With rapid vaccine rollouts and loosening restrictions in some of private aviationТs core markets, charter demand is returning as we head into summer. Elsewhere, lockdowns remain in place and leisure demand is some way off. In this article, Avinode will look at global demand and pricing patterns, with particular focus on the USA and Europe.

15 months on from the emergence of COVID in China, its prevalence continues to have a huge impact on demand trends. The recent outbreak in India saw demand for travel from the country increase to levels never seen in Avinode, entering the top 10 of requested departure countries; it was driven by demand to the UAE, which increased 900%, and to the United States. Demand for travel from India continues for the next 2 weeks. Even as demand patterns normalize, we will no doubt continue to see sudden peaks due to outbreaks for the duration of the pandemic.

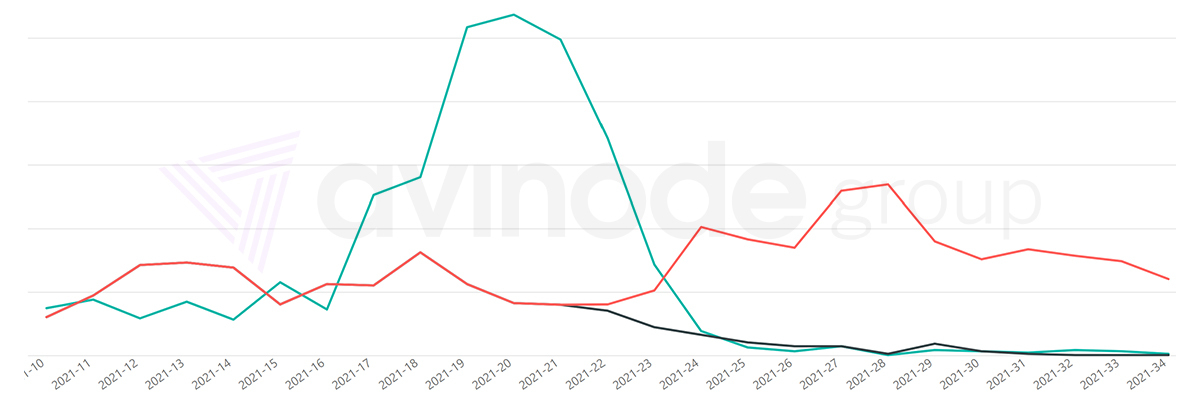

Demand by departure week from India (Green = 2021 demand, as of today, Red = 2020, Black = 2020 equivalent demand, as of today). 2021-21 is the current week.

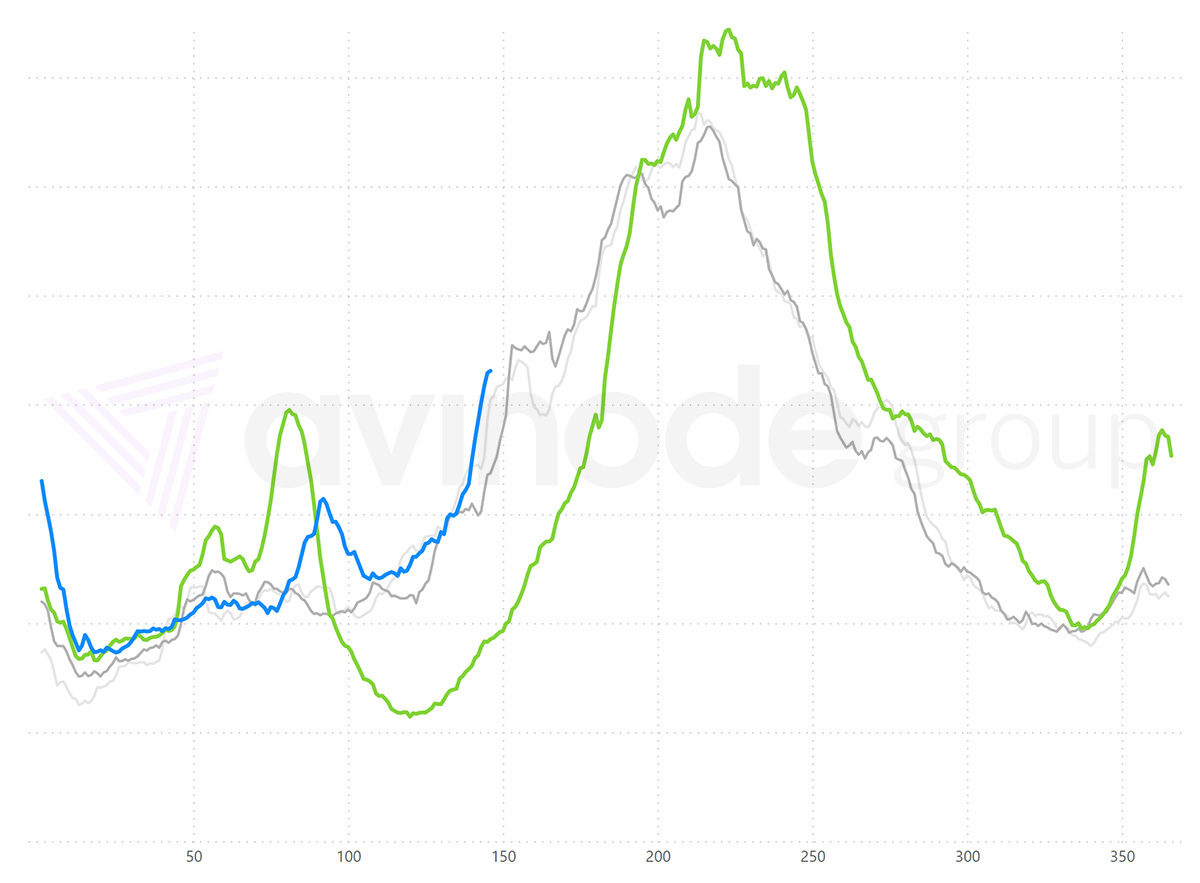

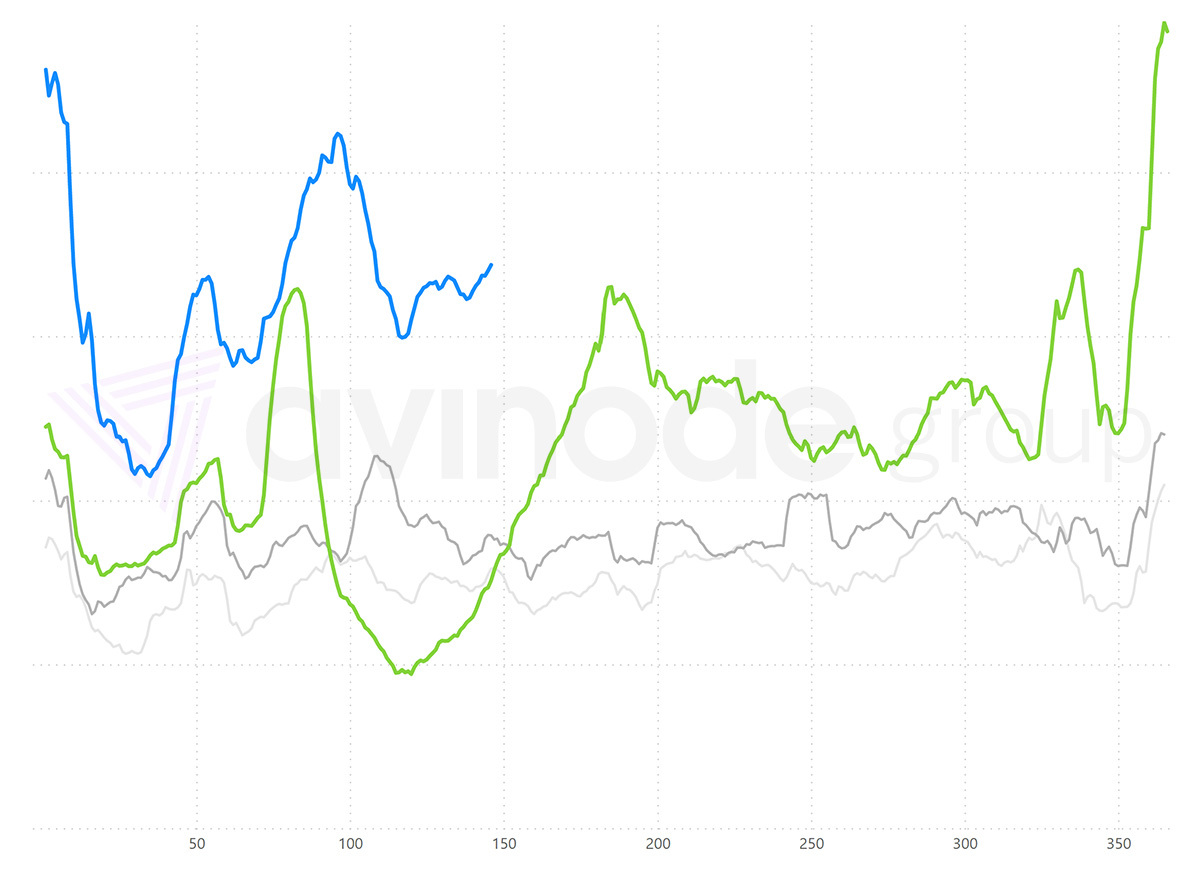

Rolling 14-day index of internal demand within Europe (Blue = 2021, Green = 2020, Dark grey = 2019, Light grey = 2018). Day of year along the horizontal axis. Demand for 2021 is similar to non-COVID years.

Right now, Intra-European charter demand through Avinode is tracking along similar curves to 2018 and 2019. Demand from the large UK market has struggled all year due to lockdown, but the addition of Portugal to the “green list” of countries, from which one can avoid quarantine, has seen demand rocket for the school holiday week, further boosted by the Champions League final featuring two English teams taking place in Porto on 29th May. Despite the need to quarantine on return, Spain is top of the demand rankings from the UK for travel until 1st August, with Portugal second and domestic travel third. From the other major European markets, domestic travel is most popular from France, Italy, and Spain. From Germany and Switzerland, the sunshine of Spain sees it take the top spot.

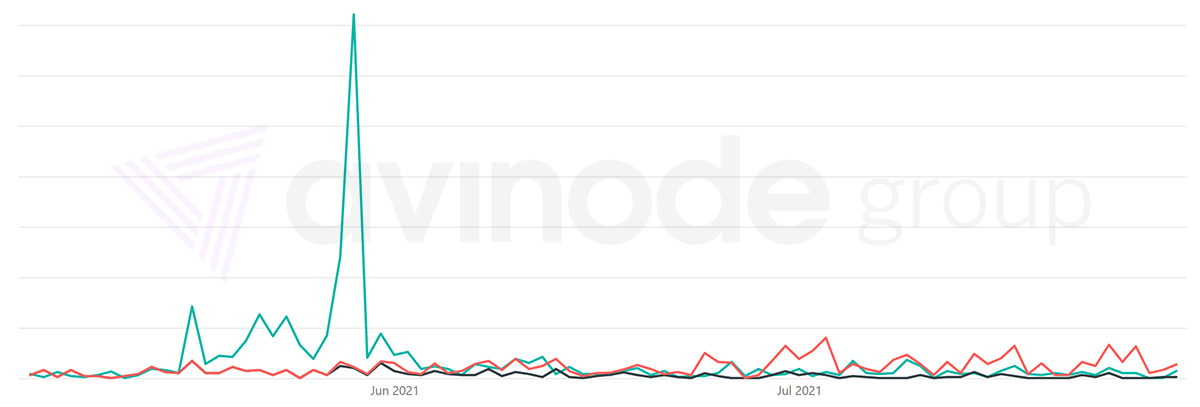

Demand by departure date from the UK to Portugal (Green = 2021, Red = 2020, Black = 2020 demand, at the same lead time before departure). The first spike is 17th May, the largest spike is 29th May.

COVID resulted in hundreds of events being cancelled in 2020. As limited crowds return to events in 2021, we are seeing events driving more demand peaks. The Europa League final in Gdansk caused a modest peak this week, and the Monaco Grand Prix saw nearly five times as much demand into Nice on Friday 21st May, compared to the week before. Events are returning and that is great news for private charter – although the Olympics is a notable exception.

From Russia, the story is a little different. The winter and early spring saw international demand focused on longer haul travel to the UAE and Maldives. That has now stopped. With the weather improving closer to home, demand has shifted to the Eastern Mediterranean for the summer. For the next couple of months, demand is up year-over-year to Turkey, Greece, Cyprus, Italy, and Montenegro. Outside the top 5, demand to France and Spain is struggling. Domestic demand for Russia on Avinode has been high all year, and that trend will continue as well. Moscow to Sochi and St. Petersburg are the top routes.

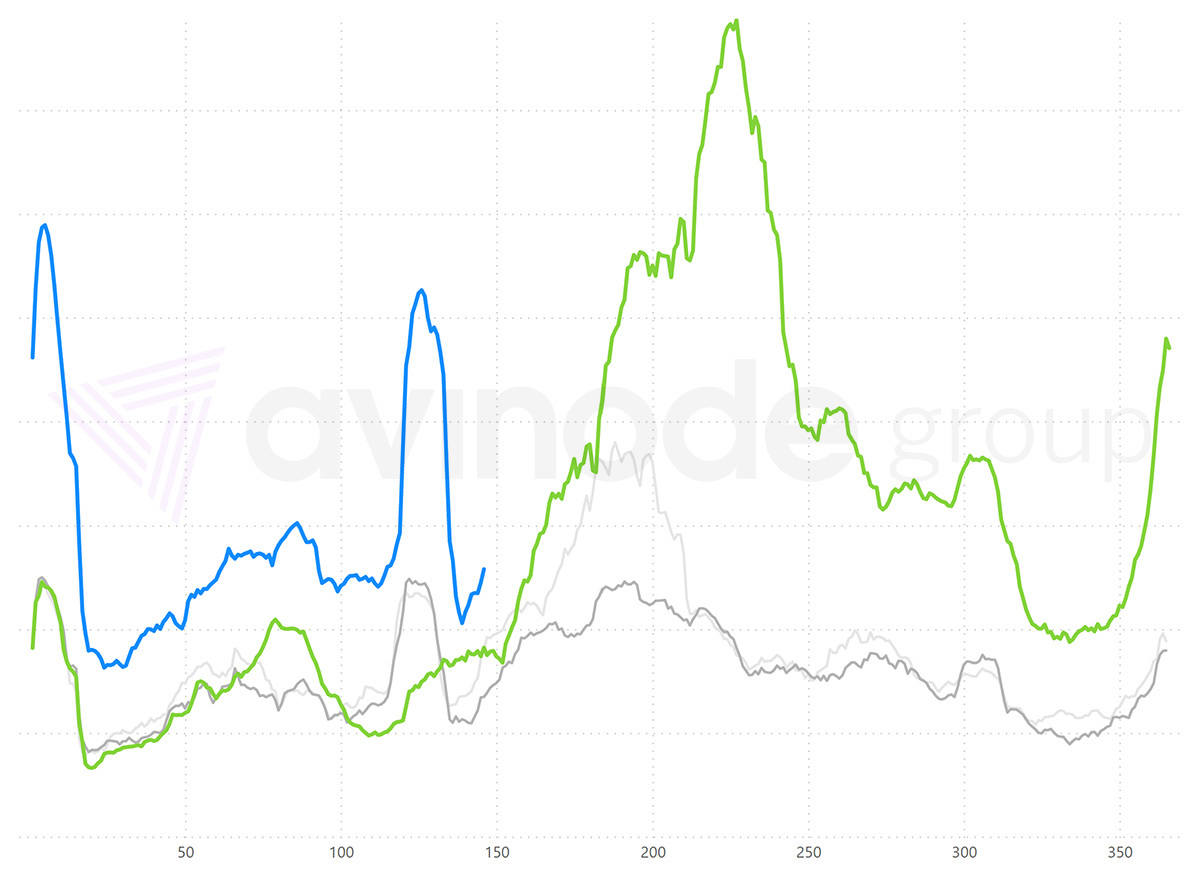

Rolling 14-day index of demand from Russia & CIS (Blue = 2021, Green = 2020, Dark grey = 2019, Light grey = 2018). Day of year along the horizontal axis. Demand on Avinode boomed in H2 2020.

Private charter has been recovering well in the USA, dominated by a strong domestic market and robust demand to Latin America. Florida is the star performer, caused by travel up to the Northeast and intrastate, but it is encouraging to see that for the next couple of months, demand is up year-over-year from all fifty US states. Spreading demand is resulting in some airports that weathered the pandemic well last summer seeing decreases year-over-year, including KPBI, KBCT and KAPF. KVNY and KTEB are back at the top of the rankings. Demand from Vegas is up 172% compared to last year.

Rolling 14-day index of domestic demand in the USA (Blue = 2021, Green = 2020, Dark grey = 2019, Light grey = 2018). Day of year along the horizontal axis.

International travel is coming back too. Over Memorial Day weekend, demand from the West and Central areas is headed to Mexico whilst demand from the East is headed to the Bahamas and the Turks & Caicos. Demand to further afield is still slow; demand for transatlantic travel from the US is down on last year until at least mid-June. The US is still the main market for travel from Canada, but Mexico is showing the strongest year-over-year performance, up until late-June.

14-day rolling Avinode hourly rates pricing index for US domestic trips.

Thankfully, charter rates are also recovering Ц the long-term improvement trend continues in the United States. Rates have been particularly buoyant for super-midsize aircraft in the last two weeks, comfortably above pre-pandemic levels.

14-day rolling Avinode hourly rates pricing index for intra-European trips.

In Europe, rates are recovering too Ц particularly for larger aircraft Ц although they remain a long way below pre-pandemic levels.

Demand is being driven by different factors in different parts of the world. Pent up leisure demand is there and starting to be released in some markets as the weather improves. Events are gradually returning. Elsewhere, COVID continues to ravage, and demand is anything but typical. Domestic and short haul demand is still dominating as entry restrictions remain for so many countries. Demand is coming back in summer 2021… but normality remains elusive.