WINGX’s weekly Business Aviation Bulletin.

Summary

Week 30, completing July 2023, is seeing a stabilisation towards fairly modest deficits in flight activity compared to 2022, just 2% in North America. There is still growth compared to year´s highs, notably in Texas, also across most fractional operators. Part 135 activity has levelled out compared to last year, although branded charter operators are flying less than last summer. In Europe there is a larger drop in activity compared to last year, acute in UK and Germany, with over 15% declines in Week 30. Bizjet flights out of the Middle East are down 1% compared to last year but still up 35% versus 2019.

Global

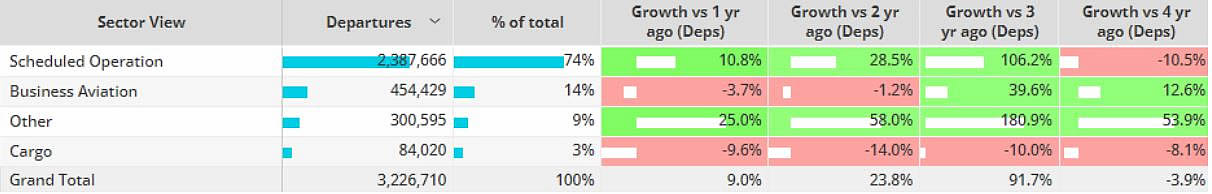

Global business jet and turboprop sectors in July 2023 fell 4% below July 2022, still 13% ahead of July 4 years ago. Whilst bizjet demand in the US has consolidated, the YOY decline in Europe is substantial. Scheduled airline departures are 11% ahead of last year, although still 11% behind pre-pandemic July 2019. The trend for the top 5 business airlines (Southwest, American, Delta, Ryanair & United Airlines) is slightly behind of the global airline trend, departures 10% ahead of July 2022, 8% ahead of 2019.

Chart 1: Global fixed wing flights by sector, July 2023 compared to previous years. (Note business aviation includes turboprops)

North America

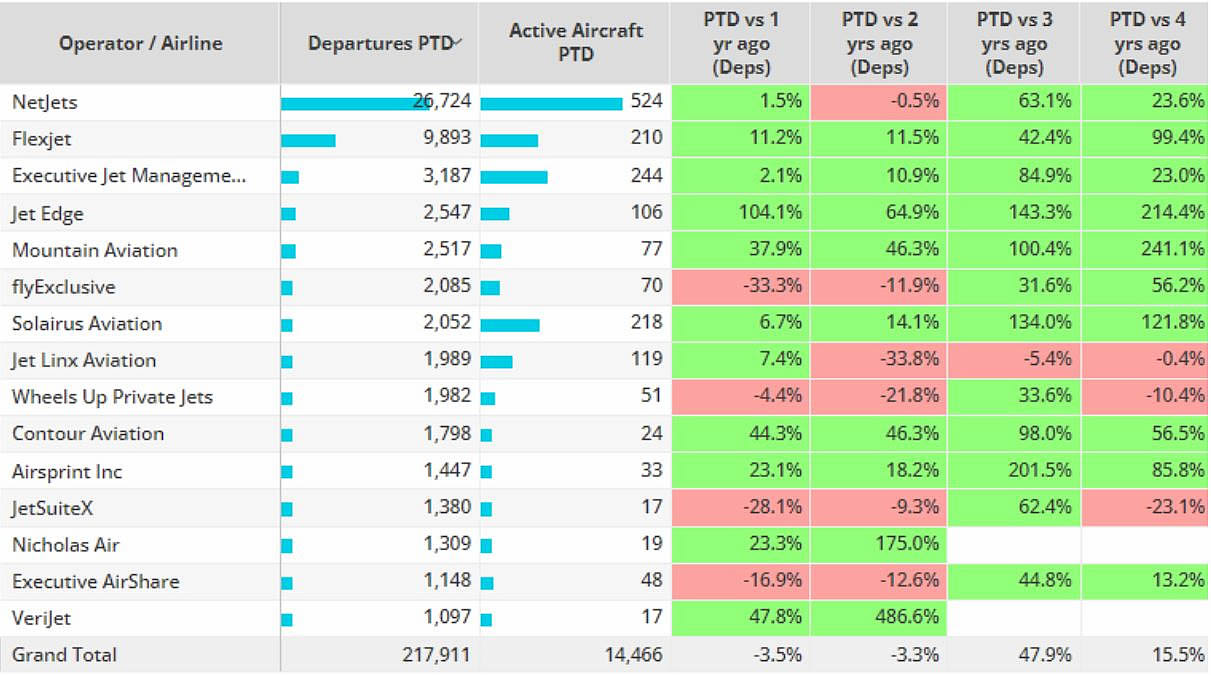

In Week 30 (ending 30th July), business jet activity across North America grew 1% compared to the previous week, 2% below the same dates in 2022. Year-to-date business jet activity across the North America region is 6% behind comparable last year, 18% ahead of the same period four years ago. Activity in July ended 4% behind July 2022, 16% ahead of July 2019. Nine out of 10 bizjet departures were domestic flights in July, departures were down by 4% compared to last year, 16% more than 2019. International flights dropped 2% compared to July 2022, 14% more than 4 years ago. Activity across the operator types was mixed in July, Private Flight Departments were the busiest fleets, departures well ahead of last July. Branded charter activity is down 11% vs last year, up 9% vs July 2019. Fractional operations are up 33%, with Flexjet fleet doubling activity compared to July 2019.

Chart 2: North America Bizjet Top Operators, July 2023 compared to previous years.

Europe

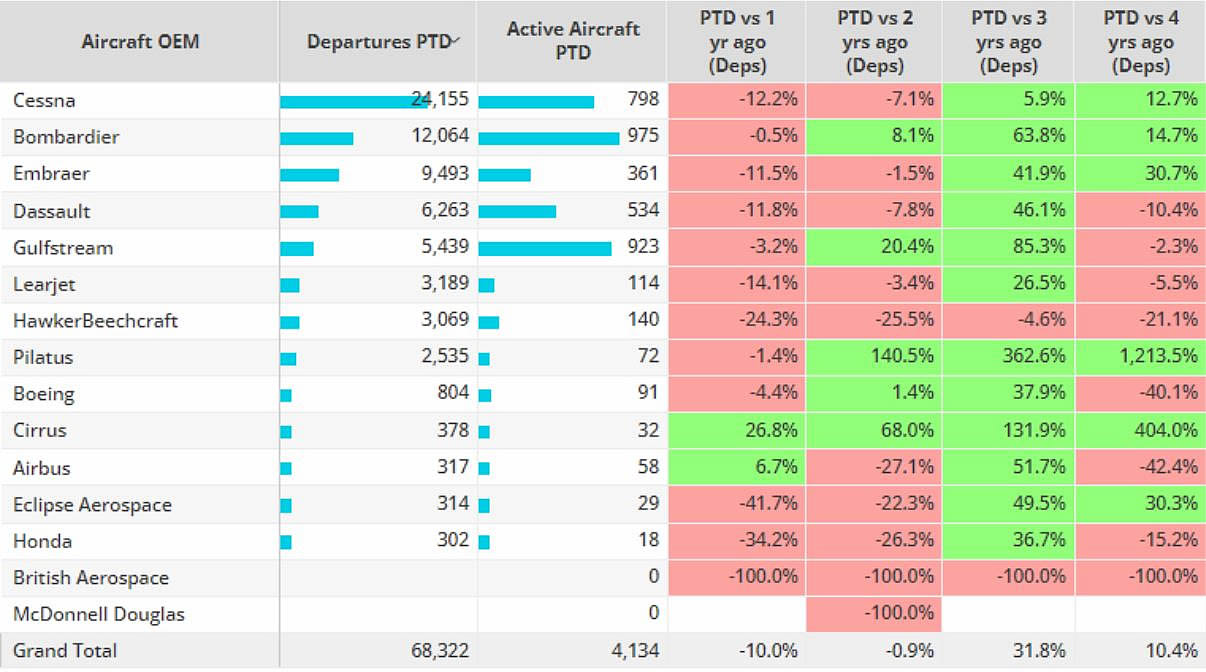

In Week 30 business jet activity in Europe fell 1% compared to Week 29, 7% below the same dates in 2022. Year-to-date activity in Europe is 9% behind comparable 2022, although 8% ahead of pre-pandemic 2019. Business jet activity in July ended 10% down compared to July last year, although 10% ahead of July 4 years ago. Cessna fleets flew 12% fewer flights than July 2022, 13% ahead of 2019, Bombardier jet activity was on par with last year. Dassault and Gulfstream aircraft both flew fewer flights than July 2019.

Chart 3: Europe Business Jet OEMs, July 2023 compared to previous years.

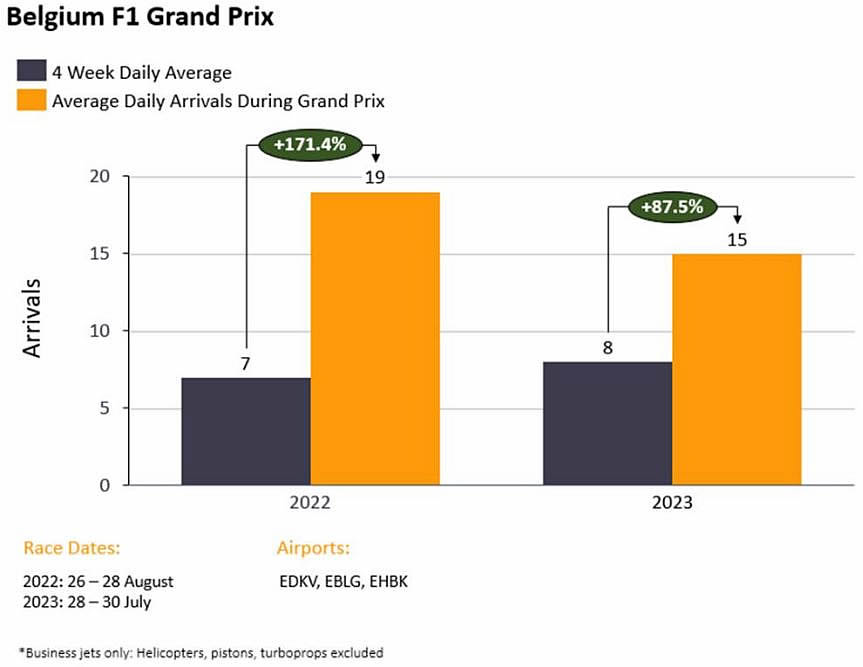

Nice was the busiest bizjet airport in July, departures down 13% compared to last year, although 10% ahead of 2019. Elsewhere activity was mixed, departures from Le-Bourget saw double digit declines compared to last year, 5th ranked Farnborough saw double digit growth compared to last year. Over the weekend (28th – 30th July), airports near (EDKV, EBLG, EHBK) the Belgium Grand Prix saw an increase in business jet arrivals. Average daily arrivals during the Grand Prix weekend were 88% above the average daily arrivals for the previous 4 weeks.

Chart 4: Belgium F1 Grand Prix 2023

Asia

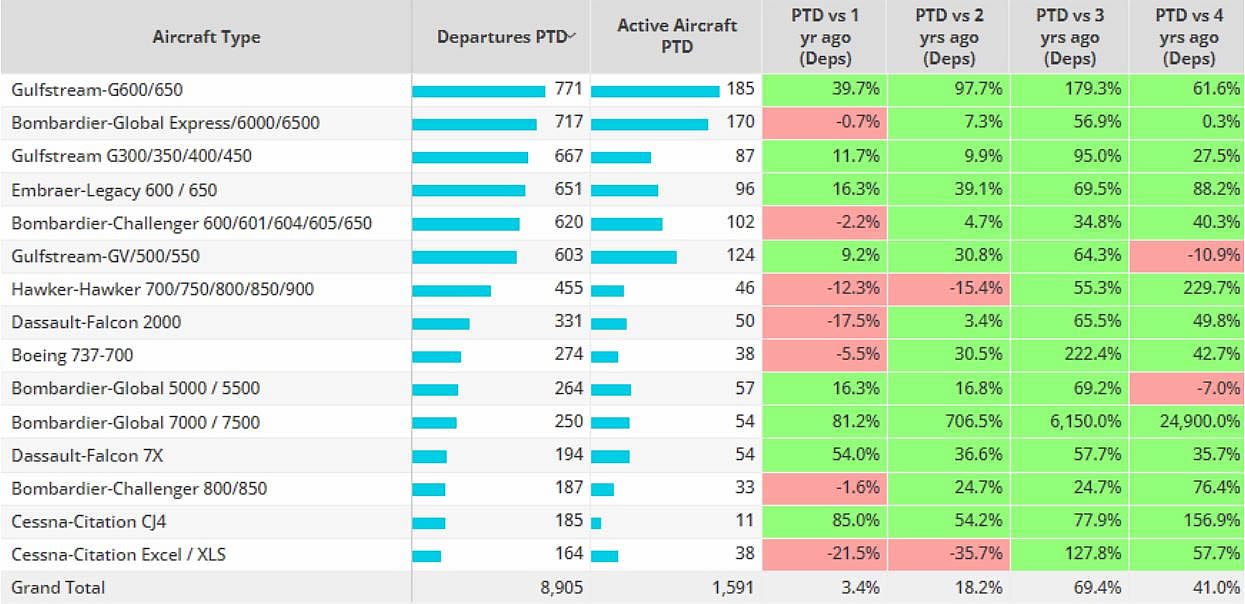

Year-to-date business jet activity in Asia is seeing 14% growth compared to last year, 47% growth compared to YTD 2019. In July activity finished 3% ahead of July 2022, although 41% ahead of 2019. India was the busiest market in July, activity 9% ahead of last year, triple digit growth compared to 4 years ago. Flight activity in China recovered to beyond pre-pandemic levels, departures up 3% compared to July 2019. The Gulfstream G600/650 was the busiest aircraft type in July, departures 40% above last year, 62% above 2019. Other types seeing double digit growth compared to last year, namely the Gulfstream G300/400 and Embraer Legacy 600/650 series.

Chart 5: Asia Business Jet Types, July 2023 compared to previous years.

Middle East

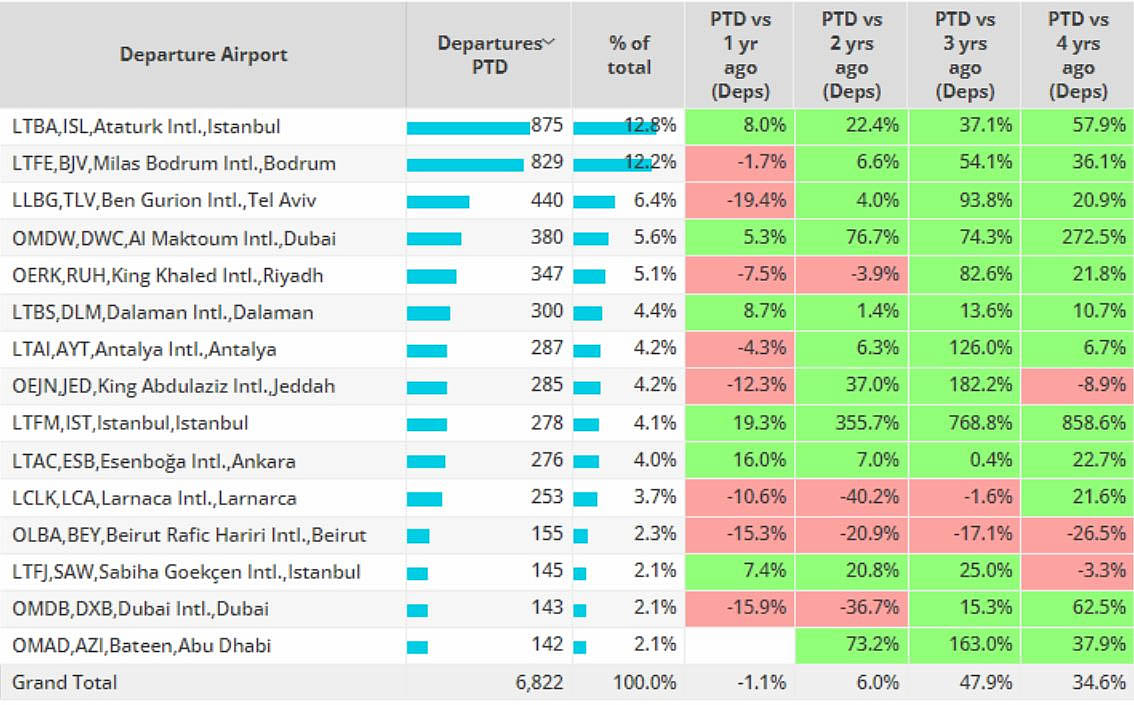

Year-to-date business jet activity in the Middle East is 3% ahead of comparable 2022, 46% ahead of 2019. In July, activity was 1% behind July 2022, although 35% ahead of 2019. Turkey, the top market bucks the regional trend, activity was 6% ahead of July last year, 39% ahead of 2019. Qatar saw double digit growth compared to July 2022, contrast Saudi Arabia and Israel seeing double digit declines.

Chart 6: Top Middle East airports, July 2023 compared to previous years.