WINGX’s weekly Business Aviation Bulletin.

Summary

Bizjet demand in the key US market is down by 4% compared to August 2022 and August 2021, with both previous years setting high points for flight activity. The earlier 2023 declines versus last year appear to be narrowing, with the market holding at least 10% gains compared to 2019. Europe is the weakest regional market. Asia is seeing a strong rebound compared to last year.

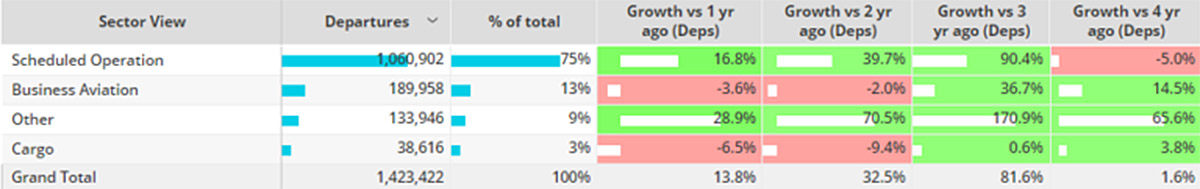

Global

13 days into August, global business jet and turboprop sectors fell 4% compared to the period last year, still 15% ahead of August 4 years ago. Comparatively, Scheduled Airline activity is 17% ahead of last year, 5% short of August 2019. The top 5 commercial airlines (Southwest, American, Delta, Ryanair & United Airlines) are flying 13% ahead of August 2022, 8% ahead of 2019. Global cargo activity is 7% down on last year, 4% up on 2019.

Chart 1: Global fixed wing flights by sector, August 2023 compared to previous years. (Note business aviation includes turboprops)

Europe

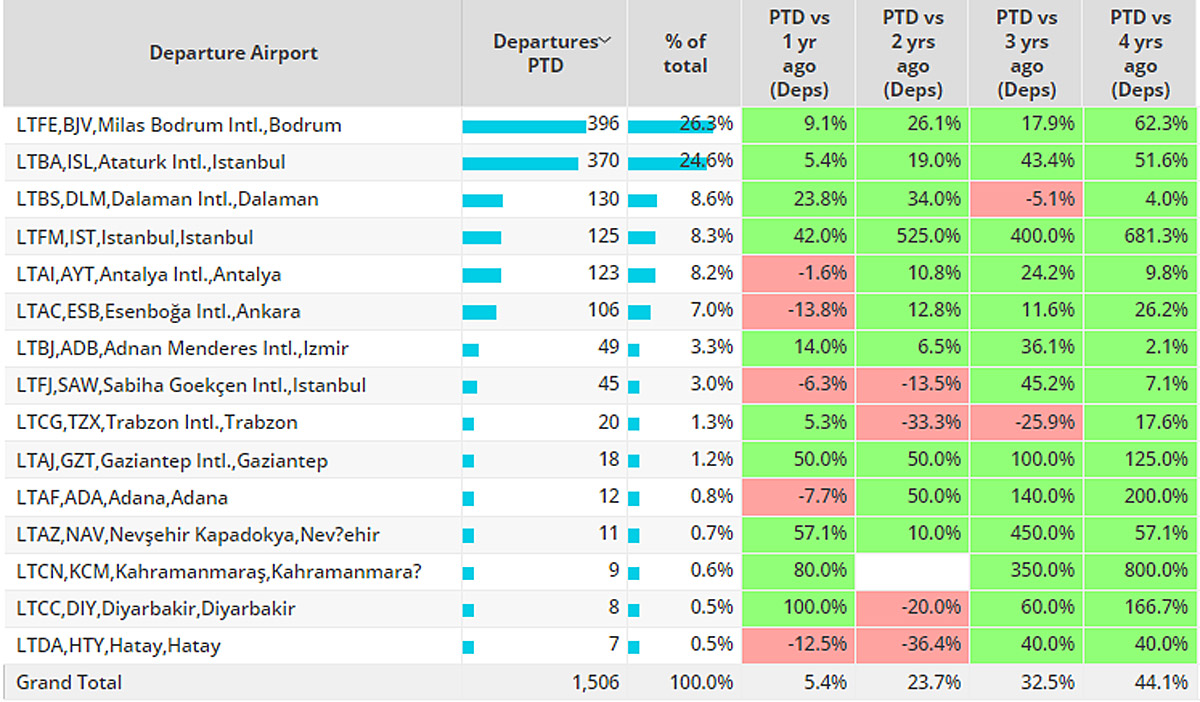

In Week 32 (ending August 13th) business jet activity in Europe fell 9% compared to Week 31, 9% below the same dates last year. These trends are in line with last 4 weeks activity, 9% behind comparable 2022. Italy remains the top market so far this month, slightly edging out France, bizjet departures down 3% and 7% respectively compared to last year. Several top markets are still seeing double digit growth compared to August 2019, notably Italy, United Kingdom, Spain and Switzerland. Turkey is seeing 5% growth compared to 2022, the only top market to continue to see gains compared to last year. Business jet flights from Russia are stagnating at two thirds the levels of four years ago. Milas Bodrum is the busiest bizjet airport in Turkey, closely followed by Ataturk. Both airports are seeing bizjet departures well ahead of August 2019, 62% and 52% respectively.

Chart 2: Bizjet departures from airports in Turkey, August 2023 compared to previous years

North America

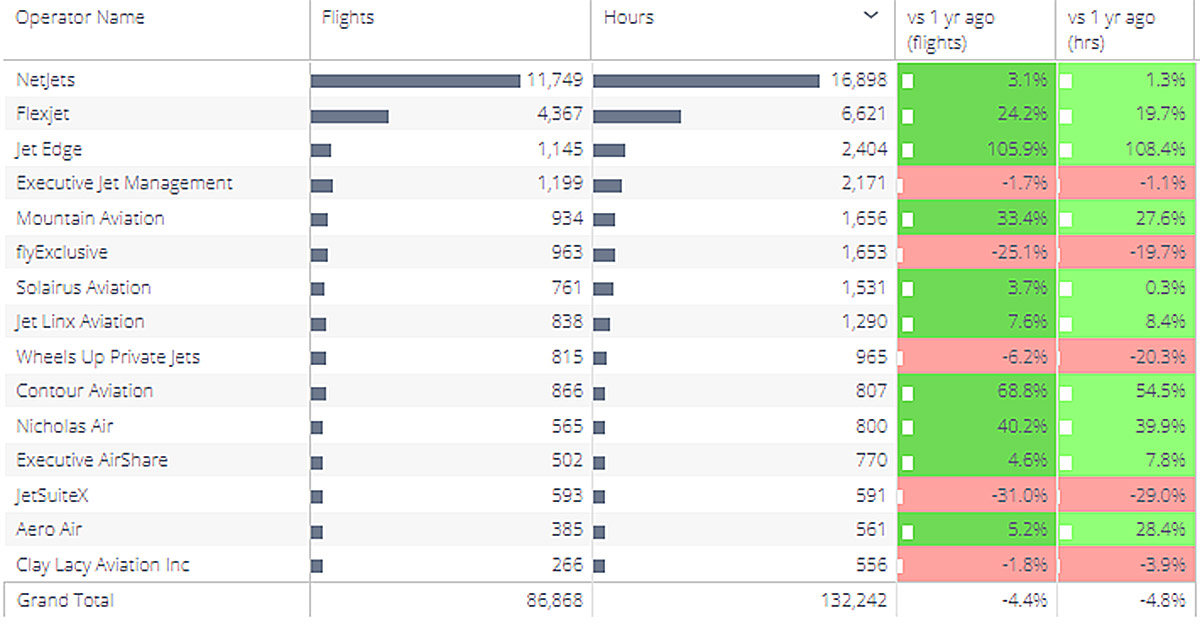

In Week 32 (ending 13th August), business jet activity across North America grew 2% compared to the previous week, fell 5% below the same dates in 2022. 92% of regional bizjet departures this month have been from United States airports, although departures falling 4% behind last year. Canada and Mexico are seeing small growth vs last year, 2% and 5% respectively. Activity across the Caribbean is mixed, Sint Maarten on par with last year, declines in Bahamas and Barbados compared to last year, double digit growth in Jamaica. Amongst the largest US bizjet operators, Netjets is steadily adding activity, Flexjet growing faster, Jet Edge doubling flights, Executive Jet Management flatlining, Wheels Up Private Jets seeing substantial declines.

Chart 3: Top bizjet operators, United States, August 2023

Asia

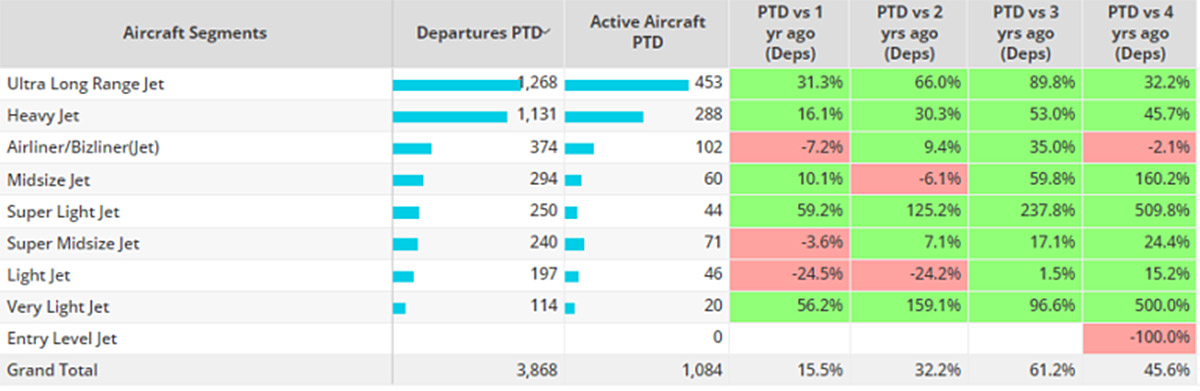

Business jet activity in Asia continues to trend well above last year, departures up 16% compared to August 2022, 46% growth compared to 2019. India remains the top market this month, departures 7% ahead of last year, triple digit growth vs 2019. China is seeing triple digit growth vs last year, 32% growth vs 2019.

Chart 4: Asia Business Jet Segments, August 2023 compared to previous years

Middle East

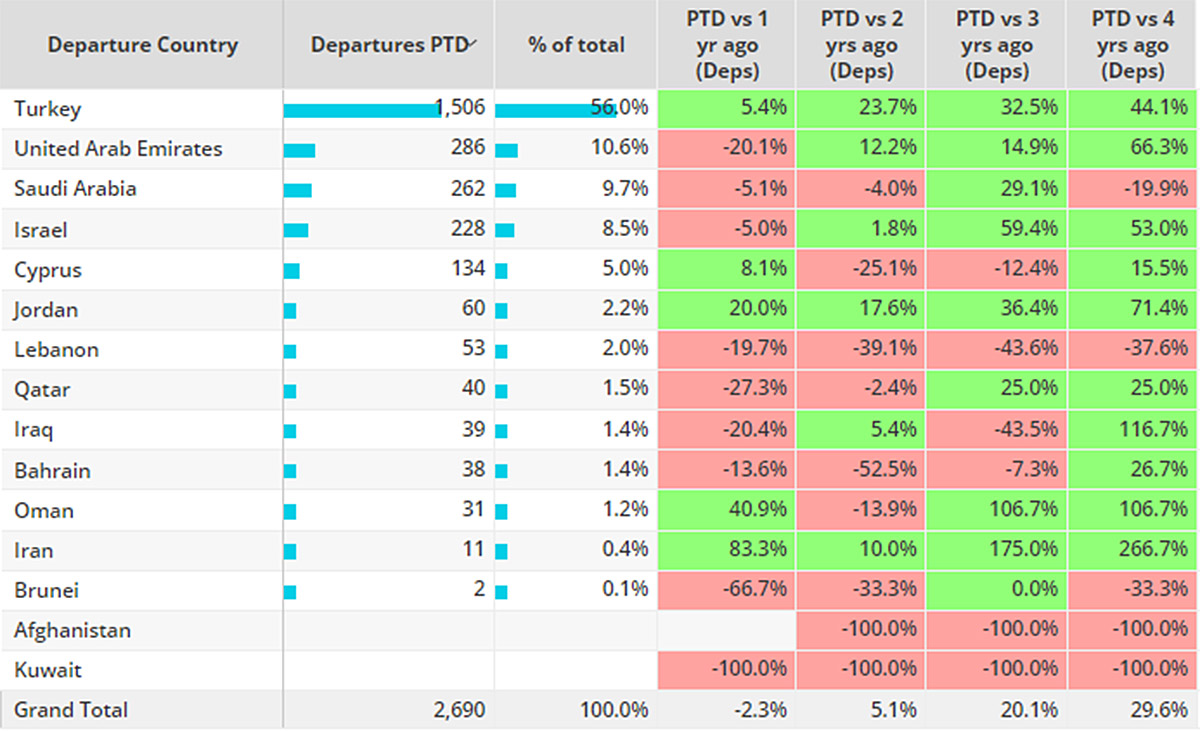

In the Middle East region business jet activity has fallen 2% compared to August last year, although still 30% ahead of 2019. Demand is mixed, Oman up 41% compared to last year, UAE and Qatar down 20% and 27% respectively.

Chart 5: Bizjet flights in Middle East countries, August 2023 compared to previous years.