the activity, flights up by 23% versus 3 years ago. The North American charter market is particularly hot, flights up by 31% versus May 2019 this month. The Fractional operators are also flying well above pre-pandemic levels. The only large segment with modest growth compared to 2019 are the Corporate Flight departments, but still 6% more flying than 3 years go. There is also some variance in the sector length trends, with the longer-haul flights, more than 6 hours, at a slight increase compared to 2019, whilst the short haul sectors of 1.5 to 3 hours operating 34% higher than in May 2019.

Business jet activity in North America by Operator Type in May 2022

Rest of World

Outside the US and Europe, amongst the weakest markets are in the North America region: both Canada and Mexico are still seeing business jet activity deficits of at least 20% compared to 2019. East Asia is amongst the weakest regional markets for business jet demand, flights down by 28% this month versus last year. Business jet departures from China are down 65% this month compared to May 2021 and trailing 48% this year vs 2019. The Middle East region, by contrast, is seeing more business jet traffic than ever in 2022, up by 43%. Business jet arrivals into the UAE are up by 83% this year versus 2019. Flights into Larnaca are 7% down on last year but still 34% ahead of May 2019.