WINGXТs weekly Business Aviation Bulletin.

Summary

The Independence Day holiday over the long weekend saw record business jet activity, even surpassing last year, and for the full week 26, midpoint to 2023, activity was flat year on year. This is an improvement on the month of June, which was 5% off June 2022. Europe is considerably weaker, with the UK seeing a steep drop-off from last June.

Global

During the month of June 2023, global business jet and turboprop sectors dipped 3% year on year, staying 18% ahead of 2019. Focusing on just business jets, global activity in June finished 5% below last year, 21% ahead of 2019. Year to Date (1st January 2023 – 30th June 2023), business jet activity is 5% behind last year, 19% ahead of 2019.

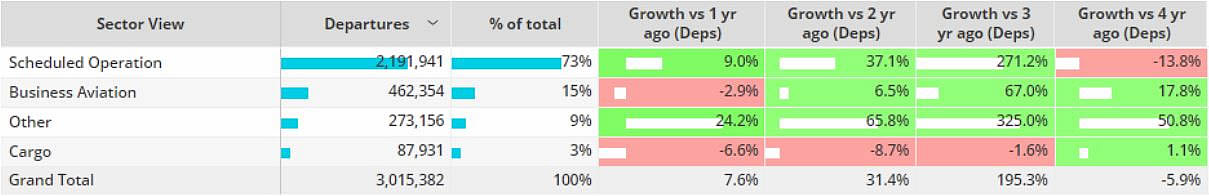

Scheduled airline activity was up 9% in June 2023 versus June 2022, 14% less activity than in 2019. The top 5 busiest airlines (Southwest Airlines, American Airlines, Delta Airlines, Ryanair, United Airlines) are performing well above the global trend for airlines, sectors up 11% compared to June last year, 6% ahead of June 2019.

Chart 1: Global fixed wing flights by sector, June 2023 compared to previous years. (Note business aviation includes turboprops)

North America

In Week 26, ending 2nd July, business jet activity across North America grew 5% in terms of sectors flown compared to the previous week, and kept on par with the week in 2022. In the last four weeks bizjet flight volumes are down 5% compared to the same dates in 2022.

In June, activity across the United States fell 5% compared to last year, although 20% ahead of pre-pandemic 2019. Canada and Mexico saw activity finish 1% ahead of last June, double digit growth compared to June 4 years ago. Ultra-Long-Jets were the only aircraft segment in June to see growth compared to last year, sectors up 2%. Bizliner activity fell short of 2019 levels, departures down 9% compared to June 2019, down 26% compared to June 2022.

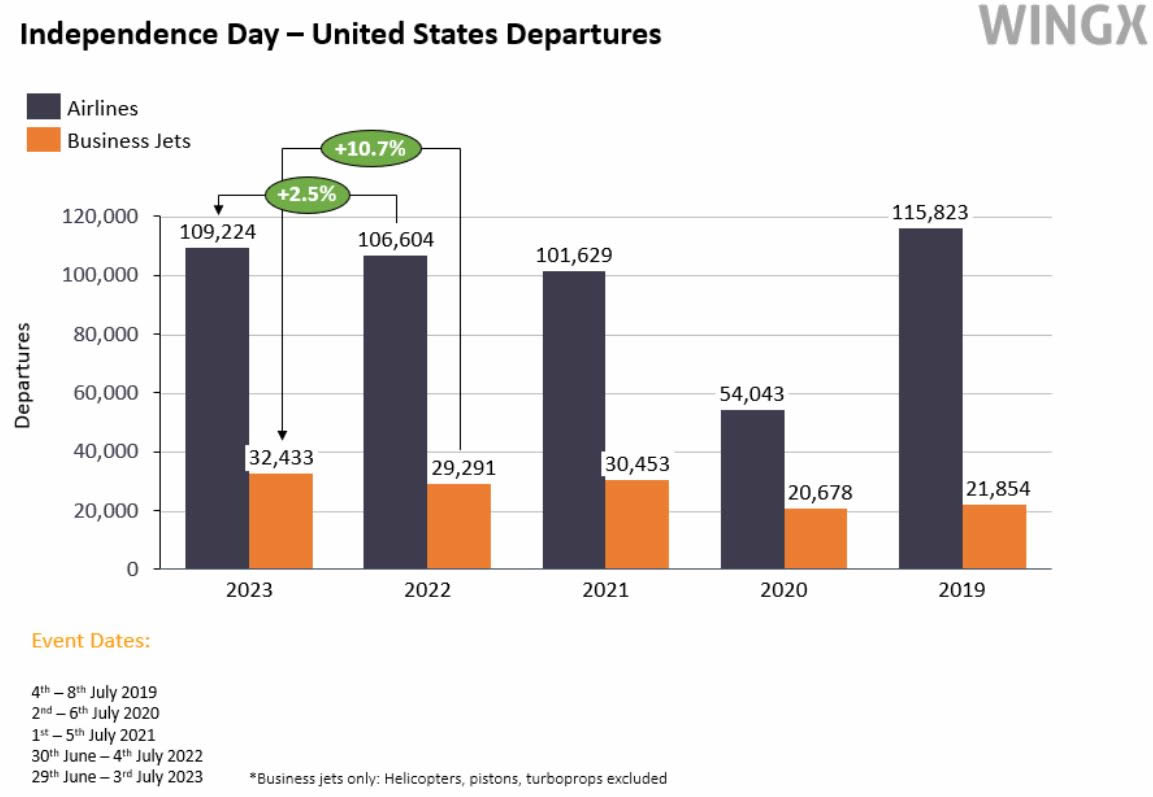

During the Independence Day weekend (June 29th Ц July 3rd), bizjet activity in the United States was up 11% compared to the same Thursday Ц Monday holiday period last year, 48% ahead of 2019. Scheduled airline activity over the same period increased 3% compared to last year, although still down 6% compared to 2019. Aircraft Management operators were the busiest operator type during the period, 9% ahead of the Thursday Ц Monday holiday period in 2022. Private flight departments flew 37% more flights compared to 2022, Branded Charter 5% fewer. The busiest bizjet pair this year was Las Vegas McCarran to Van Nuys, departures down 16% compared to the same period last year.

Chart 2: Business jet traffic during Independence Day holiday in the US, June 29th Ц July 3rd

Europe

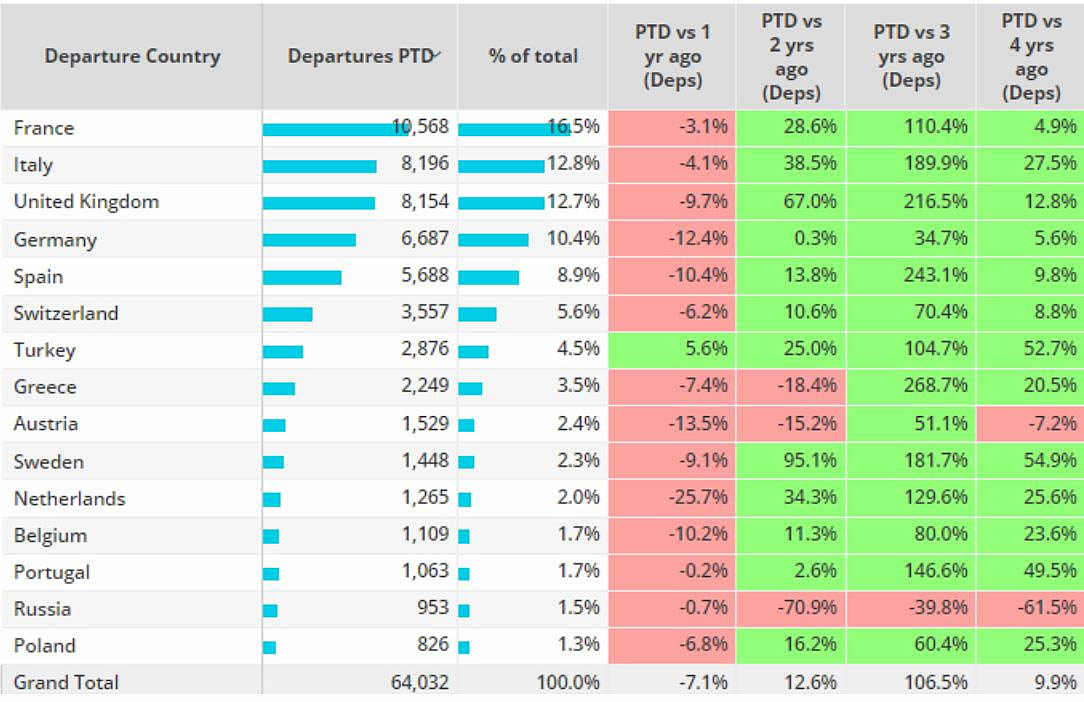

In Week 26 European bizjet activity grew 2% compared to Week 25, capped at 7% behind the same dates last year. Business jet activity across the region in June 2023 fell 7% compared to June last year, 10% ahead of June 2019. Year to Date the European business jet sectors are 8% behind last year, 7% ahead of 2019.

In the busiest European market, France, bizjet activity in June was 3% behind last year, 5% ahead of 2019. The United Kingdom, Germany and Spain saw double digit declines compared to June last year, still just ahead of June 2019. Aside from Russia, Austria is seeing less activity than in 2019, with flights in June 2023 down 7% on June 2019. Nevertheless, airports (LOWG, LOWK) hosting visitors to the Austrian F1 Grand Prix last weekend (30th June Ц 2nd July) saw a small increase in business jet arrivals. Over the Grand Prix weekend the top 3 airport pairs were Le Bourget Ц Graz, Biggin Hill Ц Graz and Hamburg Ц Graz.

Chart 3: Bizjet trends by country, Europe June 2023 compared to previous years.

Rest of World

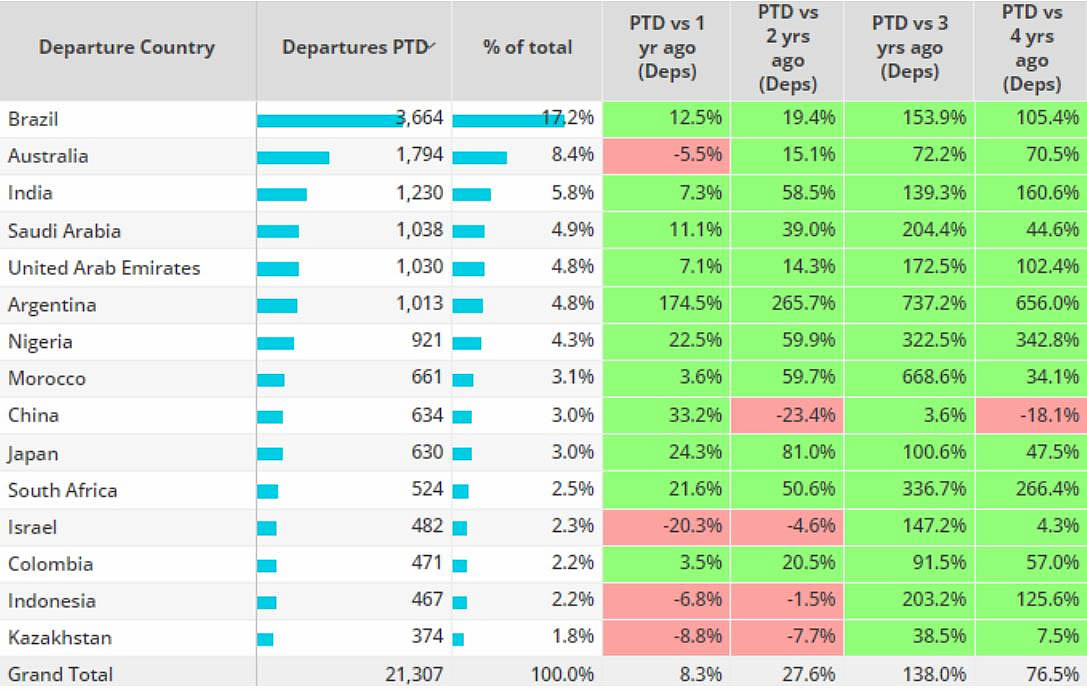

Outside North America and Europe business jet activity in June was 8% ahead of June 2022. Australia was the only leading market in the Rest of World region to see declines in June 2023 bizjet activity compared to June 2022, departures were down 6%, although 71% ahead of 2019.

Over half of flights in the region were less than 1.5 hours in duration, flights of this duration are up 8% compared to June last year. Medium haul (3-6 hours) flights fell 1% compared to June last year, Ultra-Long-Range (12+ hours) flights are trending 10% below June 2019.

Heavy Jets were the most active aircraft segment in June, departures 6% ahead of last year, 73% ahead of 2019. Super Midsize and Bizliner activity declined compared to last year, departures down 7% and 3% respectively, although both types are ahead of June 2019.

Chart 4: Rest of World Bizjet activity in June 2023 compared to previous years.