WINGX’s weekly Business Aviation Bulletin.

Summary

December 2022 activity was down on last December but still the 2nd busiest December on record, and capped off a record year for global business aviation flights. The trajectory month-to-month has been downwards for the last 6 months in Europe, where demand may fall back to 2019 levels next year. The erosion from peak demand in the US has been more modest, and the market should sustain higher than pre-pandemic activity during 2023.

Global

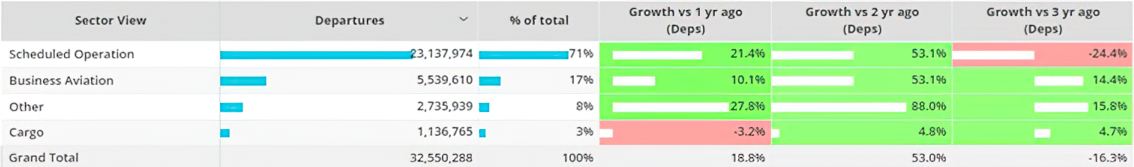

December 2022 flight activity for business jets and turboprops fell 2% compared to December last 2021, still 15% stronger than December 2019. For the full 12 months, just over 5.5 million business aviation flights exceeded last year´s total by 10%, jumping up by 53% on last year, and ending the year 14.4% above comparable 2019, the equivalent of 697,294 additional flights. Scheduled airline activity was 10% up vs December 2021, still 21% behind December 2019, ending the year 24% down on full year 2019. Cargo operations were 3% down on full year 2021, up 5% on 2019.

Global fixed wing flights, full year 2022, compared to previous years

North America

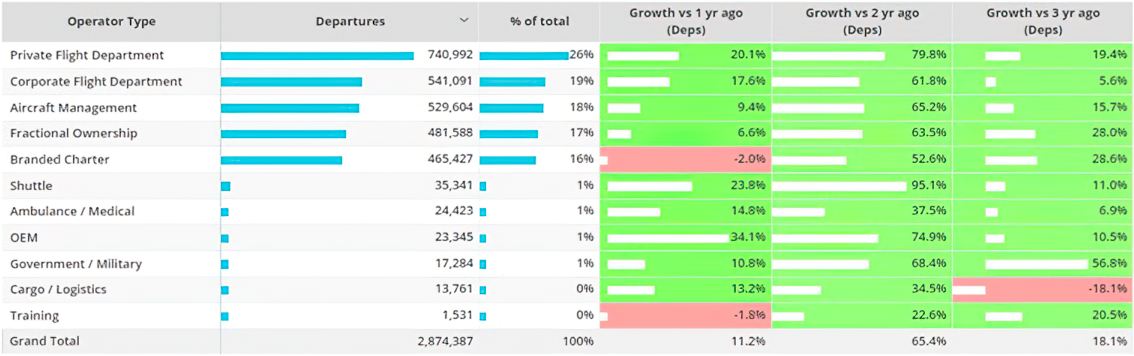

For the full year 2022, 2.8 million business jet sectors were operated in North America, up 11% compared to last year, 65% above 2020 and 18% above three years ago. March 2022 was the busiest month for the region, that month setting a record 25% higher than in March 2019. In Week 52 ending 1st January, bizjet activity grew 22% compared to Week 51, reflecting a holiday surge, though 3% below the holiday peak in Week 52 2021. There was clearly some impact from the winter storm, with business aviation flights out of New York state, for example, down 14% YOY.

Despite 29% growth in flights compared to full year 2019, branded charter operators flew 2% fewer flights during full year 2022 compared to 2021. Aircraft management and Fractional fleets modestly increased on last year´s activity, with most of the YOY growth coming from Private and Corporate flight departments, which represented some 40% of all business jet activity.

Business jet operators during full year 2022 compared to previous years

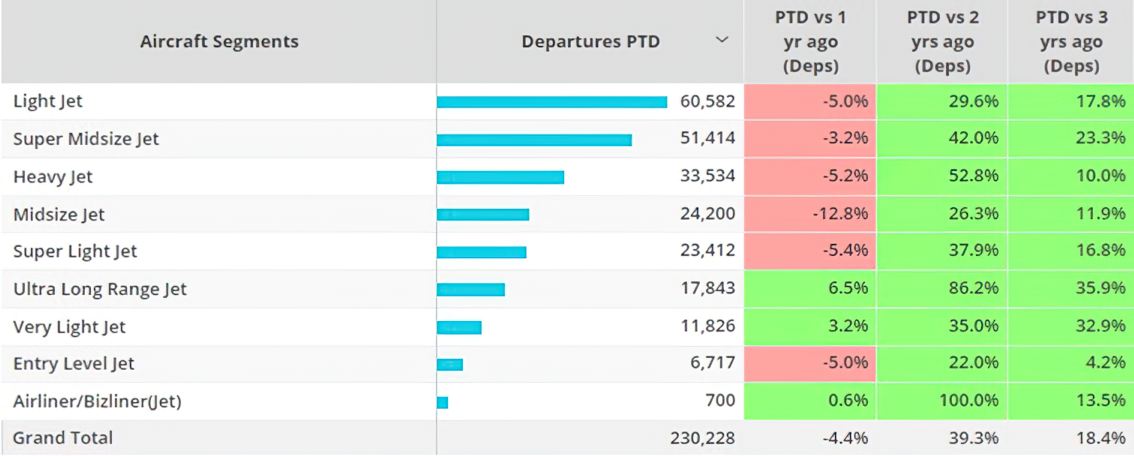

Teterboro was the top ranked bizjet airport in 2022, flights were 22% above last year, although 1% below 2019. Next busiest airport was Palm Beach, with 10% growth in business aviation traffic compared to 2021, and 65% more flights than during 2019.Light jets flew the most flights of 2022, activity up 7% compared to last year, 18% above three years ago. Midsize and Entry Level jets saw single digit growth compared to 2021, Ultra-long-range jets saw the largest rebound compared to last year and ULR flights this year trended 36% above pre-Covid 2019.

Business jet segments, ranked by flights December 2022 compared to previous years

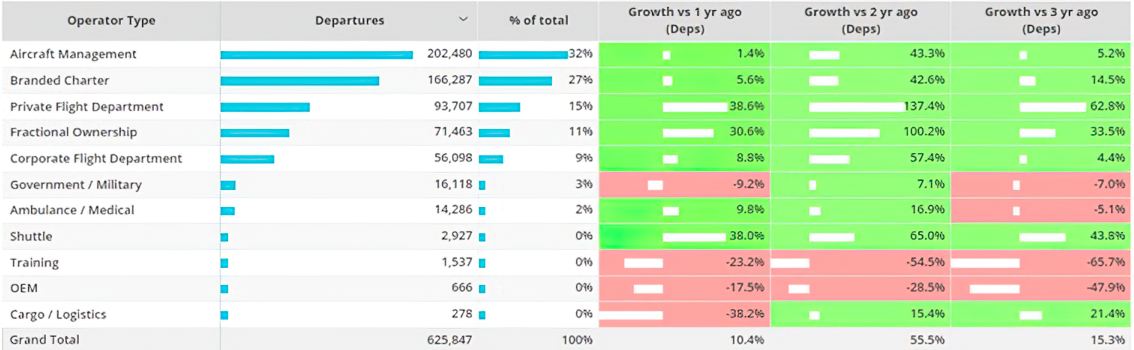

Europe

600,000 business jet flights were flown in 2022 in Europe, 10% above 2021, 56% above 2020 and 15% above 2019. July was the busiest month of the year, when flight activity soared 23% above 2019. In Week 52 2022 bizjet activity fell 18% compared to the previous week, 10% below week 52 in 2021. Private flight departments saw the largest gains in flight activity this year compared to three years ago, flights up 63%. Fractional and Branded Charter operations in Europe also saw double digit gains compared to three years ago.

Business jet operator types full year 2022 compared to previous years

France was the busiest bizjet market in Europe in 2022, followed by the UK and Germany. Key markets saw double digit growth during 2022 compared to last year, notably France, UK, Italy & Switzerland. Despite 26% growth compared to 2019, Greece saw sectors drop 7% compared to 2021. Bizjet departures from Russia fell almost 60% compared to 2021, 46% fewer than 2019. At the airport level, Le Bourget was the busiest airport, flights up 25% compared to 2021 and 18% up on 2019.

Top European Bizjet markets full year 2022, compared to previous years

Despite the strong growth during 2022, European bizjet activity has declined compared to 2019 in each of the last 6 months. December´s traffic dropped 9% compared to December 2021, only 5% ahead of December 2019. Heavy, Super Midsize and Entry level jets all flew fewer sectors than 2019. In week 52, business jet activity in Europe was down by 10%, with double-digit YOY drops in Germany, Switzerland and France, with the UK the only major market to see YOY growth in demand. In Germany, business jet traffic in week 52 was down 30% compared to week 51.

Rest of World

Outside of North America and Europe, bizjet activity in 2022 was 20% above 2021, 74% above 2020 and 54% above 2019. Private Flight departments were responsible for 41% of all departures in the ROW region in 2022, sectors up 29% compared to 2021, 86% above 2019. Heavy jets flew almost 56,000 flights in 2022, making them the top aircraft segment. All aircraft segments saw double digit growth compared to previous years.

In December ROW activity was 22% above December 2021, 56% above 2019. Brazil was the busiest market in December, flights down 2% compared to last year, up 55% compared to three years ago. Qatar closed the month with 400% growth compared to December 2021, demand being driven by the hosting of the FIFA Men’s World Cup. Elsewhere China saw a 19% reduction in flights compared to December 2021.