The importance of the leisure market in Europe is conspicuous this month as the Olympics sees a surge in high-end European tourists. The US market has had a weak start in August, also true of the main business jet destinations in Asia and Africa.

Global

In Week 32 (5th – 11th August), there were 69,409 business jet sectors flown globally, 1% fewer flights than in Week 32 2023. Part 135 & 91K bizjet activity grew 1% compared to W32 in 2023, accounting for 36,727 of the bizjet sectors flown. In the last four-weeks, the trend for bizjet departures is up by 0.3% compared to last year. Year to date (1st January – 11th August), global bizjet activity has fallen 1% compared to last year, -3% compared to 2022. Flight hours are -2% vs last year and -3% vs 2023.

North America

In Week 32, there were 48,115 bizjet sectors recorded departing North American airports, 2% below W32 in 2023. In the dominant US market, Week 32 activity fell 3% compared to W32 last year, the decline coming in Private and Corporate flying; Part 135 & 91K sectors in the US were on par with W32 last year. So far this month (1st – 11th August), US bizjet activity is 5% behind comparable August last year, still 23% ahead of comparable 5 years ago. New York and Massachusetts are the only two States in the top 10 with year-on-year growth. Westchester County, New York State’s busiest bizjet airport, is 10% ahead of comparable last year so far in August. NetJets is Westchester County’s busiest operator this month, activity up 18% YOY. Some leisure destinations saw very strong growth out of Westchester County; respectively, Nantucket and East Hampton saw a 28% and 125% rise compared to August last year.

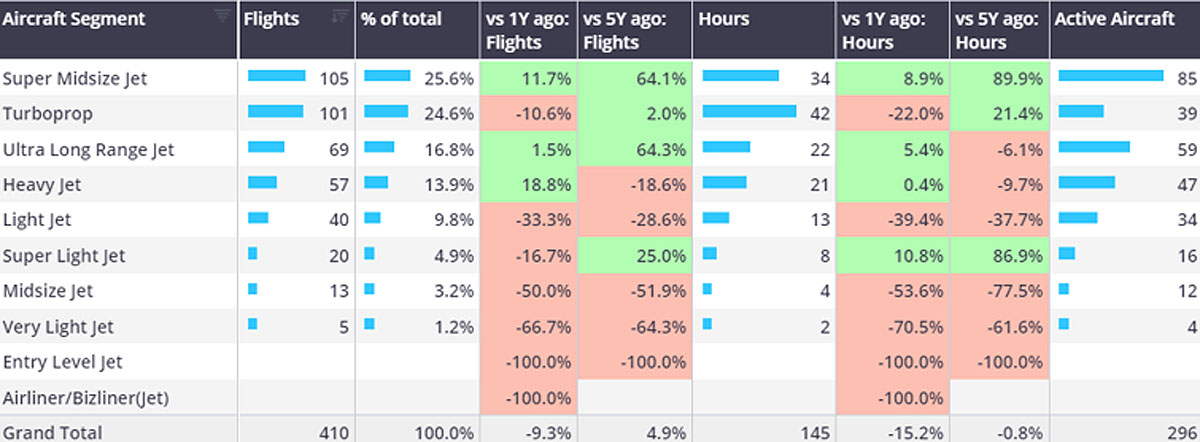

Chart 1: Los Angeles intra-city aircraft segments, 1st – 11th August 2024.

Paris handed over the Olympic torch to Los Angeles for the 2028 edition of the Games, sparking conversations around eVTOL options to combat the city’s traffic. So far this month 26% of business aviation departures on intra-city LA flights were on turboprop aircraft, very light jets accounted for just 1% of LA’s bizav traffic. Top airport pair from the city is Van Nuys to John Wayne Orange County, 46 bizjet and turboprop flights so far this August. So far this month, almost 27,500 departures from US airports have been on Cessna bizjet jets, 1% less than last year. Embraer activity is 4% ahead of last August. Last week the UK’s Civil Aviation Authority certified the Gulfstream G700, year to date there have been 53 active tails of the type globally, Gulfstream’s facilities in Savannah being the main point of activity.

European Region

In Week 32 European bizjet activity enjoyed a 6% bump on last year, the last 4-week trend trending 5% ahead of last year. Week 32 saw YOY rises in bizjet activity across France, United Kingdom, Switzerland and Italy. With the boost from the Olympic Games, airports in France saw an 18% YOY increase in bizjet departures, a sharp contrast to Germany falling 5% YOY.

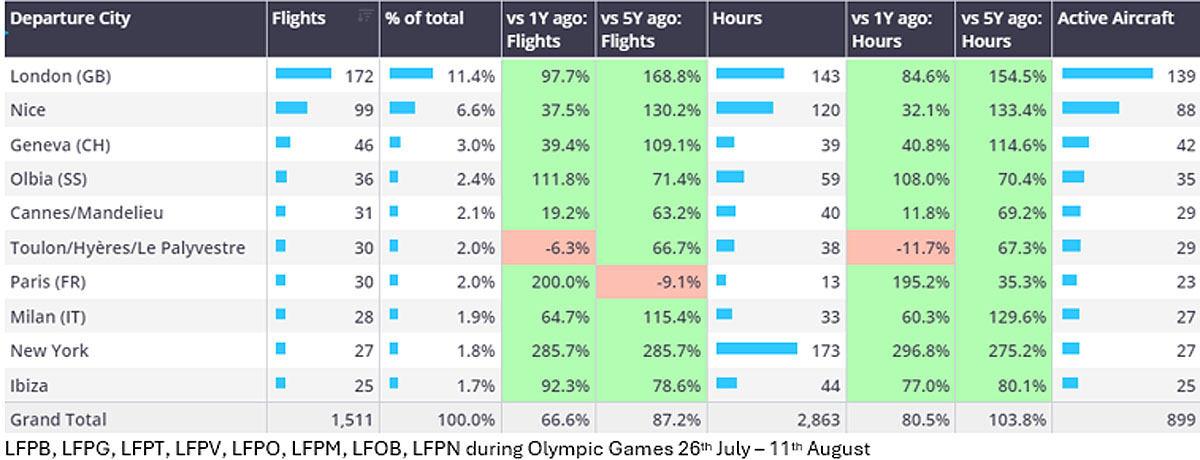

So far this month Nice (LFMN) airport has edged out as the busiest bizjet departure airport in France, with Le Bourget second-ranked, though LFPB recorded a 77% year on year spike. London was the top city connection, flights up 40% year on year. During the final weekend of the Olympics, the Ultra Long-Range jets were the single most active business jet type, with 56 active aircraft (9th – 11th July) arriving into Paris airports.

Chart 2: Busiest origin cities for bizjet arrivals into Paris airports during Olympics

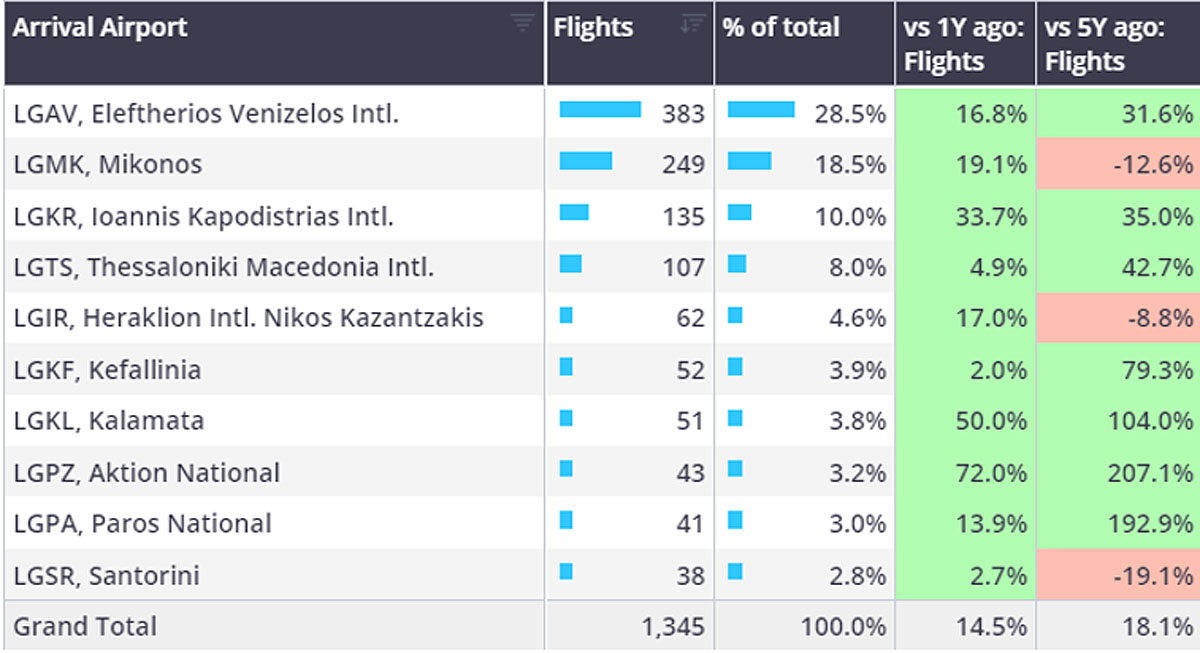

The Olympics and earlier EURO football tournament have clearly drawn a larger than usual number of high-end tourists to the European area. This is evident across airports in key summer destinations in Greece. Mikonos airport has seen 249 bizjet arrivals so far this month, up by 19% compared to the start of August 2023. Other popular European getaways have seen strong bizjet growth this month, with flights from airports in Switzerland up by 13%. Germany is an outlier, with bizjet departures down 7% this month.

Chart 3: Bizjet arrivals into Greece airports, 1st – 11th August 2024.

Rest of World

In contrast to strong growth in bizjet activity in Europe, bizjet flights in the rest of the world have seen some tapering over the last few weeks. Outside of the US and Europe, bizjet departures in the last 4 weeks have fallen 7% year on year, falling 4% in Week 32 compared to W32 last year. Bizjet flights out of the Middle East are trending down by 4% in the last four weeks. In Africa, bizjet departures are down by 24% in week 32 YOY. From Asia and South America, bizjet flights were down 8% and 5% retrospectively.