Comparing activity between 1st and 5th July, 2020 traffic was only 7% down, according to WINGX`s weekly Global Market Tracker

The Independence Day holiday period showed that recovery in business aviation is continuing apace in the world’s key market, the United States, despite the continuing virus contagion and the resumption of some travel restrictions in US States. Comparing activity between 1st and 5th July, 2020 traffic was only 7% down. And Independence Day 2019 fell on a Thursday, whereas this year on a Saturday, so comparing the same Thursday through Sunday period, the delta is just 3%. If the comparison for those days is restricted just to business jets, the Thursday-Sunday activity in 2020 was actually 4% up on the same days in 2019.

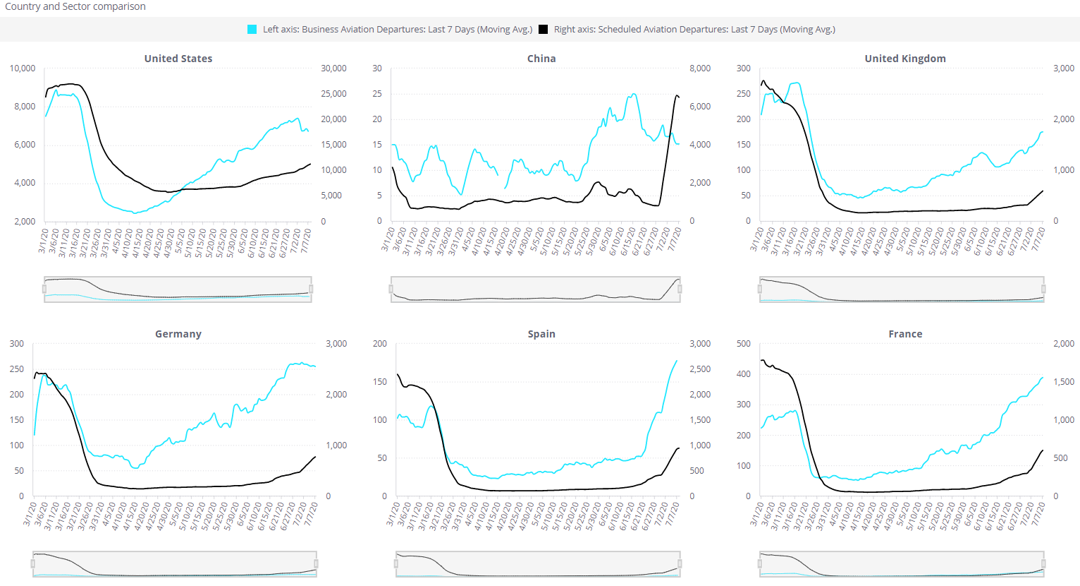

Taking a step back, the last 2 weeks have seen US business jet and prop activity catch up to 85% of normal levels for this period. California is now back to busiest State, around 10K flight departures in the last 2 weeks, 8% under par. Florida has sustained its YOY growth trends from June and is 12% up on activity coming into July. Colorado, Montana and Arizona have all seen around 5% growth in flights in the last fortnight through Independence Day. The East Coast continues to suffer biggest declines in activity, with flights out of New York State trailing 23% and flights out of New Jersey still down by over 40% in the last 2 weeks.

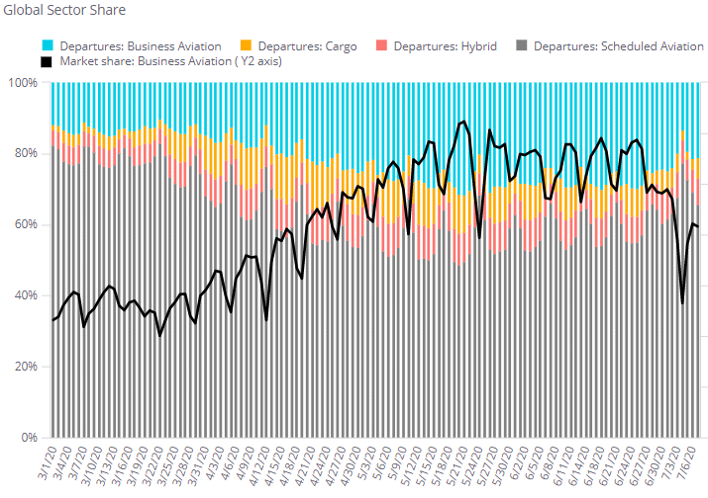

The global recovery in aircraft utilisation has also been encouraging in the last fortnight: Europe is back up to 77% of normal activity, inversing its negative trend in April; Oceania and South America have stabilised at around 93% of usual activity; Asia is somewhat stuck at 27% below normal; and recovery in Africa has been fairly slow, activity still trailing by 31%. Aircraft Management companies appear to be driving the recovery so far, activity above 90% of normal, whereas Branded Charter operators are yet to see pent-up demand released but have recovered 80% of normal. Private and Corporate flight departments are lagging, activity down close to 30%.

Outside North America, the busiest countries in the last 2 weeks are France and Germany, respectively down by 24% and 10% YOY. Australia is the 5th busiest market globally with prop activity included, with that country seeing a small increase in YOY flight hours operated. For business jets only, the UK and Greece are by far the hardest hit European market, flights down more than 55%. Spain and Italy have seen some recovery since border restrictions were lifted in mid-June. Business jet traffic from Switzerland is only down by 17%, and from Turkey, traffic is back up to 93%. Most flights are still domestic, stronger trends here, with intra-Germany activity just 3% below normal coming into July.

The emphasis on resilience in mid and small cabin aircraft has continued into July, with Very Light and Entry Level jet activity worldwide within 10% of normal, Super Light and Super Midsize jet traffic down by 15% in the last fortnight, Heavy Jet sectors down by just over 30% and Ultra Long Range jets flying almost 40% fewer sectors and close to 50% fewer hours. Turboprop recovery has stalled, flying down by 20%, but does retain the two busiest types, the PC-12 and King Air 200. The three busiest business jets are the Citation Excel, Bombardier 300 and Phenom 300, all flying at around 85% of normal. In the global charter market, the busiest jet is the Challenger 300.

Richard Koe comments: “Whether itТs despite the growing contagion concerns, or because of them, business aviation activity is continuing to be led by a recovery in the US, especially evident around Independence Day on July 4th. Leisure demand is clearly the driver at this point, with the holiday seeing lots of traffic to popular summer resorts. In Europe, charter requests are breaking records, and even if conversion is low, we expect to see the next monthТs charter activity reflect a fairly strong pipeline. The longer-term outlook depends on what happens to business travel.”