WINGX’s weekly Business Aviation Bulletin.

Summary

Back in May 2022, the post-lockdown surge started to wear-off, hence the latest weeks in May 2023 have seen a narrow year-on-year deficit. There is still some growth compared to last year in Private Flight Departments and in Fractional Programs, whereas the Branded Charter market has deflated overall. The European market is relatively the weakest region with big drops compared to early summer 2022, especially in domestic travel.

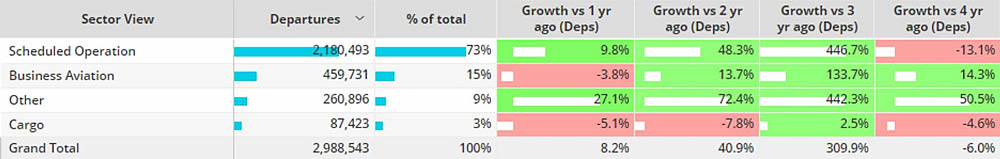

Global

In Week 22 (ending 4th June) global business jet sectors dropped 2% compared to the previous week, 3% below the same dates in 2022. Just under 500,000 business jet and turboprop sectors were flown during the month of May 2023, 4% fewer than May last year, 14% ahead of May 2019. Scheduled airline activity in May rebounded 10% compared to May last year, still 13% behind 2019. Focussing on the top 5 airlines (Southwest, American, Delta, Ryanair, United) sectors were 12% ahead of May last year, 7% ahead of pre-pandemic 2019.

Chart 1: Global fixed wing flights, May 2023 compared to previous months of May. (Note business aviation includes turboprops)

North America

In Week 22 business jet sectors in North America fell 3% compared to the previous week, on par with the same dates in 2022. For the full month of May 2023, bizjet sectors fell 6% behind May 2022, 18% ahead of pre-pandemic 2019. Ninety two percent of departures in the region were from the United States, these departures down 7% compared to May last year, 16% ahead of 2019. Mexico and Canada saw activity finish 5% and 2% ahead of May 2022 respectively. Focussing on the Caribbean, the bizjet trend was 6% below May last year, but still 20% ahead of 2019.

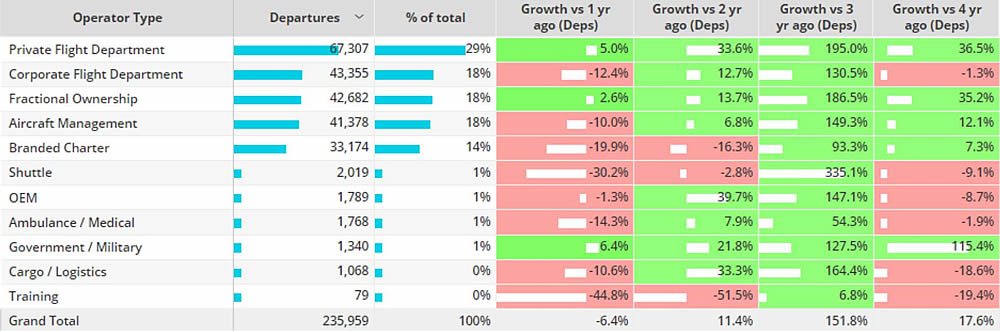

The Bombardier Challenger 300/350 was the most flown business jet type in North America in May, although departures were down 4% compared to May 2022, 19% ahead of 2019. The Embraer Phenom was the second busiest type, sectors 4% ahead of last year, 52% ahead of 2019. Cessna Citation Excel XLS departures dropped 13% compared to May 2022, although stayed 3% ahead of May 2019. Almost a third of regional business jet departures in May came from Private Flight Departments, sectors up 5% compared to last year, 37% ahead of 2019. Corporate Flight Departments saw activity drop 12% compared to last year, 1% below 2019. Branded Charter sectors have fallen compared to last year, sectors down 20%, still 7% ahead of May 2019.

Chart 2: North America Business Jet Operator Types May 2023 compared to previous years.

Europe

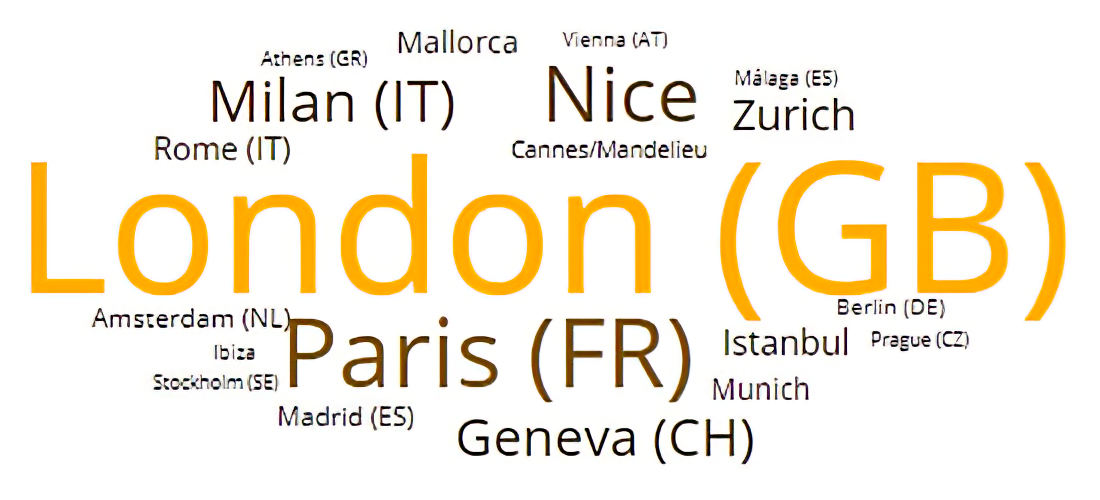

In Week 22 of 2023, European business jet sectors grew 3% compared to the previous week, 14% behind the same dates in 2022. For the month of May, European business jet sectors fell 11% compared to May last year, still 7% ahead of May 2019. France was the busiest market in May with almost 8,500 business jet departures, 13% fewer than May 2022, 7% ahead of 2019. Domestic flights made up 34% of the French bizjet market in May, sectors were 15% below May 2022 and 1% below May 2019.

Most top markets saw double digit declines compared to last year, namely the United Kingdom, Spain and Switzerland. In addition, business jet departures from Germany fell 1% compared to May 2019. All of the top 5 busiest bizjet airports in Europe in May saw departures fall behind May 2022, although all but London Luton saw activity ahead of May 2019. Milan Linate bucked the trend, departures grew 1% compared to May last year. London was the top departure city for Bizjets in May, departures down 10% compared to last year.

Chart 3: Top 20 Departure Cities, Europe, May 2023 compared to previous years.

Rest of World

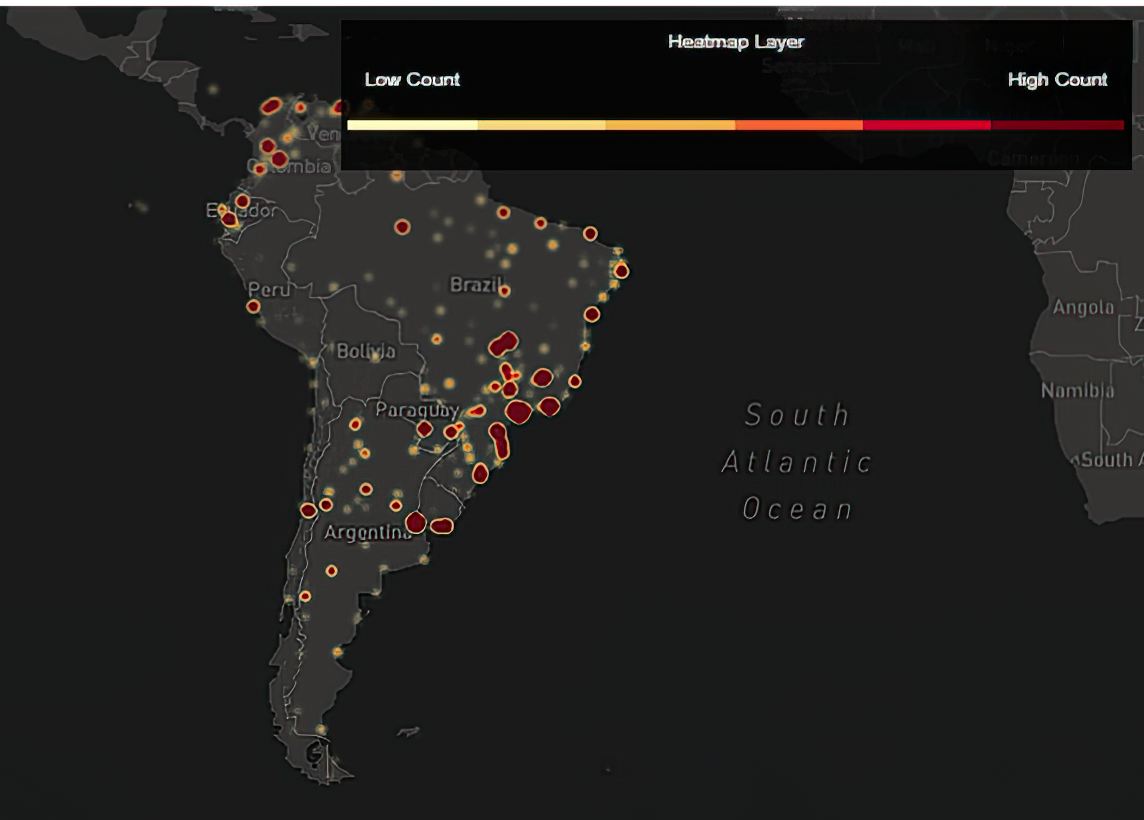

In Week 22, business jet departures from Africa are on par with the previous week, 23% ahead of 2022. Asia down 5% compared to last week, 8% ahead of 2022. South America up 4% compared to last week, 28% ahead of 2022. The Middle East up 13% compared to last week, 5% ahead of 2022. Outside of North America and Europe, business jet sectors ended May 2023 11% ahead of last May, 75% ahead of 2019. Brazil, the busiest market saw triple digit growth compared to May four years ago, 6% ahead of last year. China saw 79% growth compared to May 2022, although still 18% below pre-pandemic May 2019. Contrast Australia and the United Arab Emirates, two markets to see declines compared to last year, sectors down 5% and 2% retrospectively.

Chart 4: South America Business Jet Departure Hotspots, May 2023.