WINGX’s weekly Business Aviation Bulletin.

Summary

The record market for business jet demand has obviously peaked, with the quickly softening charter market the lead indicator of lower utilisation to come. The trends are clear in the US market, starting to show in parts of the European market, although the UK saw record-breaking business jet activity in July 2022.

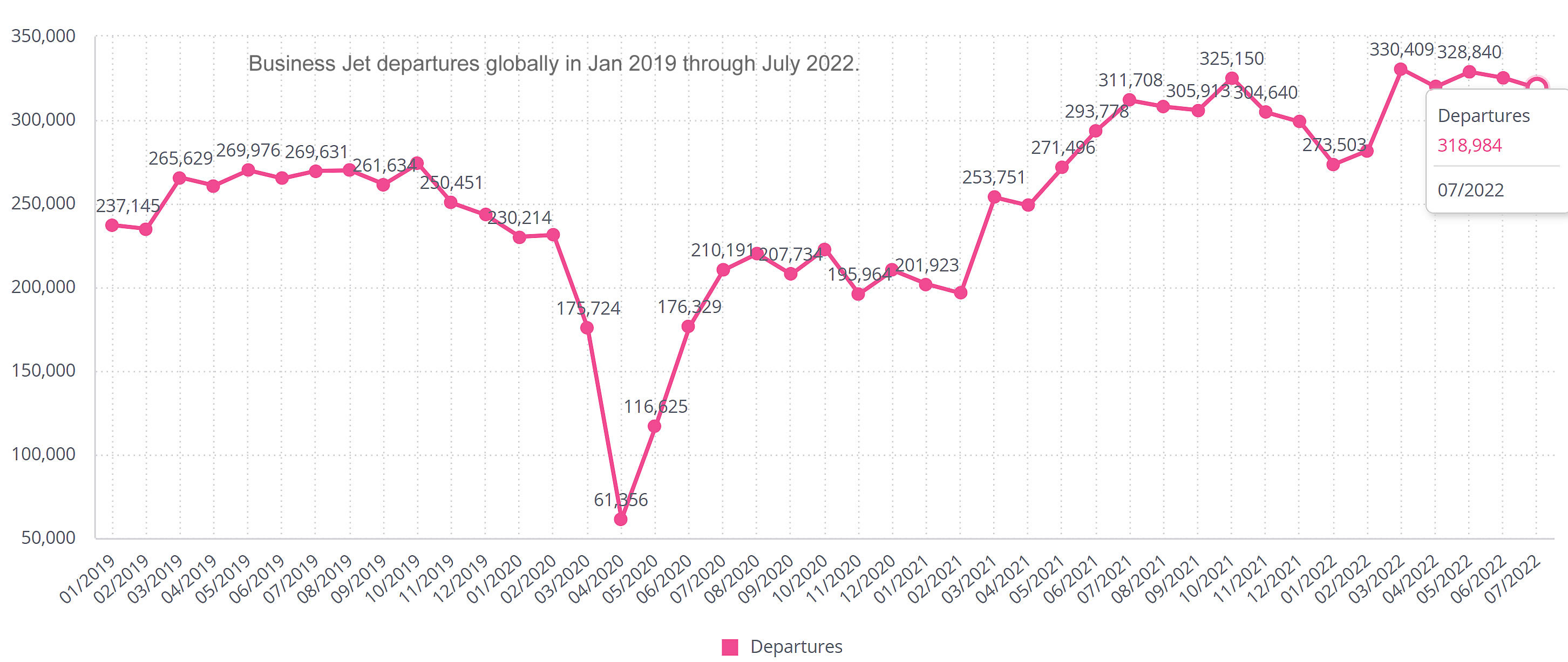

Global

July 2022 was the busiest month of July on record for business jet flights operated globally, and the 6th busiest month overall. But it was only the 5th busiest month so far this year, and just 2.5% busier in terms of sectors operated compared to July last year, up 1.7% if turboprop activity included. Week 30, ending on the last day of the month, was 2% up on week 30 last year, down 1% vs week 29 this year. For the year so far, business jet demand looks very strong, up 22% on same period 2021, up 82% on comparable 2020 and up 21% on pre-pandemic Jan-July 2019. As a comparison, top 5 busiest commercial airlines (Southwest Airlines, United Express, American Airlines, Ryanair, Delta Airlines), flew 12% more flights in July 2022 than July 2021, 6% below activity levels in July 2019.

Business Jet departures globally in Jan 2019 through July 2022

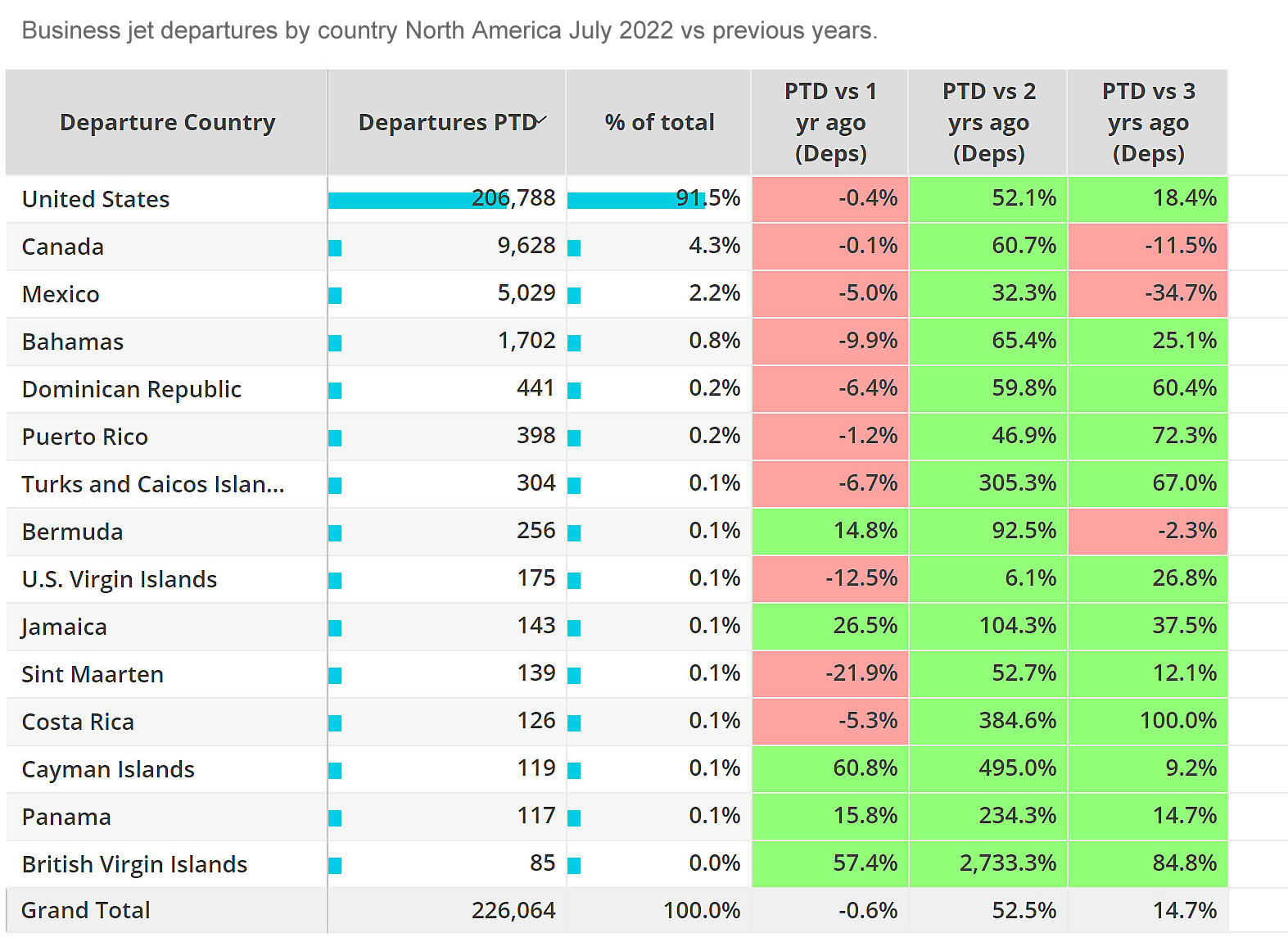

North America

Business jets and turboprops flew 1% fewer sectors in July 2022 compared to July 2021, even if they sustained a sizeable increase of 7% above July three years ago, up 15% if only business jet sectors considered. The slowdown is slight for the dominant US market, similar for the still-recovering Canada and Mexico markets, quite steep for Bahamas, Dominican Republic, Puerto Rico and Turks and Caicos, all of which saw record-breaking business jet activity during the pandemic.

Business jet departures by country North America July 2022 vs previous years

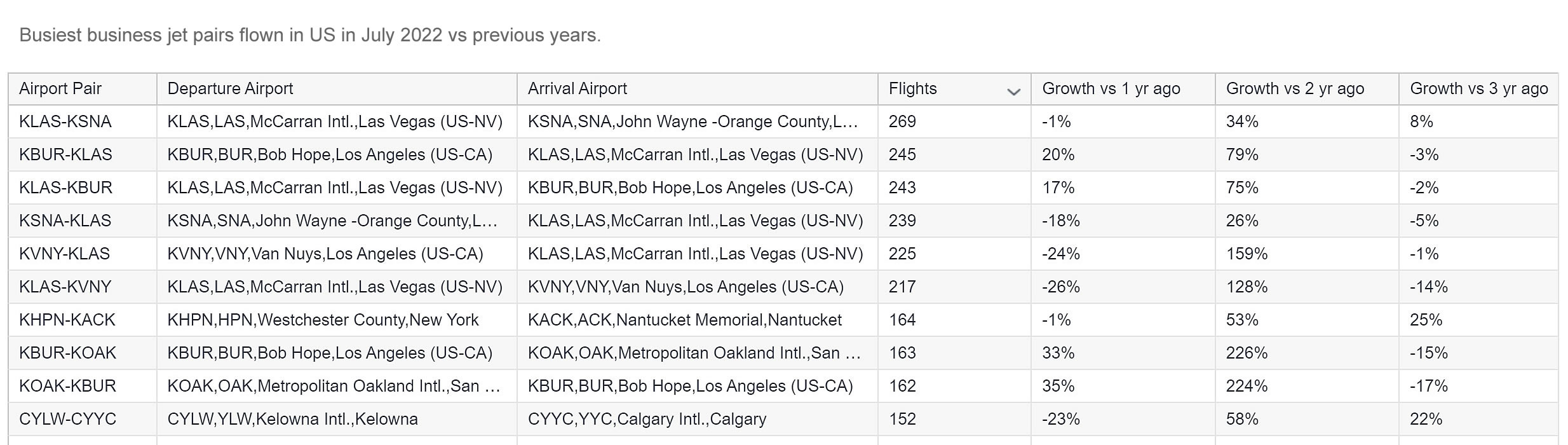

The slight decline in traffic in the US is most obvious in the Part 135 and 91K category, with 4% fewer sectors operated in week 30 year-on-year, consistent with the last 4-week trend. The trend is more severe for the dedicated branded-charter operations, sectors down by 13% in July 2022 vs July 2021. Fractional operator flights were flat in July year on year. Aircraft Management Operators flew 6% fewer missions, whereas Private flight departments were 9% busier than last July. Corporate flight Department flights edged up by 2% year on year, flat compared to July 2019. Top airport pair in the US in July was McCarran to John Wayne, down 1% on last year. Van Nuys business jet flights to McCarran were down 24% in July 2022 year on year.

Busiest business jet pairs flown in US in July 2022 vs previous years

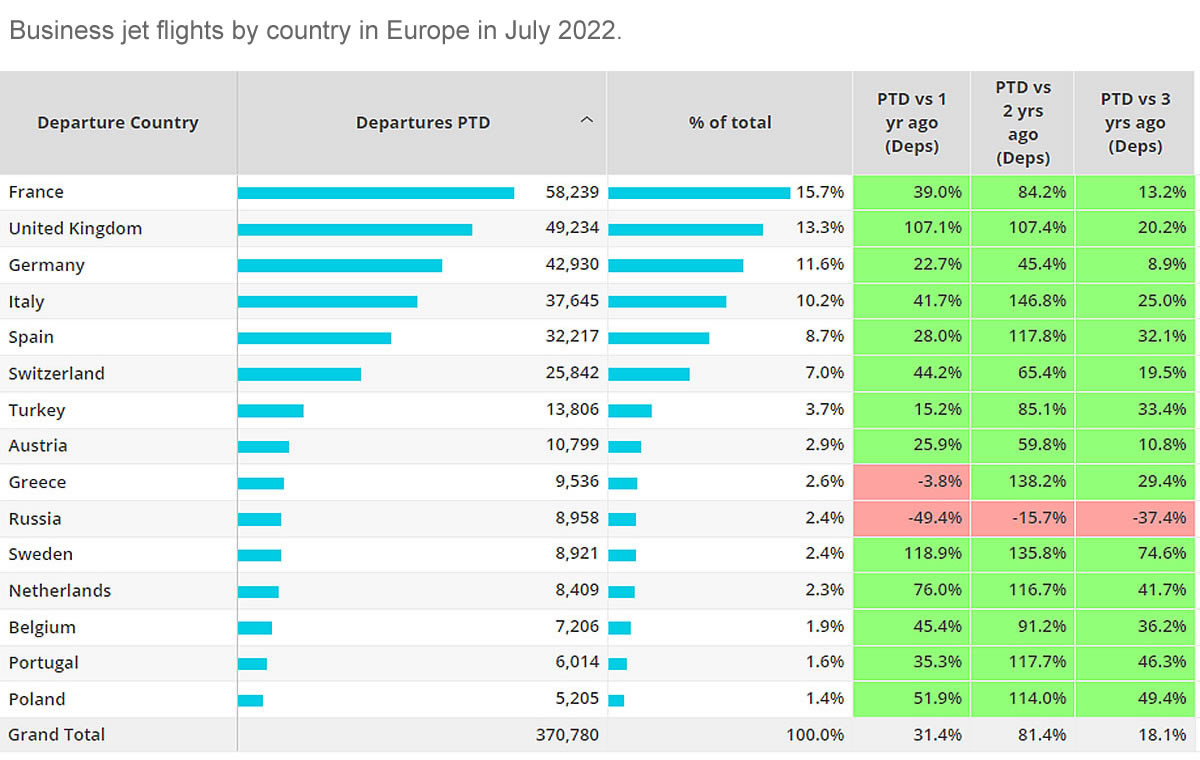

Europe

Business jet flights in the European area were up 10% in July 2022 compared to July 2021, marking the busiest July on record for the continent, fully 23% busier than three years ago in July 2019. Whilst France was the busiest departure country for business jets in July, the biggest year on year increase came from the UK, more than doubling on flights in July 2021. Both Italy and Spain continue to attract record breaking activity this summer. The downwards trend in Russia softened in July, with “just” 49% drop in business jet departures compared to July 2021. In week 30 there was some indication of a broader softening, with both Germany and Switzerland seeing slightly less activity than in the same week last year. Charter operators in Europe flew 2% more than in July 2021, up 16% on July 2019.

Business jet flights by country in Europe in July 2022