Business jet utilisation is fraying slightly on comparable 2023 flight volumes, which is itself some way below the post-pandemic peak. But the Super Mid and Ultra Long-Range fleet is racking up more activity than ever.

Global

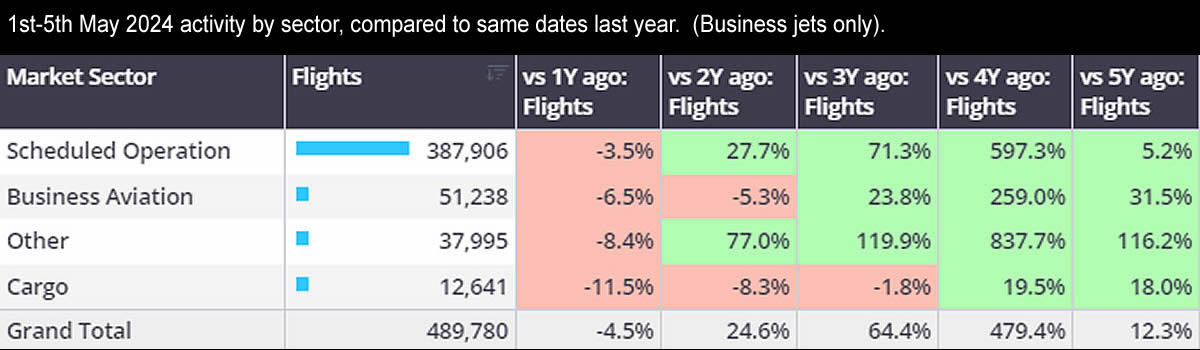

In Week 18 (29th April – 5th May), just under seventy-one thousand global bizjet sectors were flown, down 1% on the previous week, down 2% compared to week 18 in 2023. Part 135 & 91K sectors increased 3% compared to the previous week, 3% below Week 18 in 2023. At the start of this month (1st Ц 5th May), business jet sectors are down 7% YOY, 32% ahead of 2019. By comparison with business aviation, scheduled flight activity was down 4% compared to the same May dates in 2023, 5% ahead of 2019. Cargo operators are 12% behind the same dates last year, 18% ahead of 5 years ago.

Chart 1: 1st Ц 5th May 2024 activity by sector, compared to same dates last year. (Business jets only)

United States

In Week 18, 50,323 business jet sectors were flown in the United States, 4% more than the previous week, 1% below Week 18 in 2023. Part 135 & 91K activity in Week 18 jumped 7% compared to the previous week, 1% ahead of Week 18 in 2023.

At the start of May (1st Ц 5th May), bizjet activity in the US has fallen 4% YOY, 30% ahead of comparable May 2019. Busiest State Florida is 3% ahead of last year, 84% ahead of 2019. Texas and California seeing double digit declines YOY, although 36% and 6% ahead of 2019. Part 135 & 91K sectors so far this month are 4% ahead of last year, 41% ahead of 2019. 135 and 91K sectors are 8% down YOY in California, Texas up 1%, Florida up 6%.

Chart 2: Aircraft activity by type, US 135&91K bizjet activity, May 1st Ц 5th 2024.

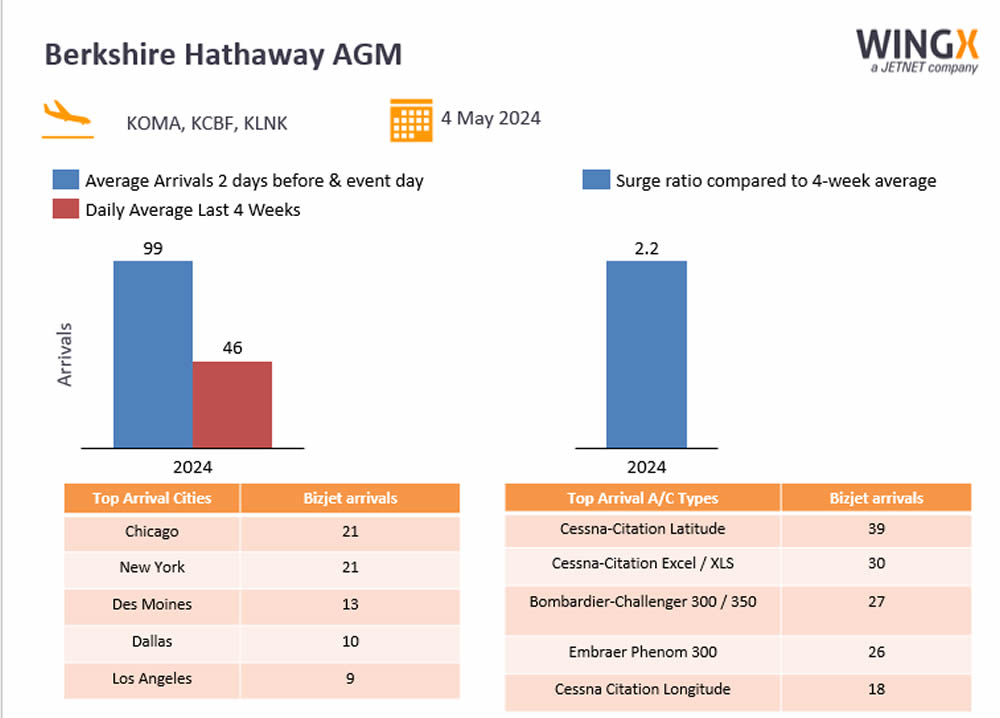

Across the US over the last week several key events have been driving bizjet activity. Airports near the Kentucky Derby this year saw the usual pre-event surge in bizjet arrivals. KSDF, KJVY and KEKX saw 676 business jet arrivals for the two days before and during the Kentucky Derby event day. NetJets had a strong presence, recording 101 bizjet arrivals, representing 15% of all bizjet arrivals into the event airports. In Omaha the Berkshire Hathaway AGM took place on May 4th, 298 bizjet arrivals were recorded at KOMA, KCBF, and KLNK airports two days before and during the event day. The average number of arrivals during those three days was 2.2x higher than the daily average for the last four weeks. And there were 603 bizjet arrivals into airports near the Miami Grand Prix (KOPF, KFLL, KTMB) during the Grand Prix weekend (3rd Ц 5th May), 8% fewer than the 2023 edition of the race.

Chart 3: Berkshire Hathaway AGM 2024

Europe

In Week 18, European business jet activity fell 9% below comparable Week 18 2023, sectors down 8% on Week 17 this year. Aircraft on operating certificates (AOC) saw a significant fall in activity, 15% fewer flights year on year, with France, Germany, UK the weakest markets.

Bizjets in Europe are seeing a slow start to May, sectors are 17% down compared to May last year, falling 1% below May 5 years ago. All major bizjet airports are seeing declines this month, except for Luton, where activity is 15% ahead of last year, 1% ahead of 2019. Most bizjet flights out of Luton this month are domestic, followed by flights to France. Trans-Atlantic connections from Luton are well ahead of previous years, flights to the US and Canada up by 120% YOY and 300% respectively.

Bizjet flights on domestic routes, that is, within the country, appear to be especially depressed this month compared to last year. In France, the first week of May saw activity fall 20% YOY, -6% vs 5 years ago. The UK’s domestic bizjet connections were down 15% YOY, even -13% vs 5 years ago. UK Ц France is the busiest international country connection this month, down 6% YOY and down 8% vs 5 years ago.

Chart 4: Bizjet country connections, London Luton airport, 1st Ц 5th May 2024.

Rest of World

In Week 18, bizjet activity in the Middle East fell 5% compared to the previous week, 3% below compared to Week 18 in 2023. So far this month activity in the Middle East has fallen 12% YOY, although 22% ahead of 2019. Top market Turkey has seen activity fall 21% YOY, although 28% ahead of 5 years ago. Saudi Arabia Ц United Arab Emirates is the busiest country flow in the region, although activity dipping 30% YOY on the route. 16 Flights to Russia from Turkey so far this month, 23% ahead of last year.